Download Arizona Trustee Deed Foreclosure Legal Forms

Arizona Trustee Deed Foreclosure Overview

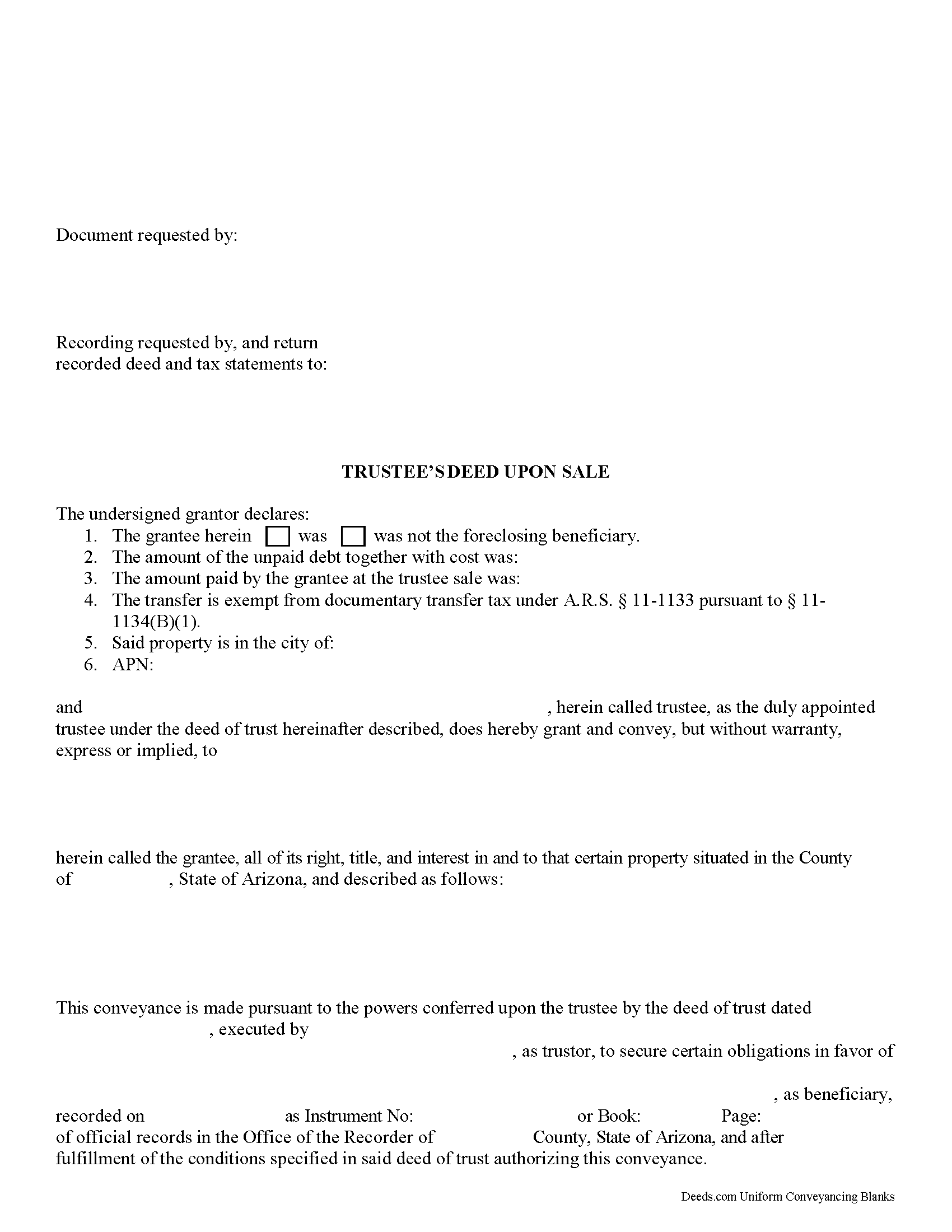

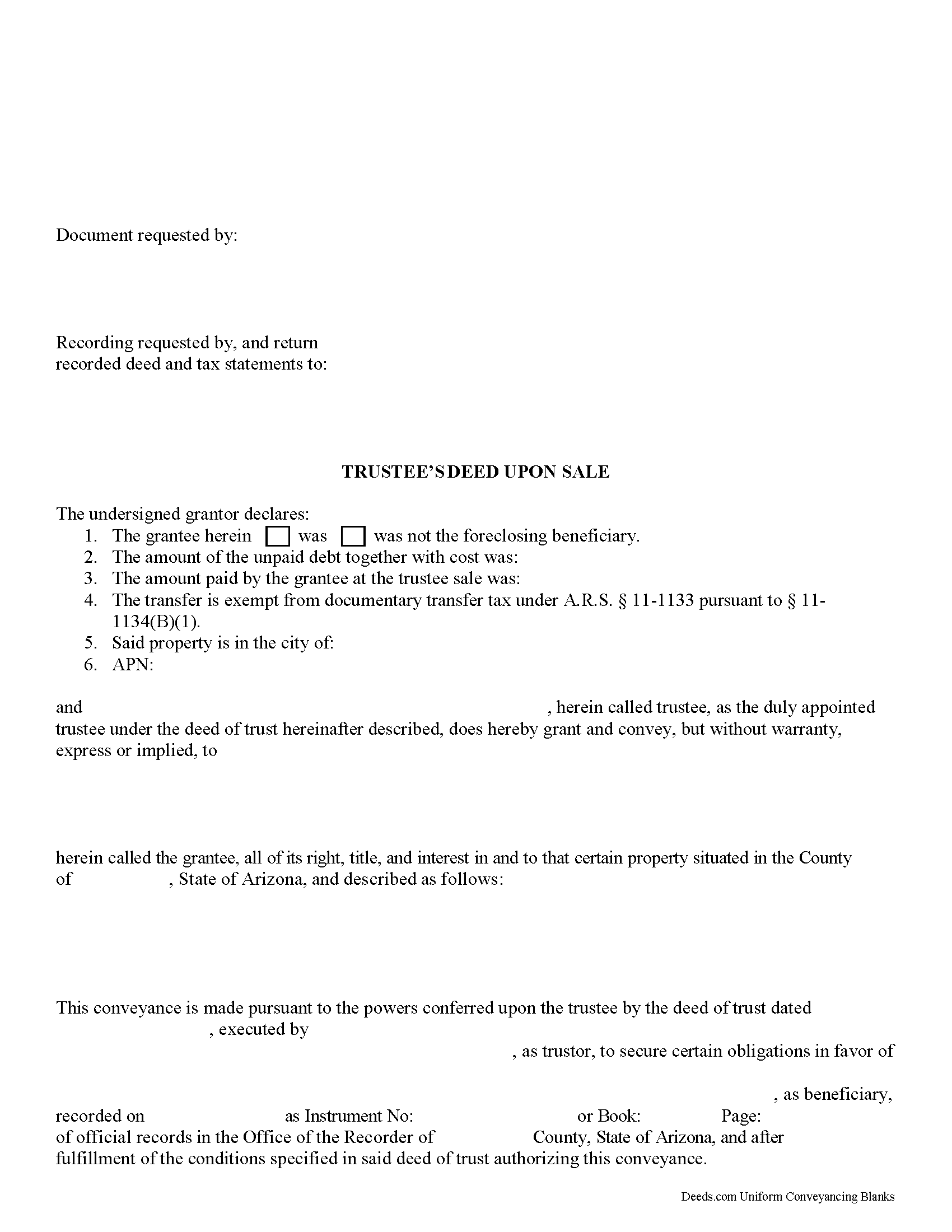

Arizona Trustee's Deed Upon Sale

Arizona recognizes two types of foreclosure: judicial and non-judicial. A judicial foreclosure must go through Superior court (as is the case with mortgages), whereas a non-judicial closure is governed by state statutes (as is the case with deeds of trust).

The laws governing Arizona's trustee's deeds upon sale are included in Sections 33-800 et seq of the Arizona Revised Statutes. This instrument is used by a trustee to convey real property identified in a non-judicial foreclosure. Qualifications for trustees are outlined in A.R.S. 33-803.

Under a trust deed, the trustee holds title to the property as security for the repayment of a loan. The trust deed includes a power of sale, which defines the conditions that prompt a sale, and authorizes the trustee to sell the property ( 33-807). If the borrower (the trustor under the trust deed) defaults on the trust deed or breaches the contract, the lender (beneficiary) instructs the trustee to initiate the foreclosure process. The trustee, then, is responsible for the sale of the property upon foreclosure using the trustee's deed upon sale.

Before the property is sold at auction, the trustee must provide notice of the trustee's sale as prescribed by A.R.S. 33-808. Requirements for the contents of the notice of sale are enumerated in 303-808(C). The trustee's sale cannot take place before 91 days after recording the notice of sale in the county in which the trust property is located ( 33-807(D)).

The trustee executes and submits the trustee's deed to the county recorder for recording within seven business days after receiving payment of the price bid ( 33-811(B)). The trustee's deed conveys the title, interest, and claim to the purchaser. Issued without warranty, a trustee's deed does not guarantee good standing of title and is subject to any liens that might appear on the title ( 33-811(E)).

Pursuant to A.R.S. 33-2211, a trustee's deed upon sale is also used in the foreclosure of timeshare estates, unless the timeshare instrument expressly mandates that judicial foreclosure is the sole method of foreclosure ( 33-2211(K)). In the case of a timeshare foreclosure, the beneficiary is the association or other managing entity, and the trustor is the specific owner who is delinquent in payment of assessments for the timeshare estate for a period of at least one year ( 33-2211(A)). If the delinquencies are not cured within thirty days of the association's issuance of a notice of delinquency, the association can then initiate the foreclosure process pursuant to 33-803.01 et seq ( 33-2211(F)).