Fulton County Mortgage Secured by Promissory Note Form

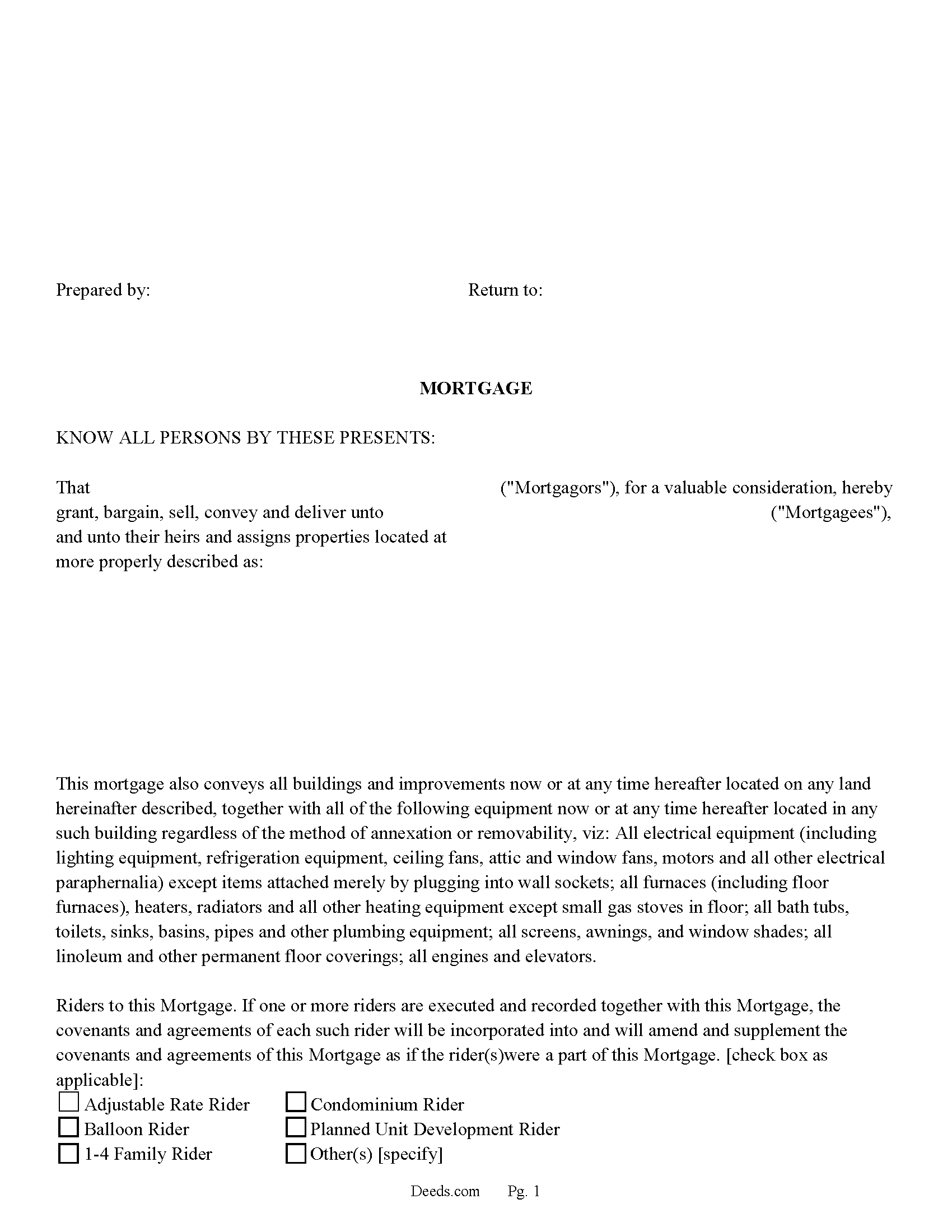

Fulton County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

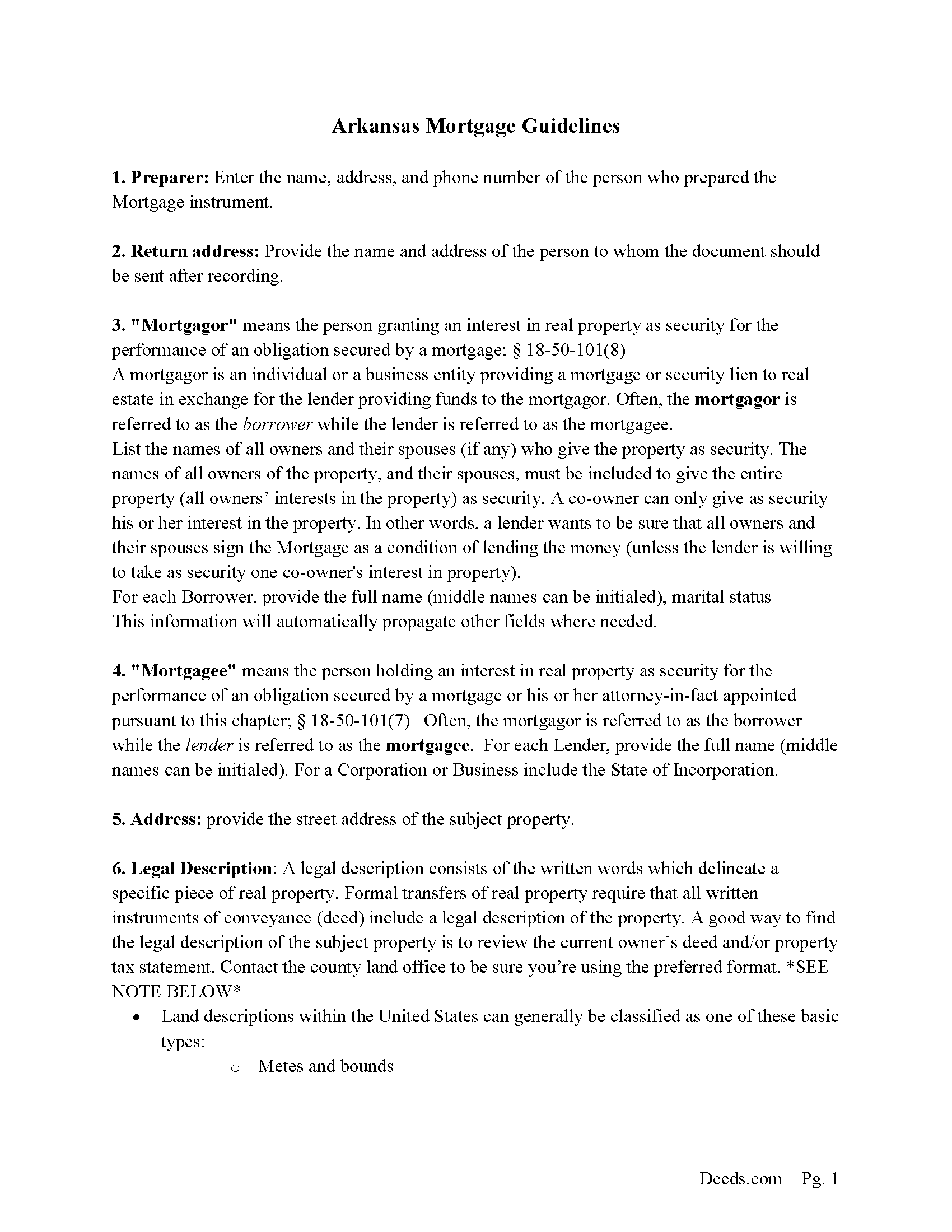

Fulton County Mortgage Guide

Line by line guide explaining every blank on the form.

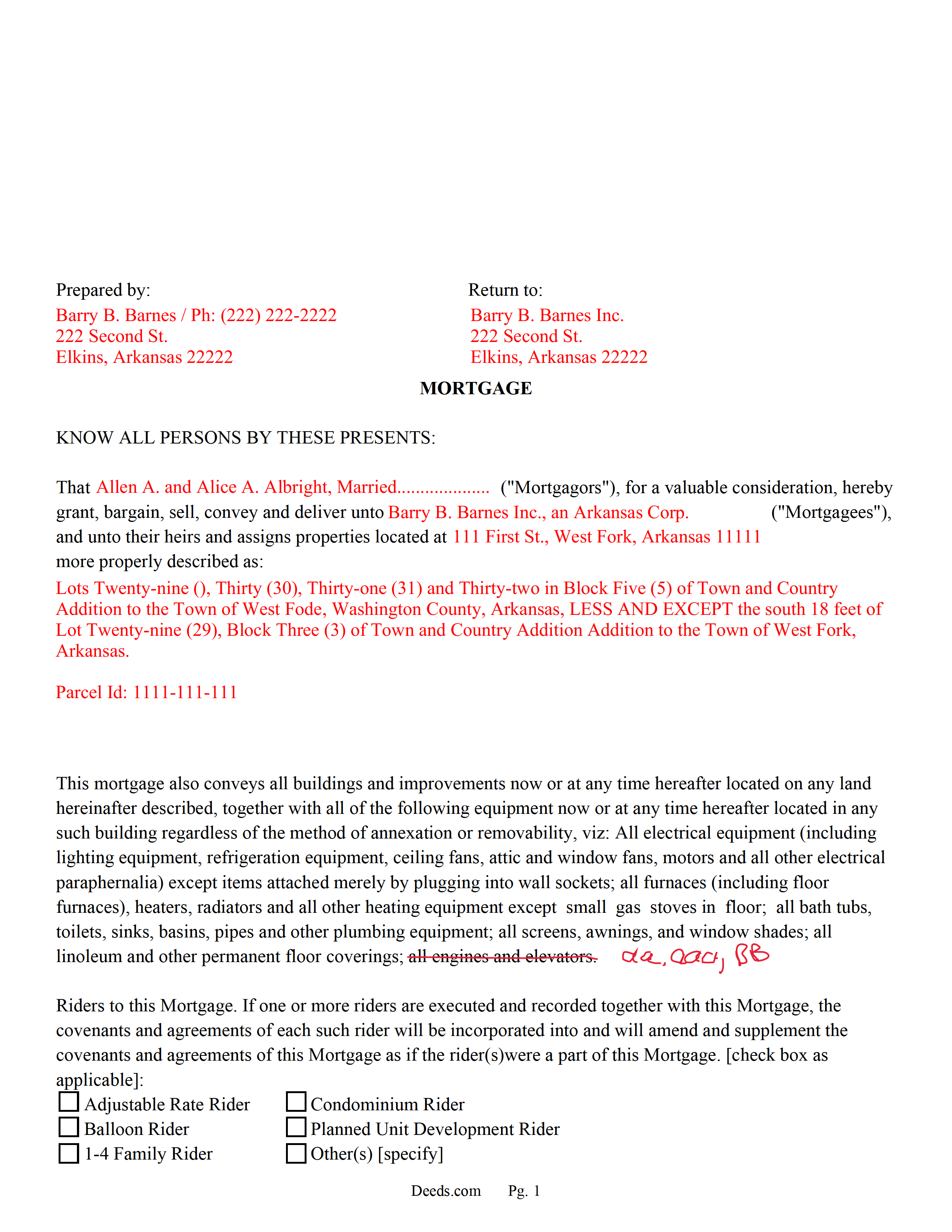

Fulton County Completed Example of the Mortgage Document

Line by line guide explaining every blank on the form.

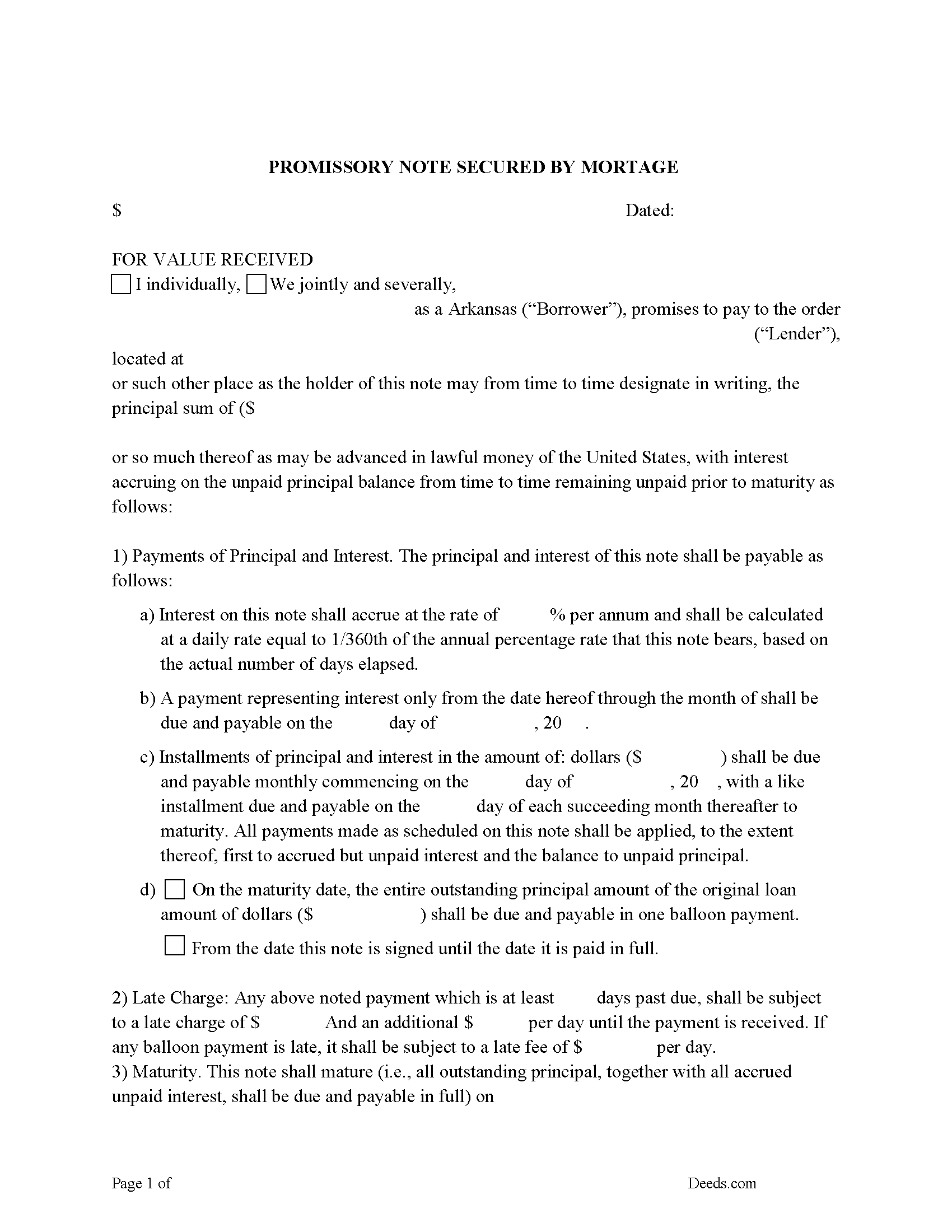

Fulton County Promissory Note Form

Fill in the Blank Form.

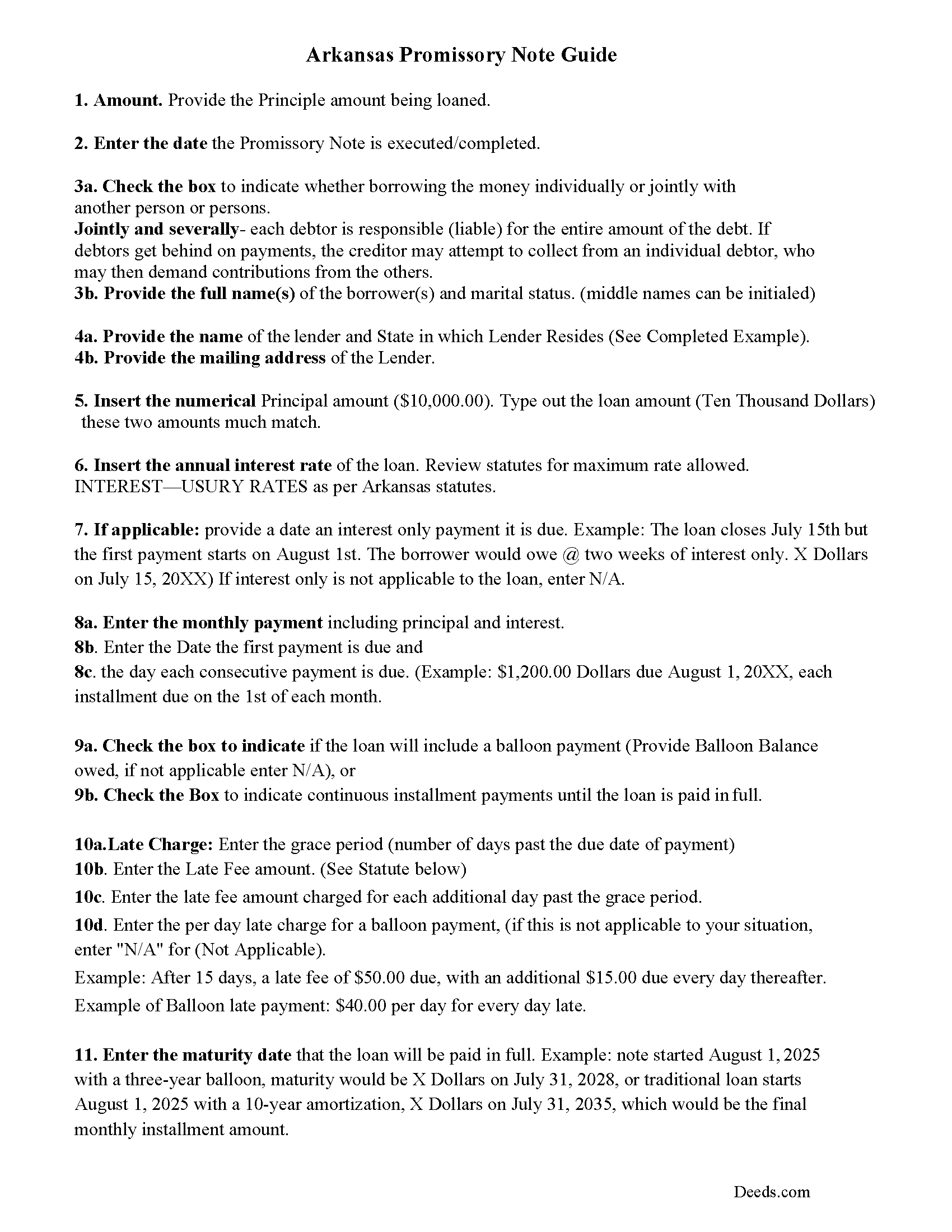

Fulton County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

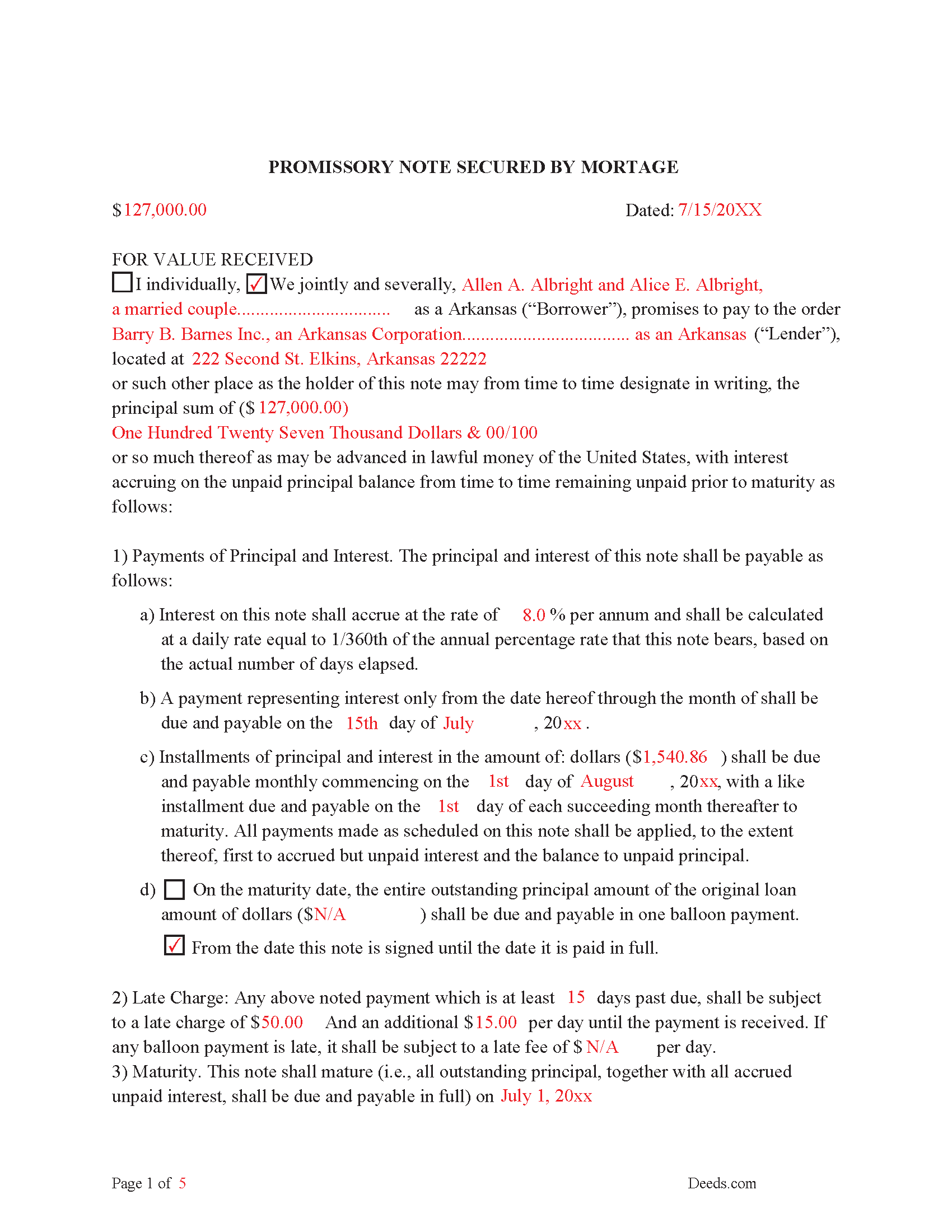

Fulton County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

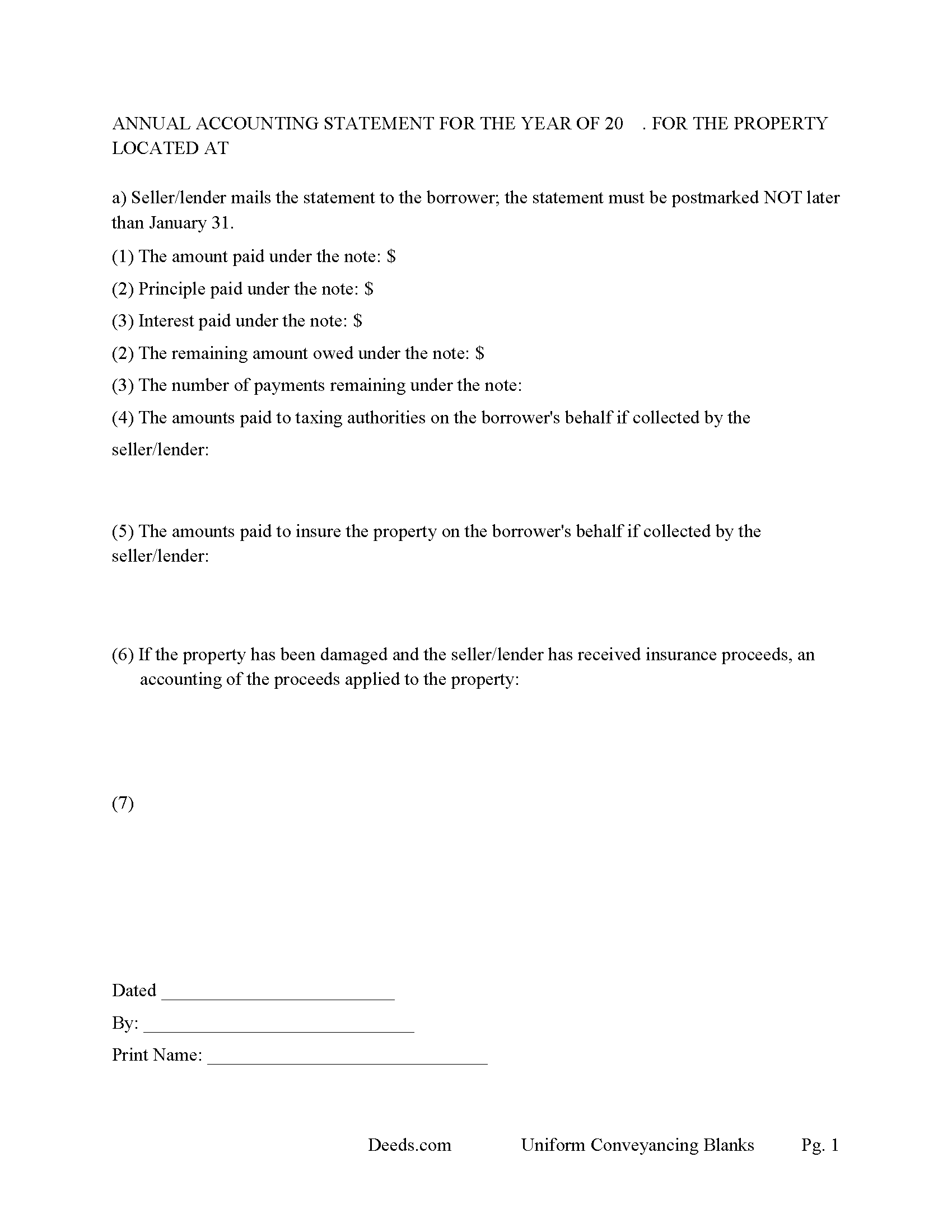

Fulton County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Fulton County documents included at no extra charge:

Where to Record Your Documents

Circuit and County Clerk

Salem, Arkansas 72576

Hours: 8:00am to 4:30pm M-F

Phone: (870) 895-3310

Recording Tips for Fulton County:

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Fulton County

Properties in any of these areas use Fulton County forms:

- Bexar

- Camp

- Elizabeth

- Gepp

- Glencoe

- Mammoth Spring

- Salem

- Sturkie

- Viola

Hours, fees, requirements, and more for Fulton County

How do I get my forms?

Forms are available for immediate download after payment. The Fulton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fulton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fulton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fulton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fulton County?

Recording fees in Fulton County vary. Contact the recorder's office at (870) 895-3310 for current fees.

Questions answered? Let's get started!

("Mortgage" means the grant of an interest in real property to be held as security for the performance of an obligation by the mortgagor or other person.) (18-50-101 (4))

Once (filed in the recorder's office) the mortgage becomes a (lien on the mortgaged property). (The filing shall be notice to all persons of the existence of the mortgage.) (18-40-102)

The (Mortgagor)/ Borrower grants (an interest in real property as security for the performance of an obligation secured by a mortgage.) (18-50-101 (8))

The (Mortgagee)/Lender holds (an interest in real property as security for the performance of an obligation secured by a mortgage.) (18-50-101 (7))

The borrower must also complete a promissory note. A promissory note is a negotiable instrument that contains an unconditional written promise, signed by the borrower, to repay the lender or its designated agent. It defines the amount and specific terms of the loan between the borrower and the lender (interest rates, default rate, late payment fee, etc.), and must be completed at the same time as the security instrument. Many lenders retain the promissory note for the duration of the mortgage and return it to the borrower after the debt is repaid.

Use these forms for real property, land, single family, condominiums, small commercial and rental units (up to 4). The promissory note can be used for traditional installment and balloon payments. In Arkansas, the Mortgagor/Borrower has the right to redeem the property if it is sold through decree of the circuit court/foreclosure. (This may be done at any time within one (1) year from the date of sale). [The mortgagor may waive the right of redemption in the mortgage so executed and foreclosed.] In this form the Mortgagor/Borrower releases their right of redemption. They also relinquish their rights of homestead (if any). These terms can be beneficial to the Mortgagee/Lender if default occurs. (18-49-106 (2)) [18-49-106 (b)]

(Arkansas Mortgage Package includes forms, guidelines, and completed examples) For use in Arkansas Only.

Important: Your property must be located in Fulton County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured by Promissory Note meets all recording requirements specific to Fulton County.

Our Promise

The documents you receive here will meet, or exceed, the Fulton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fulton County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4596 Reviews )

Bea Lou H.

December 2nd, 2022

easy access and easy to find what I was looking for. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Alexia B.

June 11th, 2020

Excellent service with rapid turn around time!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Randall M.

March 31st, 2022

These forms worked fantastic!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wayne S.

March 12th, 2025

The website is quick and easy to navigate and the downloading of forms is a simple process.

Thank you, Wayne! We're thrilled to hear that you found our website quick and easy to navigate. Making the process simple for our customers is our goal! If you ever need anything, we're here to help. Appreciate your support!

Giuseppina M.

October 23rd, 2024

Love to work with your company

It was a pleasure serving you. Thank you for the positive feedback!

Irma G.

April 30th, 2021

Although I did not use the forms yet, it appears very easy to understand and navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Marjorie K.

August 13th, 2021

This was super easy to use, especially if you remember to look for a downloaded PDF file, not a Word file. Found the files right away after the light bulb went on! Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

Virginia W.

March 14th, 2021

Easy instructions and a example on how to fill out the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly F.

October 27th, 2021

Wow! This process was incredibly easy and no commitments to monthly memberships.

Thanks for the kind words Kimberly. Have an amazing day!

Michael G. S.

January 3rd, 2019

The process was quite easy, following the instructional guide. I have yet to find out if the deed was accepted, but your site was very user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph K.

May 1st, 2020

I'm very impressed. We're a small nonprofit, and we usually walk our documents into our county offices for recording. So I was a little bit skeptical about how things would work if we did it electronically. But it was a smooth, quick, painless, and reasonably priced process. I expect that this will be our preferred method even after county offices re-open.

Thank you for your feedback. We really appreciate it. Have a great day!

MIchael T.

March 23rd, 2023

very helpful in a trouble free manner.

Thank you!

Geraldine B.

December 7th, 2019

Top notch real estate forms. Easy to use, printed out nice, and the guide and example are priceless. You're not going to find anything better anywhere.

Thank you for the kind words Geraldine! Have an incredible day!

Dorothea H.

November 23rd, 2020

I am so glad I chose Deeds.com for my forms! The directions were clear and comprehensive, and the form allowed for customization far beyond the free forms I had looked at before. I highly recommend this site!

Thank you for your feedback. We really appreciate it. Have a great day!