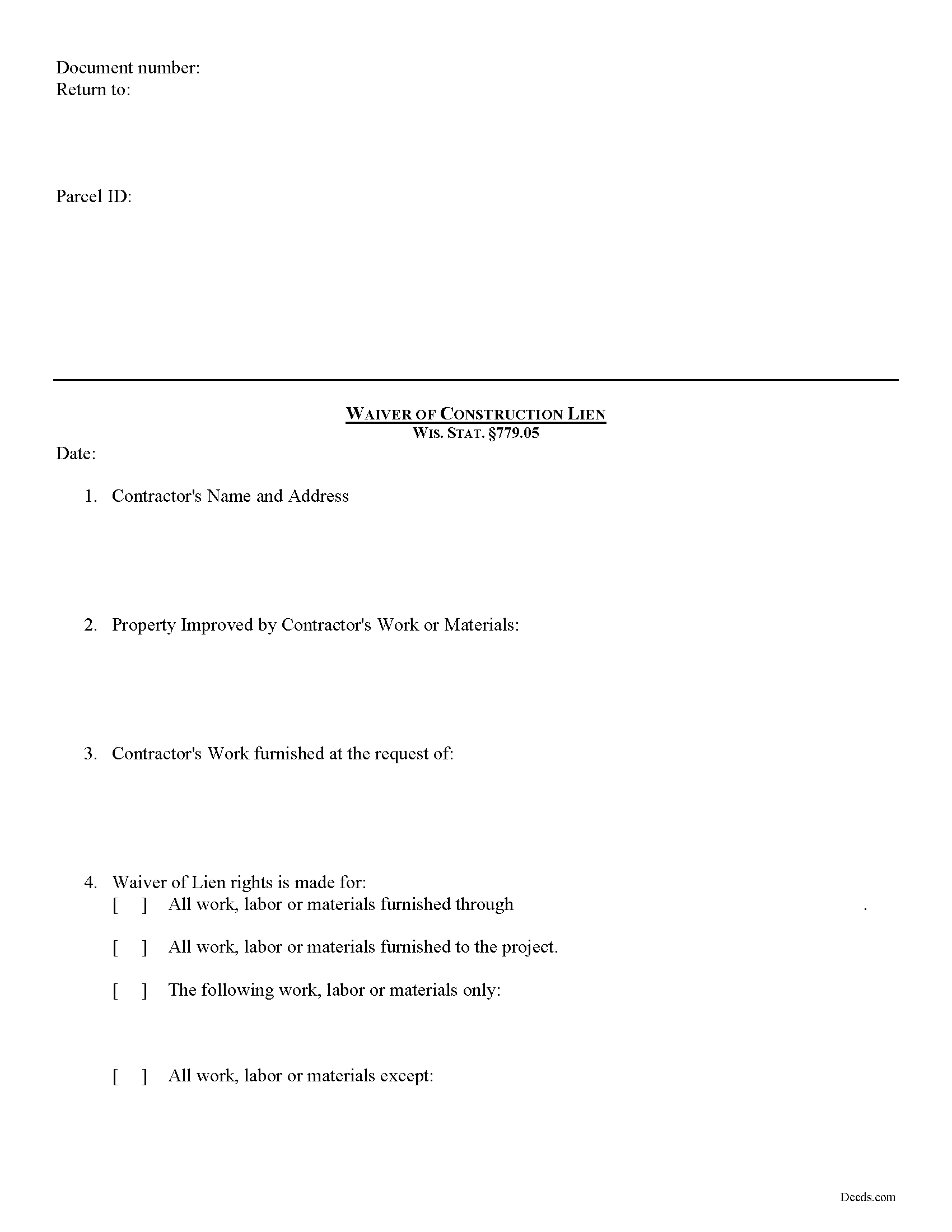

Jefferson County Construction Lien Waiver Form

Jefferson County Construction Lien Waiver Form

Fill in the blank form formatted to comply with all recording and content requirements.

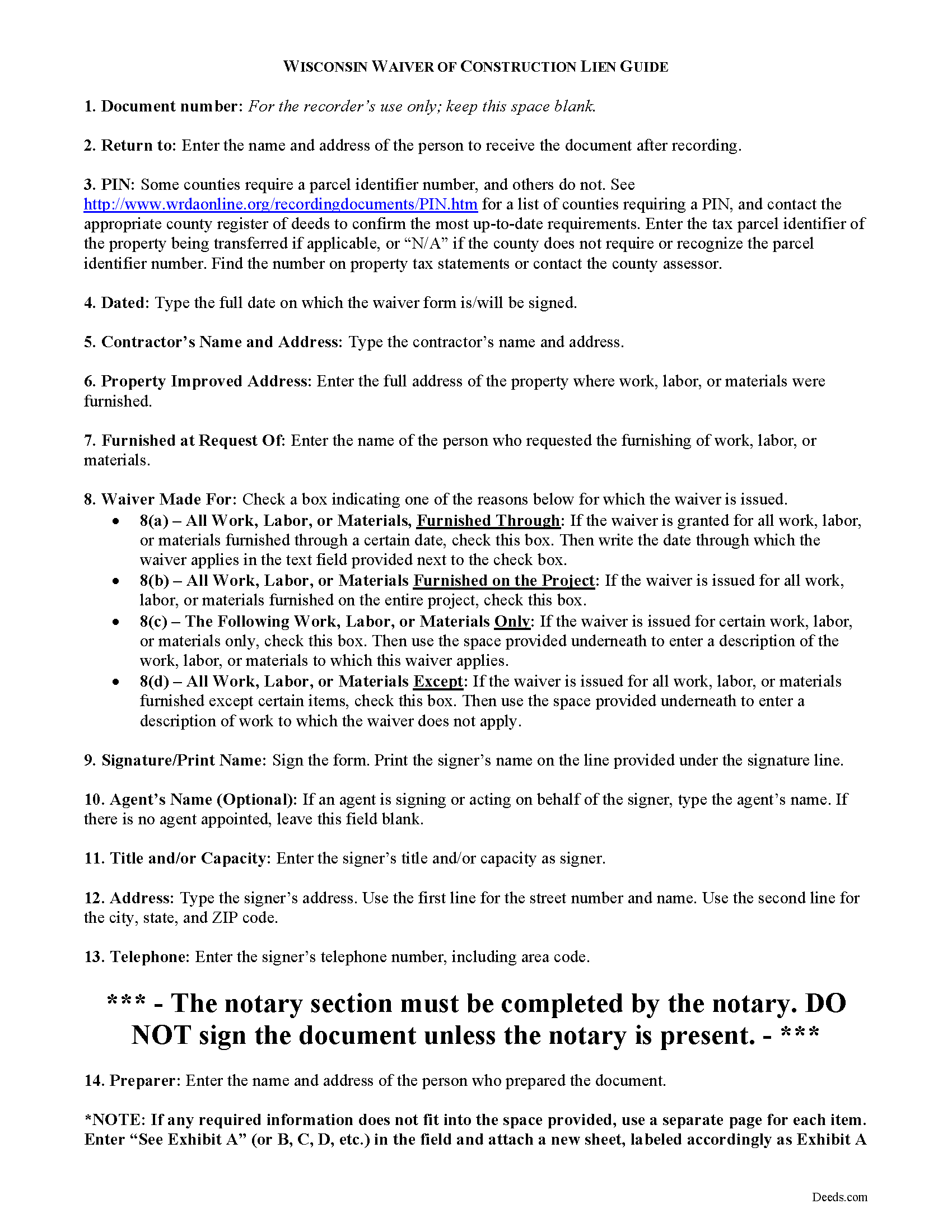

Jefferson County Construction Lien Waiver Guide

Line by line guide explaining every blank on the form.

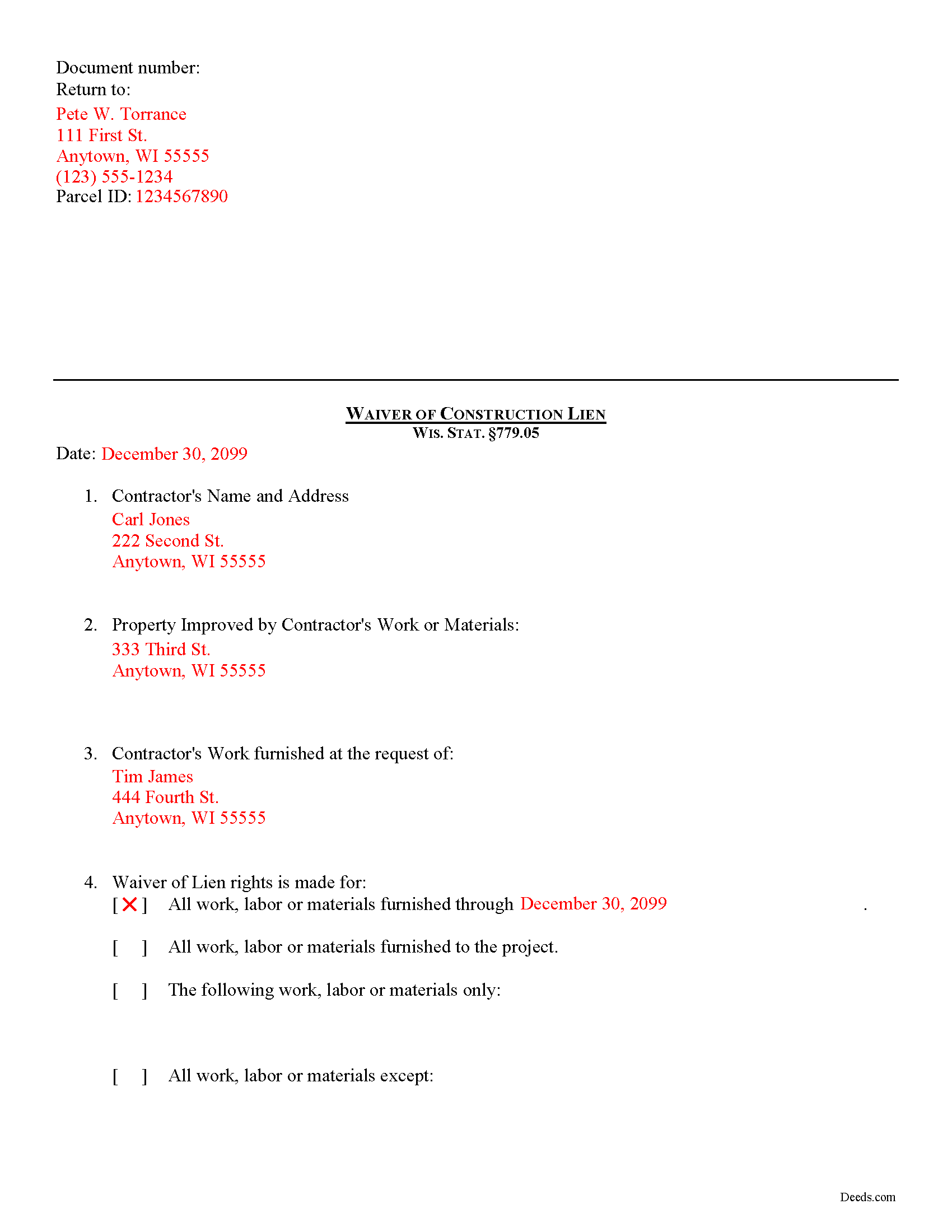

Jefferson County Completed Example of the Construction Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Register of Deeds

Jefferson, Wisconsin 53549

Hours: Monday - Friday 8:00am to 4:30pm

Phone: 920-674-7235

Recording Tips for Jefferson County:

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Fort Atkinson

- Helenville

- Ixonia

- Jefferson

- Johnson Creek

- Lake Mills

- Palmyra

- Sullivan

- Waterloo

- Watertown

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at 920-674-7235 for current fees.

Questions answered? Let's get started!

Lien Waivers in Wisconsin

Lien waivers are used to simplify payments between contractors, subcontractors, customers, and property owners. A waiver is a known forfeiture of a legal right. In this case, the person granting the waiver forfeits the right to seek a mechanic's lien for all or part of the amount due.

Unlike other states, Wisconsin outlines a broad array of waiver rights and the law does not require verification of payment before the waiver takes effect. Any document signed by a lien claimant or potential claimant and purporting to be a waiver of construction lien right, is valid and binding as a waiver whether or not consideration was paid therefor and whether the document was signed before or after the labor, services, materials, plans, or specifications were performed, furnished, or procured, or contracted for. WIS. STAT. 779.05(1). Any ambiguity in such document shall be construed against the person signing it. Id.

Any waiver document shall be deemed to waive all lien rights of the signer for all labor, services, materials, plans, or specifications performed, furnished, or procured, or to be performed, furnished, or procured, by the claimant at any time for the improvement to which the waiver relates, except to the extent that the document specifically and expressly limits the waiver to apply to a particular portion of such labor, services, materials, plans, or specifications. Id. Therefore, be sure to spell out any exceptions to the waiver in the waiver document as any mistake could lead to an inadvertent waiver.

Be certain that payment is guaranteed before issuing a waiver, especially if the account still shows a balance due. A lien claimant or potential lien claimant of whom a waiver is requested is entitled to refuse to furnish a waiver unless paid in full for the labor, services, materials, plans, or specifications to which the waiver relates. Id. A waiver furnished is a waiver of lien rights only, and not of any contract rights of the claimant otherwise existing. Id.

A promissory note or other evidence of debt given for any lienable claim shall not be deemed a waiver of lien rights unless the note or other instrument is received as payment and expressly declares that receipt thereof is a waiver of lien rights. WIS. STAT. 779.05(2).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an attorney with questions about lien waivers, or any other issues related to liens in Wisconsin.

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Construction Lien Waiver meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Construction Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Julia M.

March 9th, 2019

Your PDF form Personal Representative's Deed was exceedingly helpful.

Thank you Julia. Have a fantastic day!

DONNA F.

June 7th, 2019

very easy and fast thank you would recommend

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CHARLES V.

June 4th, 2019

Legit. Reasonable prices.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ruby C.

April 27th, 2019

very easy to use this site as I live out of state.

Tanks Ruby, glad we could help.

Michael W.

July 27th, 2021

Appreciate the help with DC's non-intuitive forms. Superb service.

Thank you!

Linda W.

January 22nd, 2021

Fast service. From the time I sent my Quit Claim Deed to deeds.com, and six hours later my deed was recorded. It was painless, great convenience.

Thank you!

SHEDDRICK H.

June 17th, 2023

I got exactly what I paid for. No fraudulent transaction on my card. I like that. This is an excellent service. Straight and to the point help. That e-recording process looks like a winner. When I get my forms filled out I might use that.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David G.

April 25th, 2019

Thanks got what I needed

Thank you David, glad to hear that.

Norman K.

August 13th, 2021

Easy to use, would like to convert to a Word doc though

Thank you!

Claudia S.

October 18th, 2022

The site is very user friendly. Where can I get a copy of all the invoices that were paid? Thank you. Claudia

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn A.

October 18th, 2019

Easy to use!!

Thank you!

Deloris L.

August 25th, 2020

I downloaded documents easy. But haven't started work on them yet. Seems to be ok.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert H.

January 10th, 2024

Easy to use and understand. I am glad to have found this resource.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Rick W.

November 13th, 2019

Hi, I must have done something wrong. I need a QuitClaim North Carolina Dare County form. I don't need the Warranty Claim that appeared in my download list. Can I exchange forms?

As a one time courtesy we have canceled the order and payment you made for the warranty deed in error. Have a wonderful day.