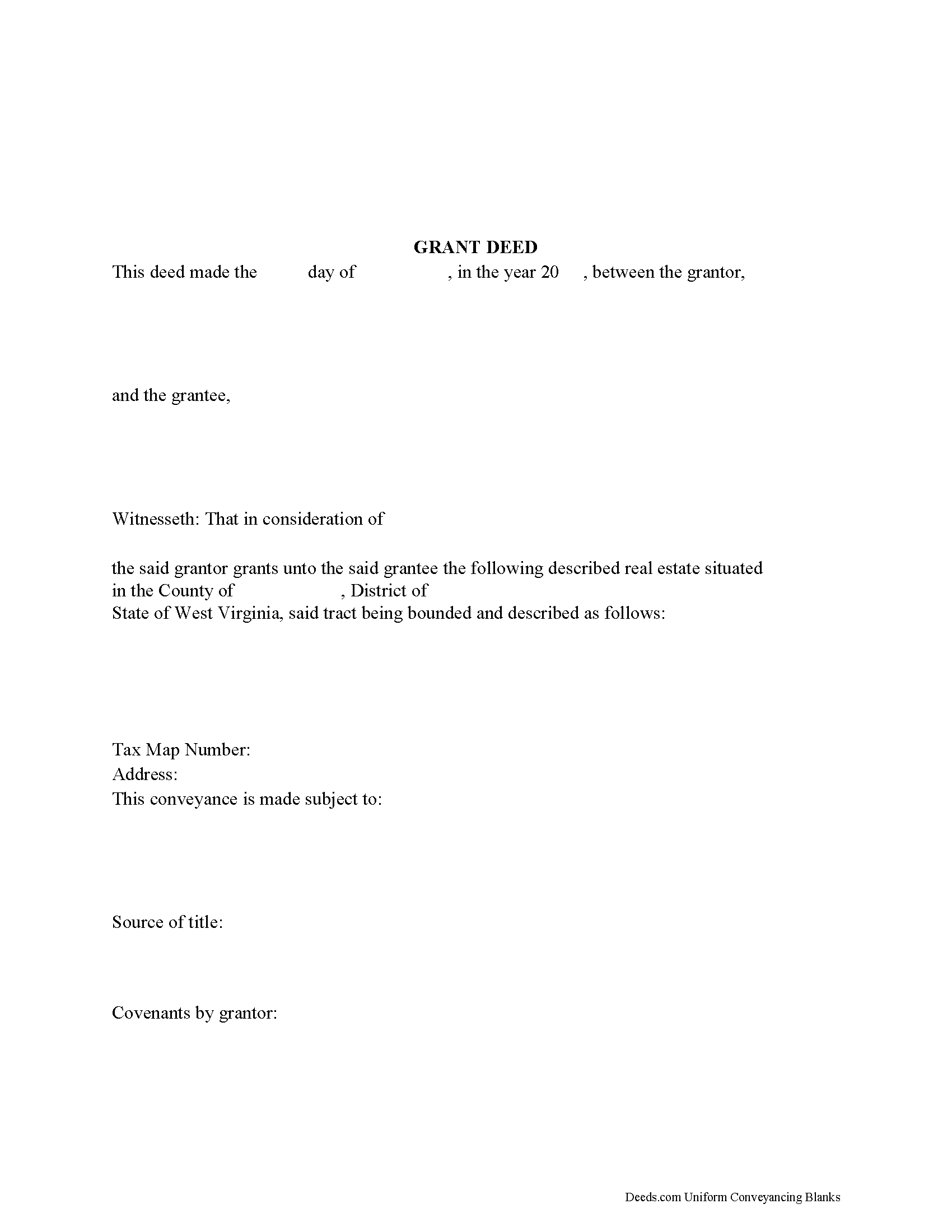

Jackson County Grant Deed Form

Jackson County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

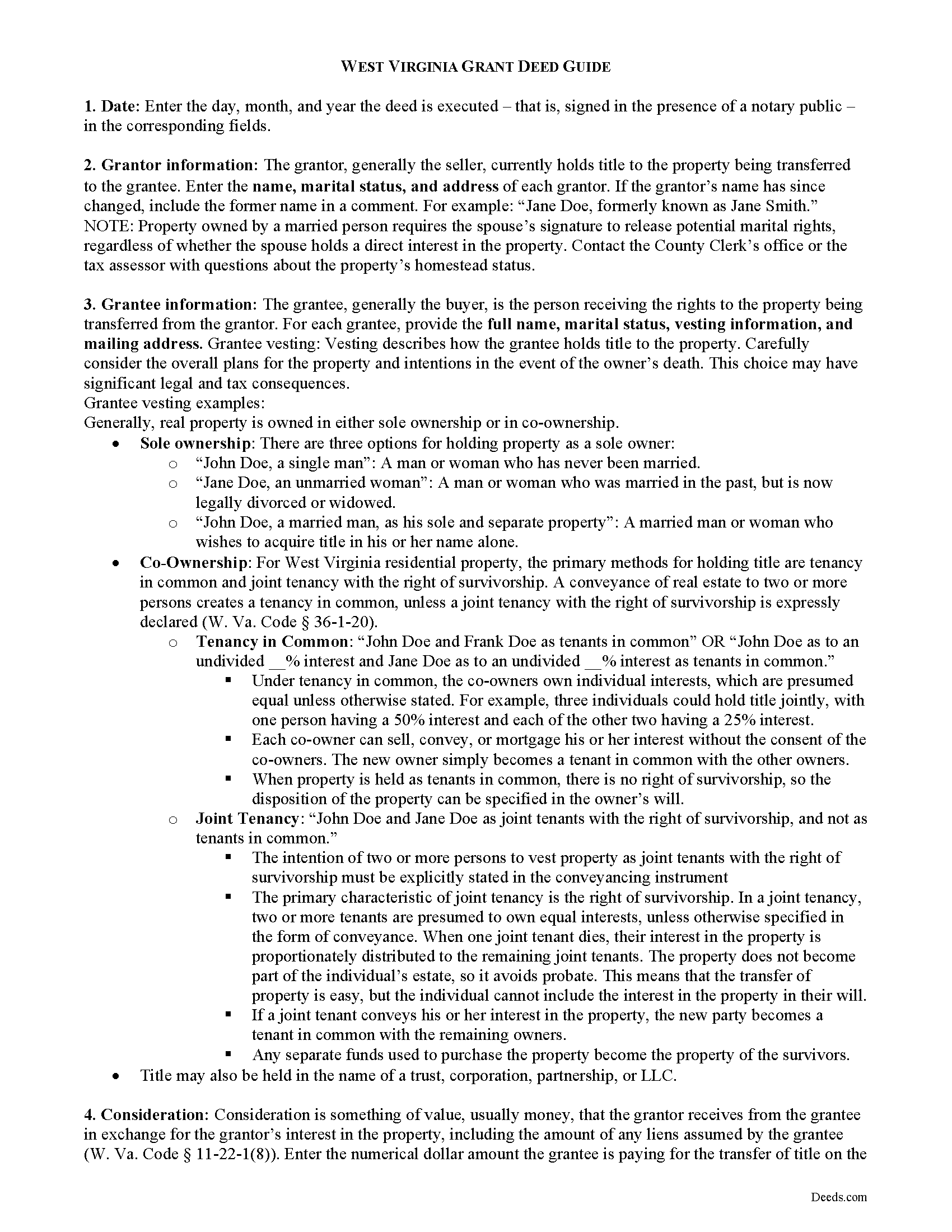

Jackson County Grant Deed Guide

Line by line guide explaining every blank on the form.

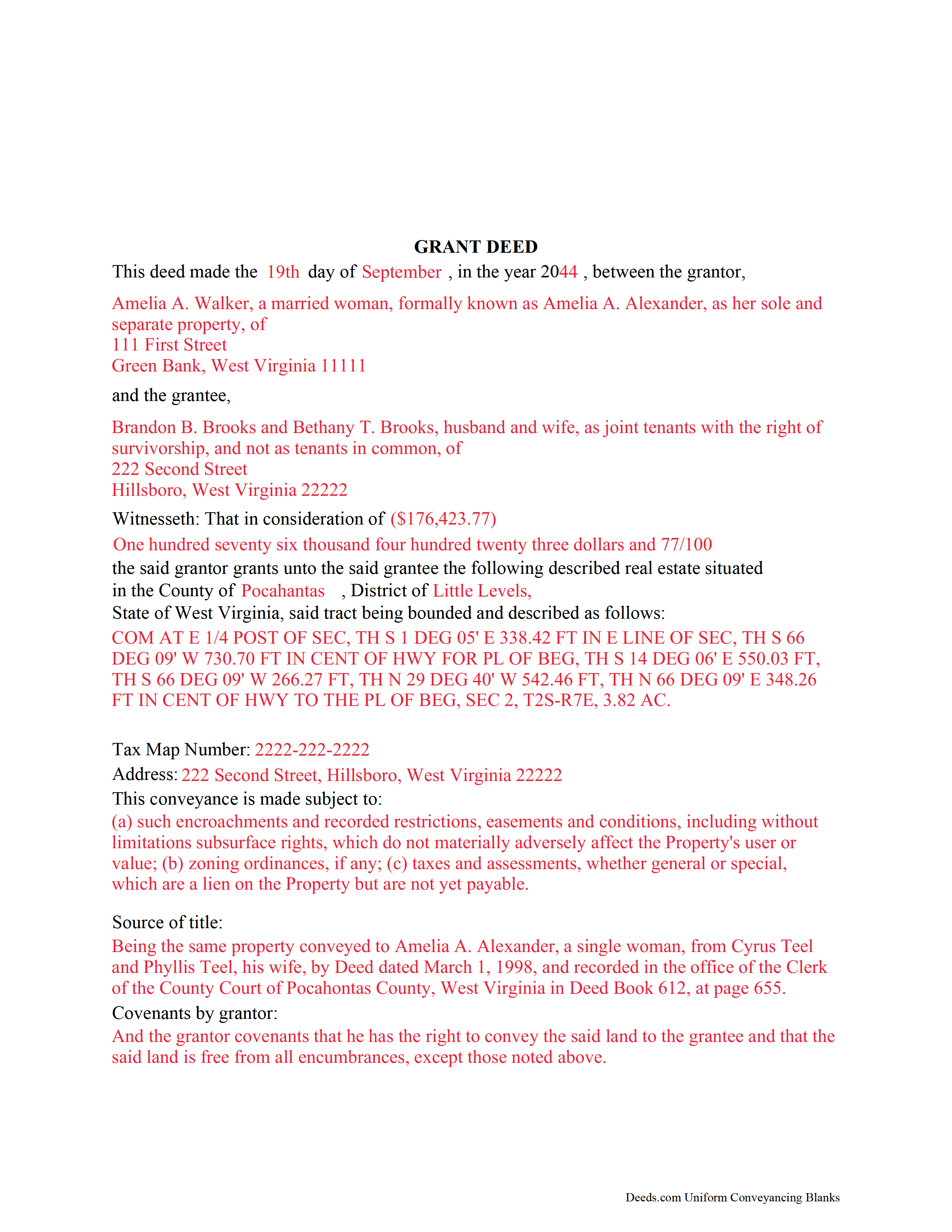

Jackson County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional West Virginia and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Clerk

Ripley, West Virginia 25271

Hours: 8:30 to 4:30 M-F

Phone: (304) 373-2250

Recording Tips for Jackson County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Advent

- Cottageville

- Evans

- Gay

- Given

- Kenna

- Le Roy

- Millwood

- Ravenswood

- Ripley

- Sandyville

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (304) 373-2250 for current fees.

Questions answered? Let's get started!

In West Virginia, title to real property can be transferred from one party to another using a grant deed.

A statutory form for conveying real property is codified at West Virginia Code Section 36-3-5, with room to customize the form as needed for the situation. Typical covenants of a grant deed include that the grantor has not previous sold the interest now being conveyed and that the premises are free from encumbrances, excepting those noted in the instrument. Statutory covenants are codified at W. Va. Code 36-4, and require specific language in the body of the deed.

To be valid and to provide a quality public record, the section of the deed that details the words and terms of conveyance (granting clause) must name both the grantor and grantee. It also includes a legal description detailed enough to identify the specific parcel within its district.

The granting party must sign the deed in the presence of a notary public. Property owned by a married person requires the spouse's signature to release potential marital rights, regardless of whether the spouse holds a direct interest in the property.

Deeds in this state are void as to creditors and subsequent purchasers for valuable consideration without notice until it is recorded in the county where the property is located (W. Va. Code 40-1-9). In other words, record it or it didn't happen.

To record a grant deed with a county clerk in West Virginia, the instrument must meet state and county requirements of form and content for documents pertaining to an interest in real property. Deeds recorded in West Virginia are subject to a transfer tax based on the purchase price (consideration) listed on the deed, or, if no consideration is listed, the fair market value of the property. Transfers with no consideration require a Declaration of Consideration or Value. All recorded deeds must be accompanied by a Sales Listing Form.

If the grantor is not a West Virginia resident, tax withholding pursuant to W. Va. Code Section 11-21-71b is also required.

Consult a lawyer with questions about grant deeds, or for any other issues related to real property in West Virginia.

(West Virginia Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

James E.

December 1st, 2020

Forms were available for immediate download. Examples were helpful in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rod G.

August 7th, 2020

You guys have it DOWN!! You made it easy to navigate your site and services. You explained things effectively. You are helpful and fast. NO WAY would even entertain using a different deed/ document recording service. I'll be back! Thank you. Rod

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael S.

January 23rd, 2024

Great Price & Really Easy To Download

We are motivated by your feedback to continue delivering excellence. Thank you!

Sara M.

October 5th, 2024

Efficient, well written documents

Thank you for your feedback. We really appreciate it. Have a great day!

Terry W.

September 10th, 2020

Loved it no recurring fees easy to use your app

Thank you!

DONNA P.

July 21st, 2020

Deeds.com was quick, efficient, and cost effective. Deeds.com works with individuals where I found other companies only offer services to title companies, settlement companies, etc. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

mary s.

July 30th, 2021

It would help if pages of a document indicated 1 of 3 etc. When I downloaded the TOD guide I got a 4th page though it only showed 3 on the screen.

Thank you for your feedback. We really appreciate it. Have a great day!

Carl T.

February 23rd, 2021

Great site with good information and pricing. Let me know when you are able to record documents in California.

Thank you for your feedback. We really appreciate it. Have a great day!

Peter E.

September 28th, 2020

I think Deeds is a great site for learning. On recording a document, I had trouble. It was me, because I was new to the site.

Thank you!

B A A.

March 9th, 2023

So far I like the ease of availability of the site and the help guides.

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

March 16th, 2022

I was able to use your website for the purpose I was looking for. I was able to conclude the transactions I needed without having to use an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John B.

January 23rd, 2019

Forms are as advertised and easy to access.

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis D.

November 7th, 2019

Thanks for the efficient process and instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald C.

January 7th, 2020

The service was VERY quick, simple and, easy. I would definetly use this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.