Kern County Interspousal Transfer Grant Deed Form

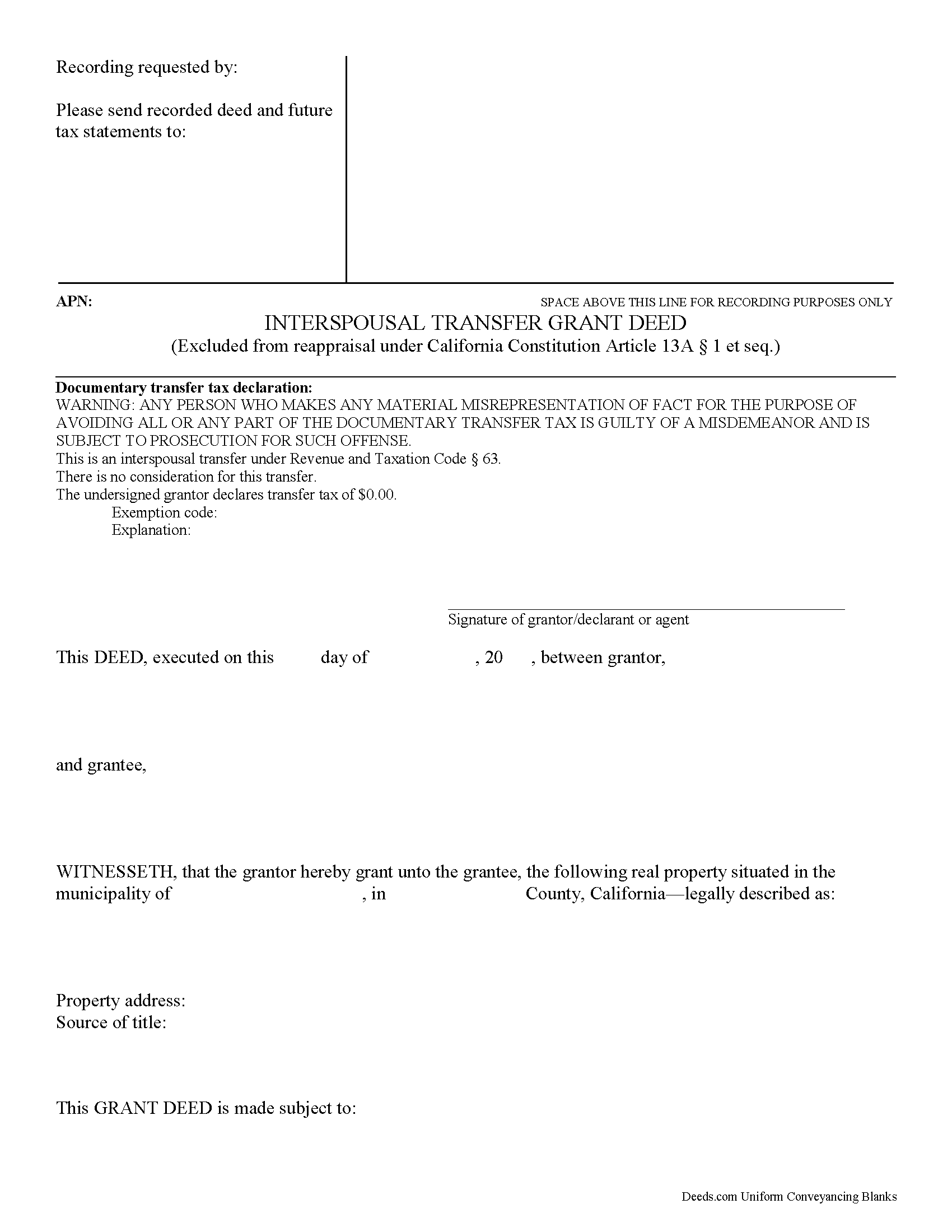

Kern County Interspousal Transfer Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

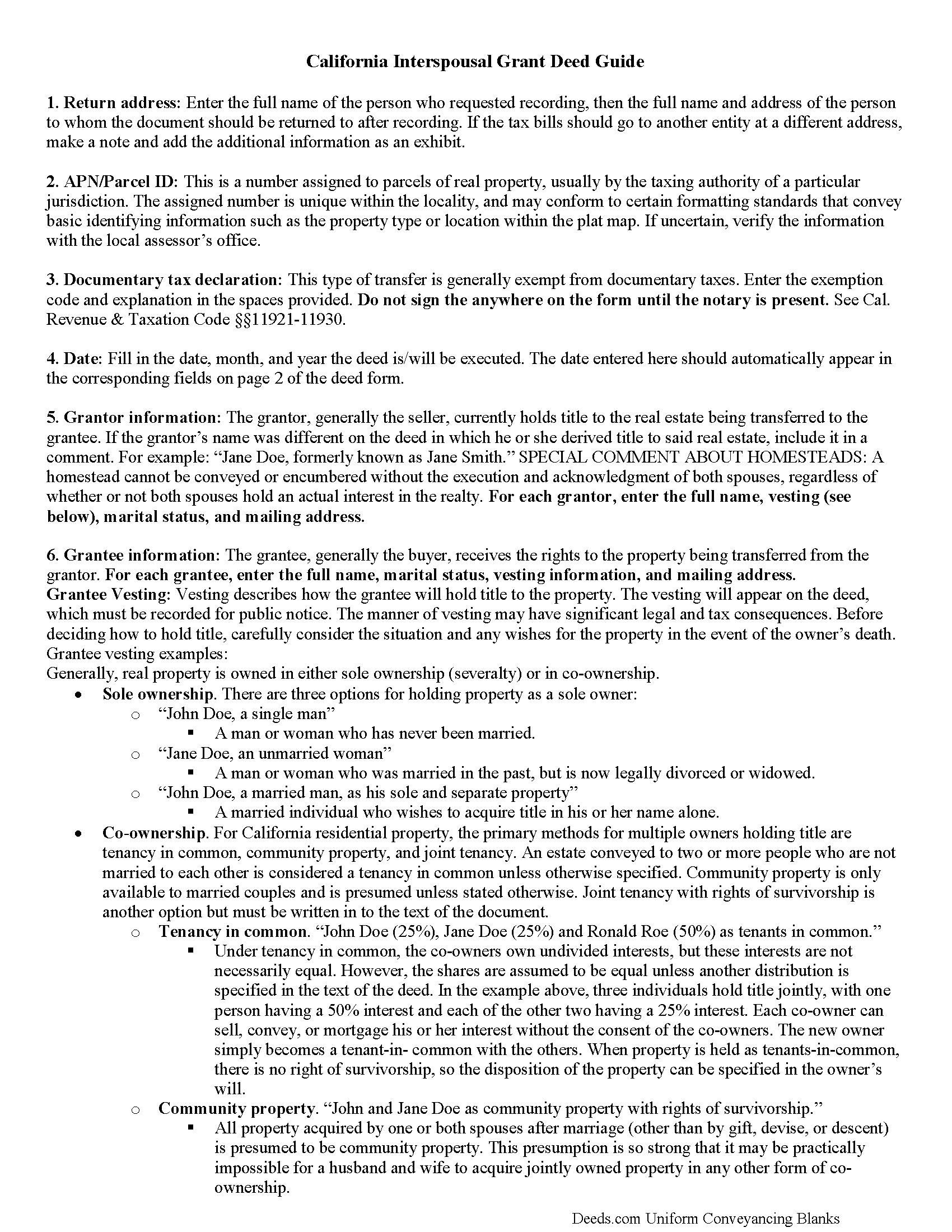

Kern County Interspousal Transfer Grant Deed Guide

Line by line guide explaining every blank on the form.

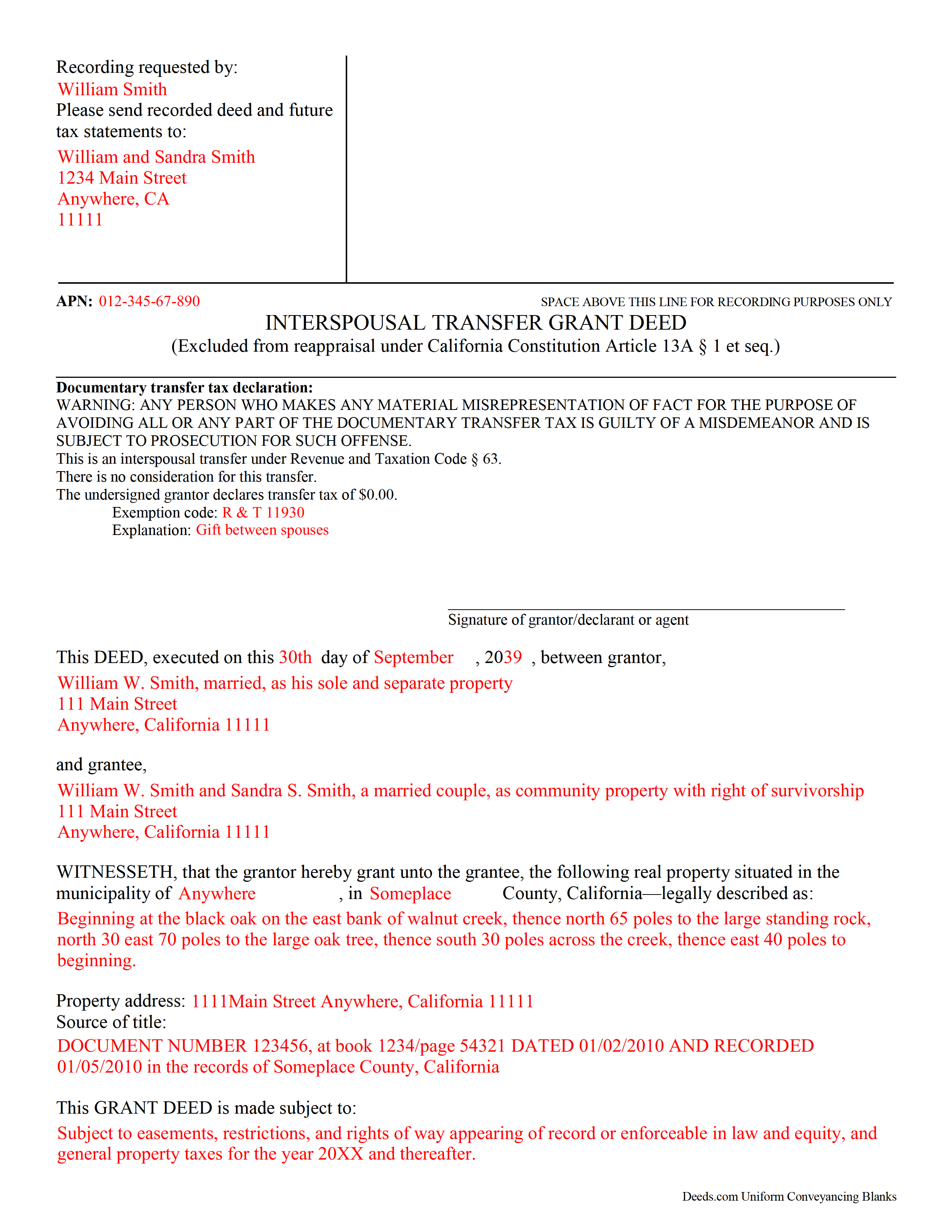

Kern County Completed Example of the Interspousal Transfer Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Kern County documents included at no extra charge:

Where to Record Your Documents

Kern County Recorder

Bakersfield, California 93301

Hours: 8:00am to 4:30pm / Recording until 2:00pm

Phone: 661-868-6400 x 86448

Recording Tips for Kern County:

- Ensure all signatures are in blue or black ink

- Recorded documents become public record - avoid including SSNs

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Kern County

Properties in any of these areas use Kern County forms:

- Arvin

- Bakersfield

- Bodfish

- Boron

- Buttonwillow

- Caliente

- California City

- Cantil

- Delano

- Edison

- Edwards

- Fellows

- Frazier Park

- Glennville

- Inyokern

- Johannesburg

- Keene

- Kernville

- Lake Isabella

- Lamont

- Lebec

- Lost Hills

- Maricopa

- Mc Farland

- Mc Kittrick

- Mojave

- Onyx

- Randsburg

- Ridgecrest

- Rosamond

- Shafter

- Taft

- Tehachapi

- Tupman

- Wasco

- Weldon

- Wofford Heights

- Woody

Hours, fees, requirements, and more for Kern County

How do I get my forms?

Forms are available for immediate download after payment. The Kern County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kern County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kern County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kern County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kern County?

Recording fees in Kern County vary. Contact the recorder's office at 661-868-6400 x 86448 for current fees.

Questions answered? Let's get started!

A California Interspousal Transfer Grant Deed is used to create, transfer, or terminate a real property ownership interest between spouses. This instrument applies to a present owner's interest and has been drafted to comply with the Revenue and Taxation Code Section 63.

A transfer of real property ownership interests between spouses is excluded from reappraisal under the California Constitution Article 13 A &1 et seq. and transfer taxes, as this conveyance establishes sole and separate property of a spouse (RT 11911)

(California Interspousal Transfer Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Kern County to use these forms. Documents should be recorded at the office below.

This Interspousal Transfer Grant Deed meets all recording requirements specific to Kern County.

Our Promise

The documents you receive here will meet, or exceed, the Kern County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kern County Interspousal Transfer Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4596 Reviews )

Connie P.

January 16th, 2024

Easy, fast, responsive. My document was filed and posted in just a matter of days.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

laura s.

February 2nd, 2023

thanks for providing my with exactly what I needed, almost instantly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOSE E.

March 19th, 2019

Thanks

Thank you!

Steve D.

January 25th, 2020

I requested a property detail report on two houses that I own. The requests were easy to make. After submitting the requests, each report was available for my review within 15 minutes. The reports contained all the information I needed. I am very satisfied with this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William A.

September 11th, 2019

I was able to get the documents I wanted, and very quickly. Good service.

Thank you!

Ron E.

September 25th, 2019

Flawless. I ordered the forms needed, along with completed samples. I filled them out, and I was on my way to the recorders office. I would use deeds.com without hesitation.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine M.

April 30th, 2021

Great service, very efficient and super fast.

Thank you!

Taylor M.

July 18th, 2020

Service is good. The website isn't very user friendly and could use some updating. Overall I'm happy with the service.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah B.

January 6th, 2019

Easy download, and super easy to fill out. Had them recorded Friday with zero issues. Recommended.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Boyd B.

June 16th, 2025

I had an issue because of what I was doing, thanks to these guys. I received an email and lickety-split done no more problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margaret S.

August 2nd, 2021

Very nice. easy to use and not too expensive.

Thank you!

Reed W.

May 19th, 2022

Thanks

Thank you!

Linda W.

August 3rd, 2020

Received feedback in a timely manner and got a quick reponse.

Thank you!

Audrey T.

August 18th, 2020

The info was good for the money, but not all that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary R.

April 29th, 2021

Very easy to load on computer and print off.

Thank you for your feedback. We really appreciate it. Have a great day!