Pierce County Trustee Deed Form

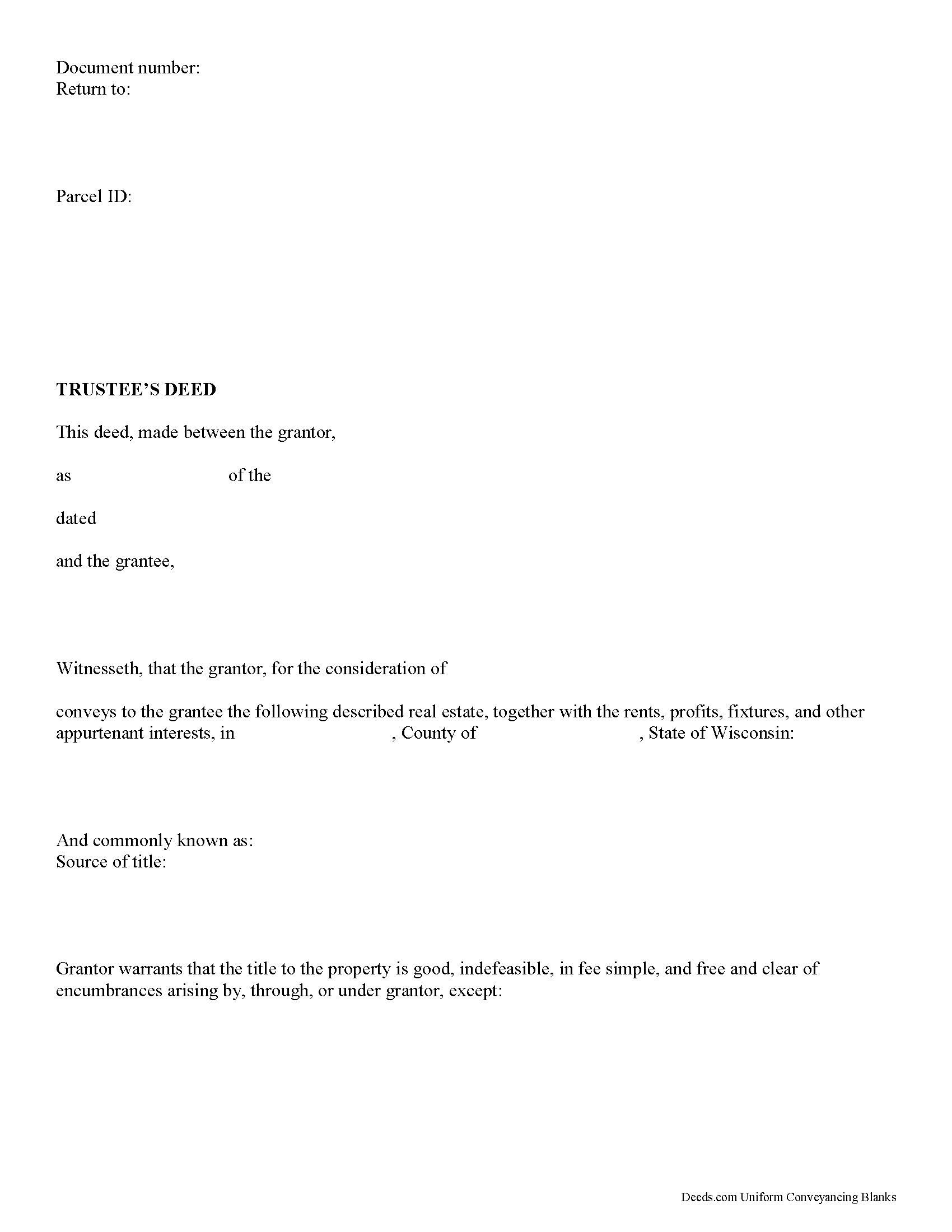

Pierce County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

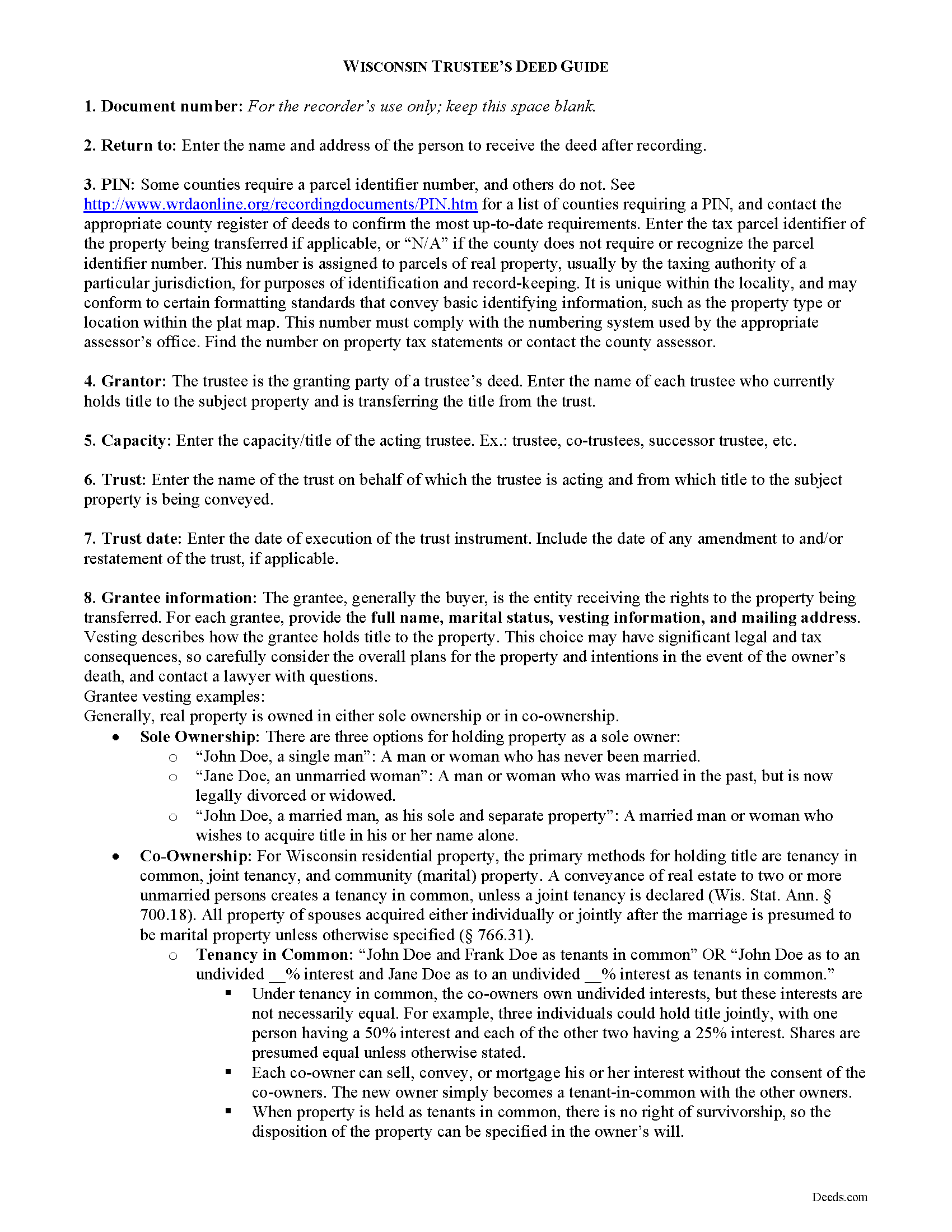

Pierce County Trustee Deed Guide

Line by line guide explaining every blank on the form.

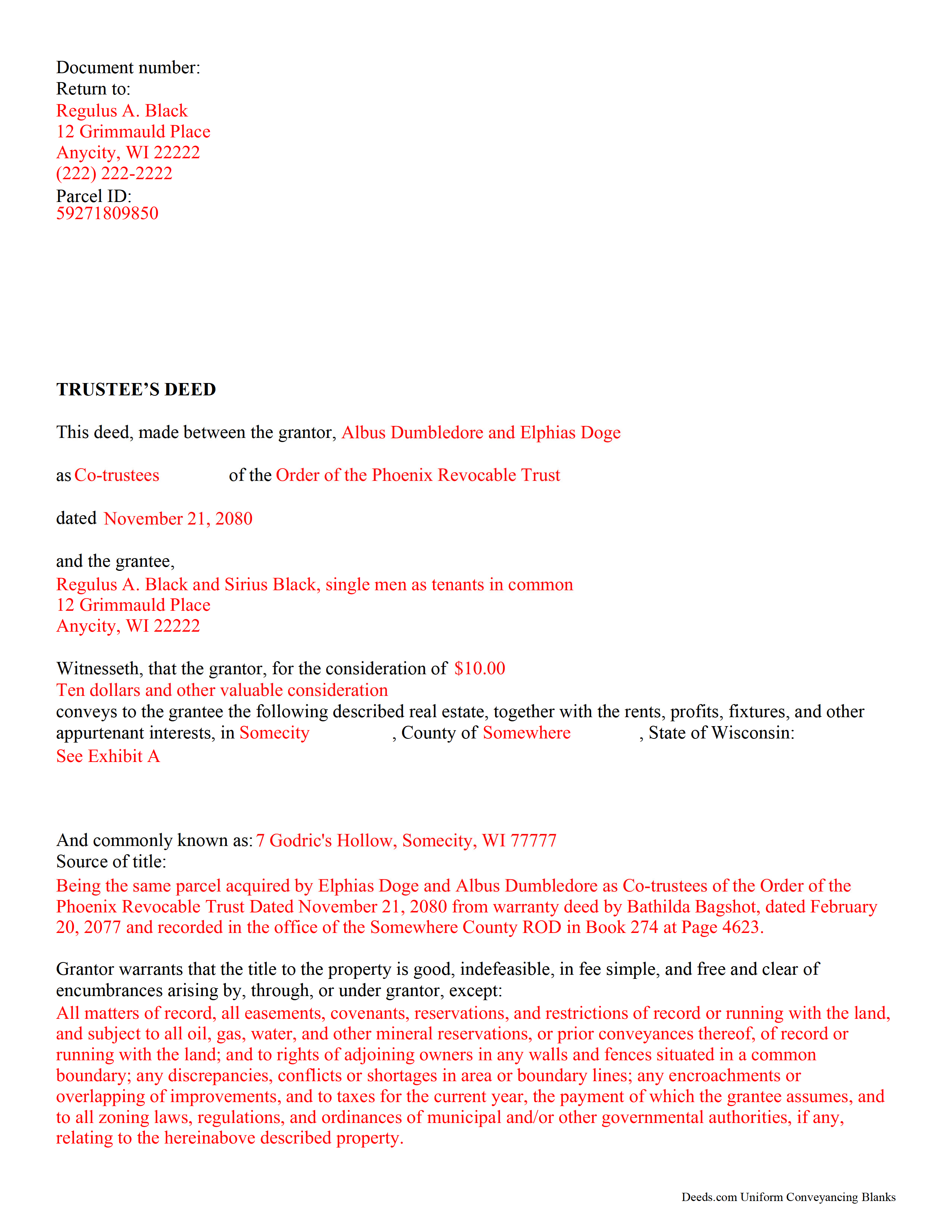

Pierce County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Pierce County documents included at no extra charge:

Where to Record Your Documents

Pierce County Register of Deeds

Ellsworth, Wisconsin 54011

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (715) 273-6748

Recording Tips for Pierce County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Pierce County

Properties in any of these areas use Pierce County forms:

- Bay City

- Beldenville

- East Ellsworth

- Ellsworth

- Elmwood

- Hager City

- Maiden Rock

- Plum City

- Prescott

- River Falls

- Spring Valley

Hours, fees, requirements, and more for Pierce County

How do I get my forms?

Forms are available for immediate download after payment. The Pierce County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pierce County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pierce County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pierce County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pierce County?

Recording fees in Pierce County vary. Contact the recorder's office at (715) 273-6748 for current fees.

Questions answered? Let's get started!

In a living trust, a grantor (settlor) transfers title to property to another person (trustee) for the benefit of a third (beneficiary). A settlor often serves as the original trustee (sometimes along with a spouse) and initial beneficiary of a living trust during his lifetime, and nominates a successor to take over fiduciary duties upon his death or incapacity, though this is not always the case. The settlor establishes the trust by executing a trust document, an unrecorded instrument outlining the scope and terms of the trust, including the settlor's estate plans. In transfers of real property into trust, the settlor executes a deed titling the property in the name of the trustee on behalf of the trust.

In order to convey real property from the trust during the settlor's lifetime, the trustee must execute a deed vesting title in the name of the grantee. In Wisconsin, a trustee's deed is a special warranty deed that has simply been named after the capacity of the granting party. The trustee's deed is identical in form to a special warranty deed, supplying in addition the name and date of the trust on behalf of which the grantor is conveying title. The deed contains the language that the grantor "warrants that the title to the property is good, indefeasible, in fee simple, and free and clear of encumbrances arising by, through, or under grantor" [2].

As noted by the Wisconsin Realtors Association, "personal representatives and other fiduciaries such as trustees and guardians...[who] are not sufficiently familiar with the history of the property to give a warranty deed" use a special warranty deed to convey title [1]. A special warranty deed contains the covenant that the title is free and clear of encumbrances only arising by, through, or under grantor, with any exceptions expressly noted in the conveyance.

The form should meet all content requisites for conveyancing instruments under 706.02, including the name of each party; a legal description of the property subject to conveyance; and original signatures of the grantors. All recordable documents should also meet formatting requisites established at 59.43(2m). The deed must be signed in the presence of a notary public before recording in the appropriate county register of deeds. Additional documentation confirming the trustee's authority may be required (see Wisconsin Trust Code 701.1013 for certification of trust).

Consult a lawyer with questions regarding transfers by trust in Wisconsin, as each situation is unique.

(Wisconsin TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Pierce County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Pierce County.

Our Promise

The documents you receive here will meet, or exceed, the Pierce County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pierce County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Lane C.

March 2nd, 2023

The documents worked perfectly! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Marjorie D.

May 13th, 2025

Makes recording fast and easy. Great service!

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Janet R.

January 7th, 2019

Disappointed. Description of Lien discharge form does not indicate it is specific to Mechanic liens. I'm inexperienced with liens & should have contacted someone before I ordered.

Sorry to hear that, it does look like our product description was lacking clarity. We have updated the description to better reflect the documents. We have also canceled your order and refunded the payment. Hope you have a great day.

Angela B.

July 22nd, 2020

The site made everything very easy to understand and access. I was able to get everything I needed and the cost was reasonable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel B.

April 7th, 2023

Very well organized and easy to understand. Will probably use your service again in the future for other forms

Thank you for your feedback. We really appreciate it. Have a great day!

Gisela A.

April 11th, 2019

Great selection of documents. Properly formatted form also included great instructions and the example was very helpful. Filed it myself - no problem!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

mary c.

May 24th, 2022

Really good product, included guide to filling out forms. Totally pleased with that part. Customer service however was terrible. Did not hear back after I sent two emails. The site signed me up but after I was accepted they would not allow me to download a form, with the notation my account was closed. Had to use another email. Had problems with that. Finally got off of site and went to a login site that allowed me to download the forms. If you can get past setting up your account, it is fantastic site. Nice price compared to alternatives. Also I recieved two validation codes. Have no idea why they were sent.

Thank you!

Francine B.

March 25th, 2020

Looks like all forms are available. Hope they are as easy to use as it was to obtain. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LeRoy E.

June 20th, 2022

So thankful I found this. I was feeling stressed out and reluctant about doing this on my own.

Thank you!

Robin G.

July 3rd, 2020

Very responsive and helpful.

Thank you!

William M.

February 27th, 2019

I got what I needed and did exactly what I needed. All legal and no hassle. Thanks Deeds.com, you made the job much easier.

Thank you!

Austin S.

August 13th, 2020

Everything is done in a timely manner which is very much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry B.

May 18th, 2021

Poor quality document. Deed did not contain space for mandatory rax info required.

Thank you for your feedback Larry. We do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!

Bruce L.

December 30th, 2023

Fantastic. The forms were easy to read and complete. Came with a guide and examples of how it looked completed Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!