Howard County Memorandum and Notice of Agreement Form

Howard County Memorandum and Notice of Agreement Form

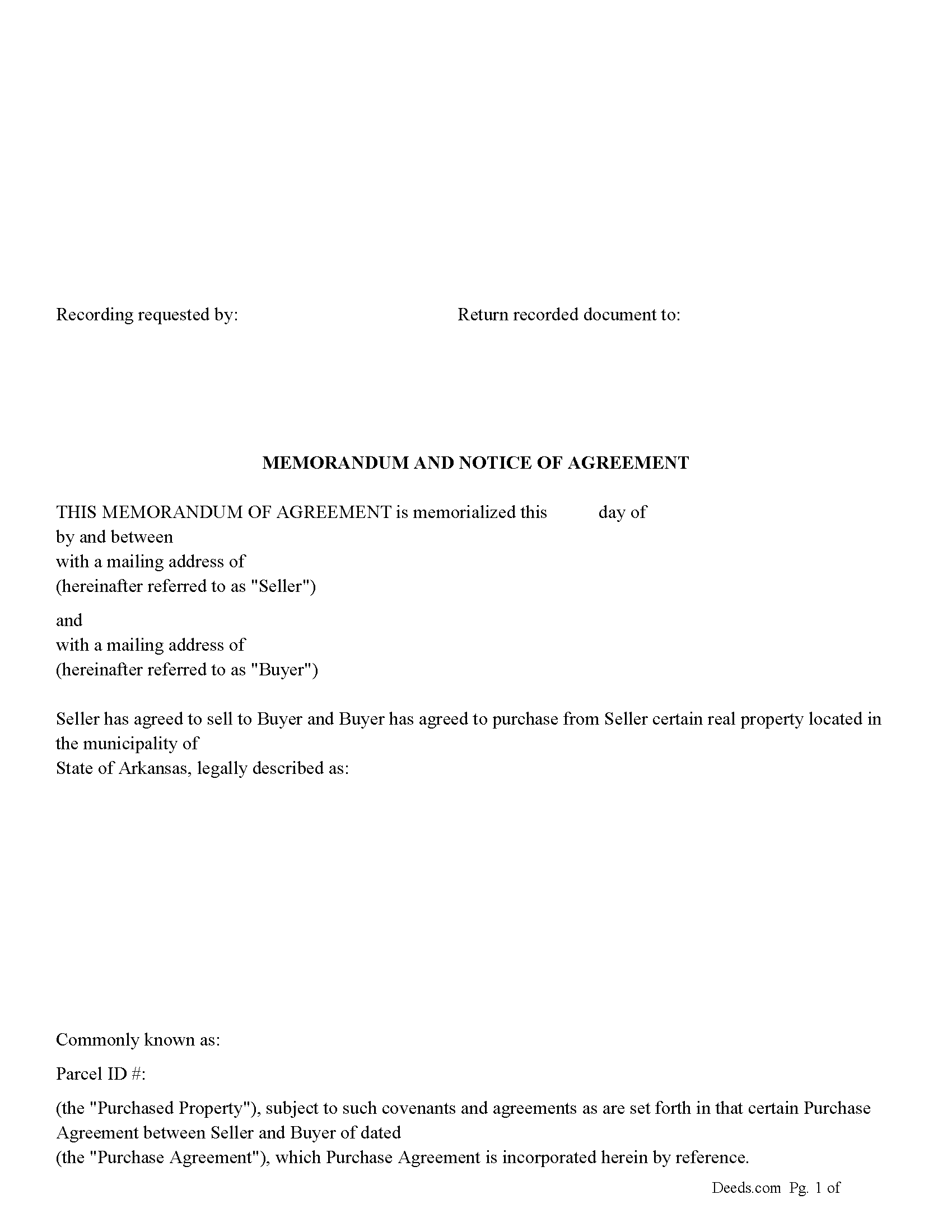

Fill in the blank Memorandum and Notice of Agreement form formatted to comply with all Arkansas recording and content requirements.

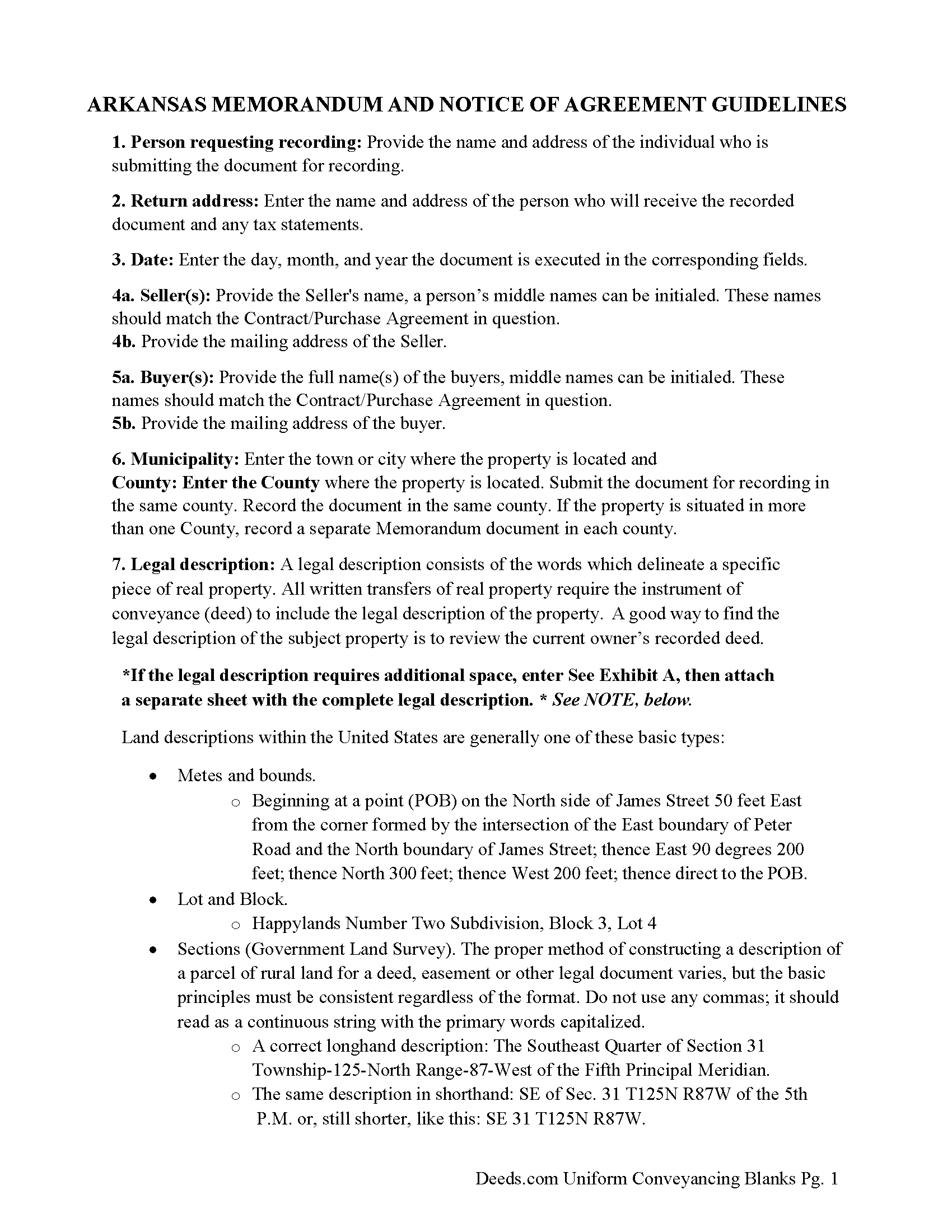

Howard County Memorandum and Notice of Agreement Guide

Line by line guide explaining every blank on the Memorandum and Notice of Agreement form.

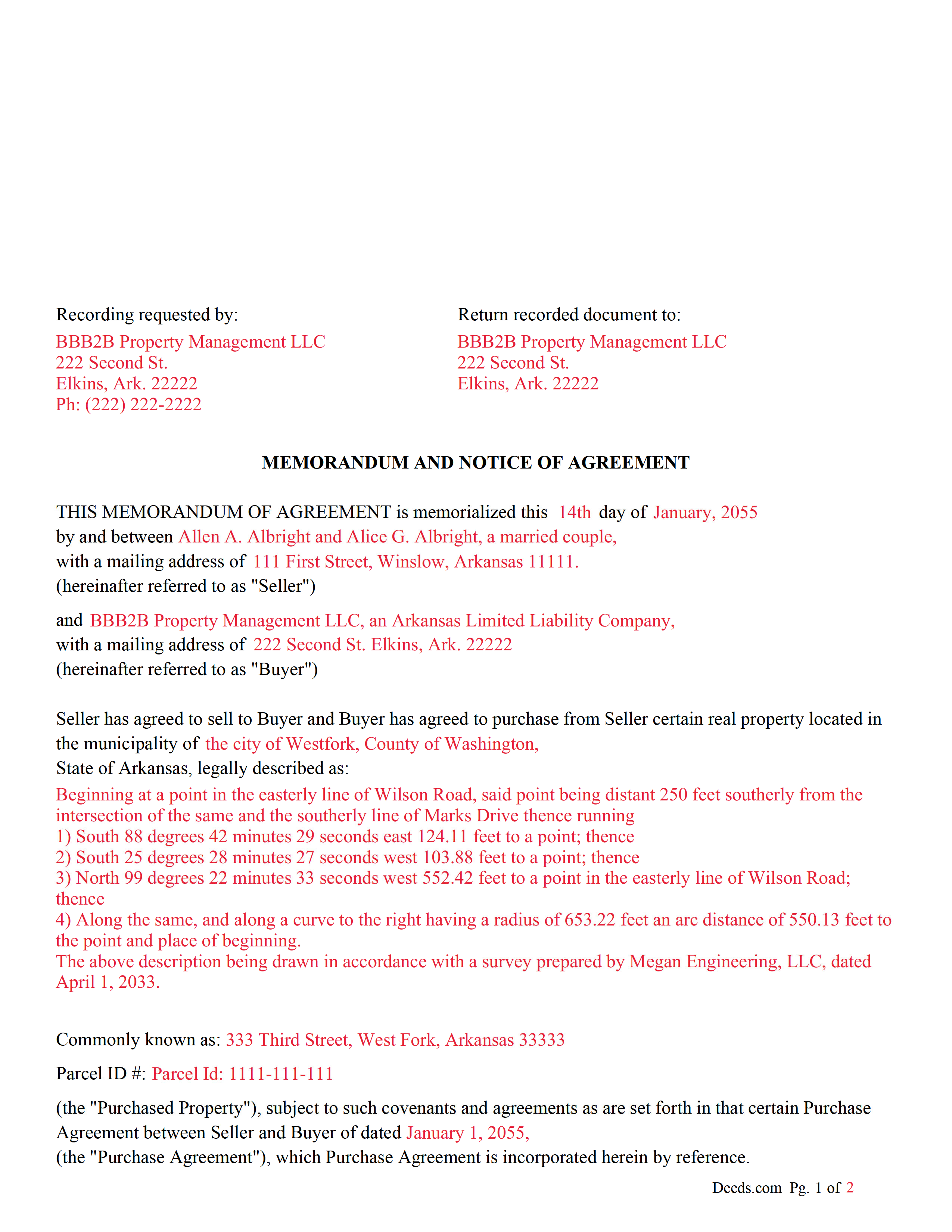

Howard County Completed Example of the Memorandum and Notice of Agreement Document

Example of a properly completed Arkansas Memorandum and Notice of Agreement document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Howard County documents included at no extra charge:

Where to Record Your Documents

Howard County Circuit Clerk

Nashville, Arkansas 71852

Hours: 8:00am to 4:30pm M-F

Phone: (870) 845-7506

Recording Tips for Howard County:

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Howard County

Properties in any of these areas use Howard County forms:

- Dierks

- Mineral Springs

- Nashville

- Saratoga

- Umpire

Hours, fees, requirements, and more for Howard County

How do I get my forms?

Forms are available for immediate download after payment. The Howard County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Howard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Howard County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Howard County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Howard County?

Recording fees in Howard County vary. Contact the recorder's office at (870) 845-7506 for current fees.

Questions answered? Let's get started!

A "Memorandum of Purchase Agreement" commonly referred to as a "Memorandum of Agreement" (MOA), Memorandum of Contract (MOC) or "Memorandum of Understanding" (MOU) in the context of real estate, is used primarily as a means to provide public notice of an equitable interest in a real estate transaction without disclosing the full details of the purchase agreement. This document is particularly useful in transactions where the buyer and seller have agreed to terms but the final closing and transfer of the deed have not yet occurred. By recording this memorandum with the county recorder's office, the buyer establishes a public record of their interest in the property, which can protect against subsequent claims or liens by third parties.

Key Purposes of a Memorandum of Purchase Agreement:

1. Notice of Equitable Interest: The memorandum serves as notice to the public that the buyer has an equitable interest in the property due to the purchase agreement. This is important in protecting the buyer’s interest against claims by other parties who might otherwise be unaware of the agreement.

2. Protection During the Closing Process: Real estate transactions can involve a lengthy closing process, including financing approval, inspections, and other contingencies. Recording a memorandum helps safeguard the buyer's interest in the property during this period.

3. Confidentiality: A memorandum of purchase agreement allows the parties to keep the specific terms of their agreement, such as the purchase price and other sensitive details, private. Only the essential facts necessary to establish interest in the property are included in the memorandum

Impact on Title: While the memorandum itself does not transfer title, it does create a public record of the buyer’s interest, which can be important in the event of disputes or if the seller attempts to convey the property to another party.

Use with Other Real Estate Transactions: Although commonly associated with purchase agreements, memoranda can also be used with other types of real estate transactions that convey an interest in property, such as land contracts or options to purchase.

Important: Your property must be located in Howard County to use these forms. Documents should be recorded at the office below.

This Memorandum and Notice of Agreement meets all recording requirements specific to Howard County.

Our Promise

The documents you receive here will meet, or exceed, the Howard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Howard County Memorandum and Notice of Agreement form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Tonni L.

June 15th, 2021

Quick and easy with great instructions and accurate documents. I plan to make this site a part of our financial planning. Highly recommend. Saved big by this DIY process. TL

Thank you for your feedback. We really appreciate it. Have a great day!

Daphne M.

March 19th, 2023

As always I found Deeds.com to be excellent. Every item required on the forms I chose was explained completely. The fact that documents are available from so many states is amazing. Daphne M.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph S.

March 31st, 2022

The website was very easy to use. I rate it a five star

Thank you for your feedback. We really appreciate it. Have a great day!

sean m.

April 28th, 2021

Wow everything I need in one place... what a concept. thanks Deeds.com for the deeds, the guides and the transfer certificate all included for a great price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa m.

April 25th, 2020

Very fast and easy! Thanks!!

Glad we could help. Thank you!

John D.

September 1st, 2021

Very helpful and easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Veronica G.

November 11th, 2020

Excellent service A+

Thank you!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

annie m.

February 13th, 2023

recently joined Deeds.com. still exploring the site. has been very helpful in providing local information for recording, such as fees and requirements. i am working to correct mistakes made within a deed. it is amazing how these municipalities operate outside the scope of Article 1, Section 8, Clause 17; to claim land is "in" the "State of ____. when the land is actually not ceded to the United States of America as for use for needful buildings. beware of the fraud perpetrated by Attorneys in the recording of your Deeds. Registration as "RESIDENTIAL" puts your private-use land on the TAX rolls with the use of that one word. i recommend this site as it appears there is information for each state and each county office. will update my review once i place an order.

Thank you!

Wilma M.

August 7th, 2020

Amazingly easy. Thank you

Thank you!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

David O.

March 19th, 2022

Service was top-notch....fast, accurate, cost-effective.

Thank you!

Judith F.

May 6th, 2022

The form I needed was perfect!

Thank you!