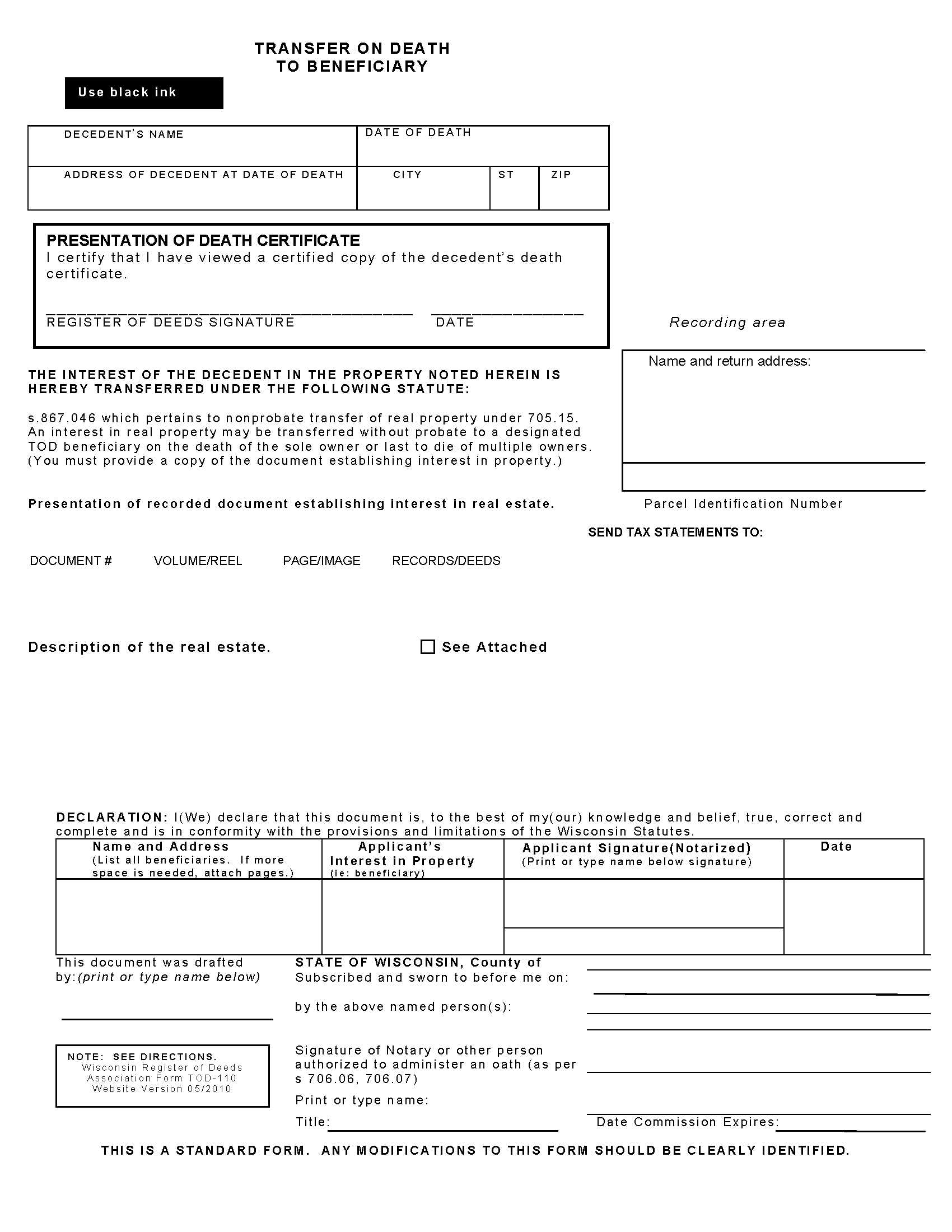

Forest County Transfer on Death to Beneficiary Form

Forest County Transfer on Death to Beneficiary Form

Fill in the blank form formatted to comply with all recording and content requirements.

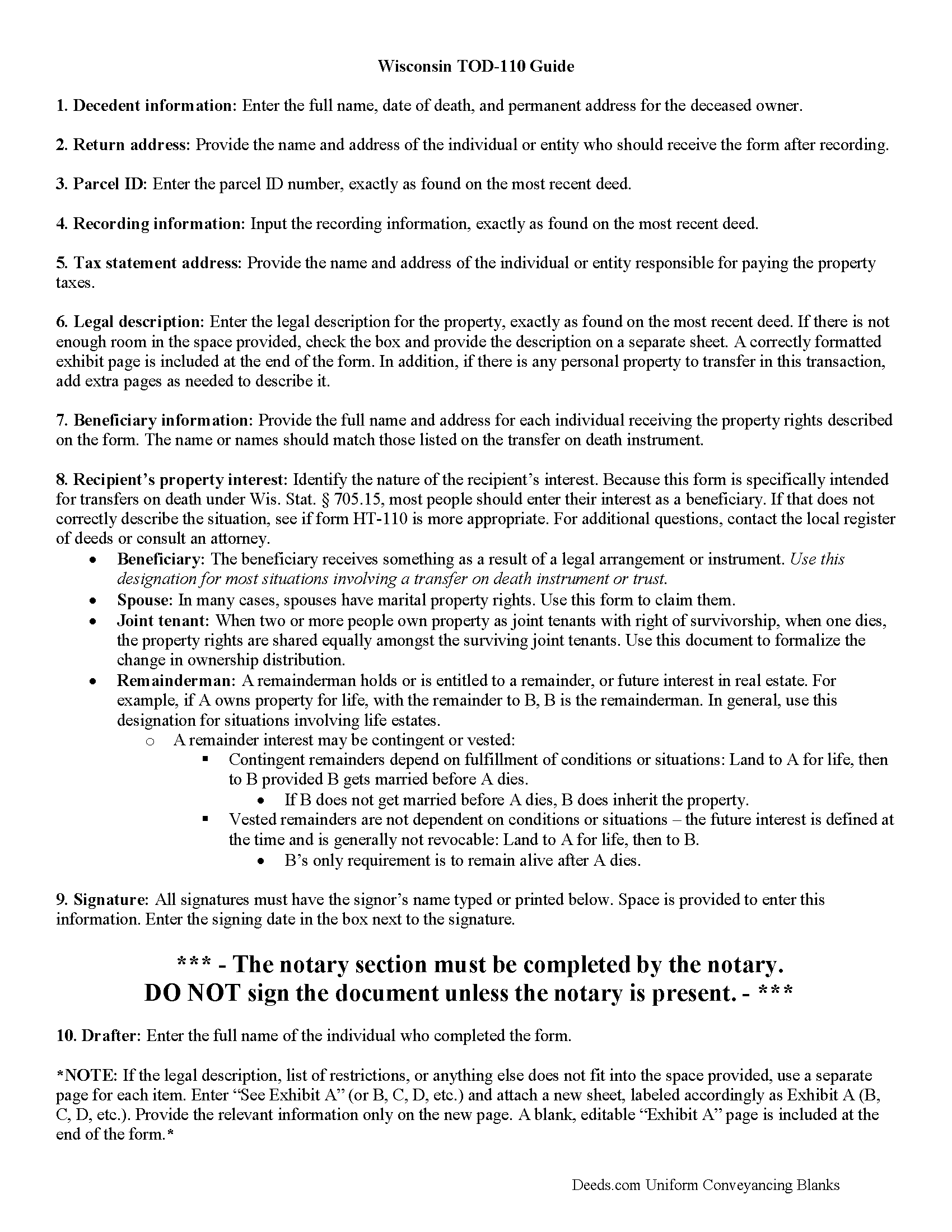

Forest County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

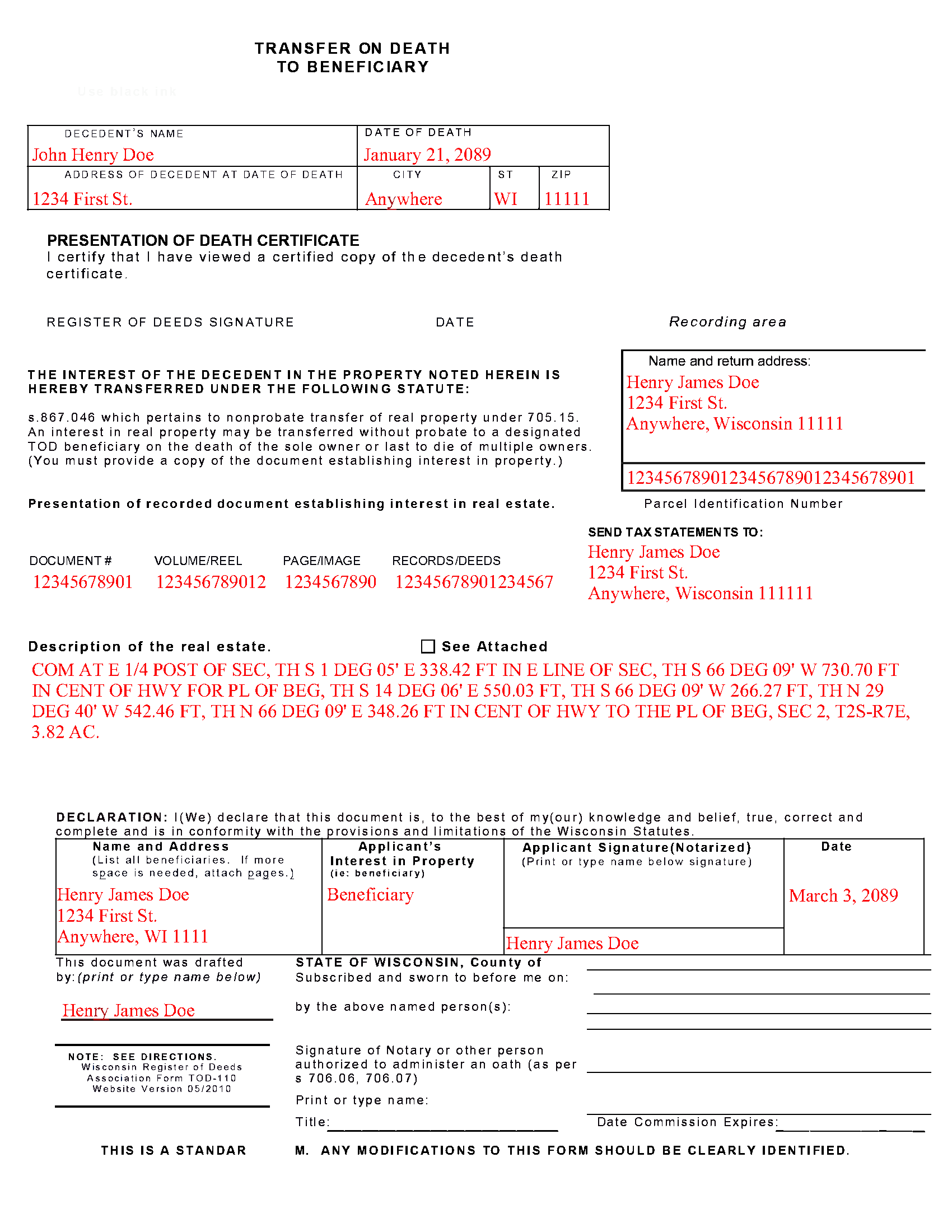

Forest County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Forest County documents included at no extra charge:

Where to Record Your Documents

Register of Deeds

Crandon, Wisconsin 54520

Hours: 8:30 to 12:00 & 1:00 to 4:30 M-F

Phone: 715-478-3823

Recording Tips for Forest County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Forest County

Properties in any of these areas use Forest County forms:

- Argonne

- Armstrong Creek

- Crandon

- Laona

- Wabeno

Hours, fees, requirements, and more for Forest County

How do I get my forms?

Forms are available for immediate download after payment. The Forest County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Forest County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Forest County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Forest County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Forest County?

Recording fees in Forest County vary. Contact the recorder's office at 715-478-3823 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Forest County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Forest County.

Our Promise

The documents you receive here will meet, or exceed, the Forest County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Forest County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

Daniel L.

September 25th, 2023

so far appears to meet my needs!

Thank you for your feedback. We really appreciate it. Have a great day!

Melody P.

December 30th, 2020

5 Stars isn't enough! I worked with KVH today (12-30-20) to get some deeds filed in Dallas County before the end of the year. Timing was critical and I thought my only option was to record in person. Someone suggested I try Deeds.com, and I'm very glad I did. KVH provided excellent service. Everything was quick and efficient, and I highly recommend using this service. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard H.

October 5th, 2022

Excellent service, very user friendly

Thank you!

Rebecca B.

September 14th, 2019

I found the form I need and while they couldn't file it via the e-recording way I had a great experience. Fingers crossed all goes well when I go in to record. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

William M.

February 27th, 2019

I got what I needed and did exactly what I needed. All legal and no hassle. Thanks Deeds.com, you made the job much easier.

Thank you!

Jennifer S.

December 11th, 2019

Fabulous

Thank you!

Mary D. B.

May 11th, 2023

BIG THANK YOU EXCELLENT WEBSITE

Thank you!

Michael M.

February 20th, 2020

Thanks worked out great as the form was perfect and no problems filing it with the county.

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie S.

July 29th, 2020

After over a month of turmoil and feeling like "you can't get there from here",you solved my problem in a little over an hour. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Larry H.

March 29th, 2019

Wow! So easy and such a cost savings. Thanks

Thanks Larry, we appreciate your feedback.

Sidney L.

July 22nd, 2022

Not a fan. Filling in the WI RE transfer return was simple enough. However, it downloaded as a DOR file and I can't find a program to open it. So, I have no way to print the form to complete the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Ben C.

December 8th, 2024

Easy and Quick,Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Keri C.

June 10th, 2020

It was confusing at first, but the customer service was excellent and fast and I got everything taken care of right away. I'll use Deeds.com even after the recorder's office is open to the public.

Thank you for your feedback. We really appreciate it. Have a great day!

Cecilia C.

June 2nd, 2023

So very easy to follow & the cost of the packet was reasonable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Essence L.

September 19th, 2020

Ordered and filled out the quitclaim forms. Had no issues with preparing or recording, smooth process.

Thank you!