Clay County Correction Quitclaim Deed Form

Clay County Correction Quitclaim Deed Form

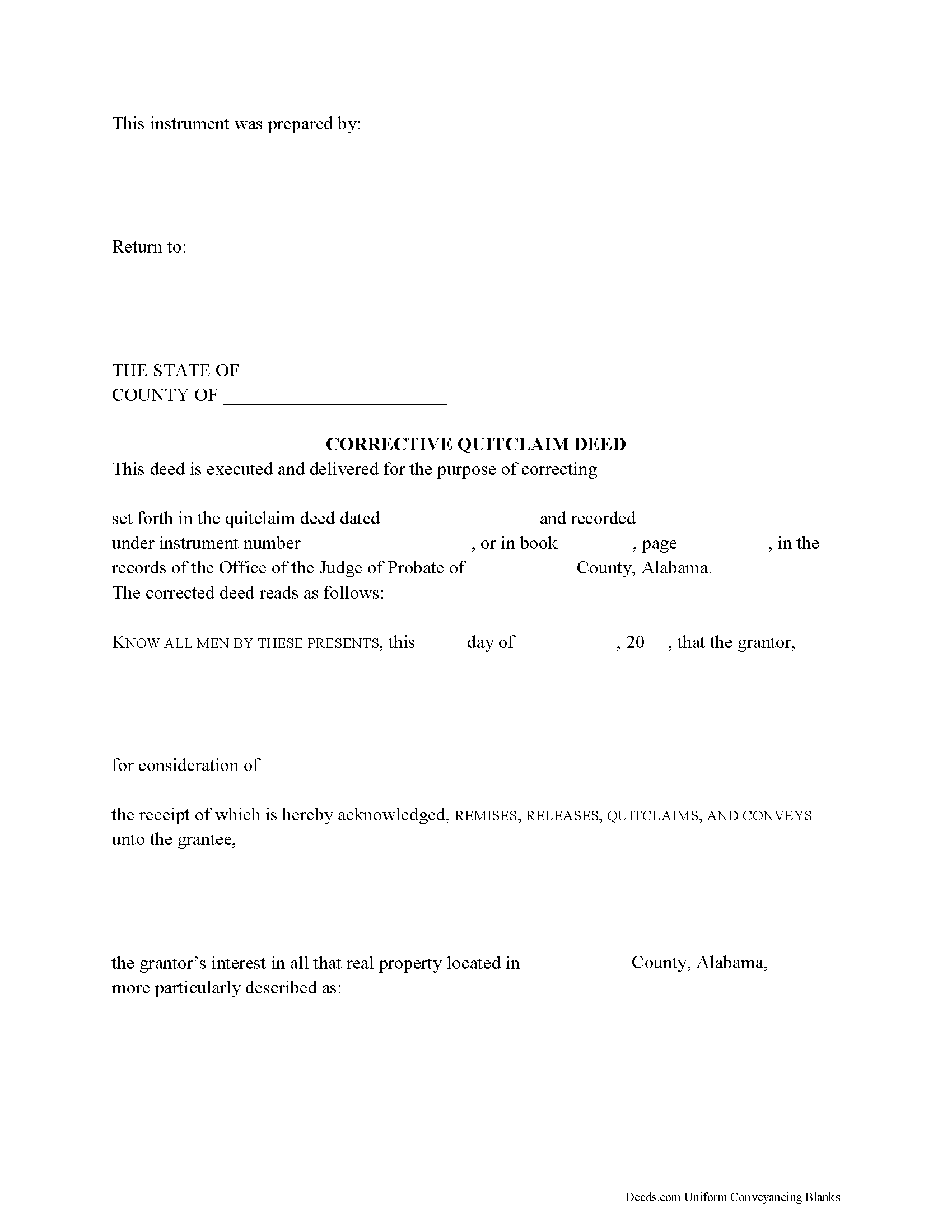

Fill in the blank Correction Quitclaim Deed form formatted to comply with all Alabama recording and content requirements.

Clay County Correction Quitclaim Deed Guide

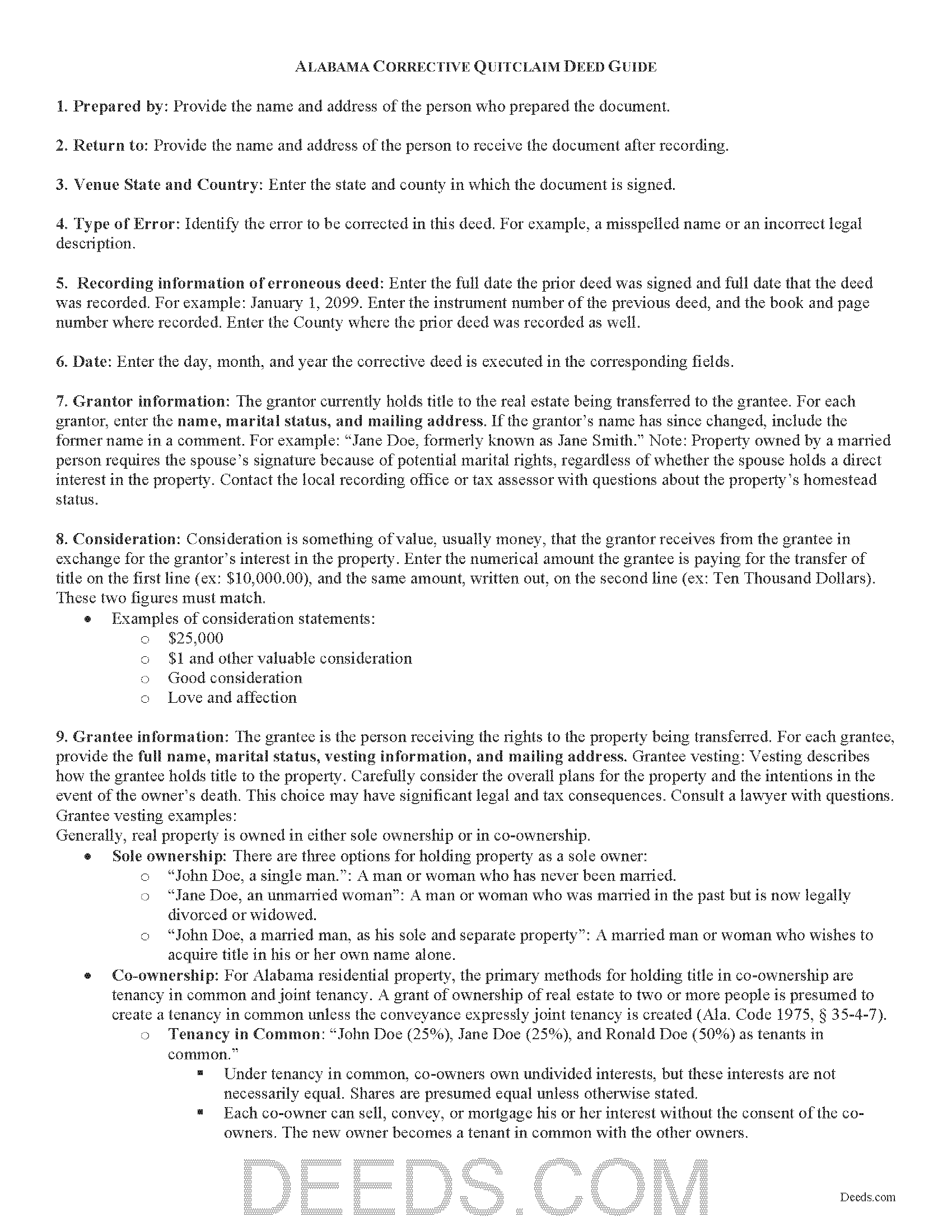

Line by line guide explaining every blank on the Correction Quitclaim Deed form.

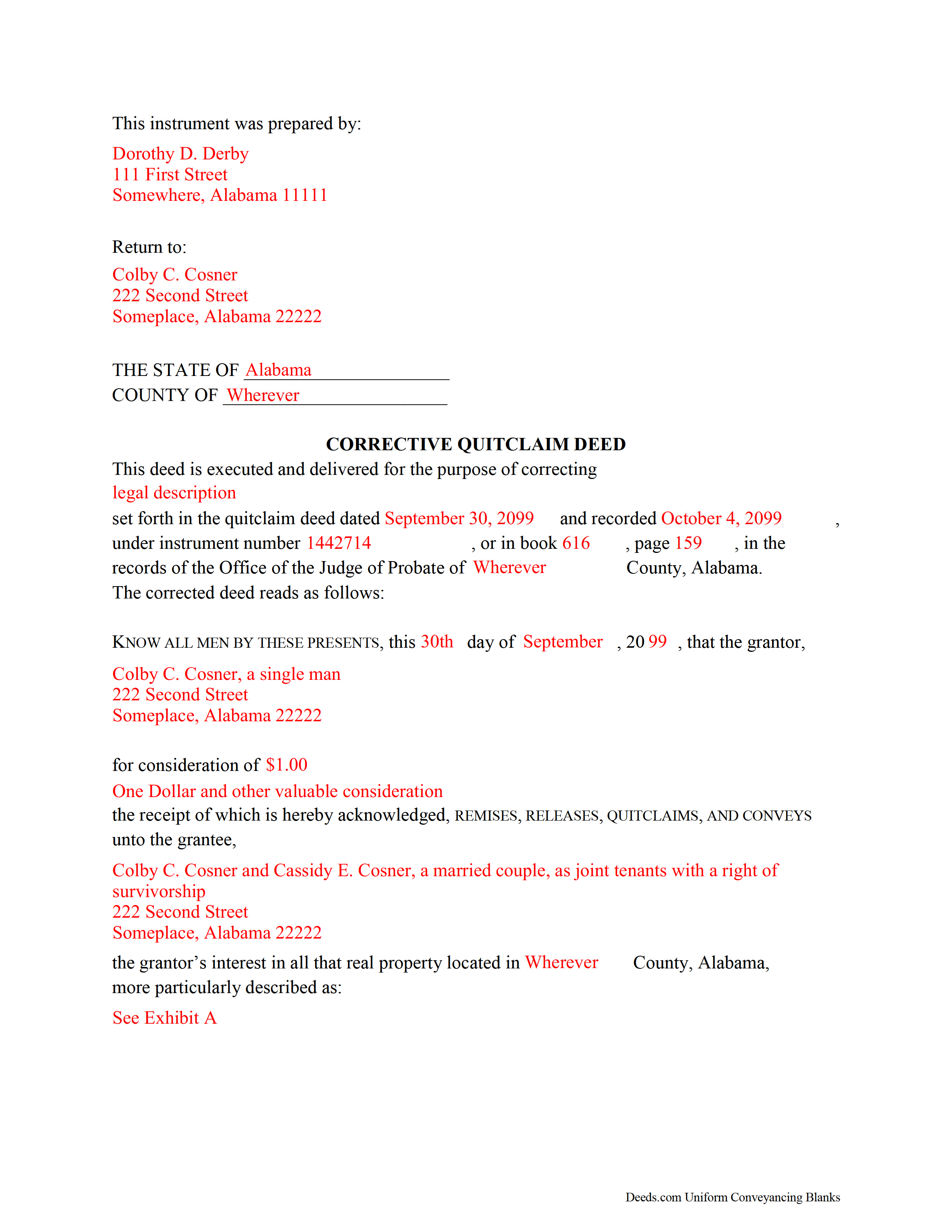

Clay County Completed Example of the Correction Quitclaim Deed Document

Example of a properly completed Alabama Correction Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Clay County documents included at no extra charge:

Where to Record Your Documents

Clay County Probate Office

Ashland, Alabama 36251

Hours: 8:30 to 4:00 M-F

Phone: (256) 354-2198

Recording Tips for Clay County:

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Clay County

Properties in any of these areas use Clay County forms:

- Ashland

- Cragford

- Delta

- Hollins

- Lineville

- Millerville

Hours, fees, requirements, and more for Clay County

How do I get my forms?

Forms are available for immediate download after payment. The Clay County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clay County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clay County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clay County?

Recording fees in Clay County vary. Contact the recorder's office at (256) 354-2198 for current fees.

Questions answered? Let's get started!

Corrective Quitclaim Deeds in Alabama

What happens when there is an error in your deed? What can you do to fix it? One option may be filing a corrective deed.

A corrective deed is an instrument used to correct a small error in a deed that has been recorded at an earlier date. Note that corrective deeds cannot change the nature of the transfer, so make sure to use the same type of document. For example, to correct a recorded quitclaim deed, use a corrective quitclaim deed.

Corrections can only be made to non-material errors, causing no actual change in the substance, or facts, of the deed. Common minor errors include misspelled names or missing information, such as marital status, or a mistake transcribing courses and distances in the legal description of the property. Material changes to the substance of the deed have a legal effect in how property is titled, and therefore require a new deed.

On the corrective deed, give the recording information from the previously filed document, then identify which section contains the error. Provide the correct details in the body of the deed. The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed.

The deed must meet the state and local formatting standards as for recorded documents, and must also be acknowledged before any of the officers listed in (Ala. Code 1975, 35-4-24). For the corrective deed to be valid, all parties who signed the prior deed must sign the corrective deed in the presence of a notarial official. The execution of a deed must be attested by at least one witness in Alabama (Ala. Code 1975, 35-4-20). If the grantor is married, Alabama requires that both spouses sign the deed (Ala. Code 1975, 6-10-3).

Most transfers of real property are subject to a privilege or license tax, but re-recording corrected deeds is exempt under Ala. Code 1975, 40-22-1, so there is no need for a Real Estate Sales Validation Form (Form RT-1).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about corrective quitclaim deeds or any other issues related to transferring real property in Alabama.

(Alabama Correction Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Clay County to use these forms. Documents should be recorded at the office below.

This Correction Quitclaim Deed meets all recording requirements specific to Clay County.

Our Promise

The documents you receive here will meet, or exceed, the Clay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clay County Correction Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Kevin U.

January 27th, 2025

very smooth and easy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kelli B.

January 31st, 2019

Amazingly simple and fast. A great service.

Thank you!

Brenda B.

January 6th, 2019

Excellent transaction.

Thank you Brenda.

Patricia C.

May 13th, 2019

I found there were a large number of documents available to download. The file naming on the PDFs could be more descriptive, and it would be nice to be able to download a complete set with one click.

Thank you for your feedback. We really appreciate it. Have a great day!

Fedila A.

July 16th, 2021

Thank you! I got the forms and saved them. Fast download and the price is given before ordering which is great. The only thing missing is the sample of the Cover Page. Thanks a lot!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ismael I.

April 10th, 2019

The service was fast and outstanding. Thank you.

Thank you!

Billy R.

May 18th, 2021

Thank you...........easy process........Billy C

Thank you!

Clay H.

July 11th, 2022

The provided docs and guide were very helpful. Well worth the price in my opinion.

Thank you for your feedback. We really appreciate it. Have a great day!

Roberta J B.

February 17th, 2021

User friendly

Thank you!

Sue S.

December 22nd, 2021

Great site easy to use and the documents are great!

Thank you for your feedback. We really appreciate it. Have a great day!

Georgiana I.

January 25th, 2020

The deed itself was easy. I did notice that although the website says that the deed would exempt the house from probate, the deed clearly states that it might not. I hope that "might " is the operative word here.

Thank you for your feedback. We really appreciate it. Have a great day!

Viola G.

July 7th, 2022

Some of the forms I ordered didn't have enough space for all of the information, but were useful as a guide for creating what I needed. Now I'll be trying the e-recording to see how that goes.

Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Lisa H.

May 27th, 2020

I needed a copy of a deed for a client and wanted to be sure I had the most recent one. I used Deeds.com and had it along with detailed property information within minutes at a very reasonable price. I am very pleased.

Thank you!

Ryan P.

October 6th, 2020

It was a pleasant surprise to find out how easy the site was to use! Clear directions! very user friendly!

Thank you!