Fresno County Trustee Deed Form

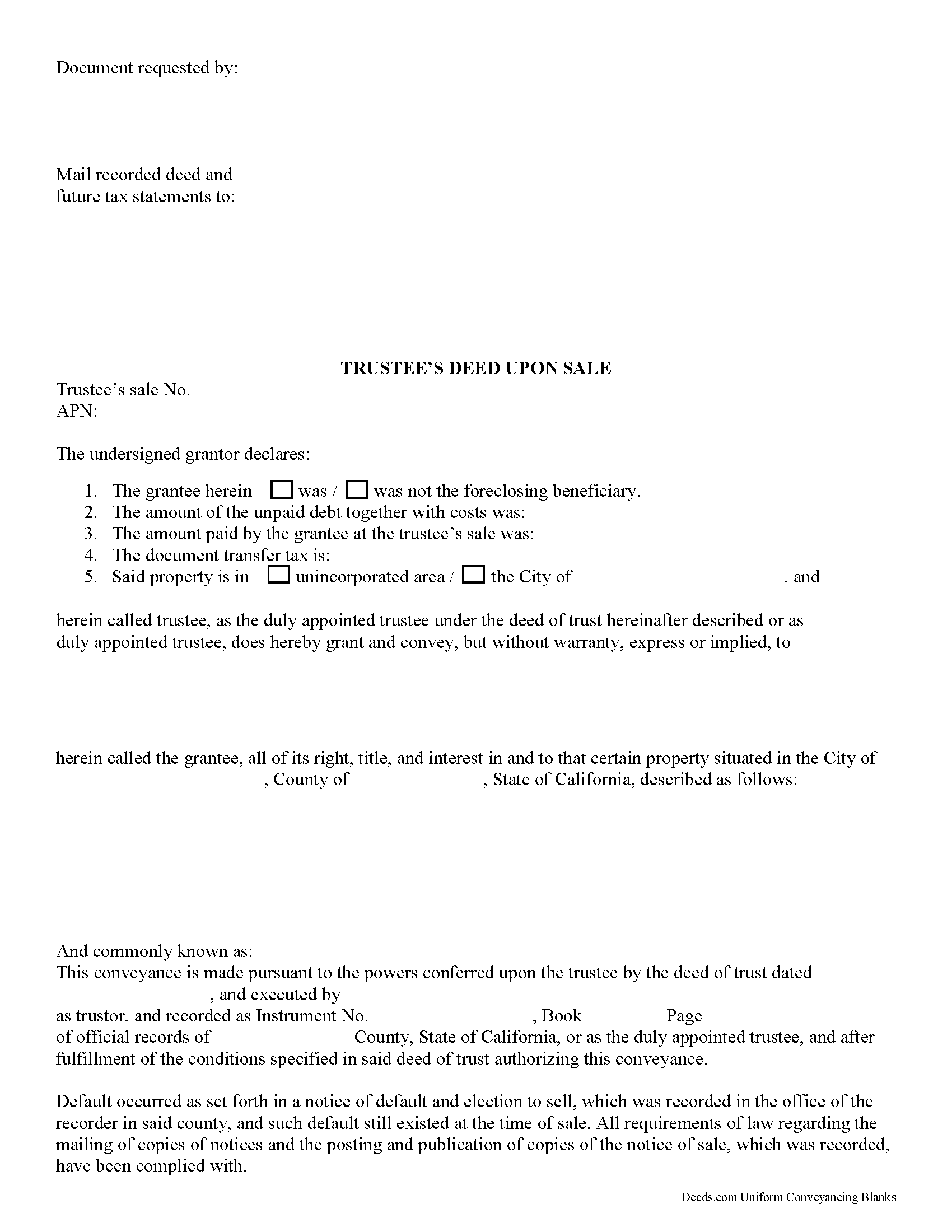

Fresno County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

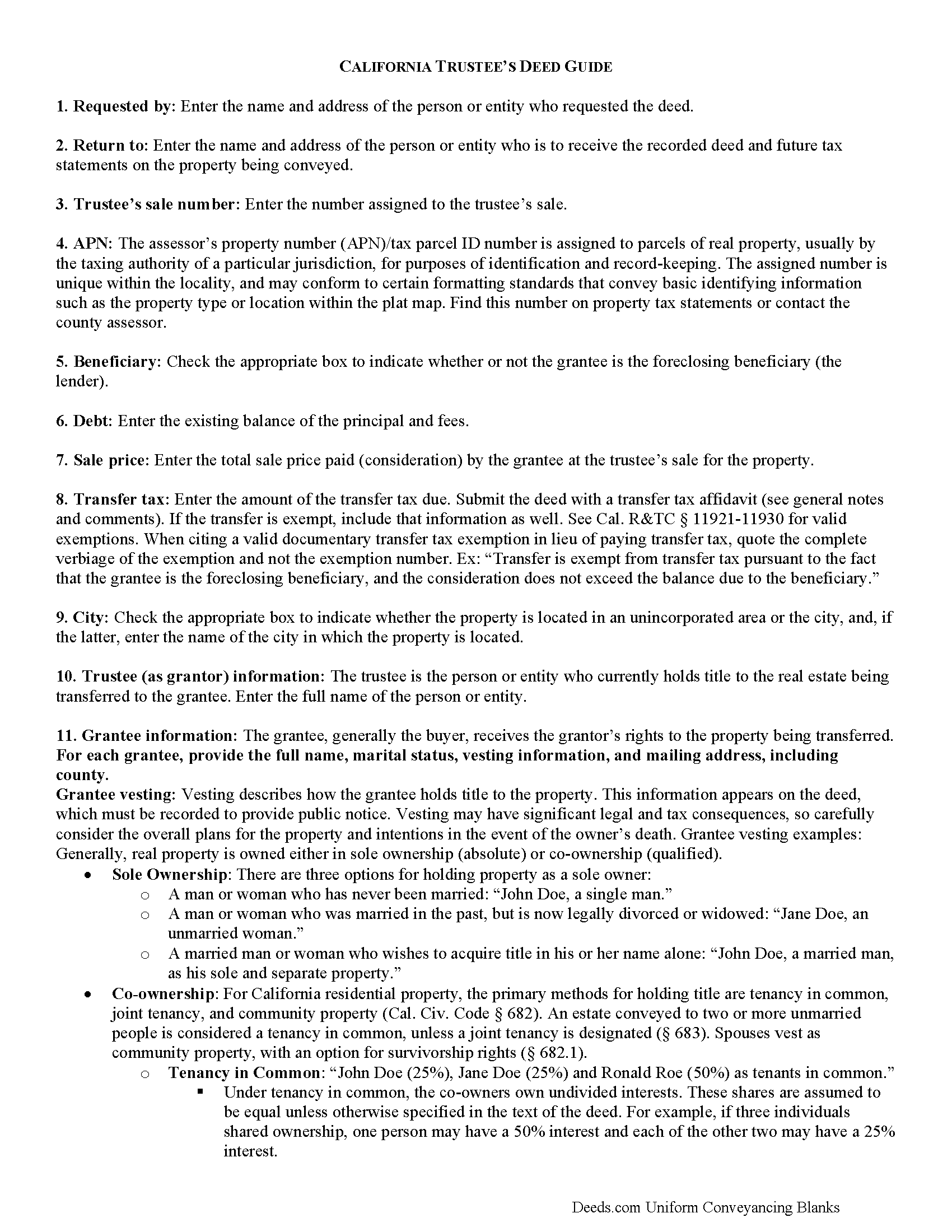

Fresno County Trustee Deed Guide

Line by line guide explaining every blank on the form.

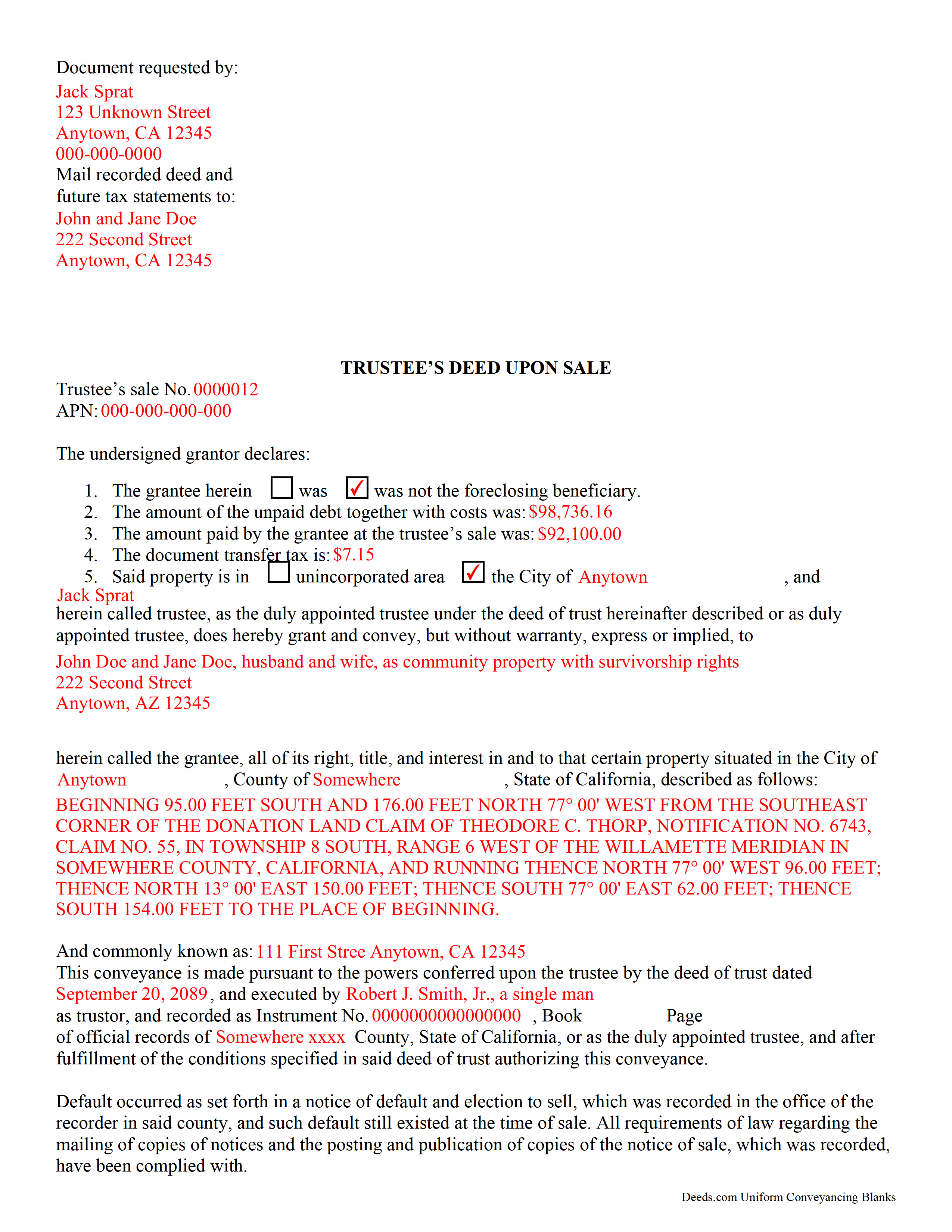

Fresno County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Fresno County documents included at no extra charge:

Where to Record Your Documents

Fresno County Recorder

Fresno, California 93721-2137

Hours: 8:30 am - 4:30 pm M-F

Phone: (559) 600-3471

Recording Tips for Fresno County:

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Fresno County

Properties in any of these areas use Fresno County forms:

- Auberry

- Big Creek

- Biola

- Burrel

- Cantua Creek

- Caruthers

- Clovis

- Coalinga

- Del Rey

- Dunlap

- Firebaugh

- Five Points

- Fowler

- Fresno

- Friant

- Helm

- Hume

- Huron

- Kerman

- Kingsburg

- Lakeshore

- Laton

- Mendota

- Miramonte

- Mono Hot Springs

- Orange Cove

- Parlier

- Piedra

- Prather

- Raisin City

- Reedley

- Riverdale

- San Joaquin

- Sanger

- Selma

- Shaver Lake

- Squaw Valley

- Tollhouse

- Tranquillity

Hours, fees, requirements, and more for Fresno County

How do I get my forms?

Forms are available for immediate download after payment. The Fresno County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fresno County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fresno County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fresno County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fresno County?

Recording fees in Fresno County vary. Contact the recorder's office at (559) 600-3471 for current fees.

Questions answered? Let's get started!

In California, a deed of trust is used as a mortgage alternative to secure a loan for real property. The borrower is the trustor of a deed of trust, and a trustee (usually an agent of the lending institution) is named as grantee, with the lending institution (secured lender) as the beneficiary (Cal. Civ. Code 2929.5(e)(1),(5)). The trustee's duty is to either reconvey the title upon satisfaction of the loan, or to initiate foreclosure as directed by the beneficiary.

Under the terms of the deed of trust, the beneficiary can initiate a non-judicial foreclosure if the trustor defaults on the loan or fails to satisfy the terms of the trust. The trustee is obligated to carry out certain steps before the foreclosure sale can take place. These processes, as well as mandates for the sale, are governed by Cal. Civ. Code 2924-2924h. Once the sale ends, the highest bidder receives a trustee's deed confirming the transfer of title. The trustee's deed is named for the trustee, who executes the deed and acts as the grantor.

The trustee's deed confirms the information from the deed of trust, including the trustor name (the borrower), the trustee, and the beneficiary (lender) under the deed of trust, in addition to vesting title in the grantee's name. If the property receives no bids at public auction, title reverts to the beneficiary of the deed of trust.

The deed must comply with format and content requirements for instruments concerning real property (warranty deed, quitclaim deed, etc.) laid out in Chapter 6 of the Government Code, and be signed by the trustee and notarized with an all-purpose acknowledgment before it is recorded and filed in the county where the property is located.

Note that a deed of trust is separate from a living trust. While the deed of trust functions as a sort of mortgage, a living trust is used for estate planning. In living trusts, a trustee uses a quitclaim deed or special warranty deed to convey property into and out of the trust and has other duties in managing the living trust. The trustee under a deed of trust is not bound by statutes governing a general trust.

Because foreclosures can be complicated, contact a lawyer with any questions or for help regarding your unique situation.

(California Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Fresno County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Fresno County.

Our Promise

The documents you receive here will meet, or exceed, the Fresno County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fresno County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Wayne R.

February 22nd, 2021

Couldn't believe how simple it was to do such a very important family support task and the price was right! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shane J.

December 5th, 2024

I use deeds.com for all of my document filing needs. The amount of time and money saved on making trips to the auditor's office is well worth the nominal fee that is charged. I highly recommend deeds.com!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Robert C.

May 31st, 2023

Not easy to navigate as a first time user. I printed the first page but lost the link to the second page.

Thank you for taking the time to provide us with your valuable feedback. I'm sorry to hear that you've encountered difficulties with our website's navigation, particularly as a first-time user.

Furthermore, your comments about the website's navigation have been taken into account. We continually strive to improve our website and make it as intuitive and user-friendly as possible. Your feedback is crucial for us in achieving this goal.

Thank you again for your feedback. If you have any other suggestions or need further assistance, please don't hesitate to contact us.

LINDA S.

November 11th, 2020

This was SO much easier than having to go down to the county recorder's office. I would definitely use this company again!

Thank you for your feedback. We really appreciate it. Have a great day!

Hope A.

June 4th, 2021

Great Website and layout!! so easy!

Thank you!

Melvin L.

June 8th, 2022

So easy, very simple to use. I was very pleased with the service Deeds provided. Would definely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!

Glenda W.

April 22nd, 2021

It is a very helpful and awesome website. I was so glad to hear about it. It is very convenient and saves money as well. I'm sure I will be using it again in the future. Thumbs up to deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Harry W B.

January 11th, 2021

This is a very valuable resource. It was user friendly and made transfer happen in a day!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rohini L.

January 31st, 2024

This is the first time I am filling out a legal form downloaded from a website. Throughly impressed with the detailed explanation along with sample forms to help a novice like me to fill out the actual form. I will remember to go to your site if I need in the future and have already recommended your site to others. Thanks for an excellent job.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Jeff R.

December 4th, 2020

Great company. I had some issues with what I had prepared on my end but my contact at Deeds.com helped me with modifying the documents and submitted them successfully. Thanks for going the extra mile

Thank you for your feedback. We really appreciate it. Have a great day!

Randy T.

January 22nd, 2019

I gave your site and forms 5 stars because it is very easy to use and included all the information needed to complete the form without having had a legal background.

Thank you Randy. Have a great day!

Donald H.

November 5th, 2019

EXCELLENT,,super good. Quick & easy

Thank you!

Ann C.

October 18th, 2023

Very responsive and helpful. Made a big task quite easy and effecient. I would highly recommend. Reasonable fees as well

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jean B.

February 28th, 2023

Thank you for this service. Saved a lot of my time and money. The guide and sample was very helpful. Jean

We appreciate your business and value your feedback. Thank you. Have a wonderful day!