Kern County Deed Corrective Affidavit Form

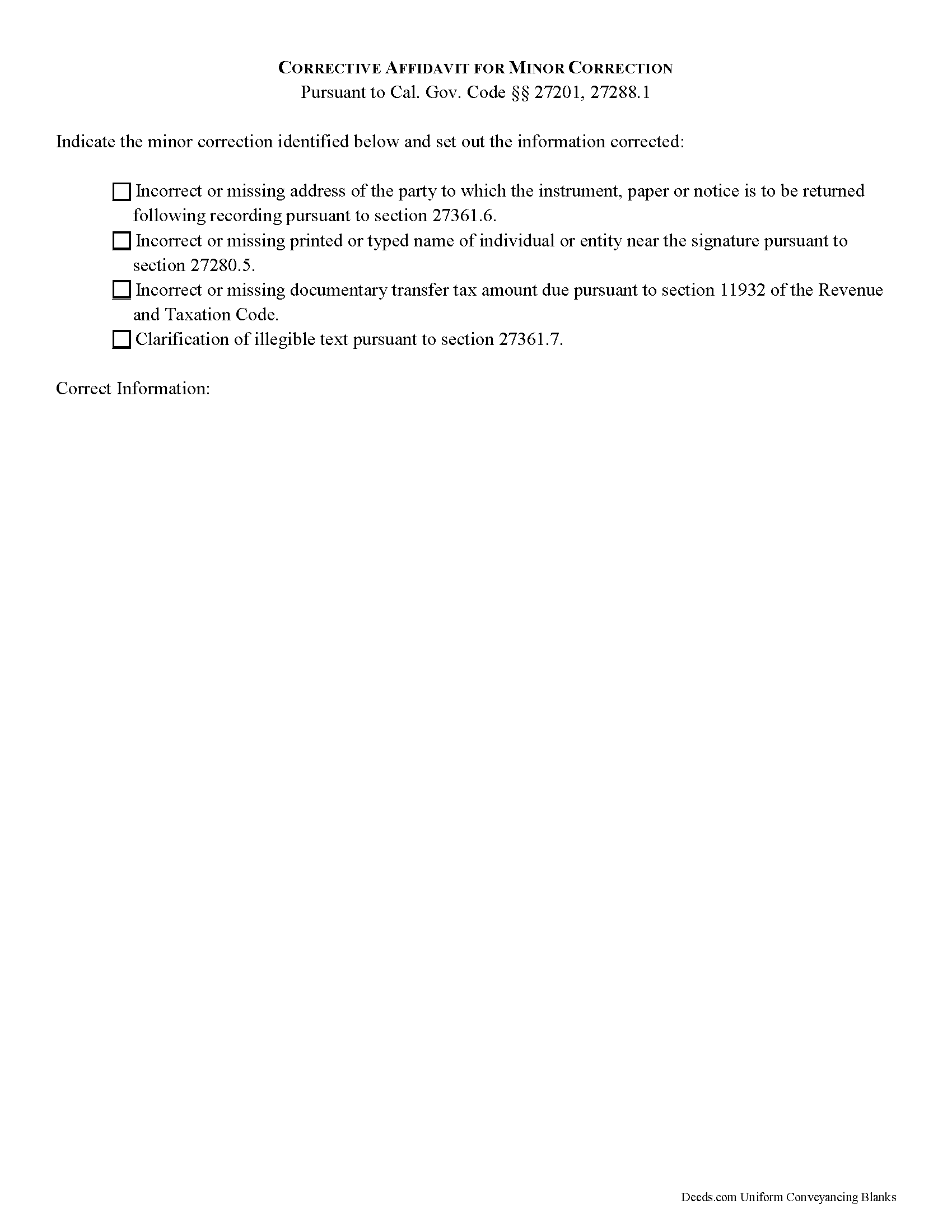

Kern County Corrective Affidavit for Minor Correction Form

Fill in the blank form formatted to comply with all recording and content requirements.

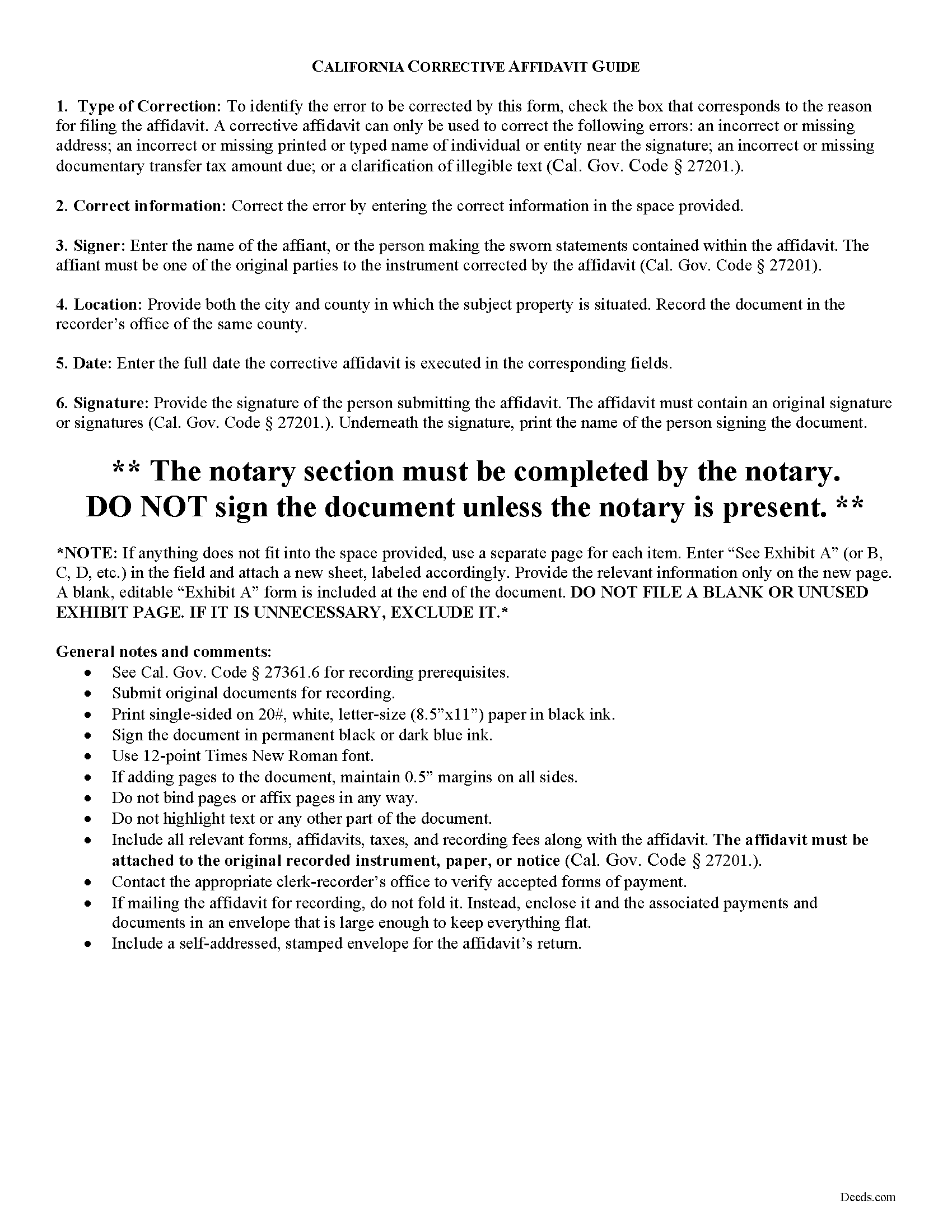

Kern County Corrective Affidavit Guide

Line by line guide explaining every blank on the form.

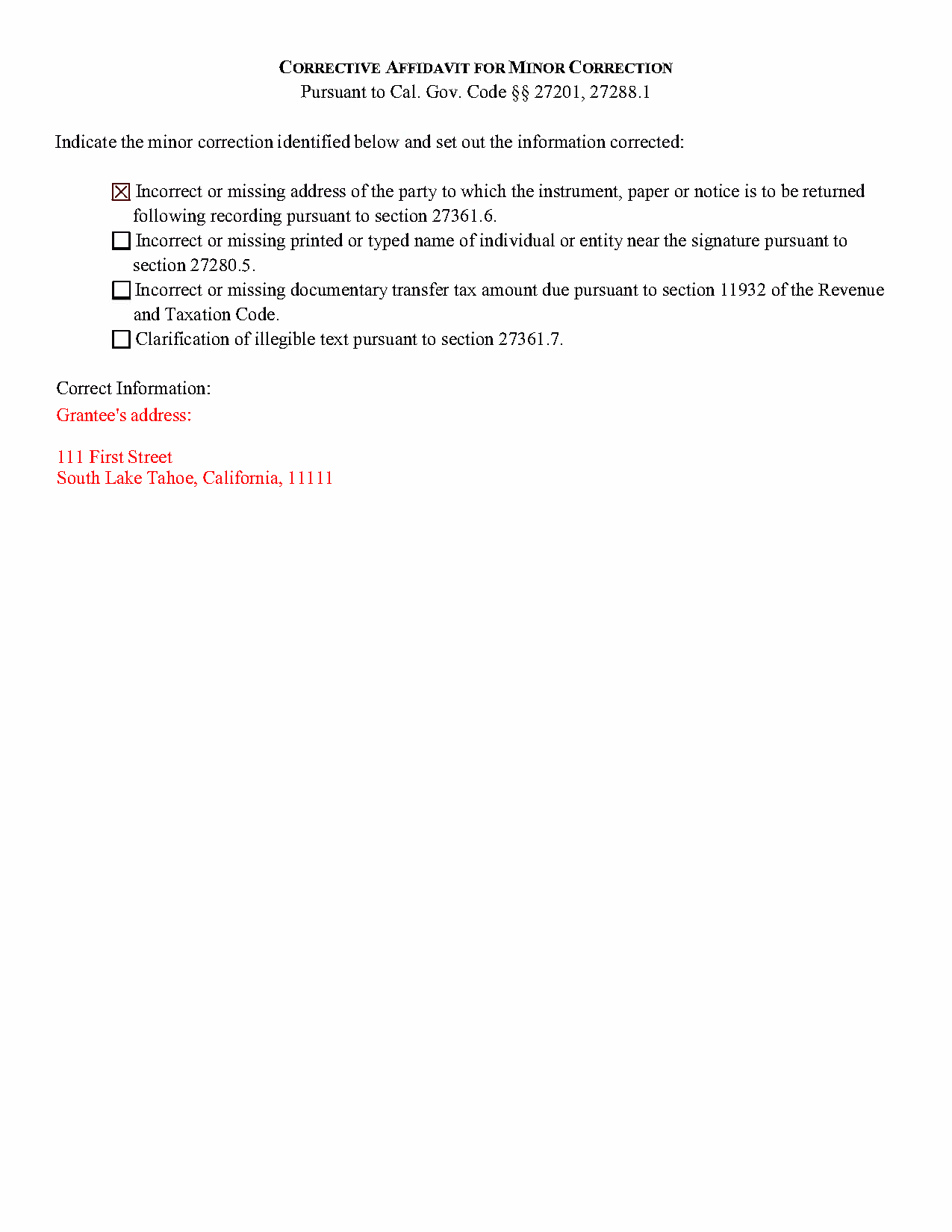

Kern County Completed Example of the Corrective Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Kern County documents included at no extra charge:

Where to Record Your Documents

Kern County Recorder

Bakersfield, California 93301

Hours: 8:00am to 4:30pm / Recording until 2:00pm

Phone: 661-868-6400 x 86448

Recording Tips for Kern County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Kern County

Properties in any of these areas use Kern County forms:

- Arvin

- Bakersfield

- Bodfish

- Boron

- Buttonwillow

- Caliente

- California City

- Cantil

- Delano

- Edison

- Edwards

- Fellows

- Frazier Park

- Glennville

- Inyokern

- Johannesburg

- Keene

- Kernville

- Lake Isabella

- Lamont

- Lebec

- Lost Hills

- Maricopa

- Mc Farland

- Mc Kittrick

- Mojave

- Onyx

- Randsburg

- Ridgecrest

- Rosamond

- Shafter

- Taft

- Tehachapi

- Tupman

- Wasco

- Weldon

- Wofford Heights

- Woody

Hours, fees, requirements, and more for Kern County

How do I get my forms?

Forms are available for immediate download after payment. The Kern County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kern County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kern County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kern County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kern County?

Recording fees in Kern County vary. Contact the recorder's office at 661-868-6400 x 86448 for current fees.

Questions answered? Let's get started!

Corrective Affidavits in California

Typically, any rerecorded document must be resigned and acknowledged as a new document. However, an erroneous document will not be recorded as a new document if it is presented with a corrective affidavit (Cal. Gov. Code 27201.). A corrective affidavit is a statutory device under Cal. Gov. Code 27201, used to correct a minor error in a document that has been recorded at an earlier date.

Minor errors are those that, when corrected, cause no actual change in the substance of the document. Section 27201 of the Government Code states that a corrective affidavit can only be used to correct the following: an incorrect or missing return address; a clarification of illegible text; an incorrect or missing printed or typed name near the signature; or an incorrect or missing documentary transfer tax amount due.

More extensive corrections to recorded documents typically require a new deed. Adding or removing a grantee, for example, or making material changes to the legal description, may all require a new document of conveyance. When in doubt about the appropriate vehicle to address the error, consult with a lawyer.

A correction deed is exempt from transfer tax because no transfer is being made, and no consideration is exchanged (Cal. Rev. and Tax. Code 11911). Some counties demand a documentary transfer tax affidavit stating the reason for the exemption, to be filed in addition to the other documents being recorded, so check the county recorder's website to confirm any local requirements.

For the correction to be valid, the affidavit must be attached to the original recorded document with a cover sheet complying with Cal. Gov. Code 27361.6, stating the reason for rerecording on the cover sheet, by the person who submitted the original document for recording (Cal. Gov. Code 27201.).

The affidavit itself must include the information corrected, be certified by the party submitting the affidavit under penalty of perjury, and be acknowledged pursuant to Cal. Gov. Code 27287. The affidavit can be acknowledged by any one of the officials listed in Cal. Civ. Code 1181. Finally, the form must meet all state and local standards for recorded documents. Submit the completed affidavit, along with any necessary supporting materials, to the local recording office to correct and update the public data.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about corrective affidavits, or for any other issues related to real property in California.

(California Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Kern County to use these forms. Documents should be recorded at the office below.

This Deed Corrective Affidavit meets all recording requirements specific to Kern County.

Our Promise

The documents you receive here will meet, or exceed, the Kern County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kern County Deed Corrective Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4596 Reviews )

Willie P.

May 13th, 2020

Your service was excellent

Thank you for your feedback. We really appreciate it. Have a great day!

Daren R.

March 4th, 2023

I believe that you should wait until a pending file is completed before asking for feedback. Thank you. Daren

Thank you!

Tullea S.

October 15th, 2024

Although I didn't get what I needed, the customer service is outstanding. I got a text asking if I needed any help. He canceled my subscription right away and was very helpful. He responded quickly each time.

We are delighted to have been of service. Thank you for the positive review!

Kenneth D.

July 23rd, 2023

I was very pleased with the service and the product. All the extras were a nice addition to my order. With the example and instructions, I was able to fill out my correction deed correctly. I filed it and it was accepted with zero reservations by my clerk and recorder's office. The expected result (which was to remove a name from the current deed) happened almost immediately. I definitely recommend deeds.com .

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

JOHN M.

October 20th, 2019

THANKS FROM A 92 YEAR OLD LADY

Thank you!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

Gary S.

November 4th, 2022

Thank you! Quick, timely and excellent quality document!

Thank you for your feedback. We really appreciate it. Have a great day!

Kristen N.

October 3rd, 2023

Very easy to use, helpful instructions and examples. I also like the chat feature and the erecording. So much better than other DIY law websites out there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark W.

May 9th, 2019

Easy, simple and fast. I am familiar with deeds in my state and these looked correct. The common missed document of TRANSFER OF REAL ESTATE VALUE document was also included. Kudos on being complete.

Thanks Mark, we really appreciate your feedback.

Anne G.

April 6th, 2020

I used deeds.com's services for the first time while the Stay at Home Order is in effect and found it to be very user friendly and seamless. I am very impressed.

Thank you Anne, glad we could help.

Susan Mary S.

August 24th, 2020

Thank you for the thorough assortment of forms!

Thank you for your feedback. We really appreciate it. Have a great day!

JOSE M.

November 3rd, 2021

Excellent Website.

Thank you!

Giovanni S.

February 23rd, 2023

Simple and easy going process

Thank you!