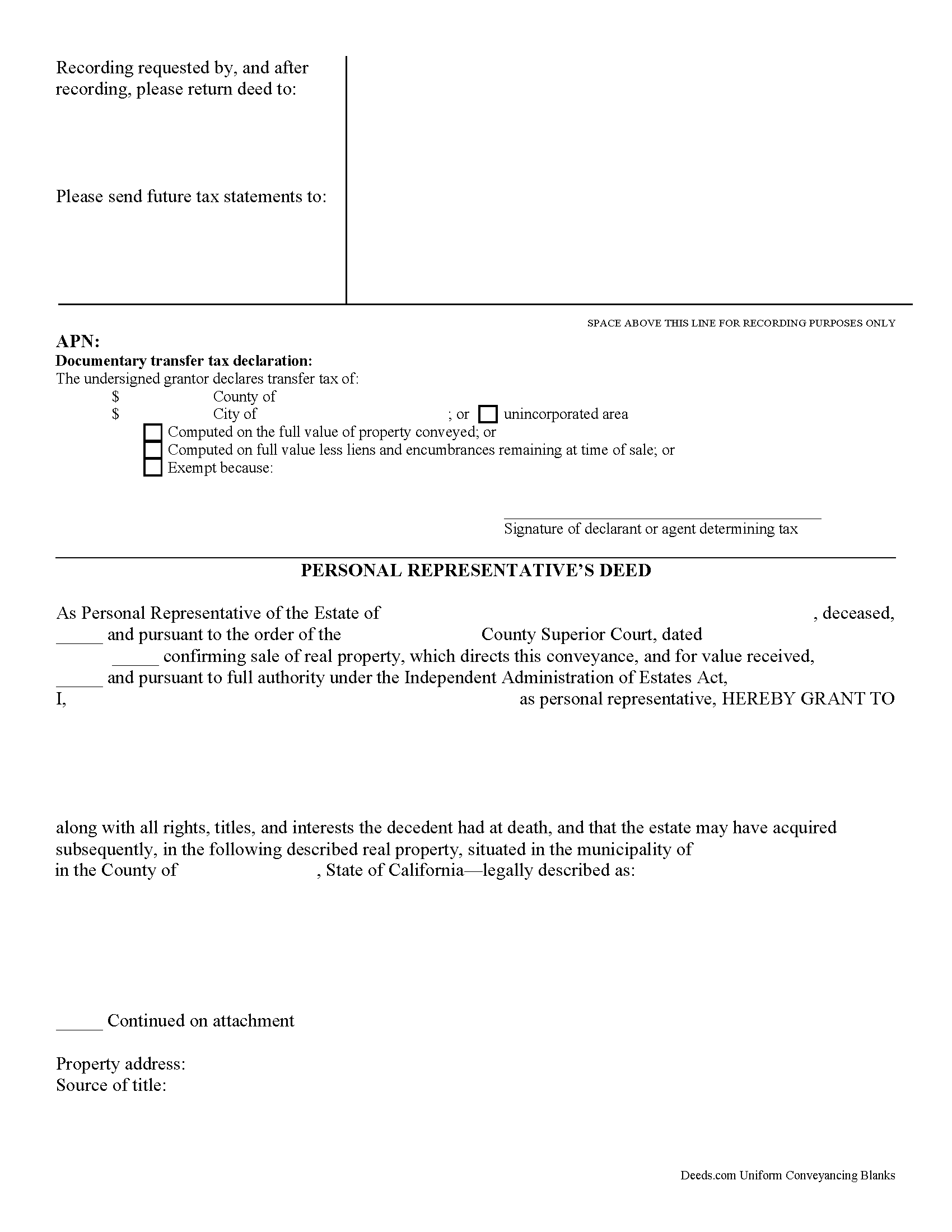

Santa Cruz County Personal Representative Deed Form

Santa Cruz County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

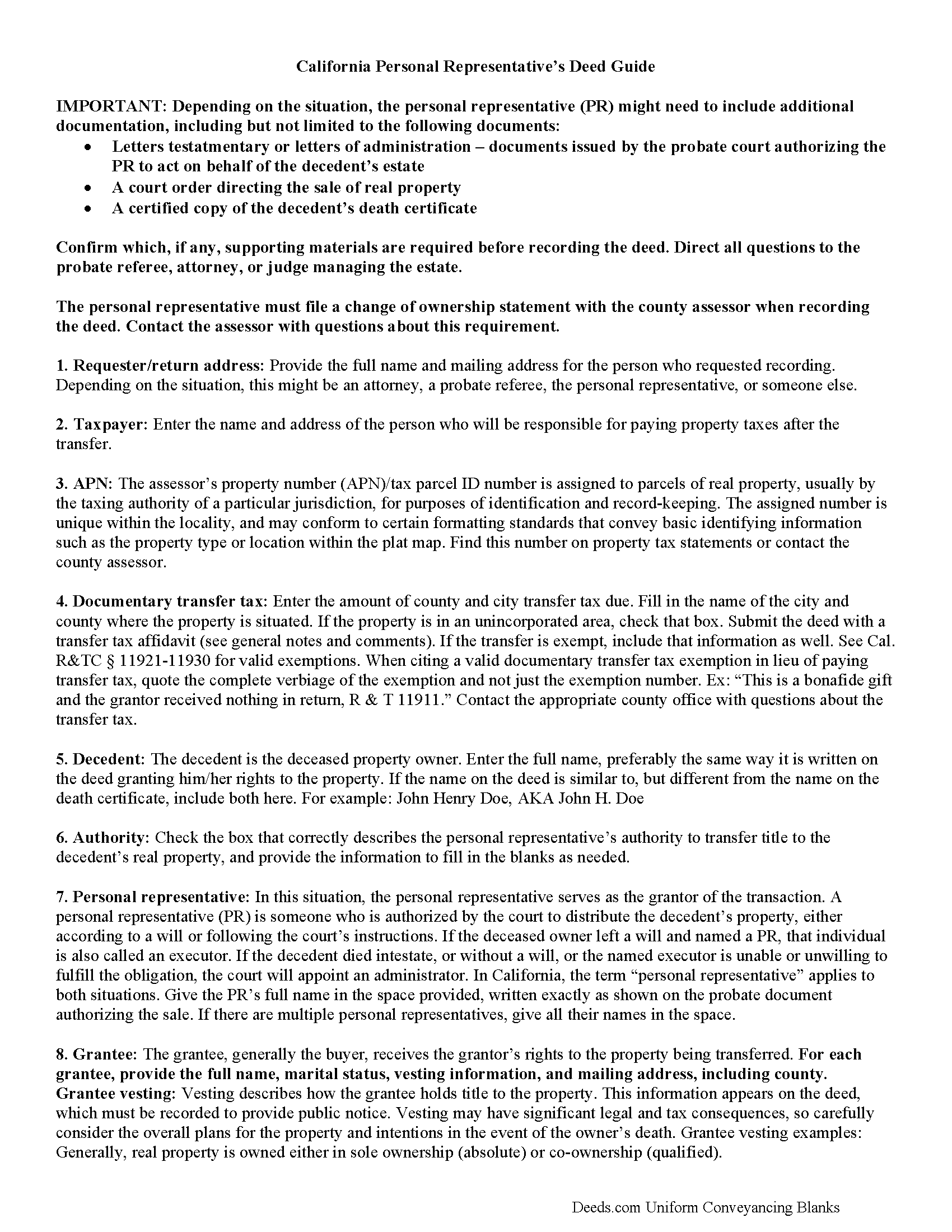

Santa Cruz County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

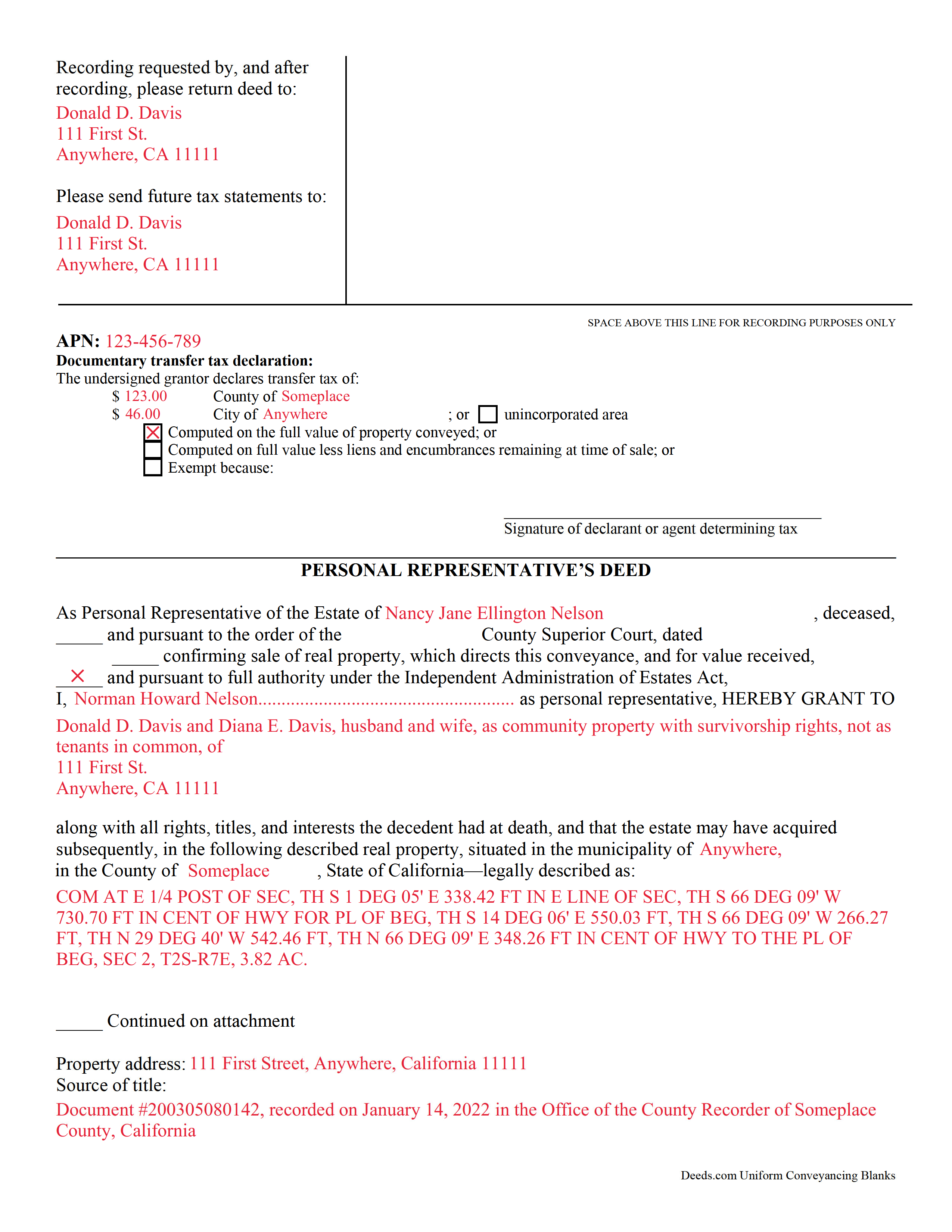

Santa Cruz County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Santa Cruz County documents included at no extra charge:

Where to Record Your Documents

County Recorder

Santa Cruz, California 95060

Hours: 8:00am to 12:00 and 1:00 to 4:00pm

Phone: (831) 454-2800

Recording Tips for Santa Cruz County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Santa Cruz County

Properties in any of these areas use Santa Cruz County forms:

- Aptos

- Ben Lomond

- Boulder Creek

- Brookdale

- Capitola

- Davenport

- Felton

- Freedom

- Los Gatos

- Mount Hermon

- Santa Cruz

- Scotts Valley

- Soquel

- Watsonville

Hours, fees, requirements, and more for Santa Cruz County

How do I get my forms?

Forms are available for immediate download after payment. The Santa Cruz County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Santa Cruz County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Santa Cruz County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Santa Cruz County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Santa Cruz County?

Recording fees in Santa Cruz County vary. Contact the recorder's office at (831) 454-2800 for current fees.

Questions answered? Let's get started!

Personal representative's deeds are used to transfer real property from both testate (with a will) and intestate (without a will) estates. These documents provide essential information about the specific probate estate and related property transfer in one document.

When a person dies, the probate court authorizes someone to take responsibility for distributing the remaining assets according to the instructions set out in the decedent's will (if one exists), while also following state and local laws. This person is often known as an executor or an administrator of the estate. California, however, identifies the individual who accepts that fiduciary duty as a personal representative (PR).

One common task involves transferring title on the decedent's real estate. Deeds used for this purpose must meet the same state and local requirements as warranty or quitclaim deeds. They also include other details, such as facts about the deceased property owner, the probate case, and anything else deemed necessary by the situation. In addition, the PR must file a PCOR with the county assessor's office when recording the completed deed.

Note that these deeds may need to be recorded with the probate court as well as the county recording office. Consult with the legal professional involved in managing the specific probate case to ensure that all recording and notice requirements are met.

See California Probate Code, Division 7. Administration of Estates of Decedents for more information. Remember that each case is unique, so contact an attorney with specific questions or for complex circumstances.

(California Personal Representative Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Santa Cruz County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Santa Cruz County.

Our Promise

The documents you receive here will meet, or exceed, the Santa Cruz County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Santa Cruz County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Nawal F.

June 1st, 2023

Friendly user

Thank you!

MATTHEW R.

March 12th, 2021

Absolutely amazing throughout the whole process

Thank you!

Eric D.

March 21st, 2019

Very helpful and informative. It has saved me time going to get the forms at county recorder / clerk (as my county and state websites dont offer forms on their sites) and also provided help understanding the uses of the specific deed I needed to use.

Thank you Eric. Have a great day!

Janet R.

September 2nd, 2019

Thanks great site

Thank you!

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RICHARD M.

May 12th, 2020

After a little glitch due to heavy volume at the County Recorder, my document was recorded. County Recorder was closed to public access at the office (due to the coronavirus issues) so all documents were either mailed to them or sent in electronically. Deeds.com was very efficient at their end with very quick responses to my questions and concerns. I would definitely use their services again.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

Wilburn R.

July 23rd, 2023

absolutely great

Thank you!

Carol N.

September 11th, 2019

Not helpful couldn't find anything

Thank you for your feedback Carol. Sorry to hear that you could not find what you were looking for. Have a wonderful day.

Fallon G.

March 7th, 2025

Very easy to use, thank you!

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Steve R.

June 17th, 2023

Hopefully filling out and filing the paperwork is as easy as this was.

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce S.

June 28th, 2019

The site was very easy to understand and to download the required documents I need to prepare a release. Response of the documents ready for my use was very efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Billie G.

October 14th, 2021

Loved this service! It was quick, easy and effective! I'll definitely be using them again!

Thank you!

Leatrice K.

February 24th, 2021

I am how simple this site is to use. I am so thankful to be able to do this and not have to worry about traveling downtown. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance G.

December 13th, 2018

You did not include the Notice of Intent to File a Lien Statement form which is necessary to properly file a mechanic's lien in Colorado. If you are going to charge people $20 to download the forms, you should include all of them not half of them.

Thank you for your feedback. We really appreciate it. Have a great day!