Yuma County Affidavit of Successor Trustee Form

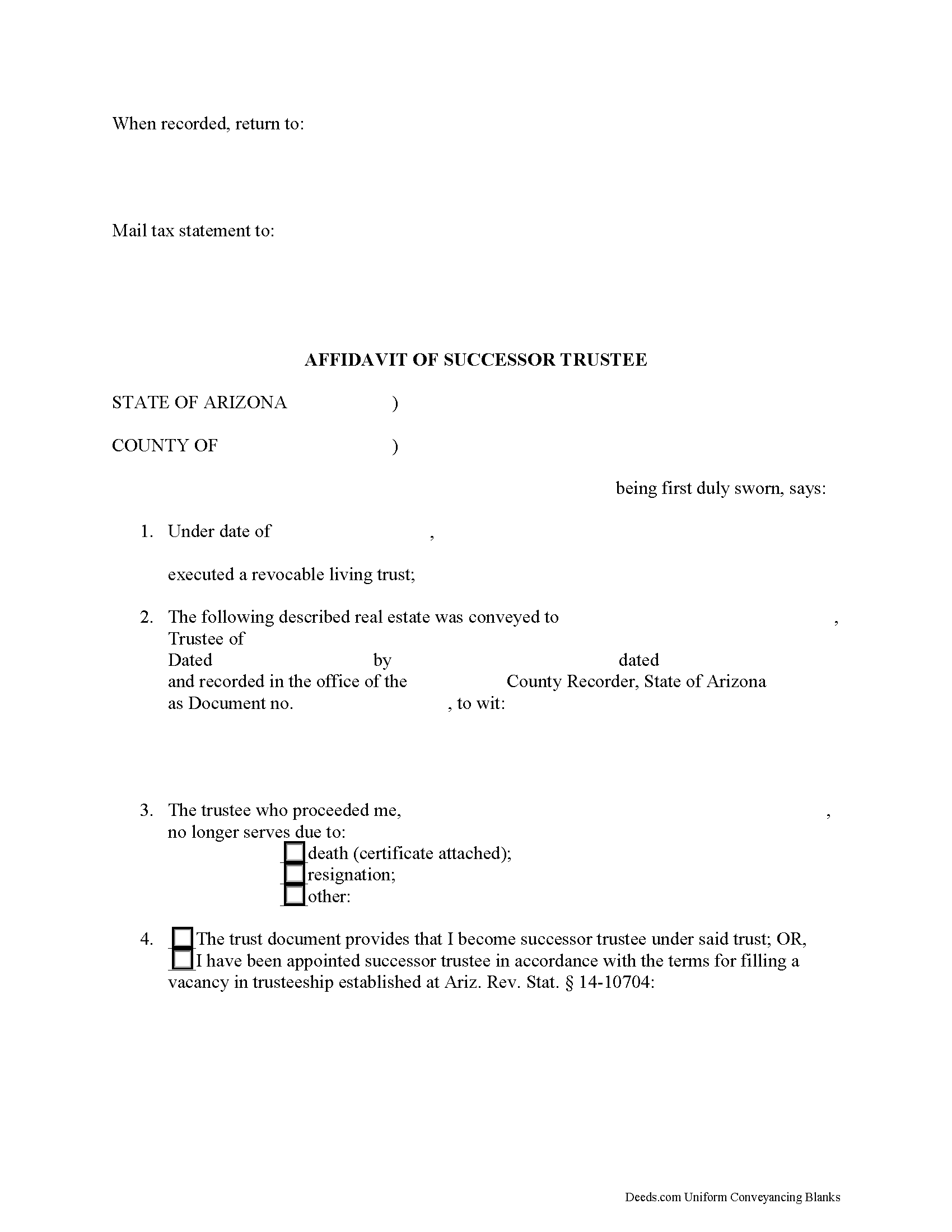

Yuma County Affidavit of Successor Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

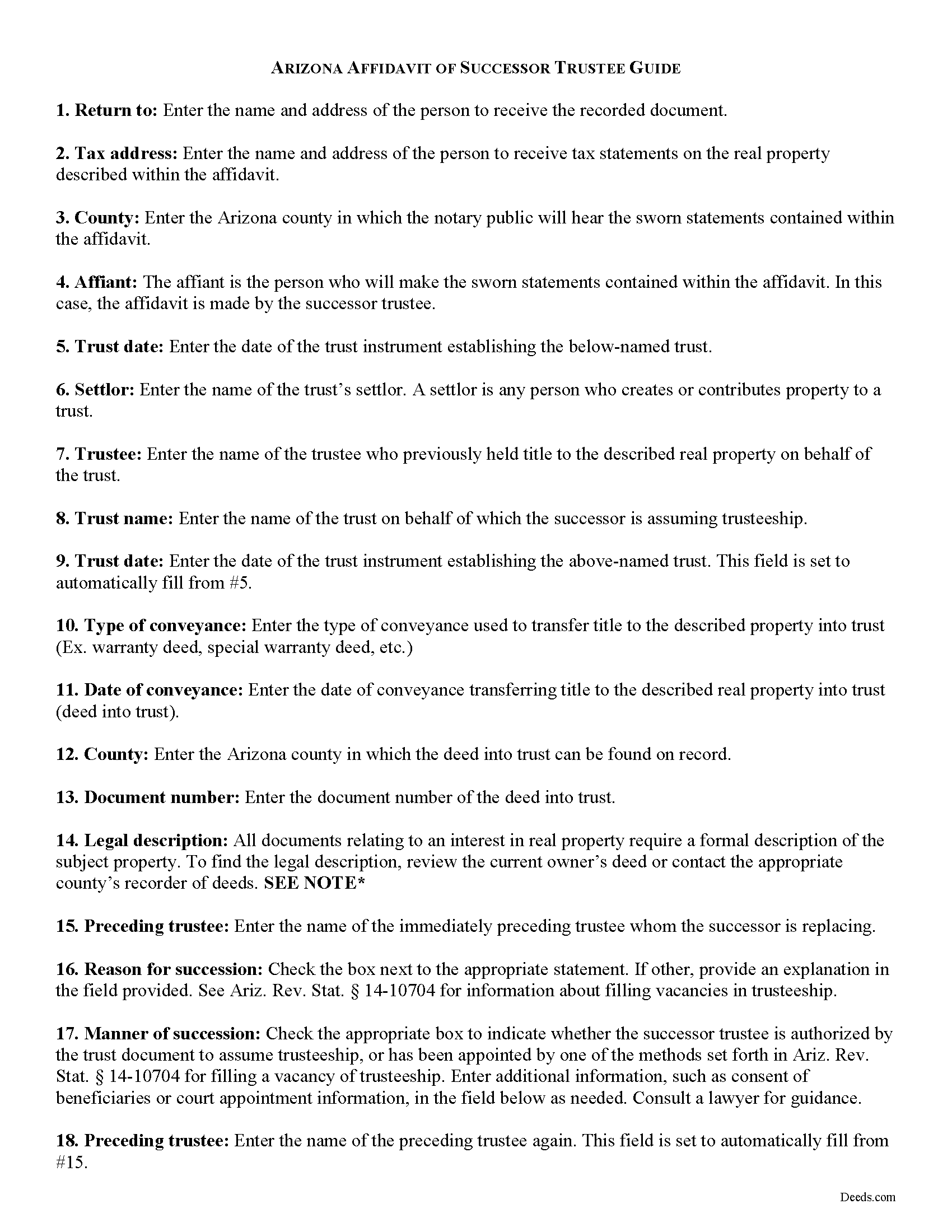

Yuma County Affidavit of Successor Trustee Guide

Line by line guide explaining every blank on the form.

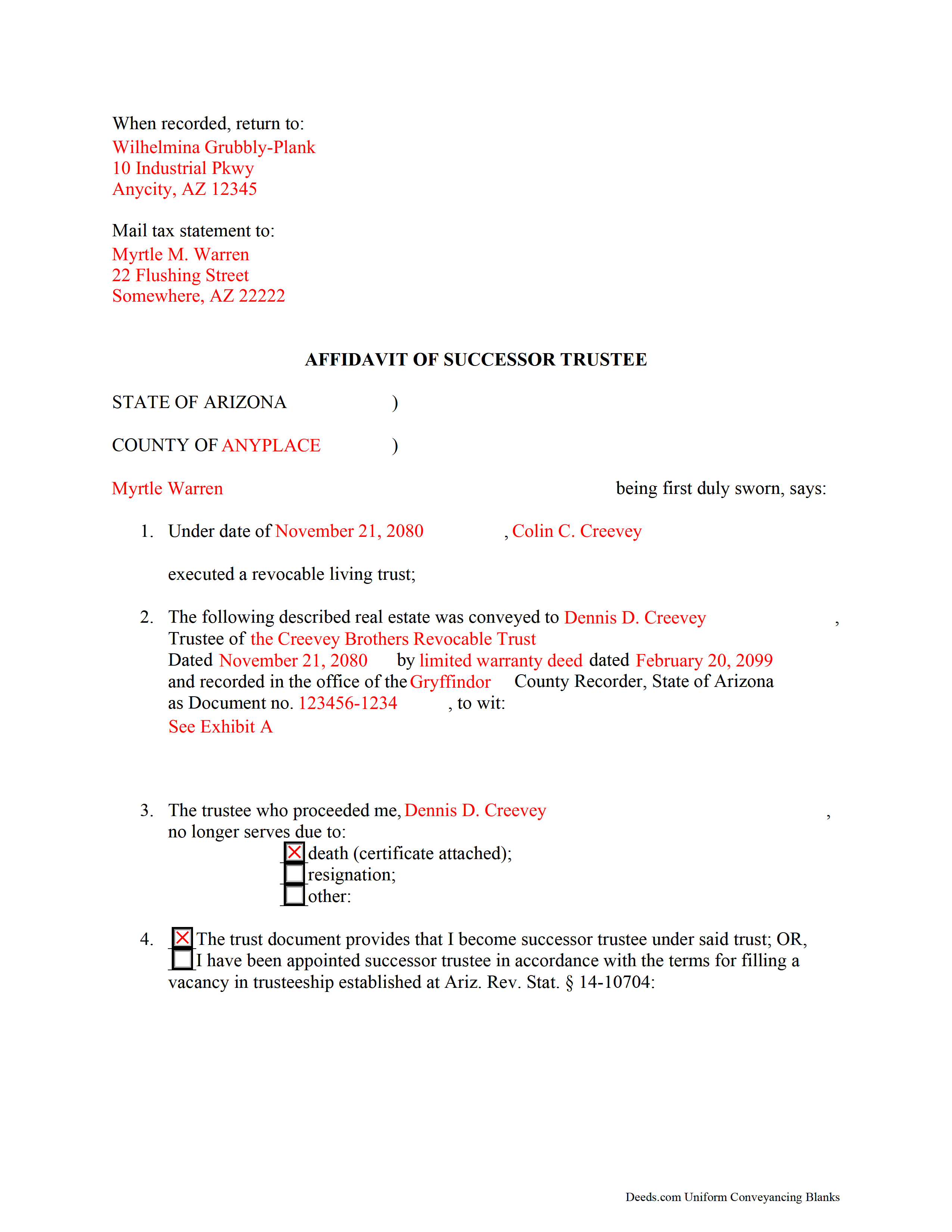

Yuma County Completed Example of the Affidavit of Successor Trustee Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Yuma County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Yuma, Arizona 85364-2311

Hours: 8:00am - 5:00pm M-F

Phone: 928-373-6020

Recording Tips for Yuma County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Avoid the last business day of the month when possible

- Have the property address and parcel number ready

Cities and Jurisdictions in Yuma County

Properties in any of these areas use Yuma County forms:

- Dateland

- Gadsden

- Roll

- San Luis

- Somerton

- Tacna

- Wellton

- Yuma

Hours, fees, requirements, and more for Yuma County

How do I get my forms?

Forms are available for immediate download after payment. The Yuma County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Yuma County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Yuma County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Yuma County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Yuma County?

Recording fees in Yuma County vary. Contact the recorder's office at 928-373-6020 for current fees.

Questions answered? Let's get started!

To transfer real property in a living trust from a trustee to a successor, the successor trustee executes and records an affidavit of successor trustee. The document contains sworn statements confirmed in the presence of a notary public, and provides notice that the successor has assumed the authority of the preceding trustee relevant to real property held in trust.

In addition to naming the affiant (the person making the sworn statements; in this case, the successor trustee), the affidavit contains the basic details about the trust for which the successor is assuming trusteeship, including its name, date, and settlor (person who created or contributed assets to the trust).

The form also requires information about the deed transferring the subject real property into trust, including the type and date of the deed, its location on record, and the grantee of the deed. The grantee is generally the preceding trustee who held title to the property. Because the affidavit confirms the successor's authority regarding the real property, the form also requires the legal description of said property. Further, the affidavit contains the details concerning the change in trusteeship.

It is not uncommon that an affidavit of successor trustee be referred to by a different name. For instance, an affidavit of death of trustee accomplishes the same task, but is obviously only useful when the preceding trustee has died. But what happens when the trustee has resigned, or another circumstance, such as removal, prevents the trustee from serving?

When a trust is served by multiple trustees and a vacancy occurs, the remaining co-trustees may act for the trust (14-10703(B)). However, Arizona statutes require a vacancy in individual trusteeship to be filled (and therefore, an affidavit of successor trustee to be recorded) in the following six cases: when a designated trustee rejects the trusteeship; when the designated trustee cannot be identified; when the trustee resigns; when the trustee is disqualified or removed; when the trustee dies; or when a guardian or conservator is appointed for an individual serving as a trustee (Ariz. Rev. Stat. 14-10704). Statutes provide the court with authority to appoint a trustee when "necessary for the administration of the trust," regardless of a vacancy ( 14-10704(E)).

A successor trustee may be designated in the original trust document (the instrument a settlor uses to establish a trust), or filled in the order provided for by statute: 1) by a person who is appointed by a person who has authority in the trust instrument to appoint a successor trustee; 2) by a person appointed by unanimous agreement of the qualified beneficiaries; and, finally, 3) by a person appointed by the court ( 14-10704(C)). (Note: this applies to noncharitable trusts only.)

Before recording in the county wherein the real property described in the affidavit is situated, the affiant must sign the document in the presence of a notary public. The form should adhere to content and formatting requirements for recording documents pertaining to interests in real property in the State of Arizona.

Contact a lawyer with questions.

Important: Your property must be located in Yuma County to use these forms. Documents should be recorded at the office below.

This Affidavit of Successor Trustee meets all recording requirements specific to Yuma County.

Our Promise

The documents you receive here will meet, or exceed, the Yuma County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Yuma County Affidavit of Successor Trustee form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Janice S.

February 28th, 2019

Really easy downloading the forms the directions everything was really easy thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah B.

January 6th, 2019

Easy download, and super easy to fill out. Had them recorded Friday with zero issues. Recommended.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanna L.

September 12th, 2019

This is a great tool. It is easy to use and saves me a lot of time.

Thank you for your feedback. We really appreciate it. Have a great day!

Chad N.

March 16th, 2021

Thank you for taking care of a recording very quickly. I am very impressed by your service an would recommend to anyone. Easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Jessica F.

February 8th, 2020

Found exactly what I was looking for in a matter of minutes at a very reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert P.

October 22nd, 2020

Excellent product. Wish I had found this site a week earlier. It would have saved me many hours of struggle and $40.00 in notary fees. Thanks and I will recommend to anyone needing forms.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN P.

January 20th, 2019

I thought your service would comply with my request quicker.

Looks like it took 4 minutes to complete your order, sorry it took so long.

Marilyn J.

July 18th, 2020

Just what I needed!

Thank you!

Katherine M.

June 26th, 2019

Very helpful!

Thank you!

Nancy W.

November 6th, 2020

This was very easy to use to record my NOC. With the new COVID restrictions, I can't record my NOC in person and I'm working from home. This was a huge convenience and easy to use. I submitted the NOC late in the day and had the recorded NOC the next day.

Thank you!

Vickie G.

January 14th, 2019

The form and instruction were perfect. Thank you.

Thank You Vickie!

Deborah O.

June 3rd, 2019

Response time was fantastic. I had no idea it would be so quick. I would definitely use again. They send you a message if they need additional information, etc. I would rate them a 10+ on a 1-10 scale

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy O.

September 20th, 2024

This would be a great form but I couldn’t tell what size the font was. Also, I didn’t know how to save it so I will have to type it all over again. I’m sure I did it incorrectly.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Eleody L.

January 7th, 2019

I mistakenly ordered the wrong package and within 3 minutes of asking for a replacement, I was given one by the company. I am extremely impressed with the prompt response and the forms! I will use this site again if I needed other deed forms!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!