Kern County Special Durable Power of Attorney for the Purchase of Property Form

Kern County Special Power of Attorney for the Purchase of Property

Fill in the blank form formatted to comply with all recording and content requirements.

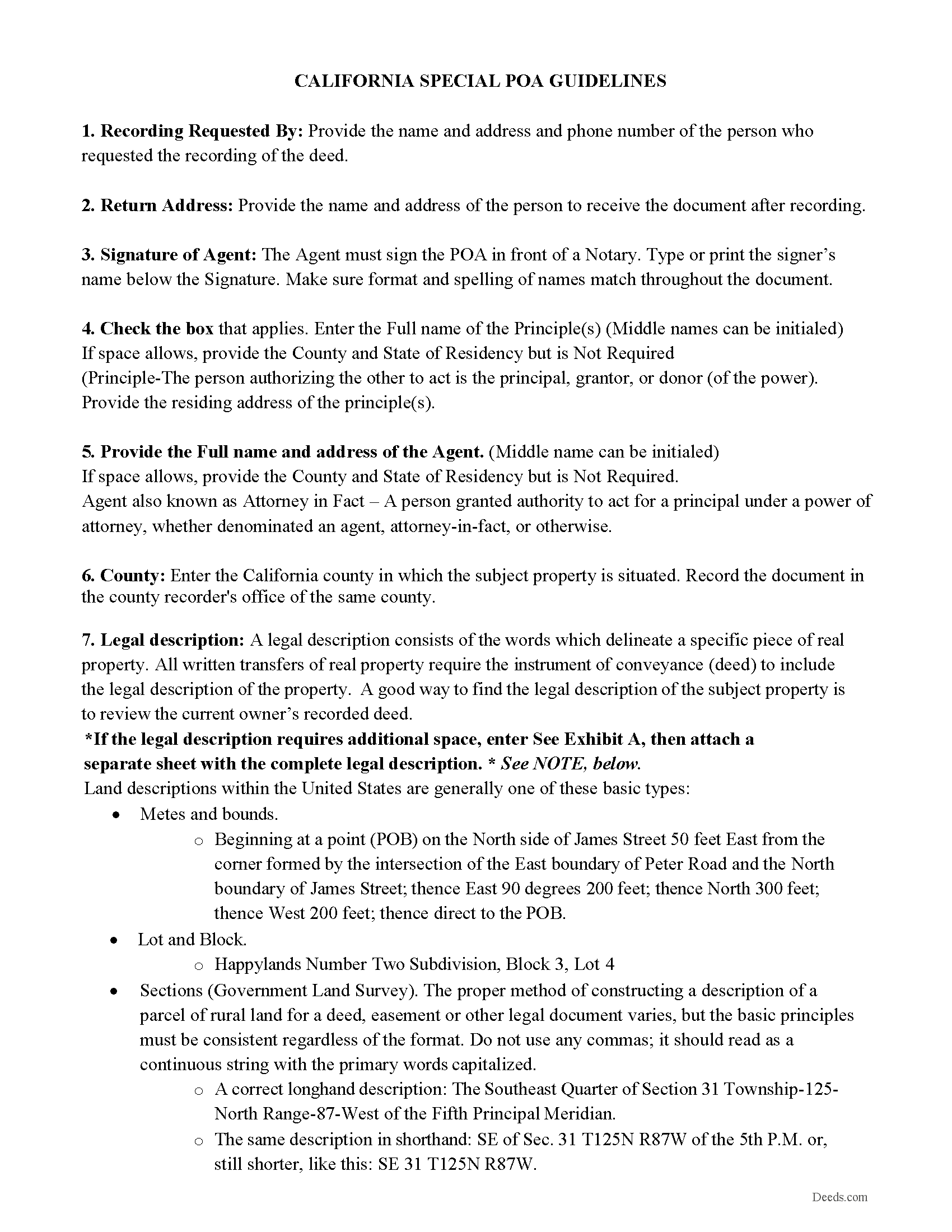

Kern County Special Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

Kern County Completed Example of the Special Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Kern County documents included at no extra charge:

Where to Record Your Documents

Kern County Recorder

Bakersfield, California 93301

Hours: 8:00am to 4:30pm / Recording until 2:00pm

Phone: 661-868-6400 x 86448

Recording Tips for Kern County:

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Kern County

Properties in any of these areas use Kern County forms:

- Arvin

- Bakersfield

- Bodfish

- Boron

- Buttonwillow

- Caliente

- California City

- Cantil

- Delano

- Edison

- Edwards

- Fellows

- Frazier Park

- Glennville

- Inyokern

- Johannesburg

- Keene

- Kernville

- Lake Isabella

- Lamont

- Lebec

- Lost Hills

- Maricopa

- Mc Farland

- Mc Kittrick

- Mojave

- Onyx

- Randsburg

- Ridgecrest

- Rosamond

- Shafter

- Taft

- Tehachapi

- Tupman

- Wasco

- Weldon

- Wofford Heights

- Woody

Hours, fees, requirements, and more for Kern County

How do I get my forms?

Forms are available for immediate download after payment. The Kern County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kern County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kern County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kern County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kern County?

Recording fees in Kern County vary. Contact the recorder's office at 661-868-6400 x 86448 for current fees.

Questions answered? Let's get started!

This document creates a durable, special power of attorney for the PURCHASE of California real property. A power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the power of attorney (the "principal") grants the right to act on the maker's behalf as that person's Attorney-in-fact.

Attorney-in-fact means a person granted authority to act for the principal in a power of attorney, regardless of whether the person is known as an attorney-in-fact or agent, or by some other term. CA Prob Code 4014(a)

This special power of attorney grants the attorney-in fact the power to execute and deliver on the principal's behalf, name and stead, any in all necessary legal documents including contracts for sale, deeds, mortgages, deeds of trusts, promissory notes, settlement statements, affidavits, and other documents with regard to all matters concerning the PURCHASE of a specific property. It includes a "special instructions" section which can be used to further limit/define the powers given.

This instrument is to be construed and interpreted as a durable power of attorney that takes effect immediately and (this power of attorney shall not be affected by the principal's subsequent incapacity.) CA Prob Code 4124(a)

This Special Power of Attorney is specifically limited to the acts specified within and terminates upon a time frame set by number of days after its execution. For example: Terminates 60 days after execution.

Included are the warning statements required when a power of attorney (is sold or otherwise distributed in this state for use by a person who does not have the advice of legal counsel)

(Notice to Person Executing Durable Power of Attorney)

(Notice to Person Accepting the Appointment as Attorney-in-Fact) CA Prob Code 4128 (b)

(California Special DPOA Purchase Package includes form, guidelines, and completed example)

Important: Your property must be located in Kern County to use these forms. Documents should be recorded at the office below.

This Special Durable Power of Attorney for the Purchase of Property meets all recording requirements specific to Kern County.

Our Promise

The documents you receive here will meet, or exceed, the Kern County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kern County Special Durable Power of Attorney for the Purchase of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4596 Reviews )

John G.

August 6th, 2019

Great on line help with the recording process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maree W.

August 5th, 2022

I am so impress with the forms that is needed for your state. It makes your task so easy and no worries. This was a big help in taking care of business. Thank you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peter E.

September 28th, 2020

I think Deeds is a great site for learning. On recording a document, I had trouble. It was me, because I was new to the site.

Thank you!

Catherine P.

January 2nd, 2019

I got what I needed and you provided great templates.

Thank you!

Maria M.

September 27th, 2023

The requested documents I needed were provided and also complete instructions on how to fill them out. I definitely will you this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig M.

August 24th, 2020

Fantastic! So much easier than going and recording it at the recorders office!

Glad we could help Craig, thanks for the kind words.

Jerry W.

March 16th, 2020

Great program and easy to follow instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia J.

September 17th, 2020

Easy quick process to download at a reasonable price. Some good info provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mike H.

February 11th, 2021

Great

Thank you!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina A G.

December 19th, 2020

It was easy to locate, purchase, and download the documents I needed on the Deeds.com website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Neil W.

December 17th, 2019

This looks easy enough. Thanks. Very simple and efficient navigating the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan G.

February 17th, 2023

This is very helpful.

Thank you!

Sheryl L.

December 1st, 2021

EZ to use program....was able to print all forms ordered. I expect to go back to to use recording ability. Instructions are easily followed...would be nice to have confirmation included but they are available to purchase. Hope for successful recording of TOD affidavit. Pretty good value...attorney quoted well over the price I paid for package.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

mary s.

July 30th, 2021

It would help if pages of a document indicated 1 of 3 etc. When I downloaded the TOD guide I got a 4th page though it only showed 3 on the screen.

Thank you for your feedback. We really appreciate it. Have a great day!