Garland County Deed of Trust with Installment of Taxes and Insurance Form

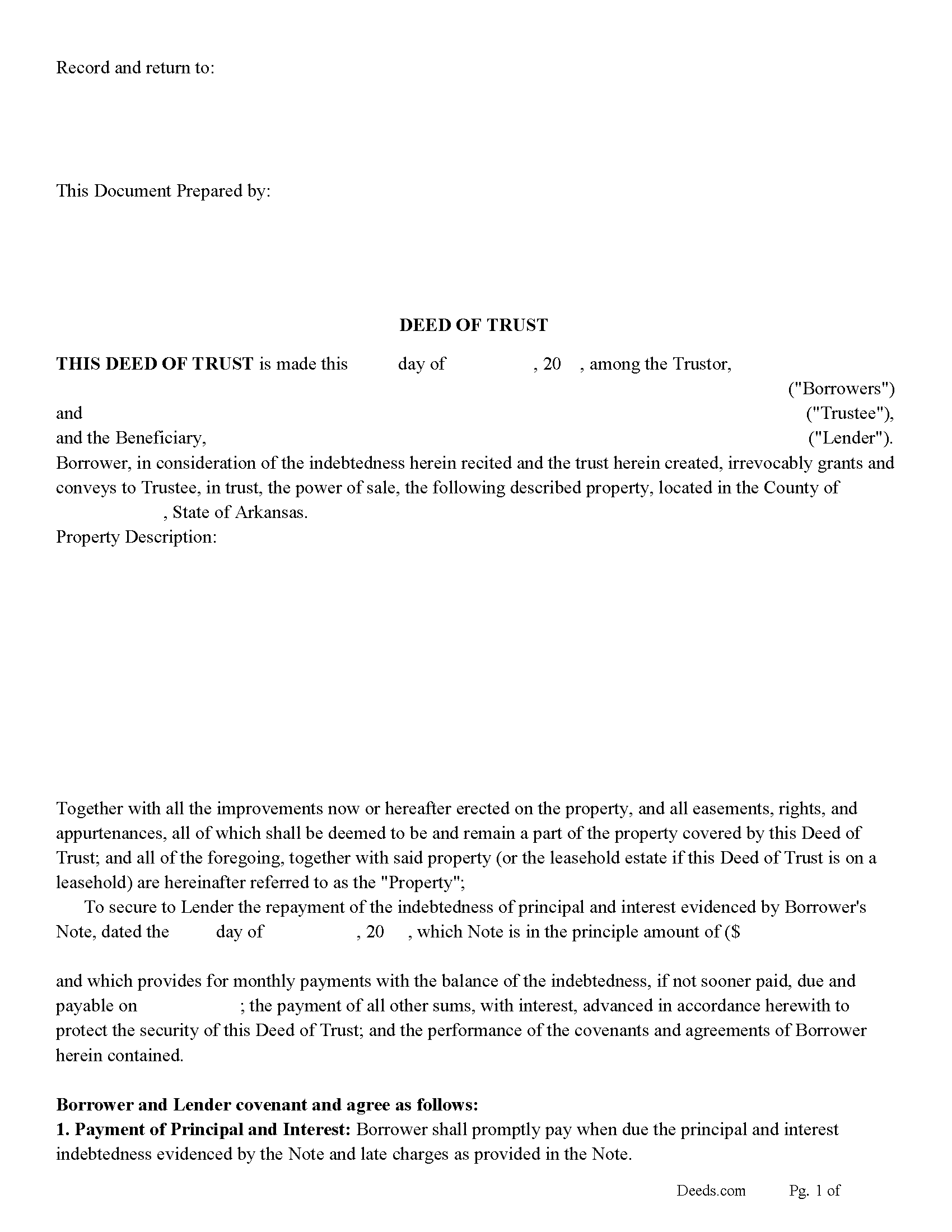

Garland County Deed of Trust with Installment of Taxes and Insurance Form

Fill in the blank form formatted to comply with all recording and content requirements.

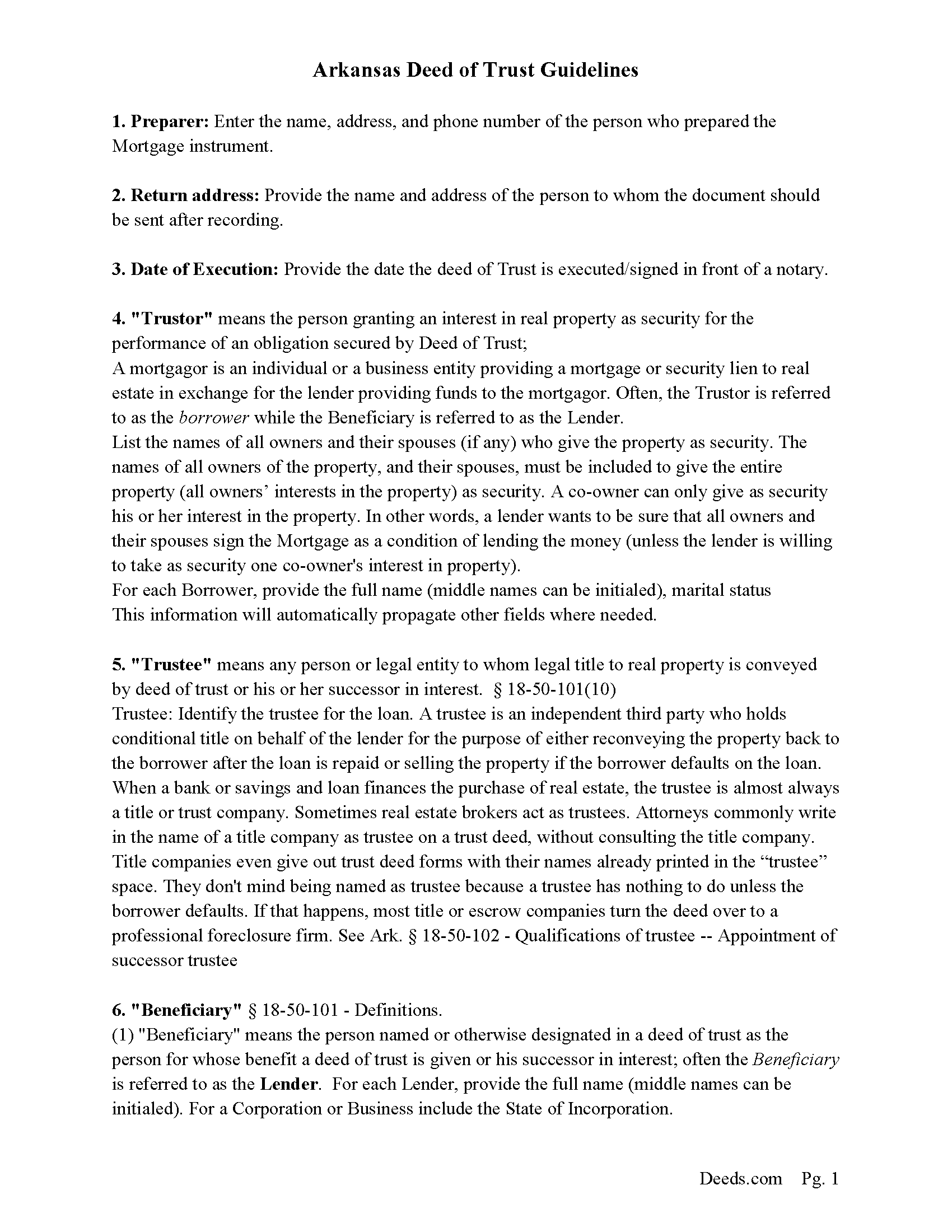

Garland County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

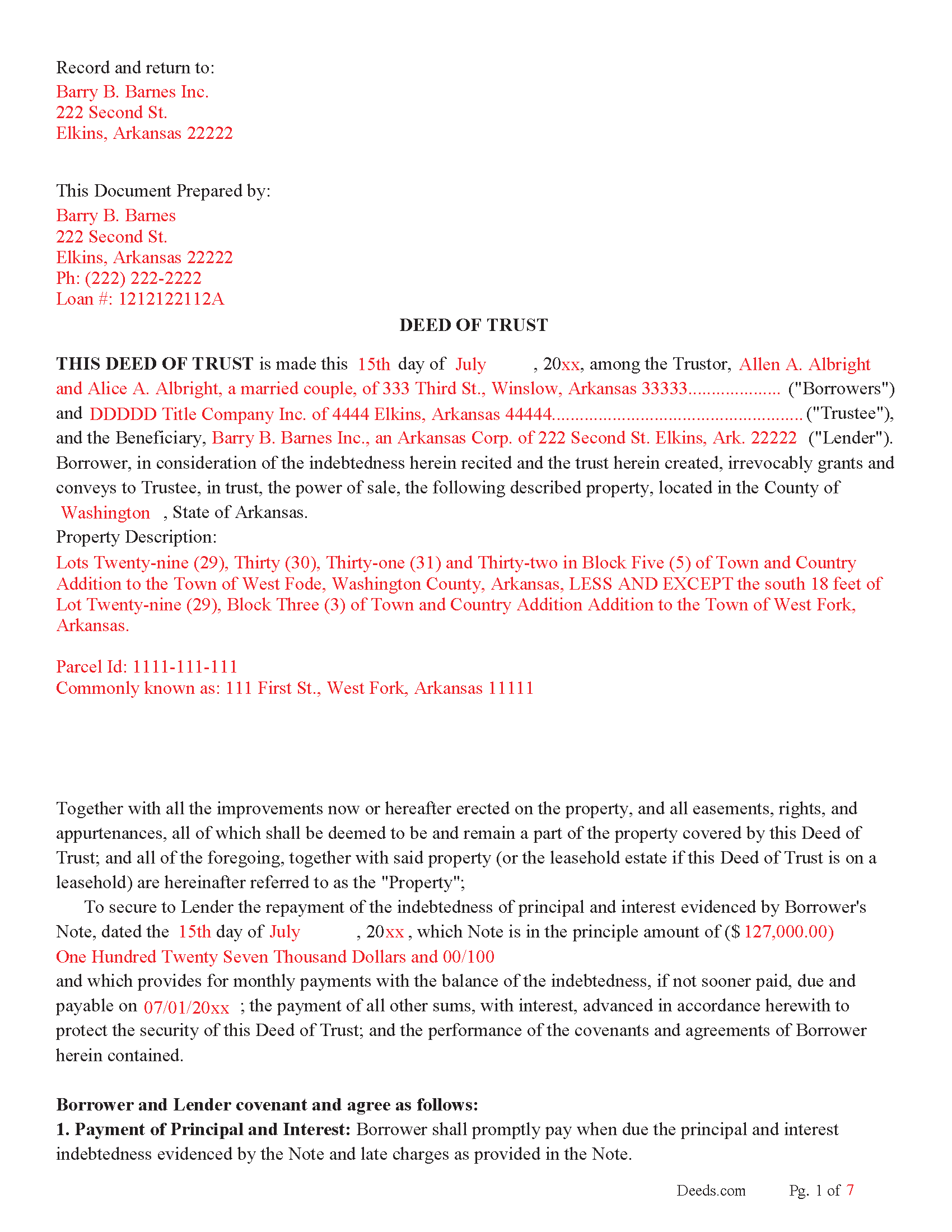

Garland County Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

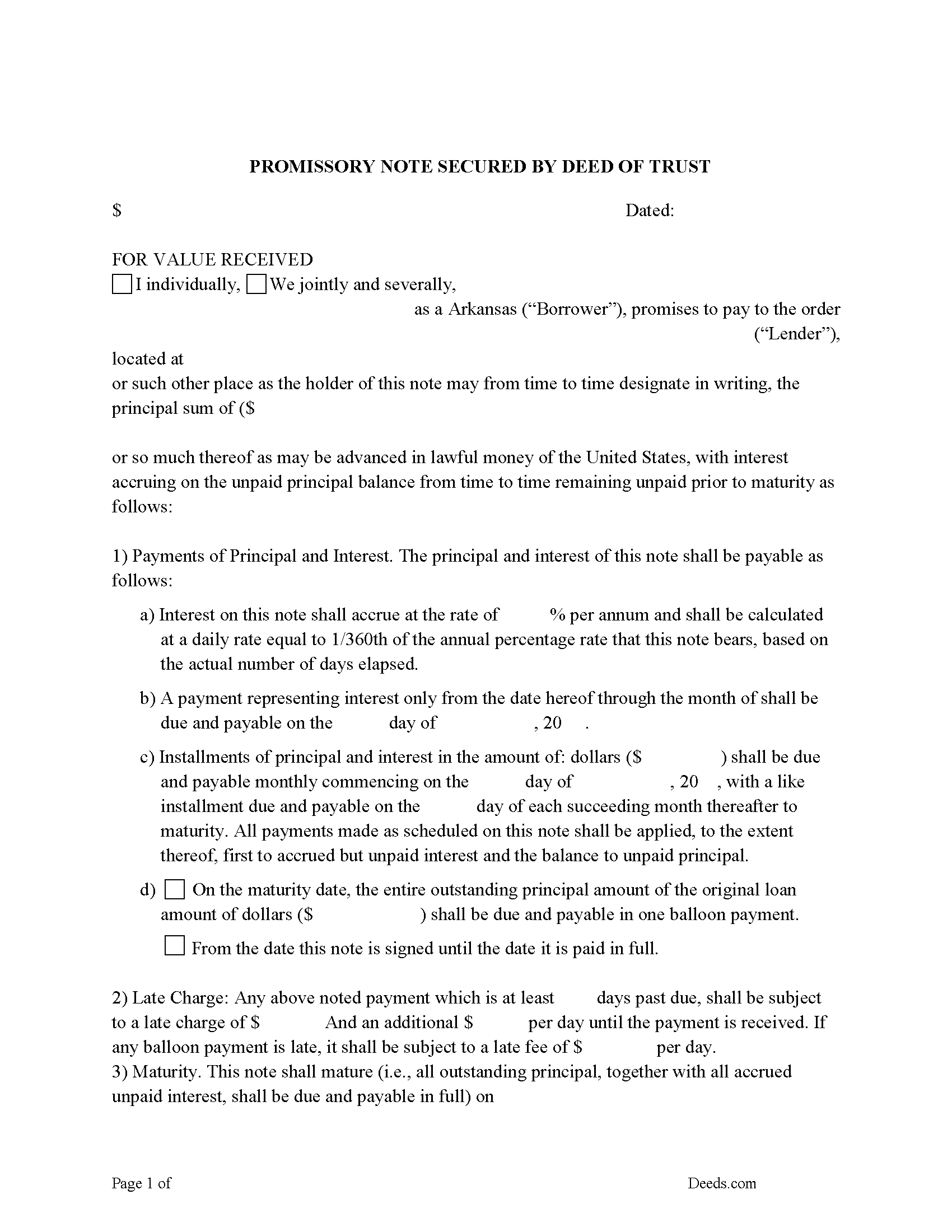

Garland County Promissory Note Form

Arkansas Promissory Note.

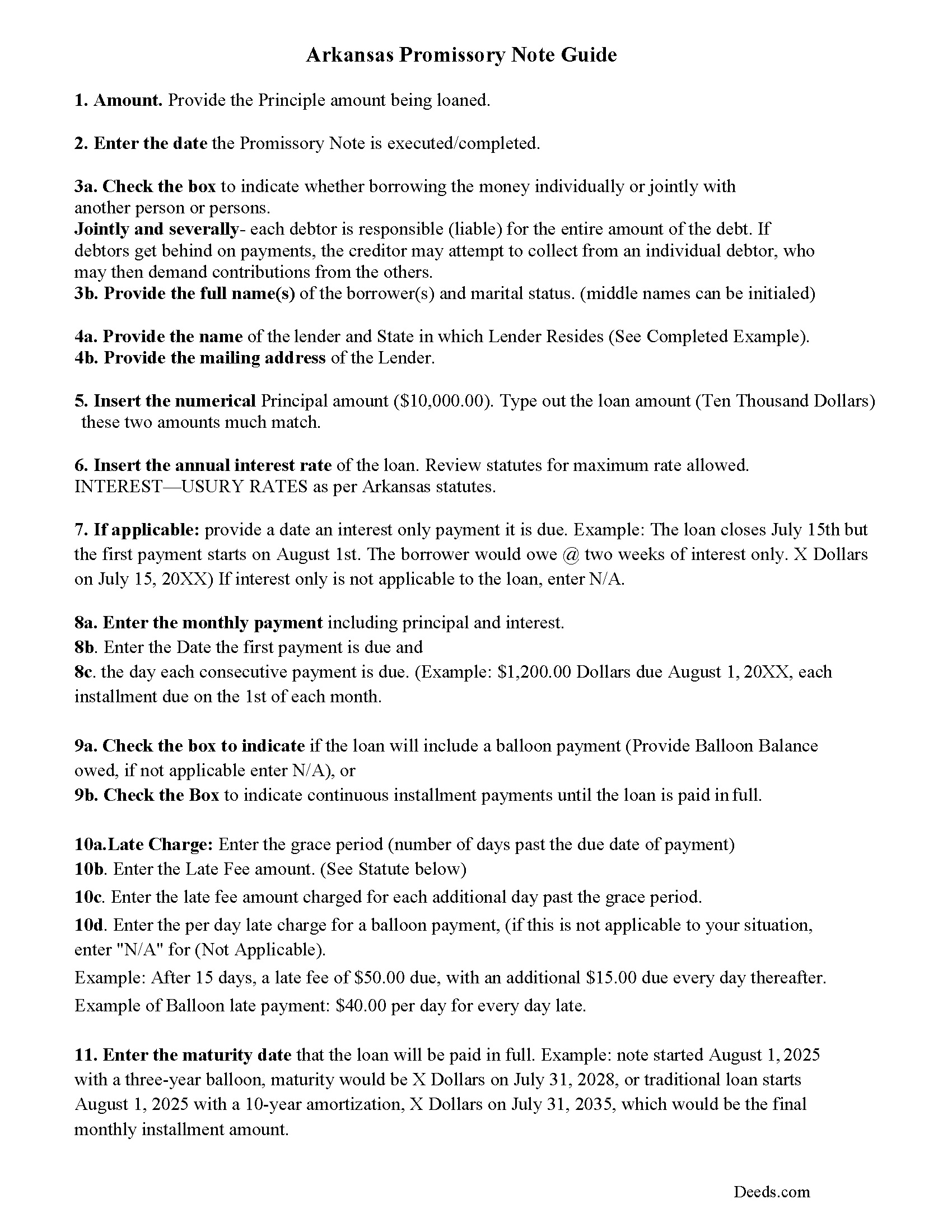

Garland County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

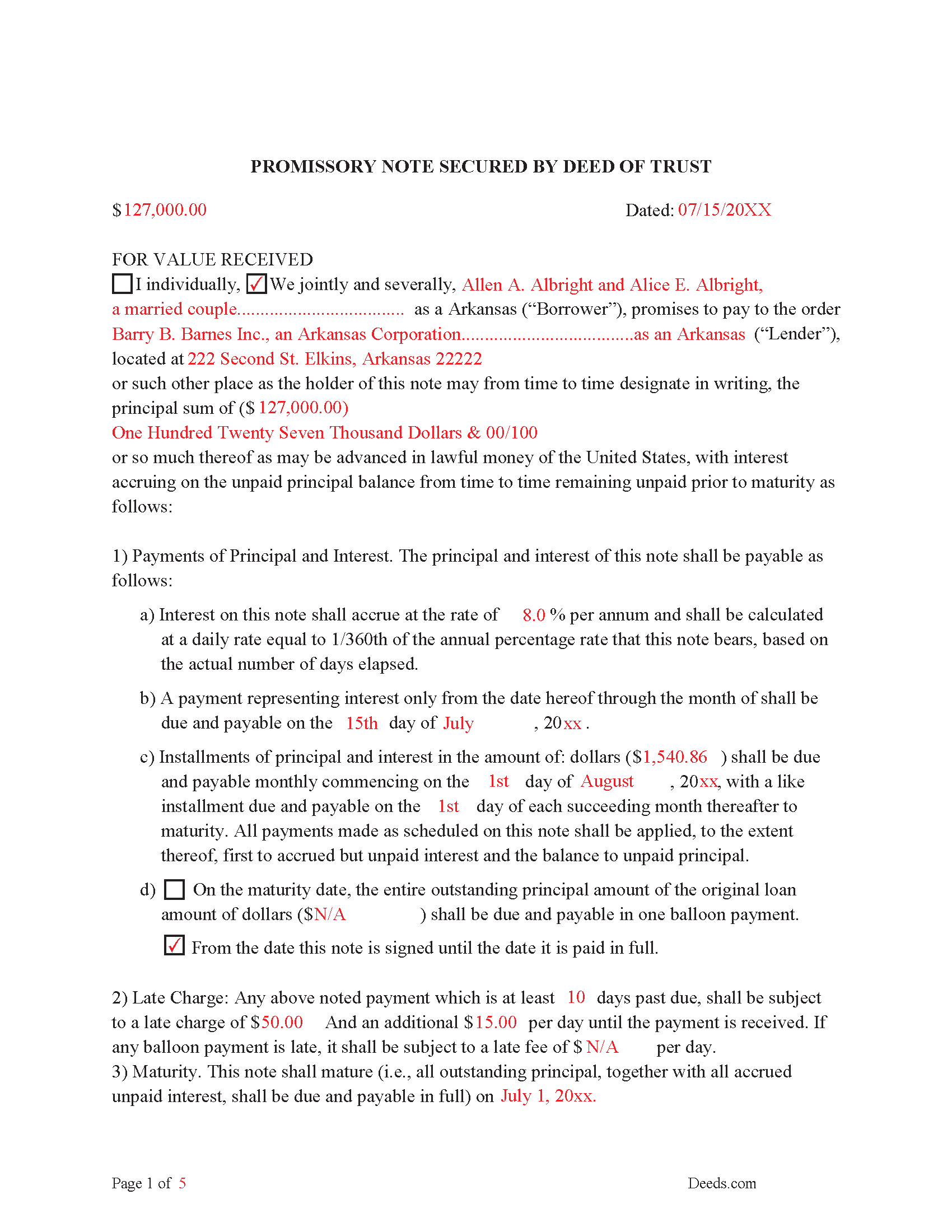

Garland County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

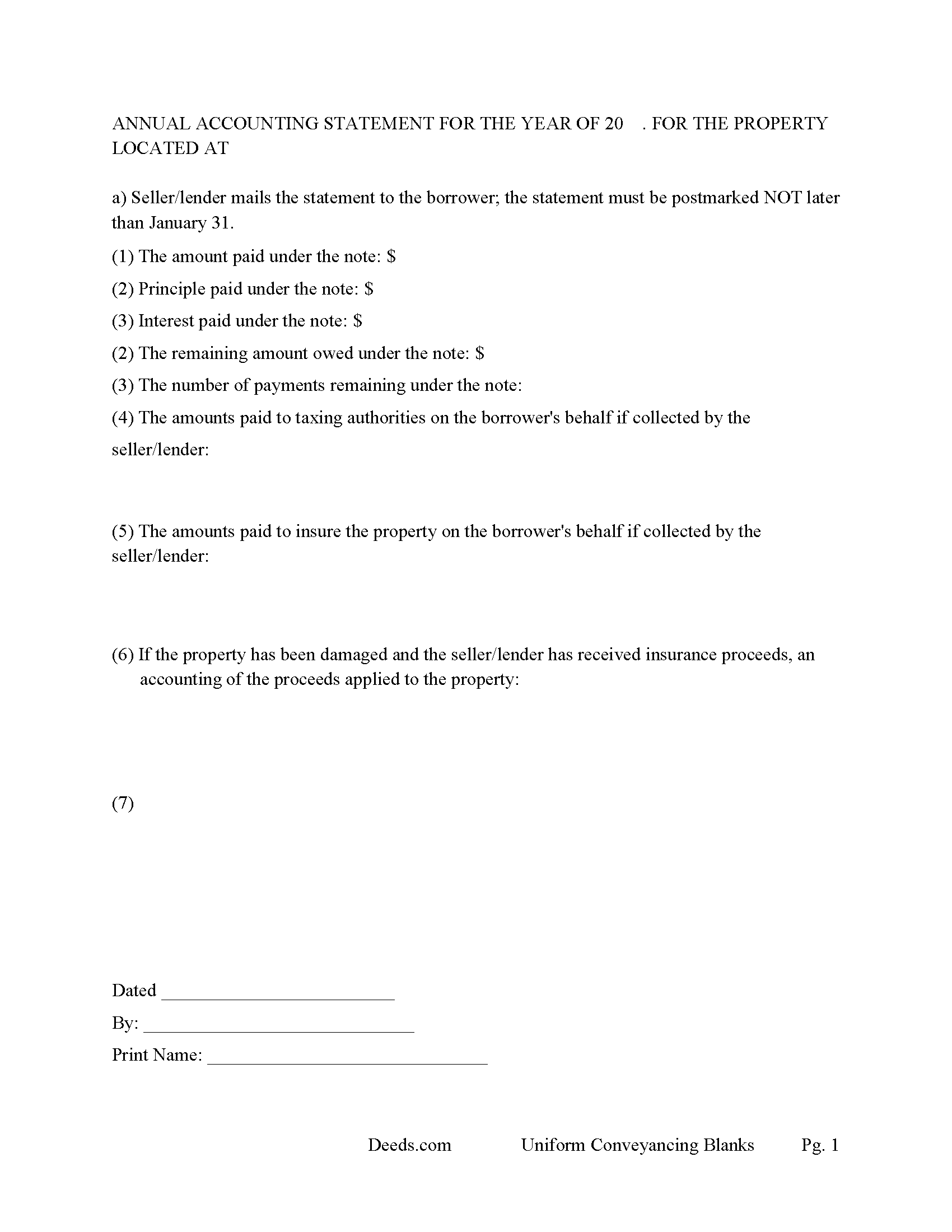

Garland County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

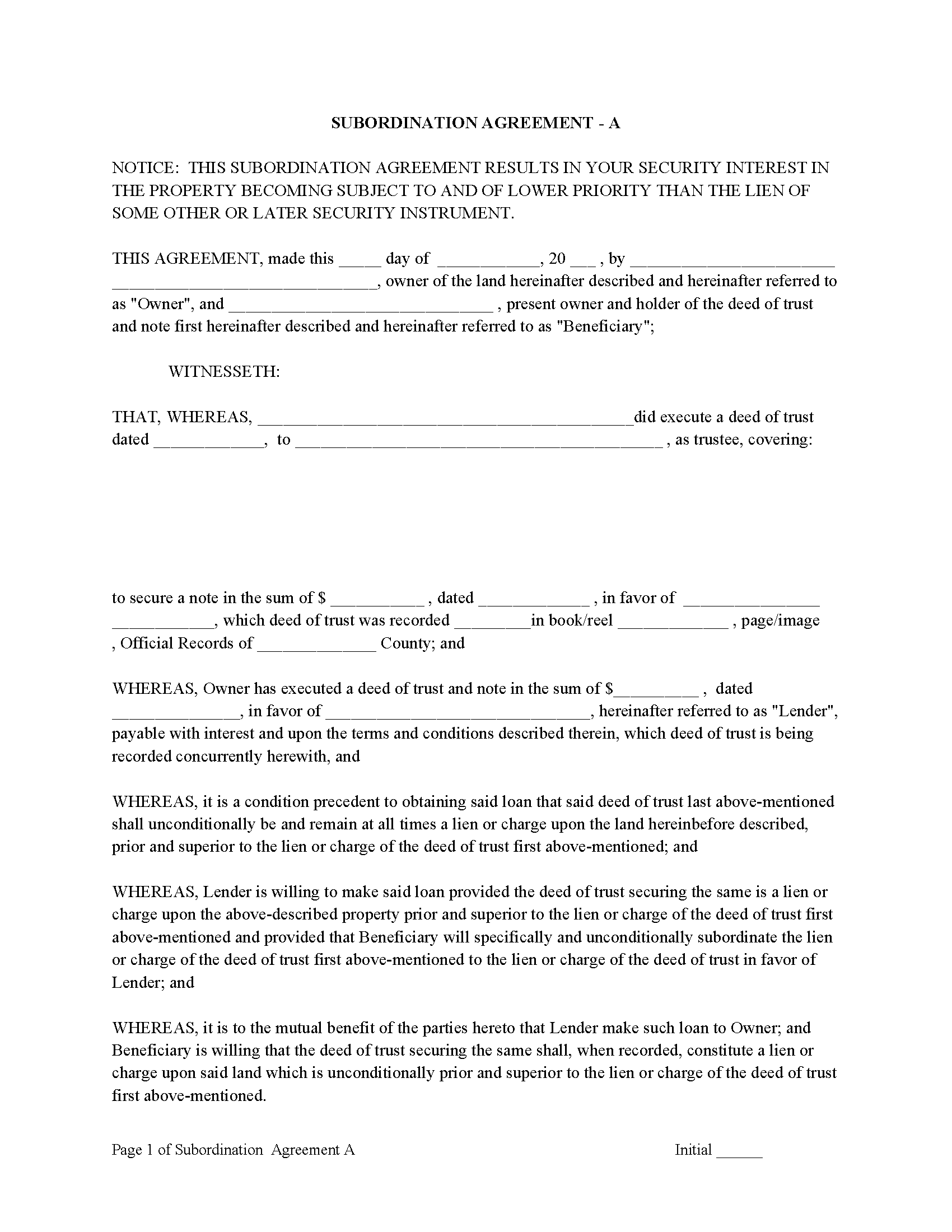

Garland County Subordination Argeements

Used to place priority on claim of debt. Included are 4 separate agreements for unique situations. If needed, add to Deed of Trust as an addendum or rider.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Garland County documents included at no extra charge:

Where to Record Your Documents

Garland County Circuit Clerk

Hot Springs, Arkansas 71901

Hours: 8:00am-5:00pm M-F

Phone: (501) 622-3630

Recording Tips for Garland County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Garland County

Properties in any of these areas use Garland County forms:

- Hot Springs National Park

- Hot Springs Village

- Jessieville

- Lonsdale

- Mountain Pine

- Pearcy

- Royal

Hours, fees, requirements, and more for Garland County

How do I get my forms?

Forms are available for immediate download after payment. The Garland County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Garland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Garland County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Garland County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Garland County?

Recording fees in Garland County vary. Contact the recorder's office at (501) 622-3630 for current fees.

Questions answered? Let's get started!

("Deed of trust" means a deed conveying real property in trust to secure the performance of an obligation of the grantor or any other person named in the deed to a beneficiary and conferring upon the trustee a power of sale for breach of an obligation of the grantor contained in the deed of trust;) (Ark. Statute 18-50-101(2)) A power of sale allows for a non-judicial foreclosure in the case of default, saving time and expense. If Lender invokes the power of sale, Lender shall execute or cause Trustee to execute the written notice of the occurrence of any event of default and Lender's election to cause the Property to be sold and shall cause such notice to be recorded in each county in which the Property or some portion thereof is located. Lender or Trustee shall mail copies of such notice in the manner prescribed by applicable law. 18-50-103.

(A trustee may not sell the trust property unless: The deed of trust or mortgage is filed for record with the recorder of the county in which the trust property is situated;) (Ark. Statute 18-50-103(1))

A deed of trust contains three (3) parties: Grantor/Trustor, Trustee, and Beneficiary/Lender

"Grantor" means the person conveying an interest in real property by a mortgage or deed of trust as security for the performance of an obligation; (Ark. Statute 18-50-101 (3))

"Beneficiary" means the person named or otherwise designated in a deed of trust as the person for whose benefit a deed of trust is given or his successor in interest; (Ark. Statute 18-50-101 (1))

("Trustee" means any person or legal entity to whom legal title to real property is conveyed by deed of trust or his or her successor in interest.) Examples of how a Trustee can be chosen are given. (Ark. Statute 18-50-101 (10)).

14-15-402. Instruments to be recorded. (a) It shall be the duty of each recorder to record in the books provided for his or her office all deeds, mortgages, conveyances, deeds of trust, bonds, covenants, defeasances, affidavits, powers of attorney, assignments, contracts, agreements, leases, or other instruments of writing of, or writing concerning, any lands and tenements or goods and chattels, which shall be proved or acknowledged according to law, that are authorized to be recorded in his or her office.

THIS DEED OF TRUST DIFFERS IN THAT IT ALLOWS THE LENDER TO COLLECT TAXES AND INSURANCE PAYMENTS MONTHLY. THIS GIVES THE LENDER MORE CONTROL, FOR EXAMPLE: A LENDER MIGHT NOT REALIZE TAXES AND/OR INSURANCE PAYMENTS ARE IN ARREARS UNTIL SIX (6) MONTHS AFTER DELINQUENCY. THIS FORM IS CONSISTENT WITH INVESTOR OR OWNER FINANCING.

Funds for Taxes and Insurance: Subject to applicable law or a written waiver by Lender, Borrower shall pay to lender on the day monthly payments of principal and interest are payable under the Note, until the Note is paid in full, a sum ("Funds") equal to one twelfth (1/12) of the yearly taxes and assessments which may attain priority over this Deed of Trust, and ground rents on the Property, if any, plus one twelfth (1/12) of yearly premium installments of hazard insurance, plus one twelfth (1/12) of yearly premium installments for mortgage insurance, if any, all as reasonably estimated initially and from time to time by Lender on the basis of assessments and bills and reasonable estimates thereof.

For use in Arkansas only.

Important: Your property must be located in Garland County to use these forms. Documents should be recorded at the office below.

This Deed of Trust with Installment of Taxes and Insurance meets all recording requirements specific to Garland County.

Our Promise

The documents you receive here will meet, or exceed, the Garland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Garland County Deed of Trust with Installment of Taxes and Insurance form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Stefan L.

May 5th, 2022

Great templates and very efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David S.

March 7th, 2022

Very good website. All government should be that clear and efficient.

Thank you!

Alfred D.

February 28th, 2023

The material was very usable and site was easy to navigate. Well worth the money. If I have similar needs, I'll ber back.

Thank you for your feedback. We really appreciate it. Have a great day!

Dana R.

February 20th, 2021

This site is Awesome! So easy to use and they really work fast. I will use this for all my Maricopa County Recorder items or deeds, etc. Love this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Julia C.

May 18th, 2025

Deeds.com was such a blessing in order for me to get something done that my lawyers could not get done. Transferring a mineral right from my deceased parents to me and my husband. The mineral company person I worked with went above and beyond helping me fill the paperwork out perfectly so that it had “right of survivorship” (and other things phrased properly) so that either my husband or I won’t have the issue I have had. Had it not been for deeds.com I don’t think I would have been able to complete this process. I hope anyone that ever needs something such as this learns about I deeds.com.

Thank you, Julia, for your kind and thoughtful review. We're truly honored to have played a role in helping you and your husband secure your mineral rights — especially after such a frustrating experience elsewhere. It’s great to hear that our team and resources were able to guide you through the process with clarity and care. Your words mean a lot to us, and we hope others in similar situations find the support they need through Deeds.com, just like you did. Wishing you continued peace of mind and security with your property.

Alan S.

September 19th, 2019

Very easy. Worked well. Will be glad to use the service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Everette W.

March 5th, 2023

This form was very helpful ... I wish I had run across your before it would have saved me a lot of money.

Thank you!

Kevin & Kim S.

August 20th, 2020

So very easy to use and we're so glad we could do everything from our home office.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann E Grace S.

June 22nd, 2021

Forms and instructions are very easy to access. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy G.

June 3rd, 2019

Downloadable documents, instructions and a completed sample form were just what I needed. Very pleased and easy to use. Deeds.com will be my first stop for any future documents I may need. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda M.

October 23rd, 2019

Happy with the forms and the service, would recommend to others.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ted C.

May 7th, 2021

Everything was straight forward. I think I was able to accomplish my objective.

Thank you!

Matthew M.

February 15th, 2023

Needed copy of deed in trust. Found info here, paid on line and then printed the docs. Easy to use, no driving to city offices, No parking fees, no waiting in line. Done fast and easy. Love it.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda T.

July 11th, 2020

The application was extremely easy to use with good instructions. Will definitely use a again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.