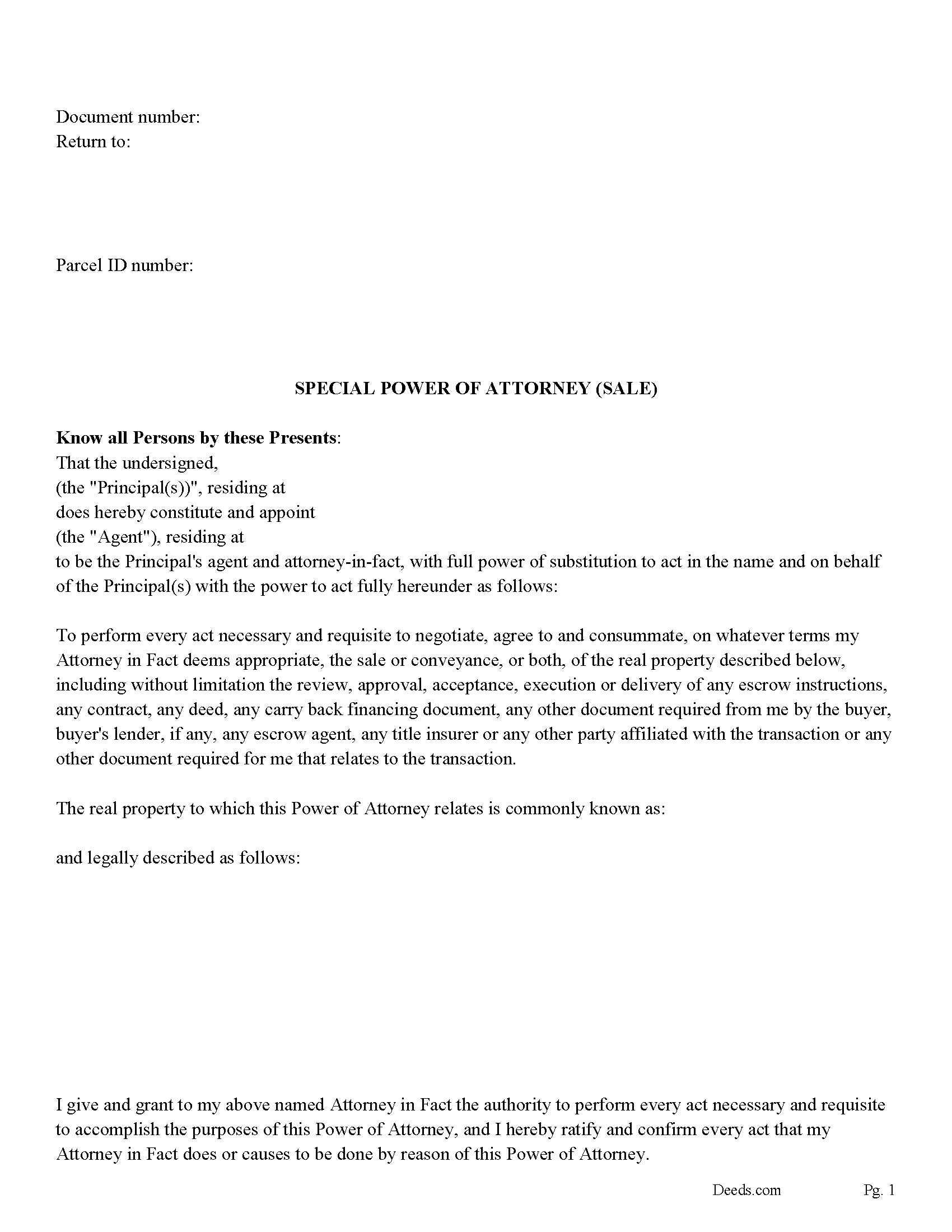

Pepin County Power of Attorney for the Sale of Real Estate Form

Pepin County Special Power of Attorney Form for the Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

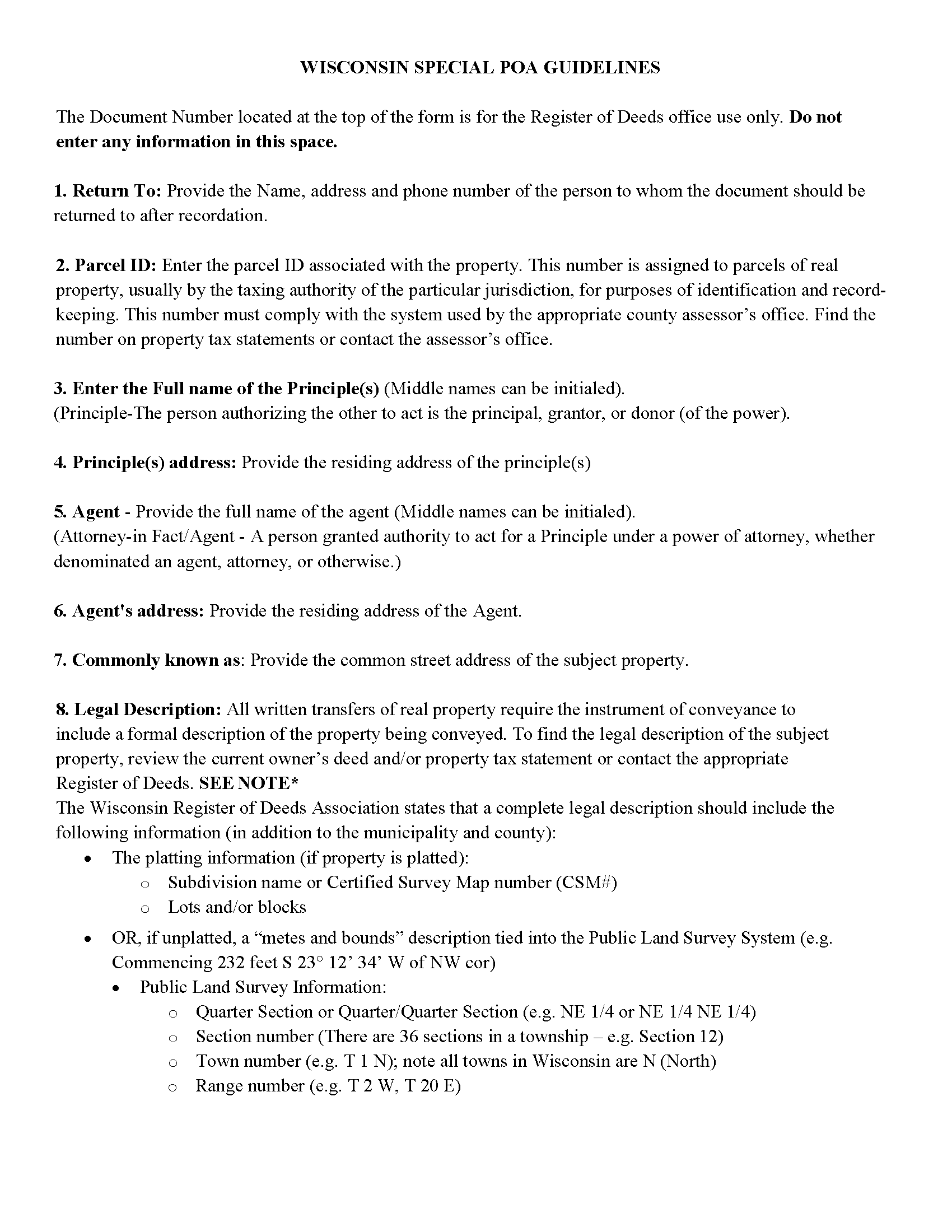

Pepin County Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

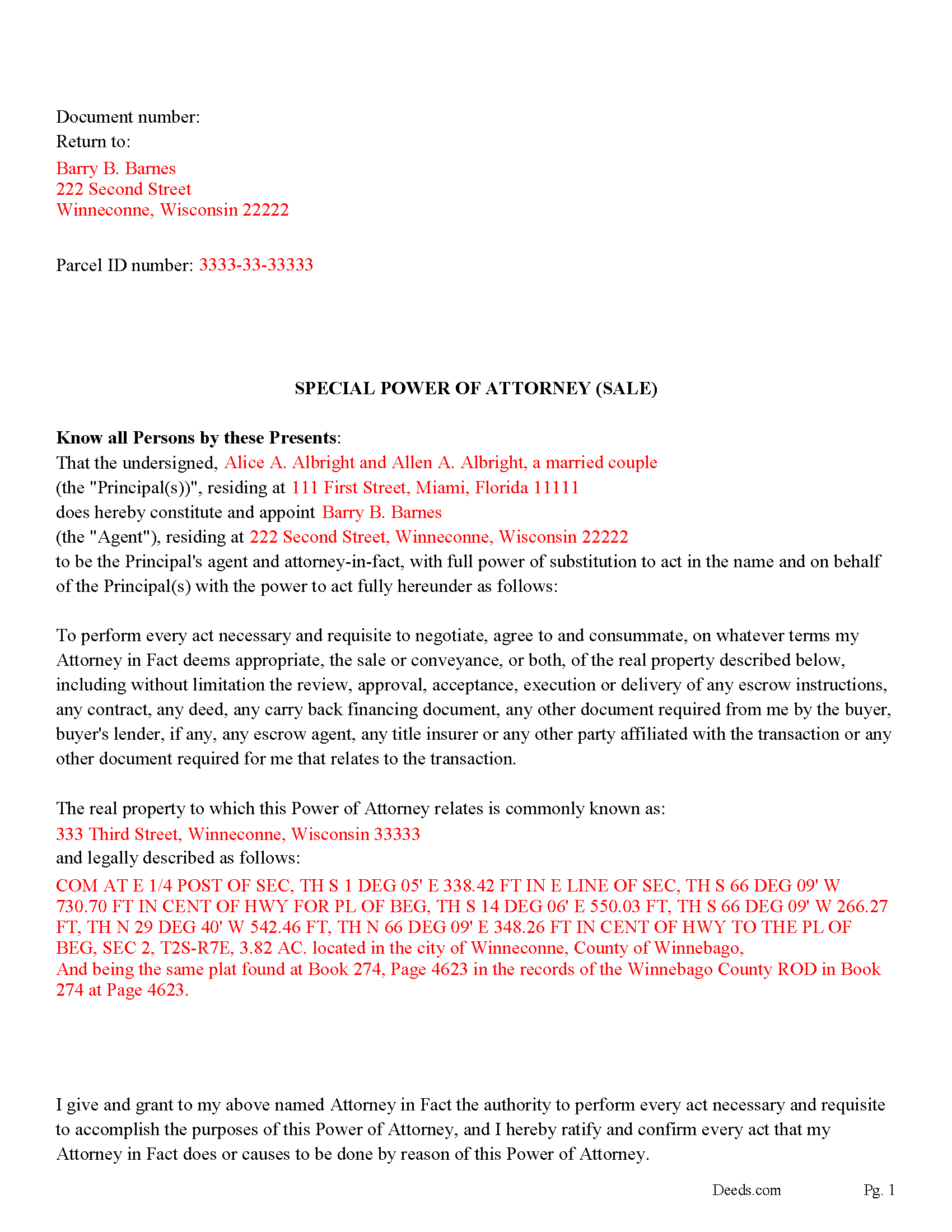

Pepin County Completed Example of the Power of Attorney

Example of a properly completed form for reference.

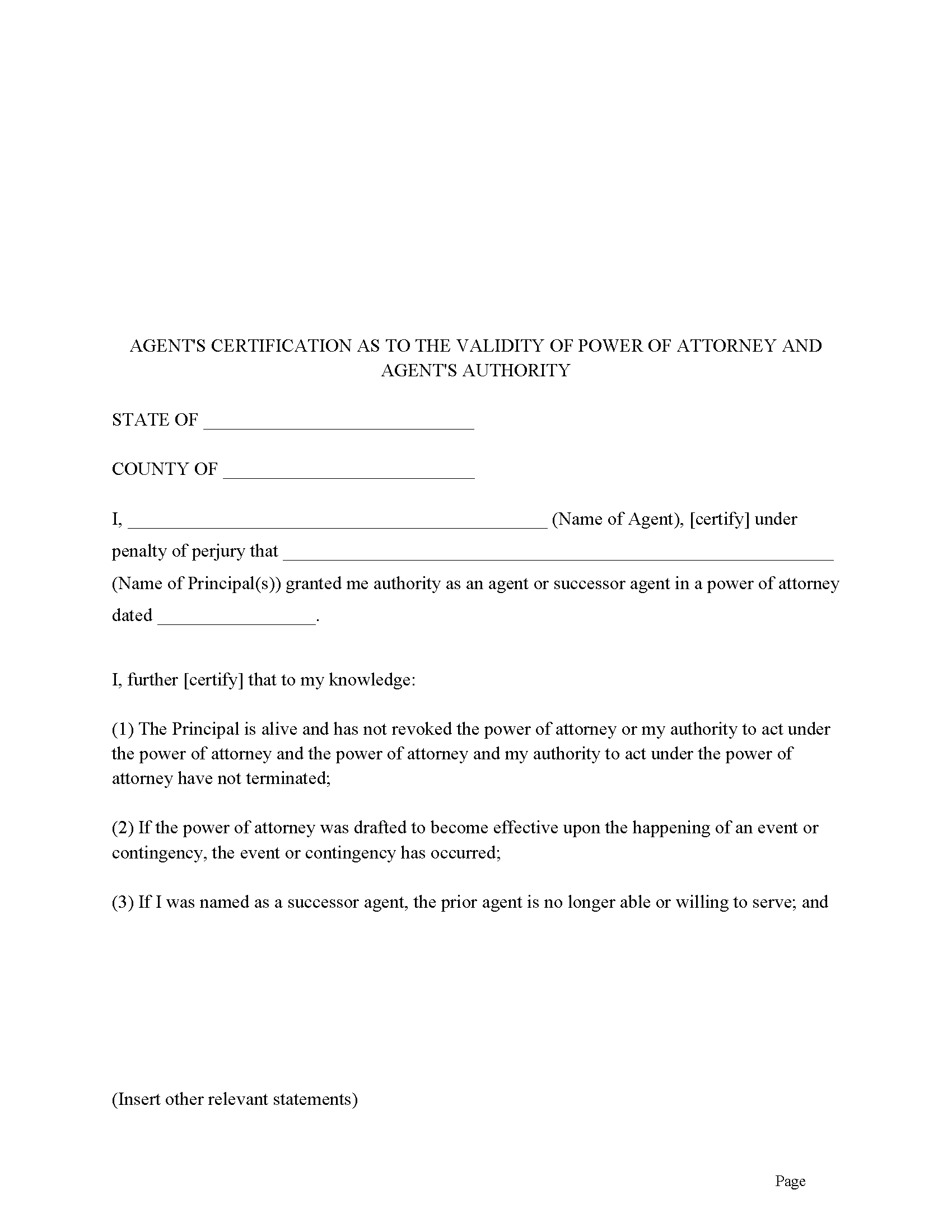

Pepin County Agents Certification Form

Often required by third parties; banks, title companies, etc.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Pepin County documents included at no extra charge:

Where to Record Your Documents

Pepin County Register of Deeds

Durand, Wisconsin 54736

Hours: 8:30A.M.-12.00P.M. ; 12:30P.M.-4:30 P.M. M-F

Phone: (715) 672-8856

Recording Tips for Pepin County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Pepin County

Properties in any of these areas use Pepin County forms:

- Arkansaw

- Durand

- Pepin

- Stockholm

Hours, fees, requirements, and more for Pepin County

How do I get my forms?

Forms are available for immediate download after payment. The Pepin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pepin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pepin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pepin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pepin County?

Recording fees in Pepin County vary. Contact the recorder's office at (715) 672-8856 for current fees.

Questions answered? Let's get started!

Use this form (Principal) to allow a second party, your Agent, to sell a property on your behalf. Your agent can perform all tasks necessary to sell a specific property located in the State of Wisconsin, in your place and stead as if you were present yourself.

This power of attorney is not affected by any subsequent disability or incapacity of the principal and shall be considered a "Durable Power of Attorney." (ii) shall be governed, as to its validity, terms and enforcement, by those laws of the State of Wisconsin that apply to instruments negotiated, executed, delivered and performed solely within the State of Wisconsin. Terminates upon a date set by the principal.

Agent's Certification Form: Often Third Parties, accepting the power of attorney will require this form. (The following optional form may be used by an agent to certify facts concerning a power of attorney for finances and property.) (Wisconsin revised statute 244.62)

(Wisconsin SPOA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Pepin County to use these forms. Documents should be recorded at the office below.

This Power of Attorney for the Sale of Real Estate meets all recording requirements specific to Pepin County.

Our Promise

The documents you receive here will meet, or exceed, the Pepin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pepin County Power of Attorney for the Sale of Real Estate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Kitty H.

February 19th, 2019

I have had it reviewed by a mortgage broker and a title manager and both said it was done correctly! Your product and the instructions are what made this possible. It took me several hours as I continued to review your information. I just finished printing and ready to file. Yeah! Thanks! Highly recommend the product!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Devra R.

May 30th, 2022

A refreshingly easy service to use. They offer auxiliary forms as a courtesy. Theres no "gotcha" capitalism. You pay the reasonable fee and the needed forms are accessible instantly to download. I've used it twice so far and it worked perfectly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia P.

July 14th, 2021

Easy to use and super convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara R.

June 19th, 2019

Worked well for me to create a deed for a house I inherited. It was very thorough and easy to use. I have no experience with the law so I just googled terms I didn't understand and was fine. I also called land records a lot and ended up not needing a lot of the material included, but it was still good to have it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy R.

October 8th, 2022

I was very pleased with the quick turn around on a response to my inquiry. Further guidance was direct and I appreciate the professionalism from deeds.com.

Thank you!

Morgan K.

August 24th, 2021

When I brought this deed to the county assessor, they were so impressed that I had done it correctly on my first try, and said they wished everyone would do such a good job on their paperwork.

Thank you for your feedback. We really appreciate it. Have a great day!

Jill M.

January 12th, 2019

This service gave me the information and guide I needed to file a Quitclaim Deed. I went through the process with no problems at all.

Thank you Jill, we appreciate your feedback.

Jane C.

February 25th, 2023

I wasn't sure what I was looking for initially so I printed out the wrong thing. Had to pay again to get the right one but much less expensive than getting it from a lawyer. Our military lawyers will make the forms official but they don't have the forms. Hope this makes things easier for our children when we pass. Thank you for offering this service.

Thank you for taking the time to leave your feedback. We have canceled and refunded the payment for your first order. We don't want you to pay for something you're not going to use. Have an amazing day.

Kenneh C.

December 23rd, 2022

I was looking for something this website does not offer. Very dissapointed.

Sorry to hear that. We do hope you found what you were looking for elsewhere.

Barbara C.

September 5th, 2021

I have used these forms now at least 3 times in order to sell the same parcel of land. The forms are great and I'm happy that I could use them more than once. To no fault of Deeds.com I used them many times to sell the same land. First the man died that was buying, before it got recorded. Then his wife was going to finish it, but then decided it should be sold to another party who was a friend of hers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine G.

April 23rd, 2021

. Easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

michael k.

February 24th, 2023

fast and easy to fill out forms.

Thank you!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

Paula V.

April 15th, 2025

Fast, easy, helpful instructions. I’ll use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara J.

October 7th, 2023

Process was simple and fast. Awaiting response form agency. I’m happy to have found deeds.com for a speedy service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!