Yuma County Correction Deed Form

Yuma County Correction Deed Form

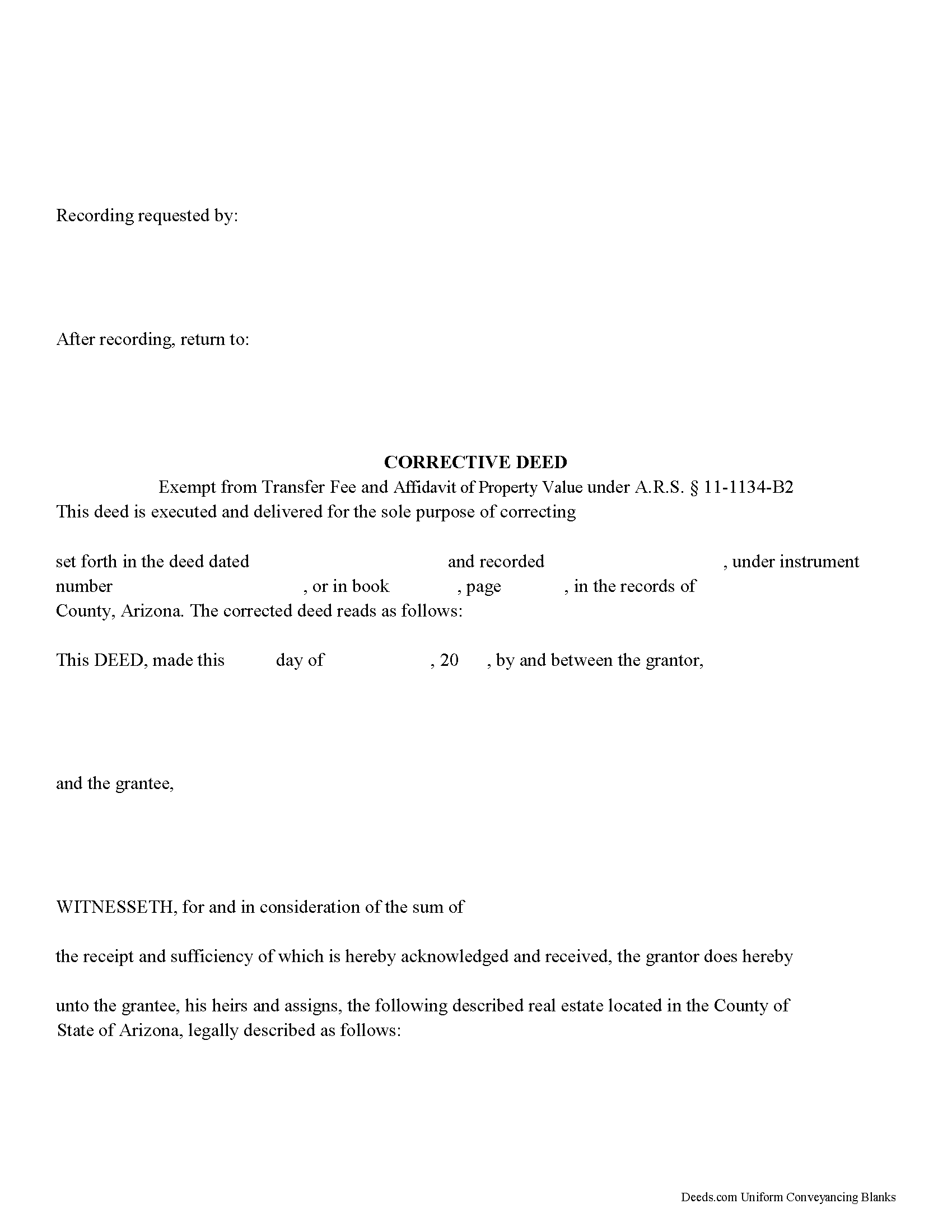

Fill in the blank form formatted to comply with all recording and content requirements.

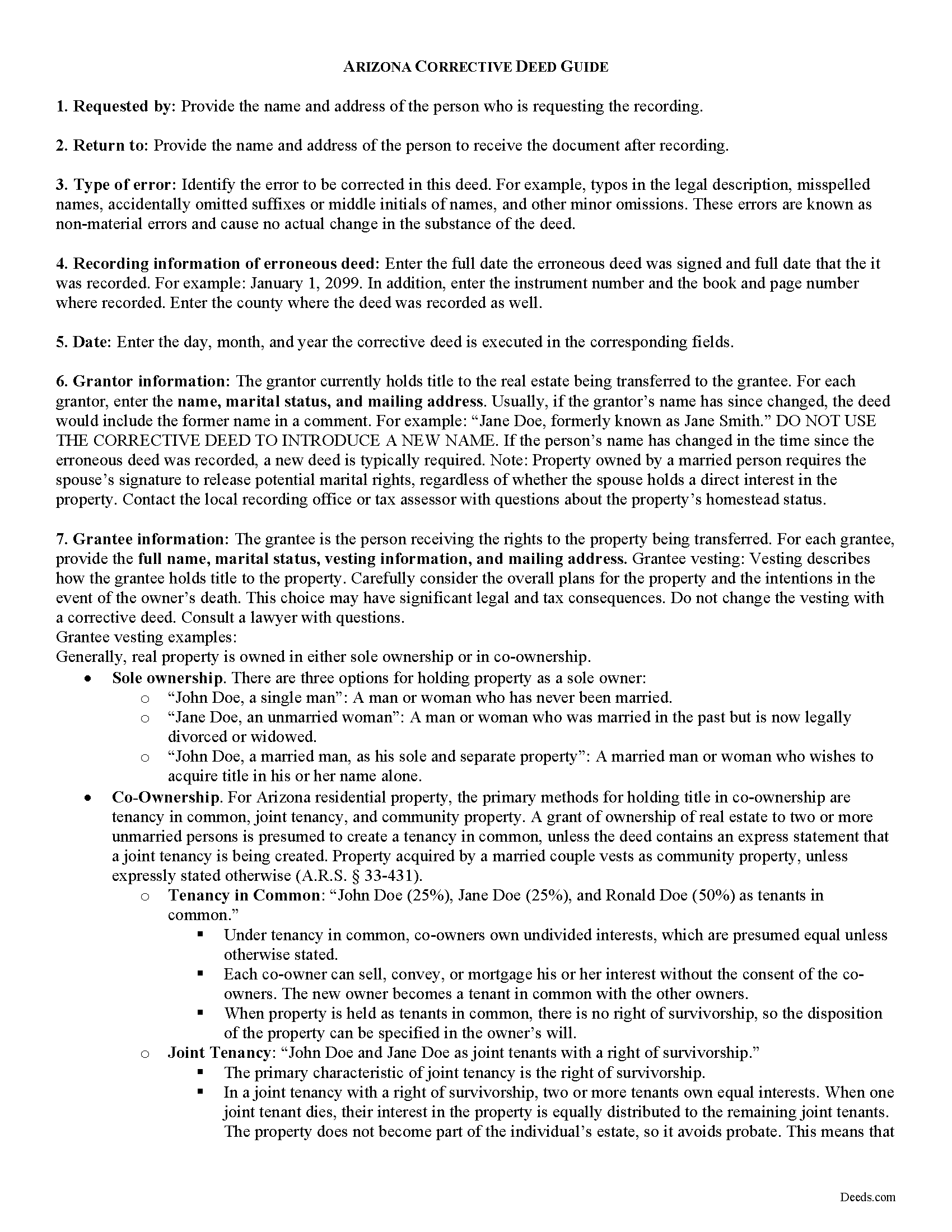

Yuma County Correction Deed Guide

Line by line guide explaining every blank on the form.

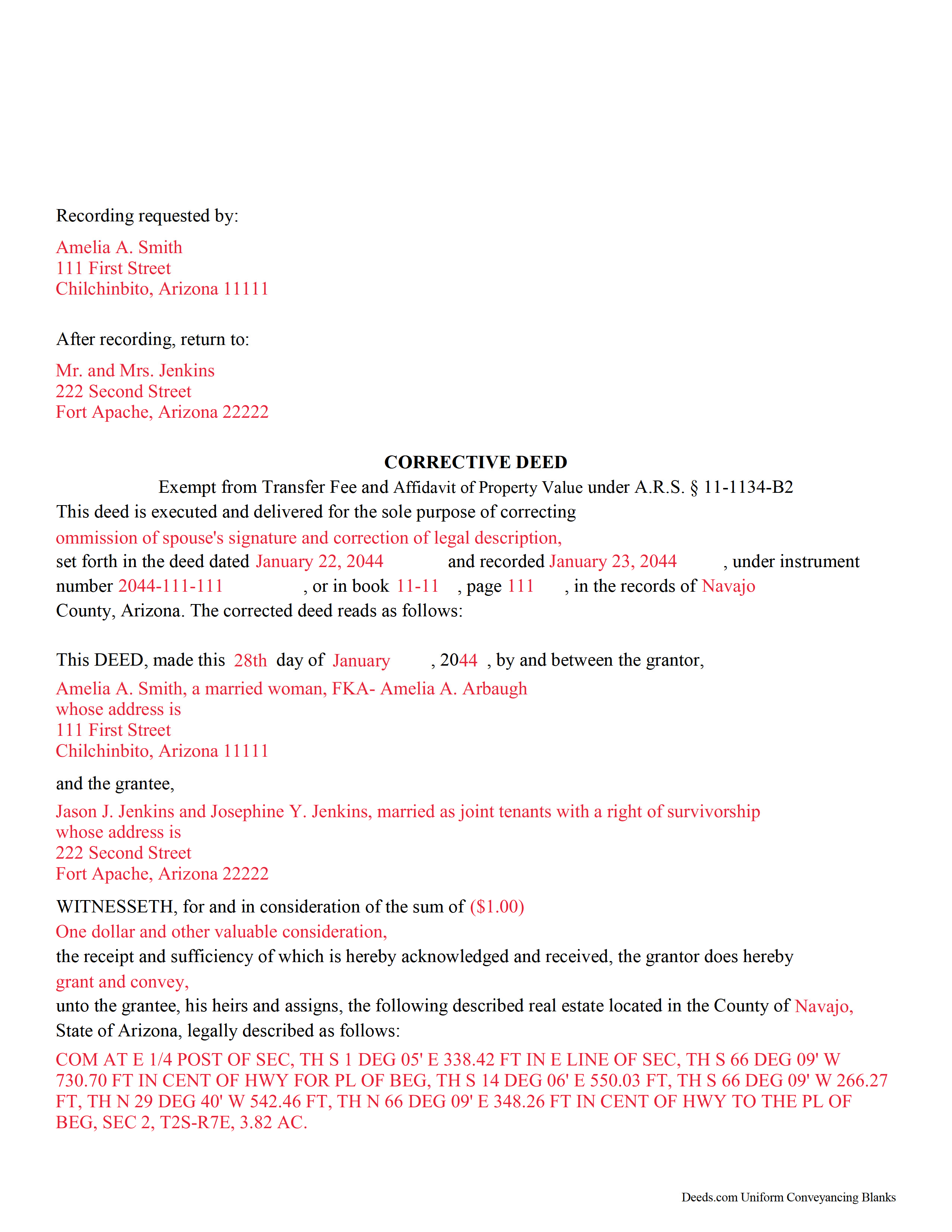

Yuma County Completed Example of a Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Yuma County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Yuma, Arizona 85364-2311

Hours: 8:00am - 5:00pm M-F

Phone: 928-373-6020

Recording Tips for Yuma County:

- Bring your driver's license or state-issued photo ID

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Yuma County

Properties in any of these areas use Yuma County forms:

- Dateland

- Gadsden

- Roll

- San Luis

- Somerton

- Tacna

- Wellton

- Yuma

Hours, fees, requirements, and more for Yuma County

How do I get my forms?

Forms are available for immediate download after payment. The Yuma County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Yuma County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Yuma County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Yuma County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Yuma County?

Recording fees in Yuma County vary. Contact the recorder's office at 928-373-6020 for current fees.

Questions answered? Let's get started!

What happens when there is an error in your deed? What can you do to fix it? One option may be filing a corrective deed.

A corrective deed is an instrument used to correct a small error in a deed that has been recorded at an earlier date. Corrections can only be made to non-material errors, causing no actual change in the substance of the deed. Common mistakes include typographical errors in the legal description, misspelled names, accidentally omitted suffixes or middle initials, etc.

Major, or material, changes to the substance of the deed have a legal effect in how property is titled, and therefore require a new deed. Adding or removing a grantee, for example, or significant changes to the legal description, may all require a new deed of conveyance. When in doubt about the gravity of an error and whether a correction deed is the appropriate vehicle to address it, consult with a lawyer.

On the corrective deed, give the recording information from the previously filed document, then identify which section contains the error. Provide the correct details in the body of the deed. The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed.

For the corrective deed to be valid, all parties who signed the erroneous deed must sign the corrective deed in the presence of a notarial official. If the grantor is married, Arizona requires that both spouses sign the deed (A.R.S. 33-452). Finally, the form must meet all state and local standards for recorded documents. Submit the completed corrective deed to the local recording office.

Most transfers of real property are subject to a transfer tax and must be accompanied by an Affidavit of Property Value. However, corrective deeds are exempt from both because the property has already been transferred (A.R.S. 11-1133, 11-1134).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about corrective deeds or any other issues related to real property in Arizona.

(Arizona Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Yuma County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Yuma County.

Our Promise

The documents you receive here will meet, or exceed, the Yuma County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Yuma County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Kevin B.

May 28th, 2023

Easy to use and very helpful

Thank you for taking the time to give us your feedback Kevin. Hope you have an amazing day.

Jacque G.

December 18th, 2019

Very helpful and easy to access.

Thank you!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer. I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

George S.

September 16th, 2021

Excellent product- very easy to use. Will use again...

Thank you for your feedback. We really appreciate it. Have a great day!

Ann C.

December 27th, 2019

This service is the absolute BOMB! I wish every business ran as fast and efficiently as you all do! Seriously - No joke! Thank you guys!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ralph f.

January 31st, 2019

I VERY MUCH APPRECIATE THE PROMPT RESPONSE & HELPFULNESS. I WILL DEFINITELY USE THIS SERVICE IN THE FUTURE. THANK YOU!

Thank you Ralph, we appreciate your feedback.

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband. THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael R.

September 15th, 2019

This was just TOO easy to do and use!! Thank you so much for your service!

Thank you!

Conrad N.

November 1st, 2021

It worked well for me.

Thank you!

Gloria J.

July 23rd, 2021

I needed a Missouri Notice of Intent to Sell without a named designated buyer. Mo Statutes require notice be notarized and filed 45 days before any closing to protect buyer from liens. You do not have that document. We are flipping a house so it must be filed. Our lawyer was on vacation. Cannot find one anywhere on net. Finally got a template from our title company.

Thank you for your feedback Gloria.

ELIZABETH G.

August 7th, 2020

This site was very easy to use. Great direction on how to complete the form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

William S.

September 25th, 2020

Love the ability to e-record a single document as a private citizen. Other companies only want to do business with large volume filers like title companies and attorneys. e-recording was super easy and so efficient. Got confirmation of recording from county clerk less than one hour after submission.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank R.

January 20th, 2020

Our notary. Marie was prompt, courteous and professional. Would definitely use again and reccomend

Thank you for your feedback. We really appreciate it. Have a great day!