Yuma County Quitclaim Deed Form

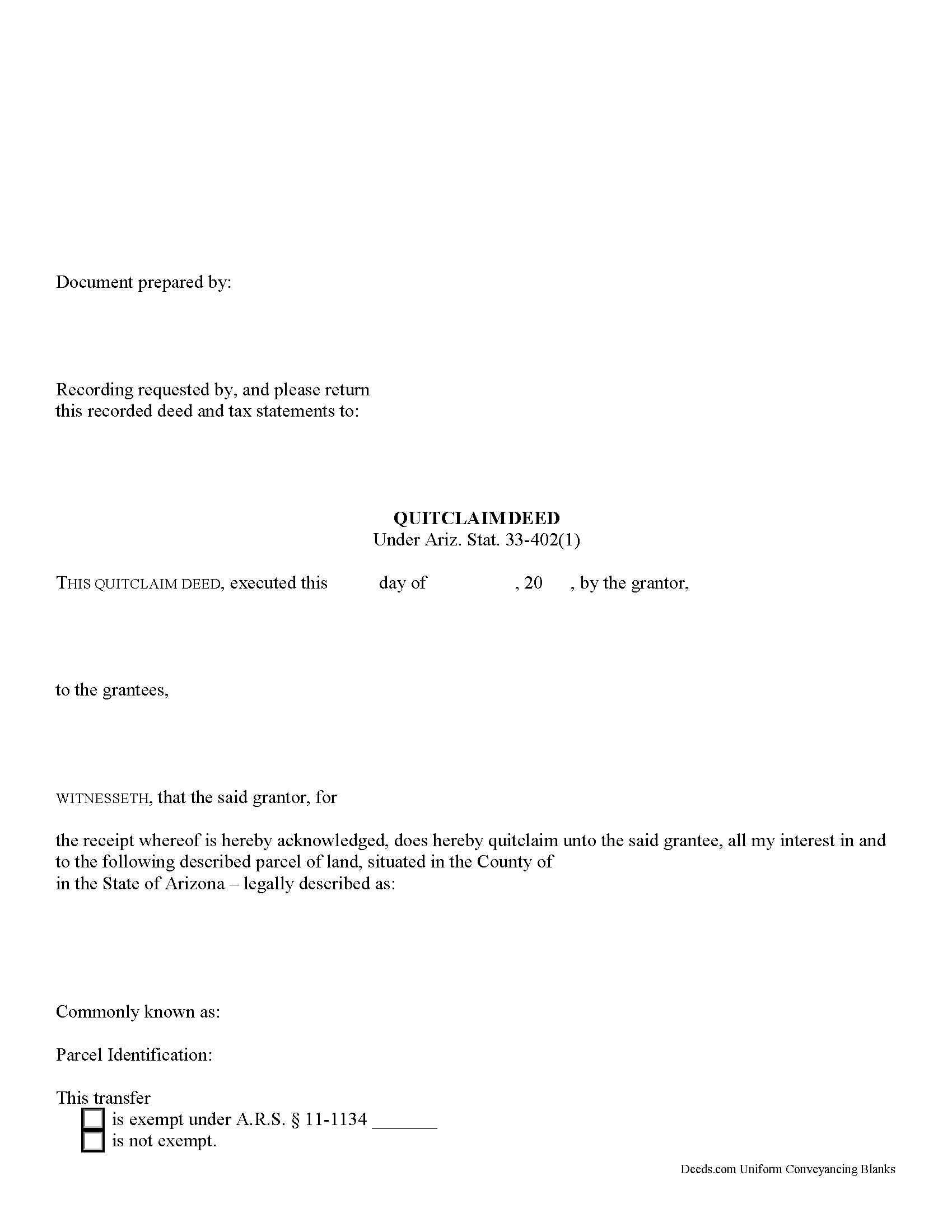

Yuma County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Arizona recording and content requirements.

Yuma County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

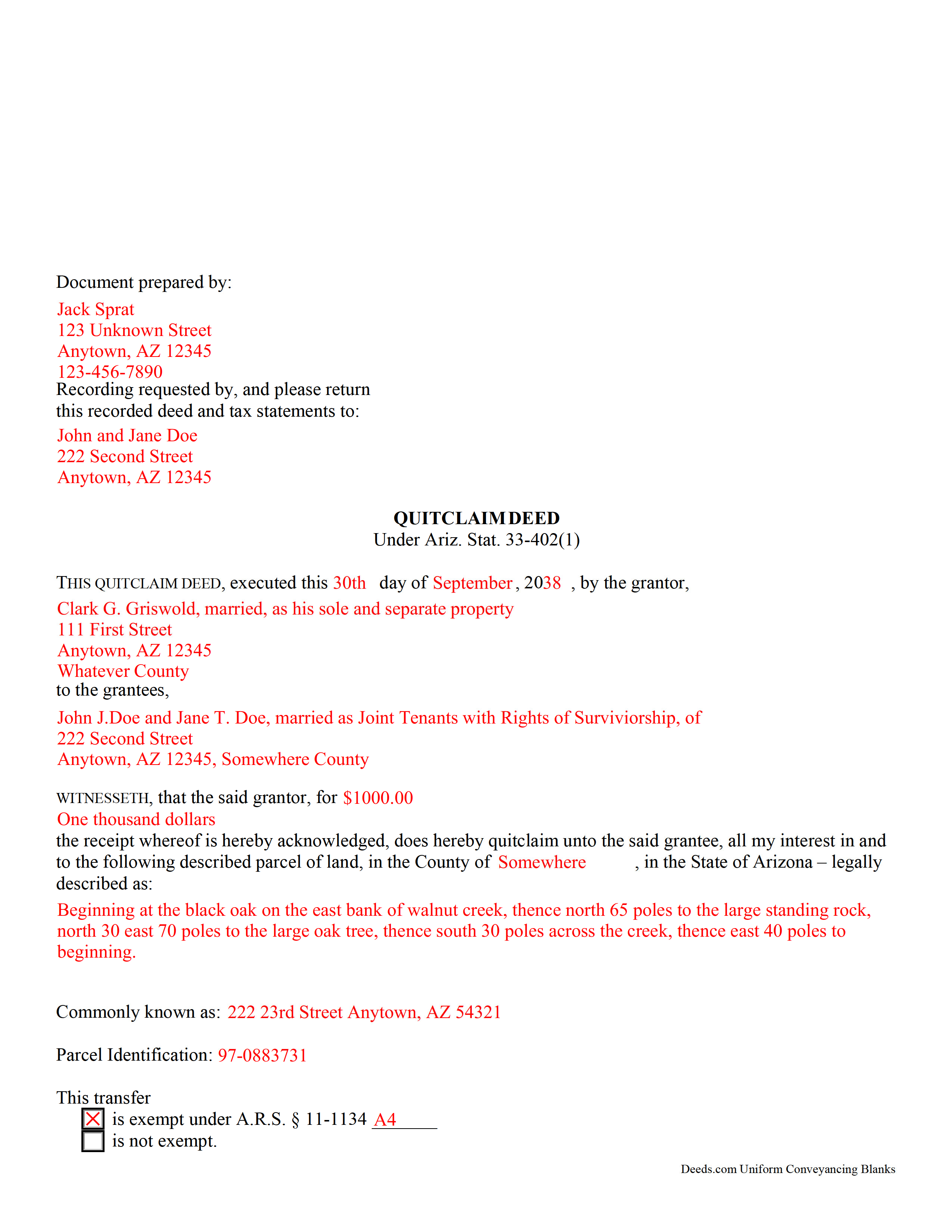

Yuma County Completed Example of the Quitclaim Deed Document

Example of a properly completed Arizona Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Yuma County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Yuma, Arizona 85364-2311

Hours: 8:00am - 5:00pm M-F

Phone: 928-373-6020

Recording Tips for Yuma County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Yuma County

Properties in any of these areas use Yuma County forms:

- Dateland

- Gadsden

- Roll

- San Luis

- Somerton

- Tacna

- Wellton

- Yuma

Hours, fees, requirements, and more for Yuma County

How do I get my forms?

Forms are available for immediate download after payment. The Yuma County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Yuma County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Yuma County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Yuma County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Yuma County?

Recording fees in Yuma County vary. Contact the recorder's office at 928-373-6020 for current fees.

Questions answered? Let's get started!

Quitclaim deeds are documents used to transfer the owner's interest (if any) in real property to someone else, with no warranties of title. The transfer may or may not include consideration (something of value, usually money). They are generally used to clear clouded titles, to settle boundary disputes between neighbors, or to make gifts of real property, and include no warranties of title for the new owners. These deeds are also appropriate for situations like divorce, where the idea is simply removing one party's name from a deed, or relinquishing marital rights in real estate.

For Arizona quitclaim deeds under Section 33-402(1) to be valid, they must conform to specific statutory requirements set forth by 33-401, as well as other relevant state and local standards for recording.

The quitclaim deed must be in writing and contain a heading that identifies the nature of the document. Original forms are preferred. LEGIBLE certified copies are also acceptable, but all signatures must be original. The grantor or an authorized agent must sign the deed in front of an officer certified to take acknowledgments. If the deed marks a change in ownership of real property, provide the prior recording information, including date, docket and page of the earlier document, and a complete legal description of the land. Quitclaim deeds should also contain the names and addresses of all grantors and grantees named in the document, as well as a statement clarifying how the grantee wishes to hold title (vesting). Identify the type and amount of consideration exchanged for ownership of the property (usually money). (Ariz. Rev. Stat. 33-401, et al (2012))

Arizona follows a "notice" recording act. This means that any document conveying title to real property must be correctly recorded or the transaction is not complete (Ariz. Rev. Stat. 33-411). In addition, it is the transferor's (grantor) obligation to record the quitclaim deed within sixty days of the transfer or to accept responsibility to defend the transferee (grantee) in any future claims against the grantee's ownership of the land. (Ariz. Rev. Stat. 33-411.01).

(Arizona Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Yuma County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Yuma County.

Our Promise

The documents you receive here will meet, or exceed, the Yuma County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Yuma County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Gary S.

January 24th, 2021

Excellent service! Incorrectly ordered a document and order was immediately canceled when I requested. Was then able to order and download correct document and complete with no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Gabriela C.

August 2nd, 2022

Easy

Thank you!

William O.

June 13th, 2025

form worked great but was over priced for such a simple form , should be around $10 and most people could easily create this themselves.

Hi William, thank you for your review. We’re glad the form worked well for you. We understand it may seem simple on the surface, but Transfer on Death Deeds—especially in New York—require precise language and adherence to both state and county-level rules. Our forms are attorney-prepared, regularly reviewed for legal compliance, and include helpful instructions to reduce the risk of costly filing errors. We appreciate your feedback and hope the document serves its purpose smoothly.

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

LISA R.

May 4th, 2022

I was very pleased to find your website and the range of services you offer. I was recommended to hire an estate attorney, but the forms you provided will eliminate the need for that. Thank you for the help!

Thank you for your feedback. We really appreciate it. Have a great day!

Mark & Linda W.

December 18th, 2020

Quite simple and easy. Only one critique: It would be easier if the names of the PDF would reflect the name of the deed/form such as 'Controlling tax return' rather than '1579101185SF56863.pdf'. However I love downloading forms rather than mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Jami B.

November 6th, 2019

I was blown away by all the information I received for just $19.00!! I am still reading through it. Great job of explaining everything.

Thank you!

irene w.

February 11th, 2021

Just found this site, what a great resource ! Thank you so much for providing affordable help to those of us navigating estate planning mazes. The forms were all very easy to download, even on our rather ancient computer, and the accompanying explanations were in clear, understandable English designed to explain, with appropriate cautions to avoid problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeannette C.

October 22nd, 2021

Very useful service! This was easy and quick. It guides you through each step and emails update you during the process. Will use again!

Thank you!

Marsella F.

May 20th, 2021

Thank you so much!! This is a fantastic tool!! Marsella F.

Thank you for your feedback. We really appreciate it. Have a great day!

Alex Q.

January 25th, 2022

10 STARS! Deeds.com never fails! Thank you so much!

Thank you!

Rodrigo M.

September 10th, 2022

Excellent service

Thank you!

Dexter Lamar H.

August 4th, 2023

Quick service!

Thank you!

Robert W.

January 5th, 2019

The forms were as I expected them to be. The guide was very helpful. Overall very good.

Thanks Robert. We appreciate your feedback.

Judy W.

January 9th, 2021

Very easy to fill out the form especially with the detailed guide and the sample. I will use deeds.com again if needed.

Thank you for your feedback. We really appreciate it. Have a great day!