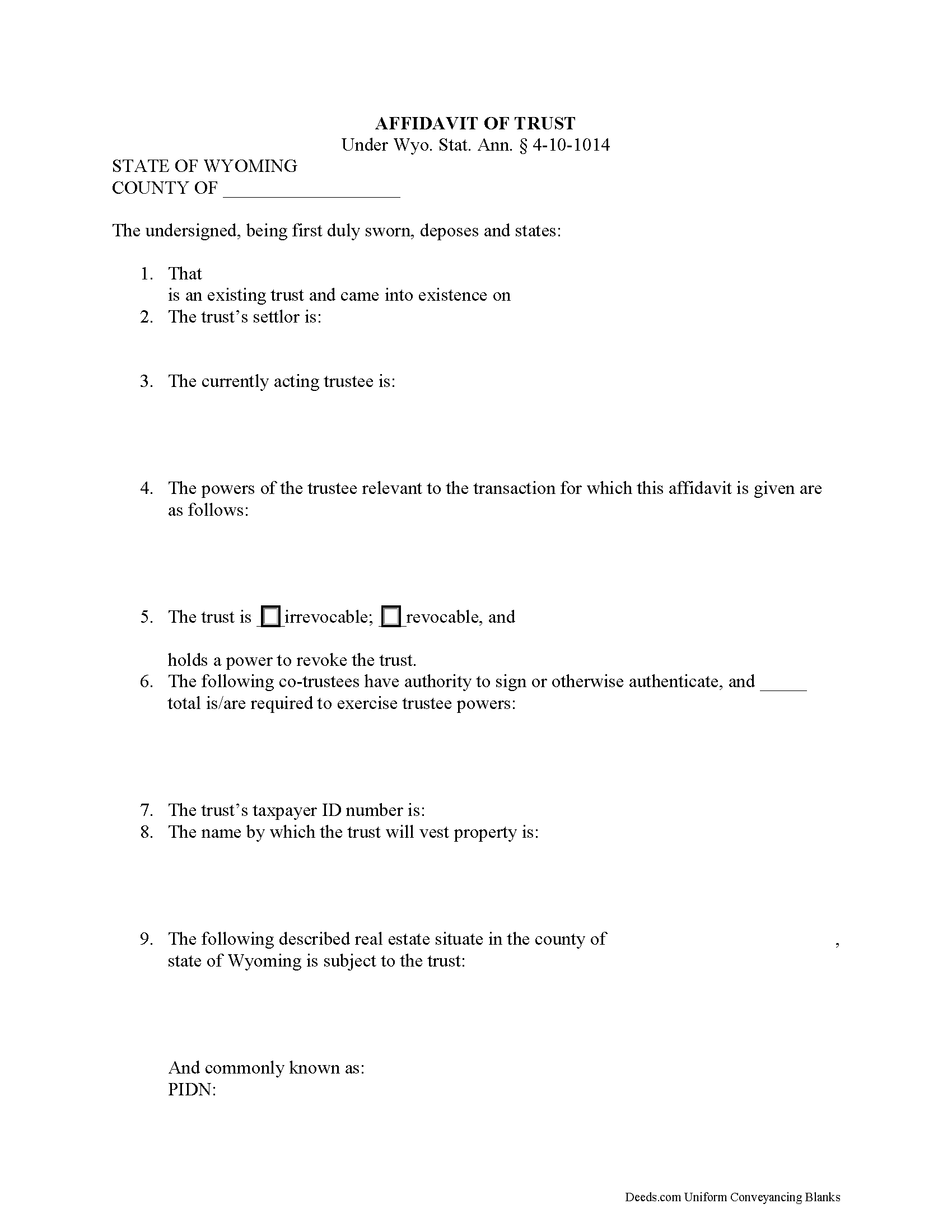

Weston County Affidavit of Trust Form

Weston County Affidavit of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

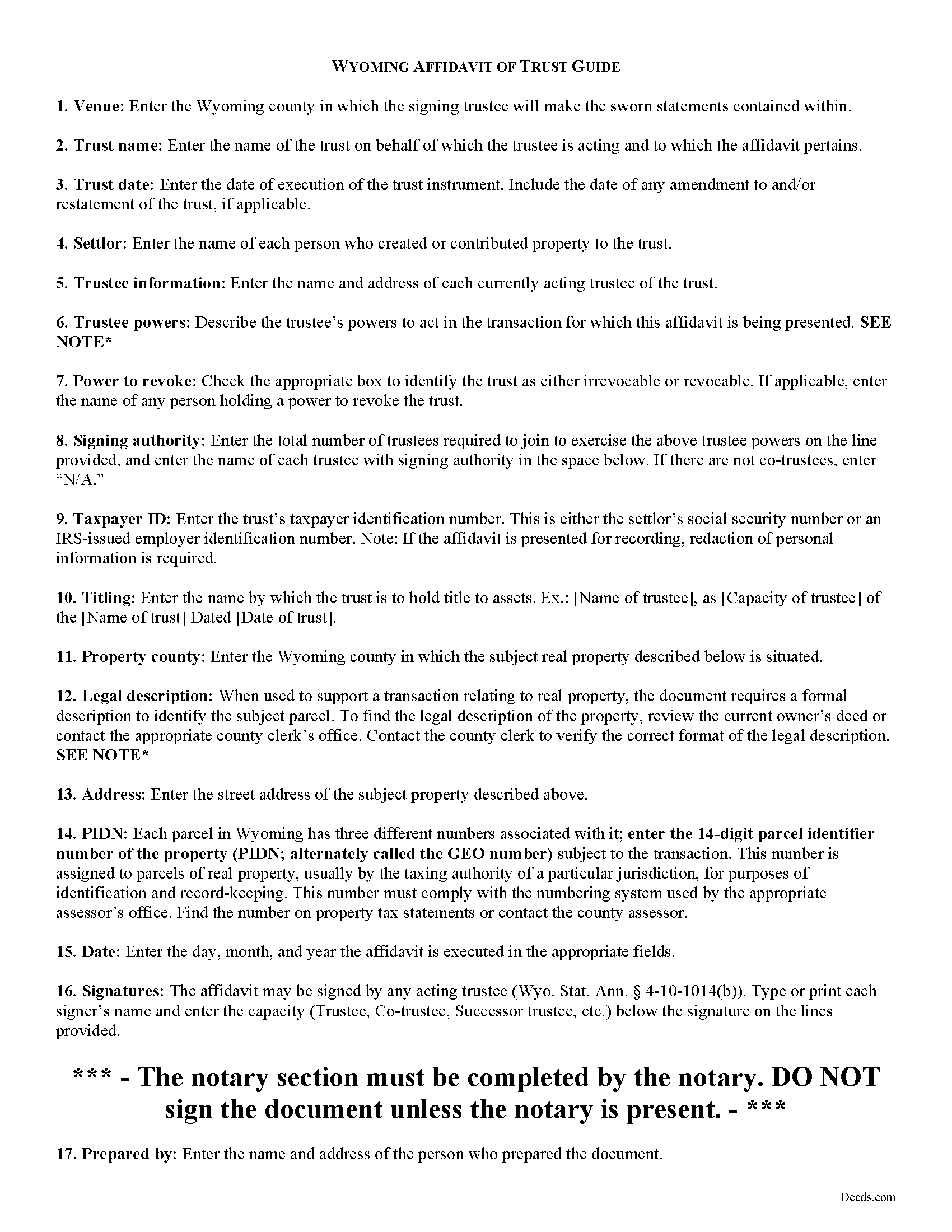

Weston County Affidavit of Trust Guide

Line by line guide explaining every blank on the form.

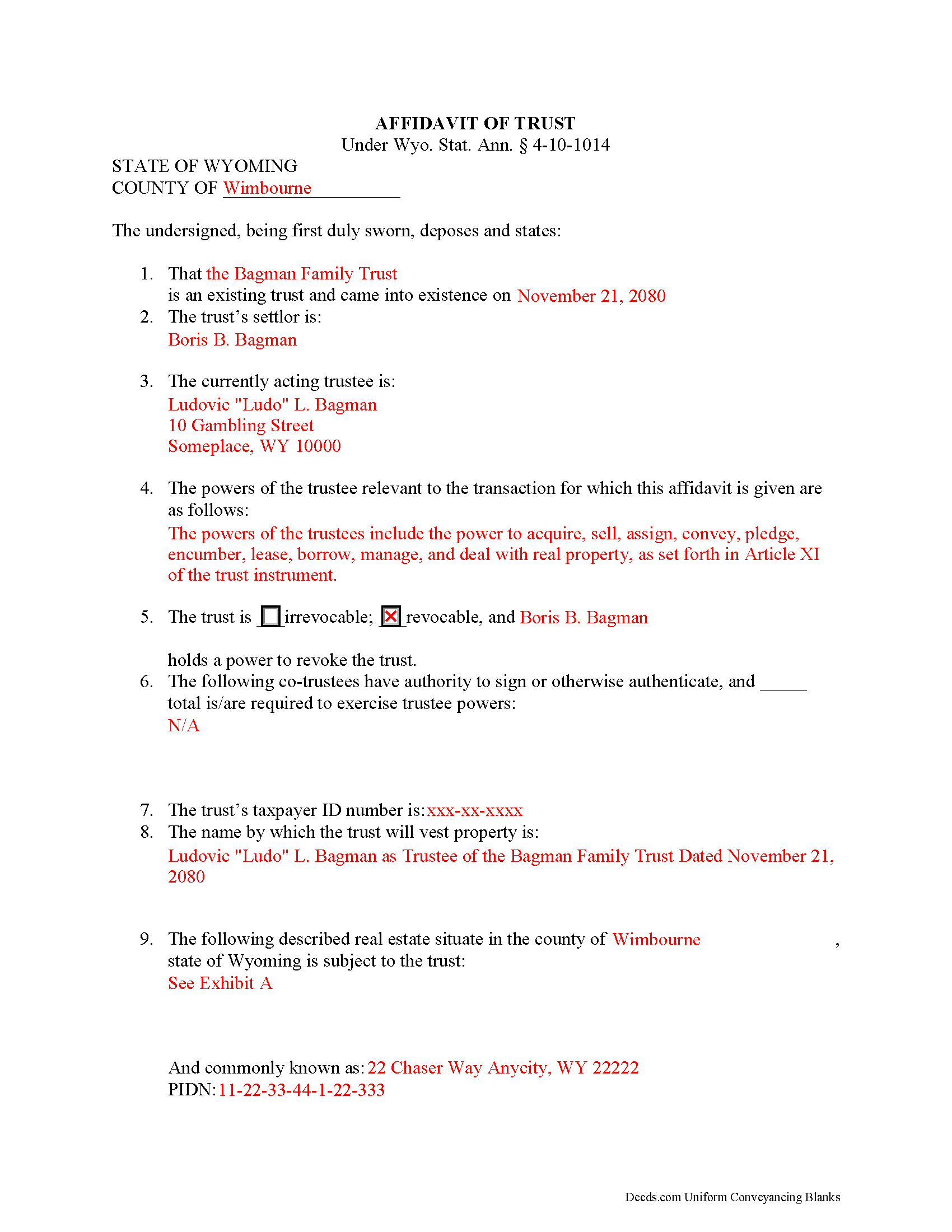

Weston County Completed Example of the Affidavit of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wyoming and Weston County documents included at no extra charge:

Where to Record Your Documents

Weston County Clerk

Newcastle, Wyoming 82701

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (307) 746-4744

Recording Tips for Weston County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Weston County

Properties in any of these areas use Weston County forms:

- Four Corners

- Newcastle

- Osage

- Upton

Hours, fees, requirements, and more for Weston County

How do I get my forms?

Forms are available for immediate download after payment. The Weston County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Weston County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Weston County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Weston County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Weston County?

Recording fees in Weston County vary. Contact the recorder's office at (307) 746-4744 for current fees.

Questions answered? Let's get started!

In a trust relationship, a settlor transfers one or more assets to another (the trustee), who holds and manages them for the benefit of a third (the beneficiary). In a living trust, the settlor indicates the intent to create a trust by executing a document called the trust instrument. This document sets out the trust's provisions and allows the settlor to plan how his assets will be distributed upon his death, without the requirement that his estate go through probate.

In the place of the entire trust document, a trustee in Wyoming may present an affidavit of trust to any person who is not a trust beneficiary. Codified as part of the Uniform Trust Code at Wyo. Stat. Ann. 4-10-1014, the document certifies that a trust exists and that the trustee has the authority to engage in the business at-hand with the recipient on behalf of said trust. Instead of summarizing the entire trust agreement, the affidavit contains only the information relevant to the current transaction, allowing the settlor to maintain the privacy of his/her estate plans (including the identity of trust beneficiaries).

As specified by statute, the affidavit is signed and sworn to before an appropriate official. Other requirements include the name and date of trust; the name of the settlor; the name and address of the current trustee; and a description of the relevant powers of the trustee. In addition, the document identifies any person who holds a power to revoke the trust, if applicable, and, if there are multiple trustees, it stipulates which trustees have signing authority and how many, if fewer than all, are required to act jointly to perform the powers listed. Wyoming also requires the trust's taxpayer identification number.

The form includes the name by which the trust vests title to property, and, when used in transactions pertaining to real property interests, may include a legal description of the subject property held in trust. Further, the trustee certifies that the trust has not been amended, modified, or revoked in a manner that invalidates any of the statements contained within the certificate. Persons dealing with trustees are protected by the provisions of 4-10-1014.

Consult a lawyer with questions regarding affidavits of trust or other issues relating to trust property in Wyoming.

(Wyoming AOT Package includes form, guidelines, and completed example)

Important: Your property must be located in Weston County to use these forms. Documents should be recorded at the office below.

This Affidavit of Trust meets all recording requirements specific to Weston County.

Our Promise

The documents you receive here will meet, or exceed, the Weston County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Weston County Affidavit of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Carol S.

November 18th, 2020

Excellent ...easy, timely!

Thank you for your feedback. We really appreciate it. Have a great day!

Dee S.

October 24th, 2023

Great service and so quick at responding!

We are motivated by your feedback to continue delivering excellence. Thank you!

Sandra N.

April 13th, 2019

Very quick and painless process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ernest K.

July 27th, 2020

Im an out of state realtor, but couldnt believe how quick and easy the process was. Recieved my deed within 15 min of submission. I will be referring clients to this service.

Thank you!

Scott A.

July 8th, 2020

Good site. Saved me a trip to one or two courthouses.

Thank you for your feedback. We really appreciate it. Have a great day!

Jo A B.

June 18th, 2022

Clean crisp website with helpful information; however. If the site states the following files are included, a single .zip, .rar, , ,download should be available instead of individual.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura L.

June 17th, 2025

Used a form from this service. Best part about these forms is that they don't let you get in trouble by removing or changing things that should not be changed. It's easy to look at something and think why is this margin so big, why is this field so small and want to change it only to find out it is incredibly important. That's why they are the deed document pros.

Thank you for the thoughtful review! We're so glad to hear you found our forms reliable and well-structured. It’s true—what might look like an odd margin or a small field is often there for a very specific legal or recording reason. We’ve seen how small changes can lead to big headaches, which is why we design our documents to be both user-friendly and compliant with strict recording standards. We really appreciate you recognizing the care that goes into each one. Thanks again for choosing us!

Deborah M.

June 24th, 2021

Absolutely great. The staff is responsive and knowledgeable. The online interface is excellent. The total cost for finalizing the sale on our property (minus state filing fees) was $39. A wonderful experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Burr A.

November 7th, 2020

So far so good. Prompt and responsive. Thank you.

Thank you!

Imari E.

June 11th, 2020

QUICK SERVICE

Thank you!

JOSEPH W.

September 17th, 2021

Easy peezy!

Thank you!

Michael M.

January 11th, 2019

I downloaded the gift deed and I can not type my info onto it what am I doing wrong. Please advise

Sounds like you may be trying to complete the form in your browser. The document needs to be downloaded and saved to you computer, then opened in Adobe.

Joseph K.

May 1st, 2020

I'm very impressed. We're a small nonprofit, and we usually walk our documents into our county offices for recording. So I was a little bit skeptical about how things would work if we did it electronically. But it was a smooth, quick, painless, and reasonably priced process. I expect that this will be our preferred method even after county offices re-open.

Thank you for your feedback. We really appreciate it. Have a great day!

Kerrin S.

April 13th, 2020

This was so efficient. Thank you for offering this service!

Thank you for your feedback. We really appreciate it. Have a great day!

Chelsie F.

April 3rd, 2020

Super customer service and communication! Fast service and more informative than expected! Can't say thanks enough.

Thank you!