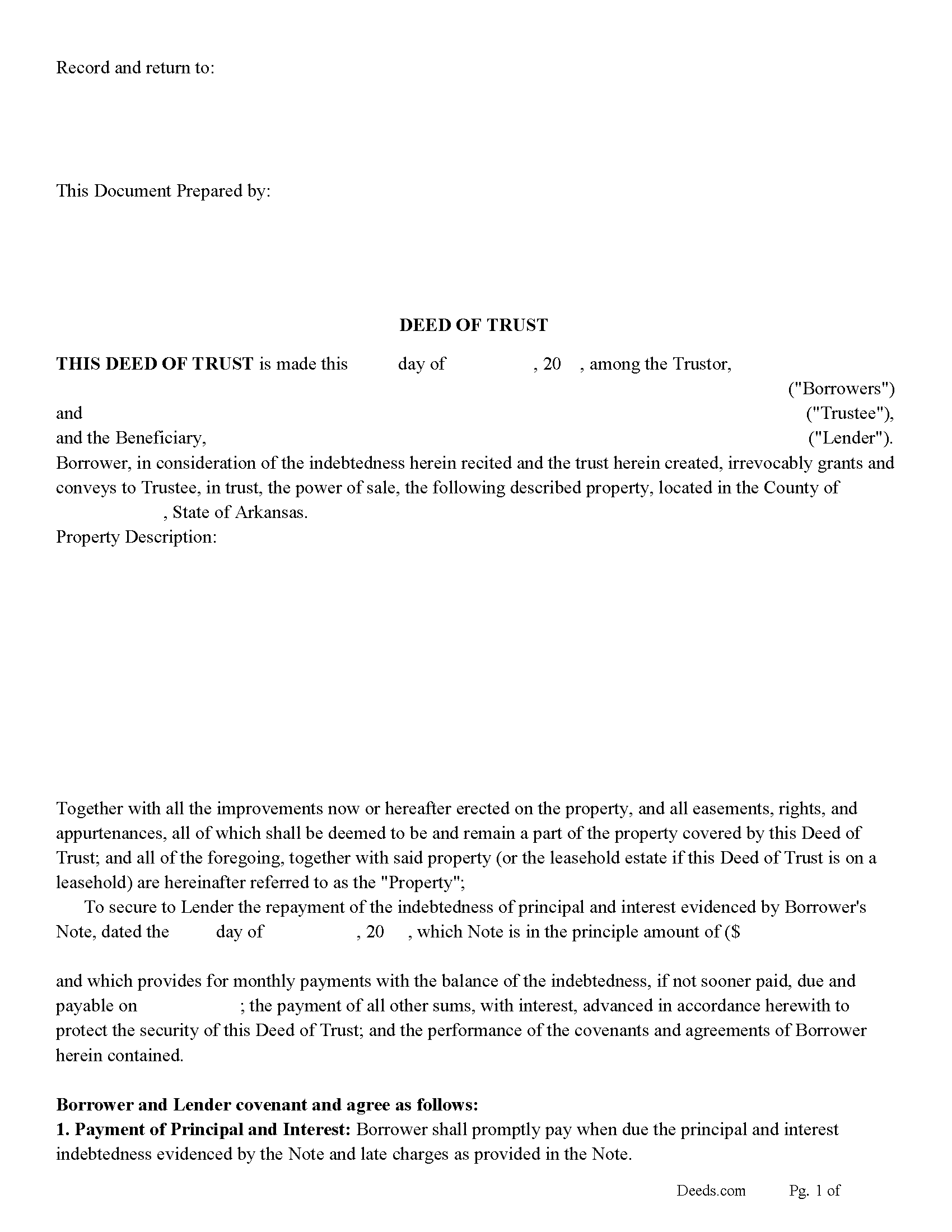

Mississippi County Deed of Trust with Installment of Taxes and Insurance Form

Mississippi County Deed of Trust with Installment of Taxes and Insurance Form

Fill in the blank form formatted to comply with all recording and content requirements.

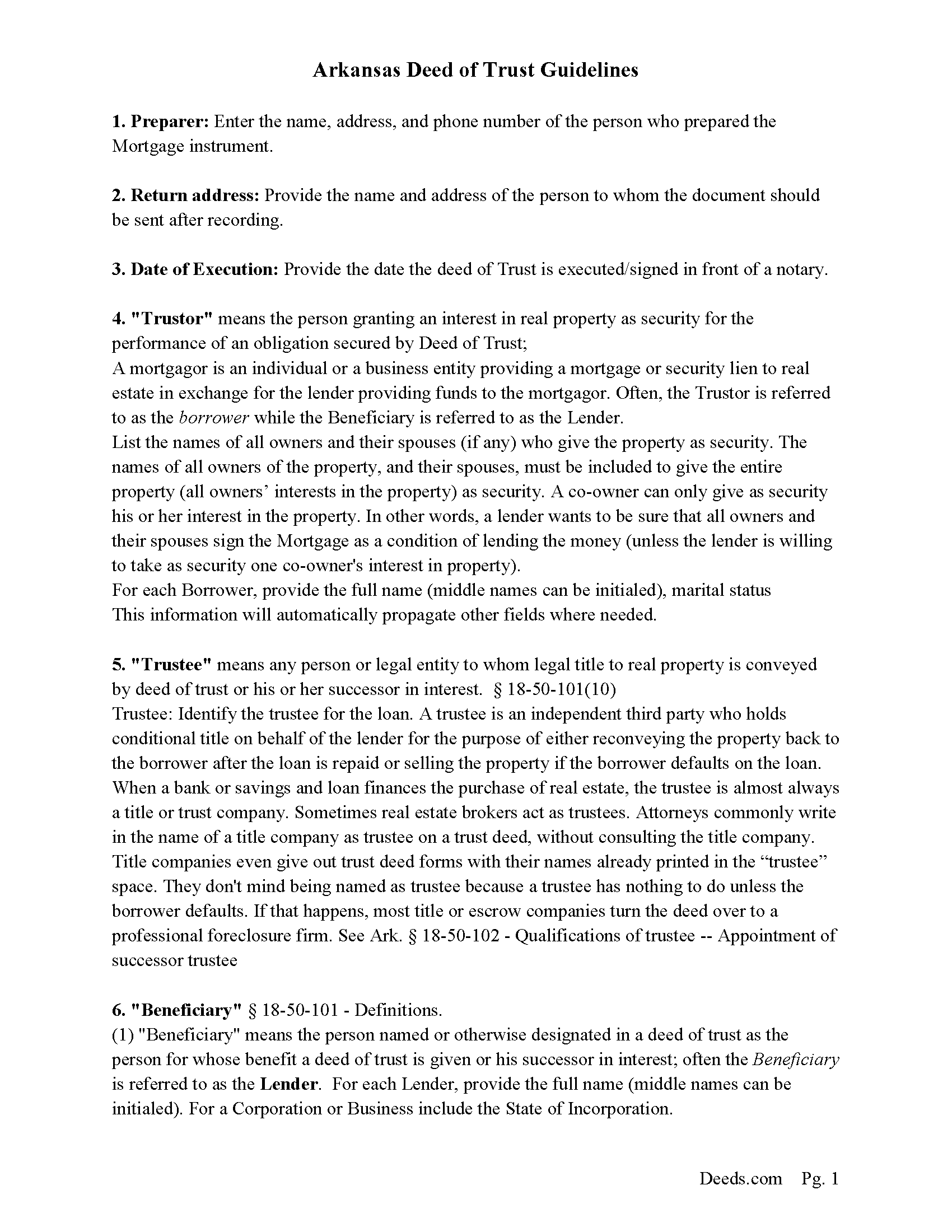

Mississippi County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

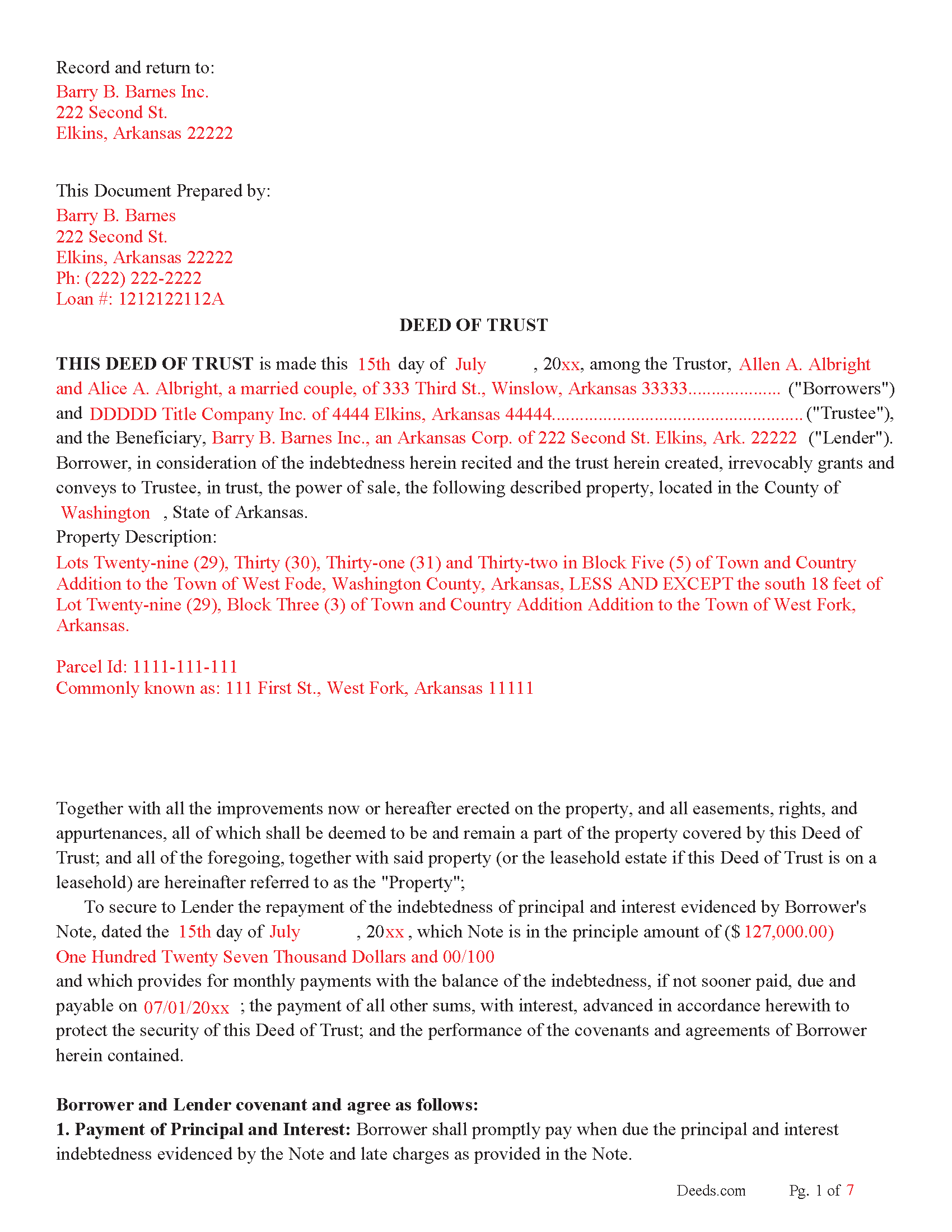

Mississippi County Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

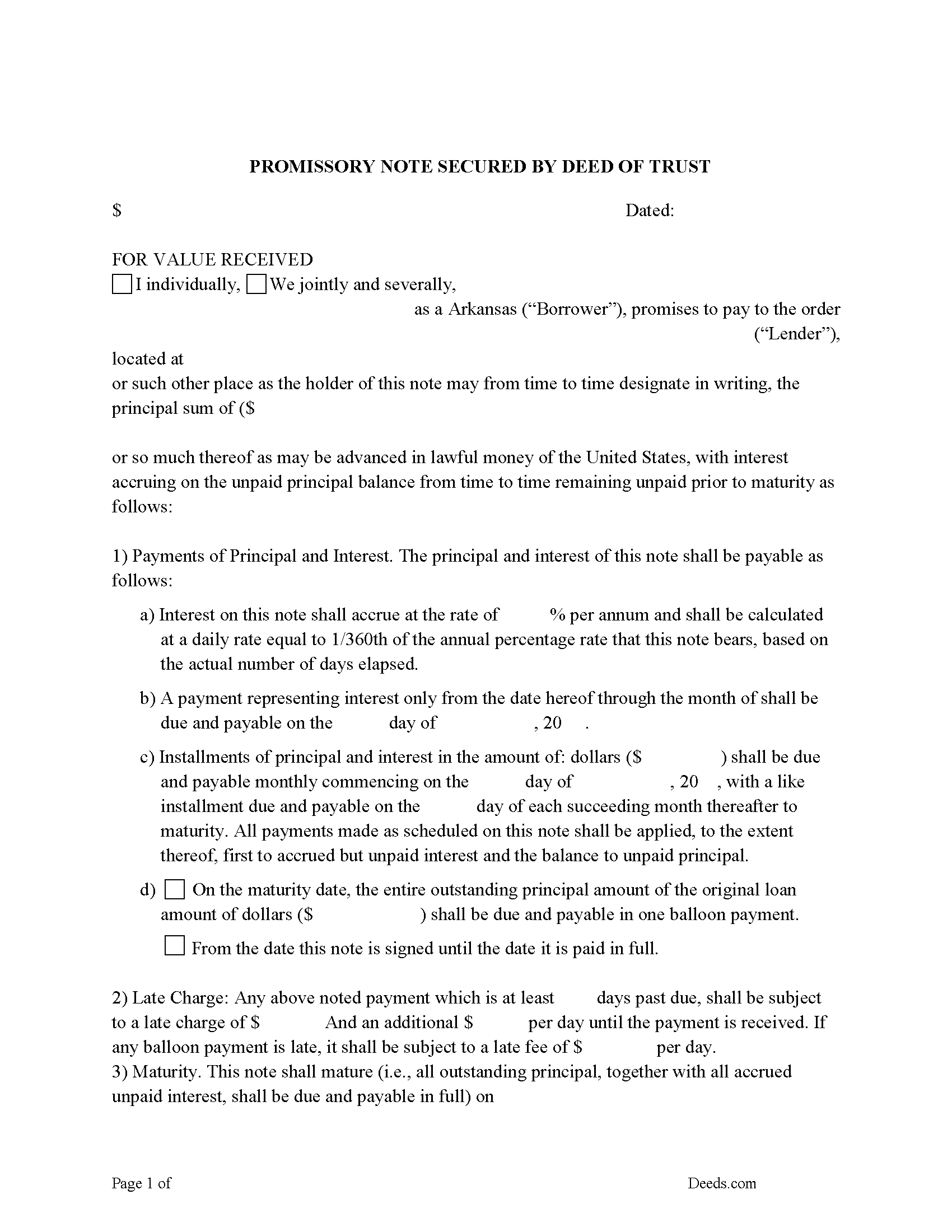

Mississippi County Promissory Note Form

Arkansas Promissory Note.

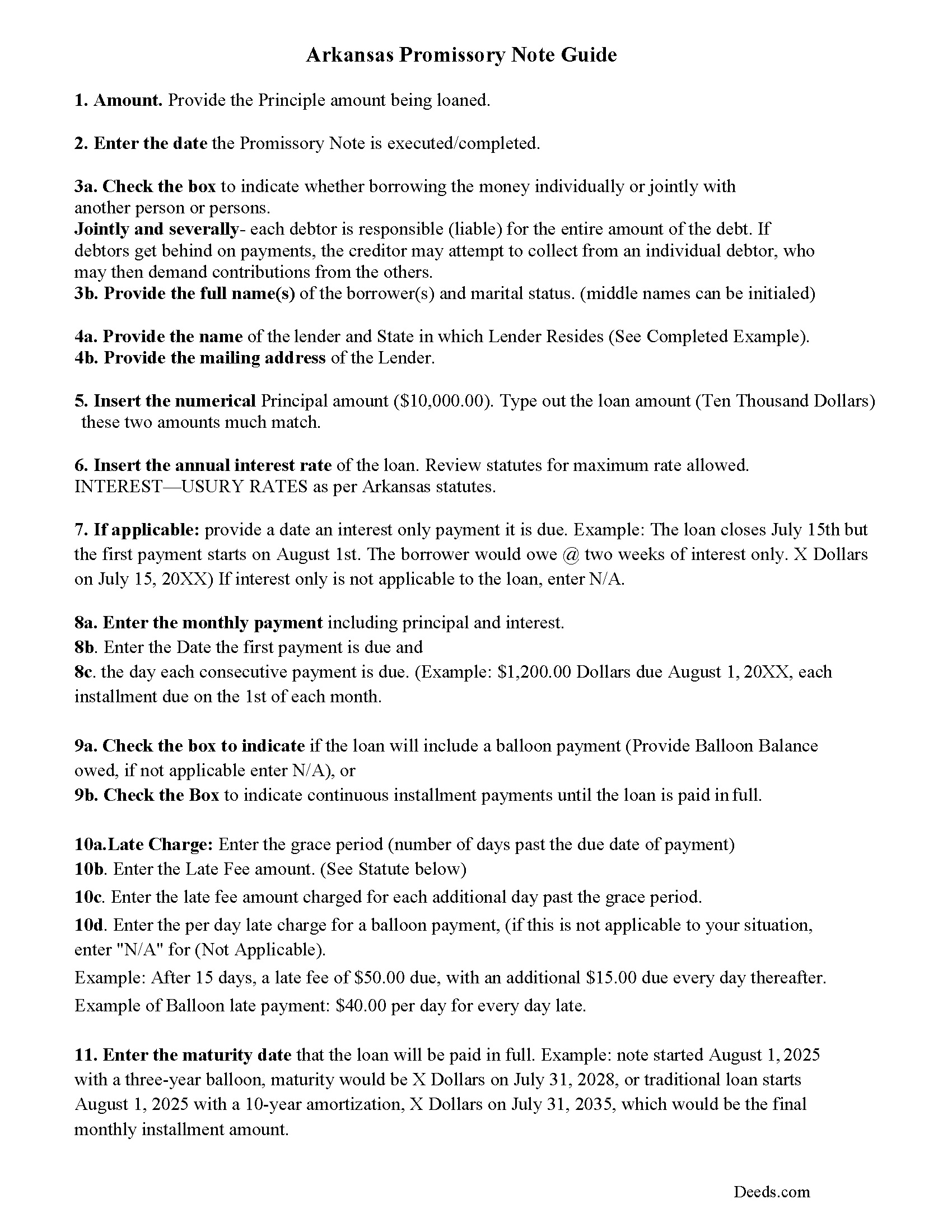

Mississippi County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

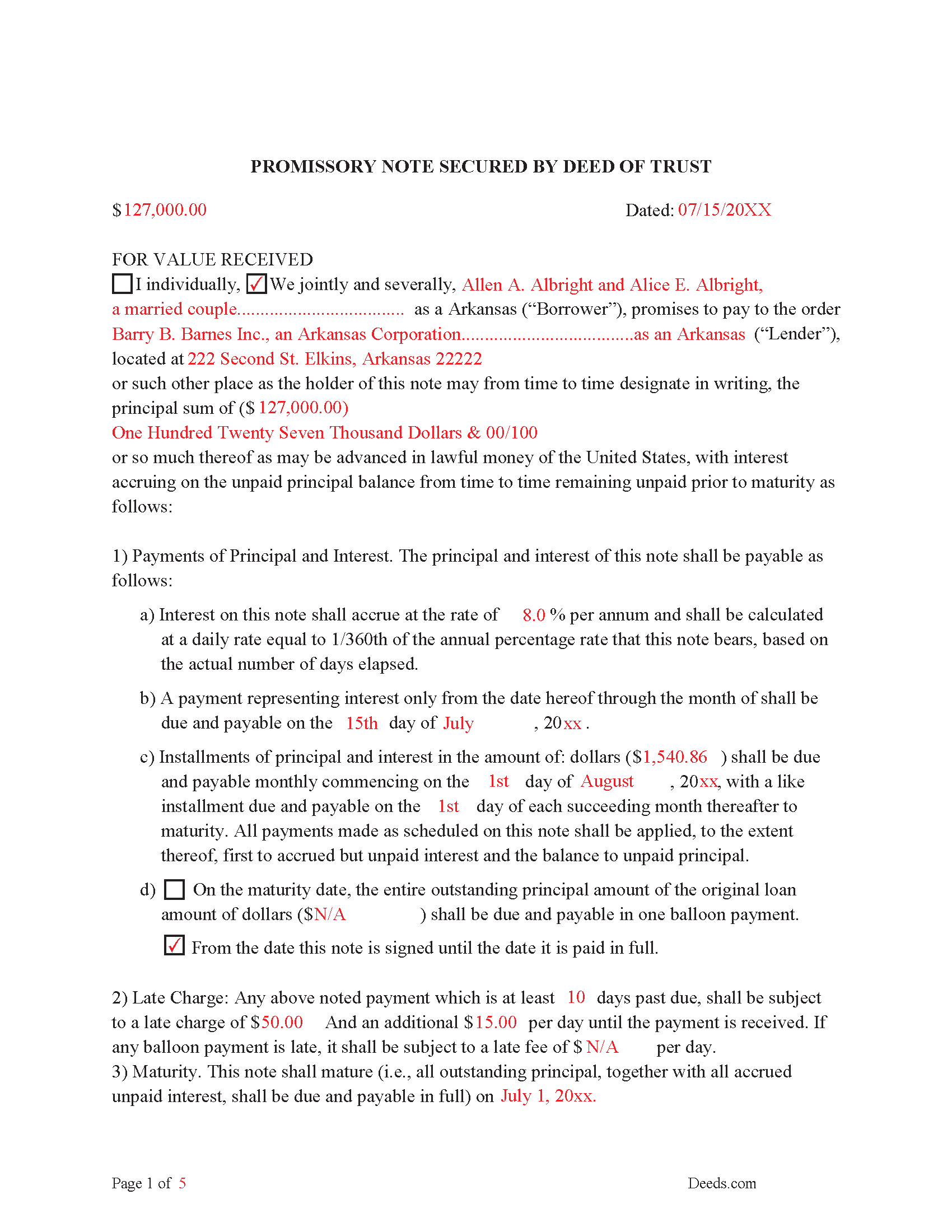

Mississippi County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

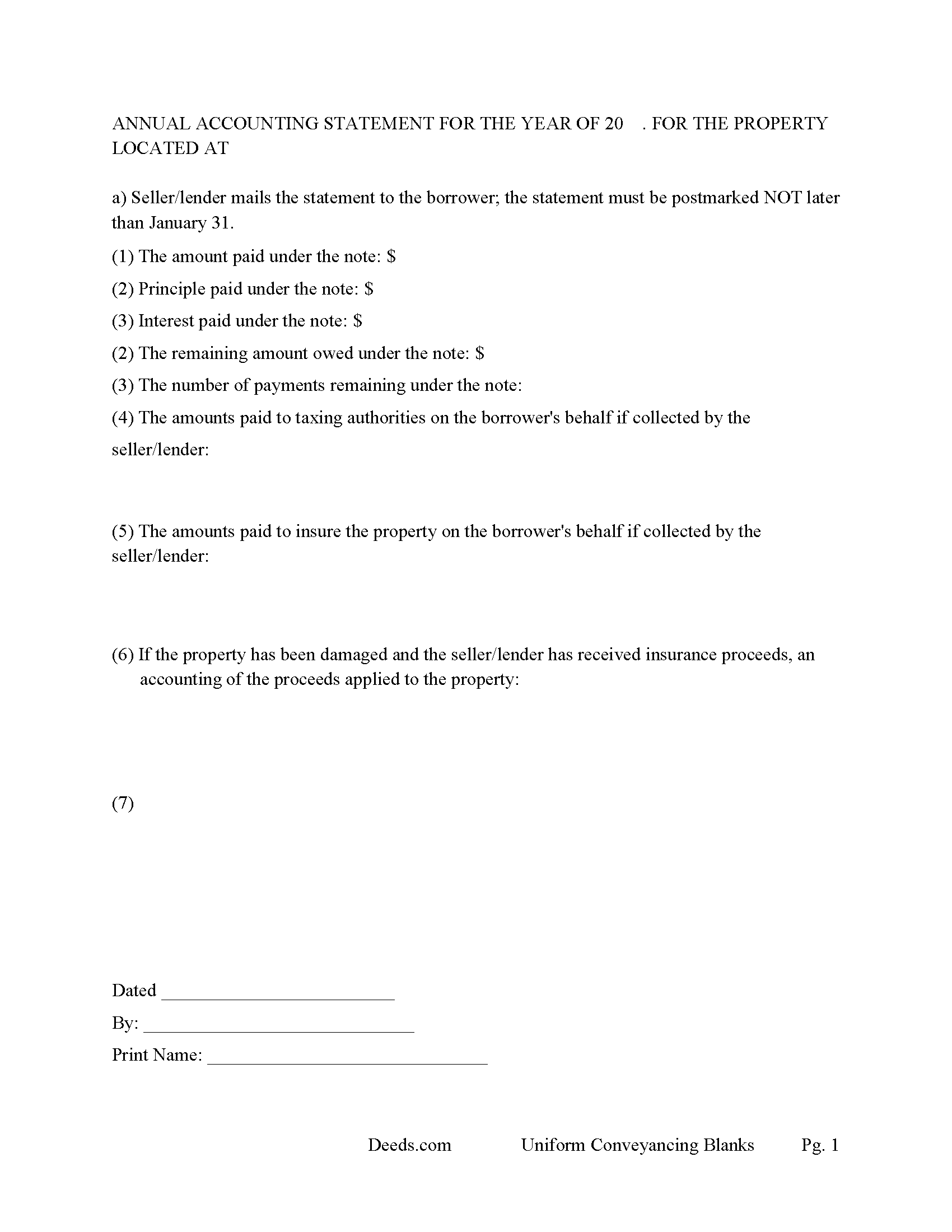

Mississippi County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

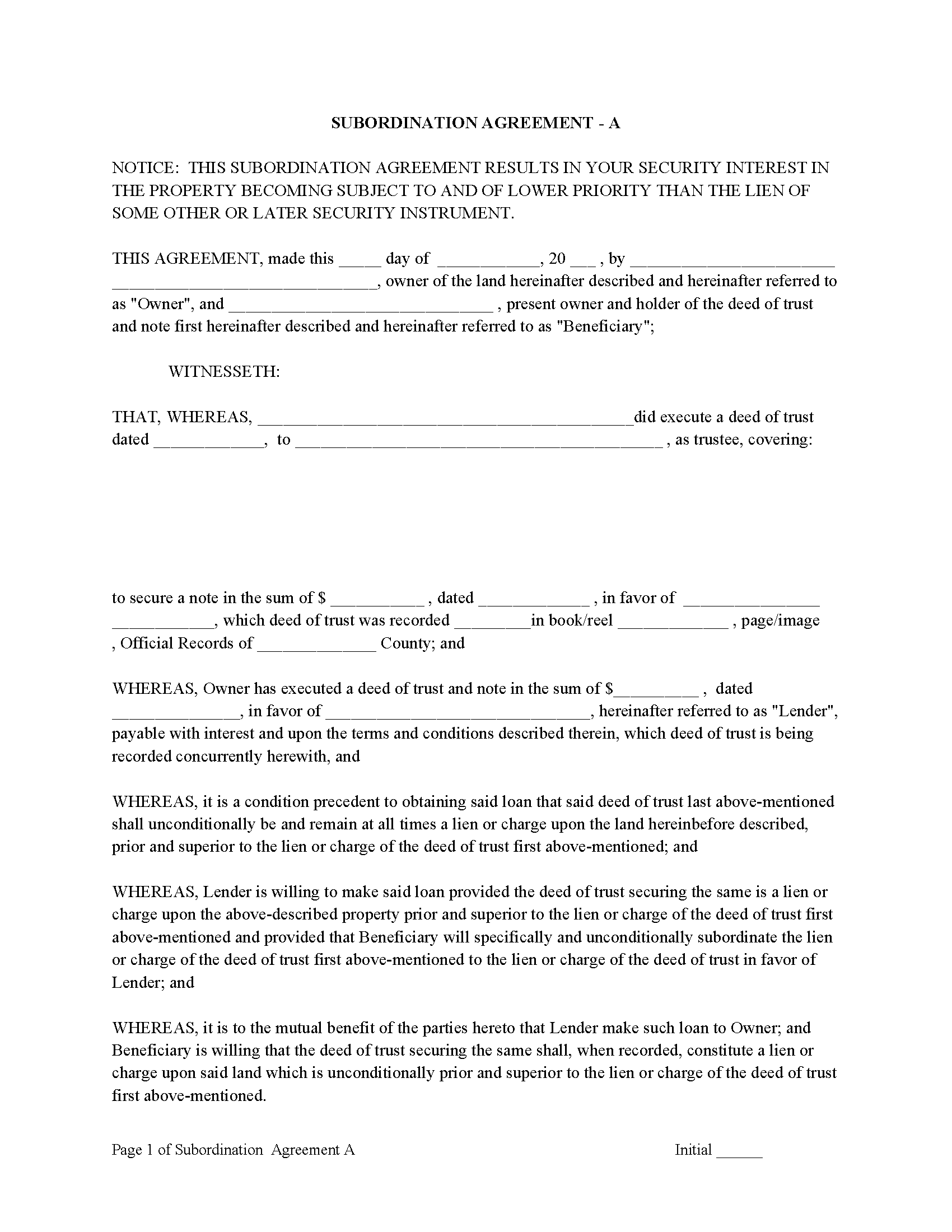

Mississippi County Subordination Argeements

Used to place priority on claim of debt. Included are 4 separate agreements for unique situations. If needed, add to Deed of Trust as an addendum or rider.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Mississippi County documents included at no extra charge:

Where to Record Your Documents

Circuit Clerk - Blytheville

Blytheville, Arkansas 72315

Hours: 8:30 to 4:30 M-F

Phone: (870) 762-2332

Circuit Clerk - Osceola

Osceola, Arkansas 72370

Hours: 8:30 to 4:30 M-F

Phone: (870) 563-6471

Recording Tips for Mississippi County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Mississippi County

Properties in any of these areas use Mississippi County forms:

- Armorel

- Bassett

- Blytheville

- Burdette

- Dell

- Driver

- Dyess

- Etowah

- Frenchmans Bayou

- Gosnell

- Joiner

- Keiser

- Leachville

- Luxora

- Manila

- Osceola

- West Ridge

- Wilson

Hours, fees, requirements, and more for Mississippi County

How do I get my forms?

Forms are available for immediate download after payment. The Mississippi County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mississippi County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mississippi County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mississippi County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mississippi County?

Recording fees in Mississippi County vary. Contact the recorder's office at (870) 762-2332 for current fees.

Questions answered? Let's get started!

("Deed of trust" means a deed conveying real property in trust to secure the performance of an obligation of the grantor or any other person named in the deed to a beneficiary and conferring upon the trustee a power of sale for breach of an obligation of the grantor contained in the deed of trust;) (Ark. Statute 18-50-101(2)) A power of sale allows for a non-judicial foreclosure in the case of default, saving time and expense. If Lender invokes the power of sale, Lender shall execute or cause Trustee to execute the written notice of the occurrence of any event of default and Lender's election to cause the Property to be sold and shall cause such notice to be recorded in each county in which the Property or some portion thereof is located. Lender or Trustee shall mail copies of such notice in the manner prescribed by applicable law. 18-50-103.

(A trustee may not sell the trust property unless: The deed of trust or mortgage is filed for record with the recorder of the county in which the trust property is situated;) (Ark. Statute 18-50-103(1))

A deed of trust contains three (3) parties: Grantor/Trustor, Trustee, and Beneficiary/Lender

"Grantor" means the person conveying an interest in real property by a mortgage or deed of trust as security for the performance of an obligation; (Ark. Statute 18-50-101 (3))

"Beneficiary" means the person named or otherwise designated in a deed of trust as the person for whose benefit a deed of trust is given or his successor in interest; (Ark. Statute 18-50-101 (1))

("Trustee" means any person or legal entity to whom legal title to real property is conveyed by deed of trust or his or her successor in interest.) Examples of how a Trustee can be chosen are given. (Ark. Statute 18-50-101 (10)).

14-15-402. Instruments to be recorded. (a) It shall be the duty of each recorder to record in the books provided for his or her office all deeds, mortgages, conveyances, deeds of trust, bonds, covenants, defeasances, affidavits, powers of attorney, assignments, contracts, agreements, leases, or other instruments of writing of, or writing concerning, any lands and tenements or goods and chattels, which shall be proved or acknowledged according to law, that are authorized to be recorded in his or her office.

THIS DEED OF TRUST DIFFERS IN THAT IT ALLOWS THE LENDER TO COLLECT TAXES AND INSURANCE PAYMENTS MONTHLY. THIS GIVES THE LENDER MORE CONTROL, FOR EXAMPLE: A LENDER MIGHT NOT REALIZE TAXES AND/OR INSURANCE PAYMENTS ARE IN ARREARS UNTIL SIX (6) MONTHS AFTER DELINQUENCY. THIS FORM IS CONSISTENT WITH INVESTOR OR OWNER FINANCING.

Funds for Taxes and Insurance: Subject to applicable law or a written waiver by Lender, Borrower shall pay to lender on the day monthly payments of principal and interest are payable under the Note, until the Note is paid in full, a sum ("Funds") equal to one twelfth (1/12) of the yearly taxes and assessments which may attain priority over this Deed of Trust, and ground rents on the Property, if any, plus one twelfth (1/12) of yearly premium installments of hazard insurance, plus one twelfth (1/12) of yearly premium installments for mortgage insurance, if any, all as reasonably estimated initially and from time to time by Lender on the basis of assessments and bills and reasonable estimates thereof.

For use in Arkansas only.

Important: Your property must be located in Mississippi County to use these forms. Documents should be recorded at the office below.

This Deed of Trust with Installment of Taxes and Insurance meets all recording requirements specific to Mississippi County.

Our Promise

The documents you receive here will meet, or exceed, the Mississippi County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mississippi County Deed of Trust with Installment of Taxes and Insurance form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Andrew T.

December 19th, 2023

The process was incredibly simple from start to finish. Someone from the team even sent a message to double check part of my document was filled out correctly. Will be bringing my business here in the future!

It was a pleasure serving you. Thank you for the positive feedback!

Laura B.

December 2nd, 2019

Downloaded and completed these quit claim forms in less than one cup of coffee, quick easy and stress free.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy P.

January 2nd, 2025

Can you also make a search that includes the parcel number because that is all I had to go with and regular name searches didn't come up with anything I needed.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

irene a.

February 8th, 2019

good forms thanks, irene

Thank you Irene.

Lillian F.

May 2nd, 2019

I LOVE THE EASE OF GETTING THE INFORMATION I REQUESTED. YOUR SERVICE IS MORE THAN WHAT I EXPECTED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda S.

April 9th, 2021

Awesome forms, filled them out on my computer, printed them out complete, notarized, recorded, wonderful process. THANKS

Thank you for the kind words Brenda. Have a great day!

Dale K.

August 11th, 2020

A very user friendly website!

Thank you!

MARCO G.

May 9th, 2019

Very easy to use. Got the emailed documents within minutes.

We appreciate your feedback Marco, thank you.

Adriana V.

July 2nd, 2020

Excellent and a very fast way to release important documents. Thank you very much.

Thank you!

William P.

June 28th, 2022

VERY difficult to work with. Nice people. But difficult system. Ask for MANY changes. Why dont you do that as a

Sorry to hear of your struggle William. We do hope that you found something more suitable to your needs elsewhere.

Daphne M.

March 19th, 2023

As always I found Deeds.com to be excellent. Every item required on the forms I chose was explained completely. The fact that documents are available from so many states is amazing. Daphne M.

Thank you for your feedback. We really appreciate it. Have a great day!

Elliot B.

January 31st, 2022

Outstanding forms and the recording service made a short day of what I needed to do. Will be back for the next one, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Suhila C.

August 23rd, 2020

This site is awesome. It has everything I need to purchase and sell (transfer deed ownership) land and property. I cannot wait to get our new land and building for business. Thanks, Suhila

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kwaku A.

May 27th, 2021

Excellent service ! Came through in the clutch! Easy to use and understand ! Exceptional service ! 10/10

Thank you!

David W.

June 28th, 2019

Excellent and customer friendly as well...ty

Thank you for your feedback. We really appreciate it. Have a great day!