Download Colorado Beneficiary Deed Revocation Legal Forms

Colorado Beneficiary Deed Revocation Overview

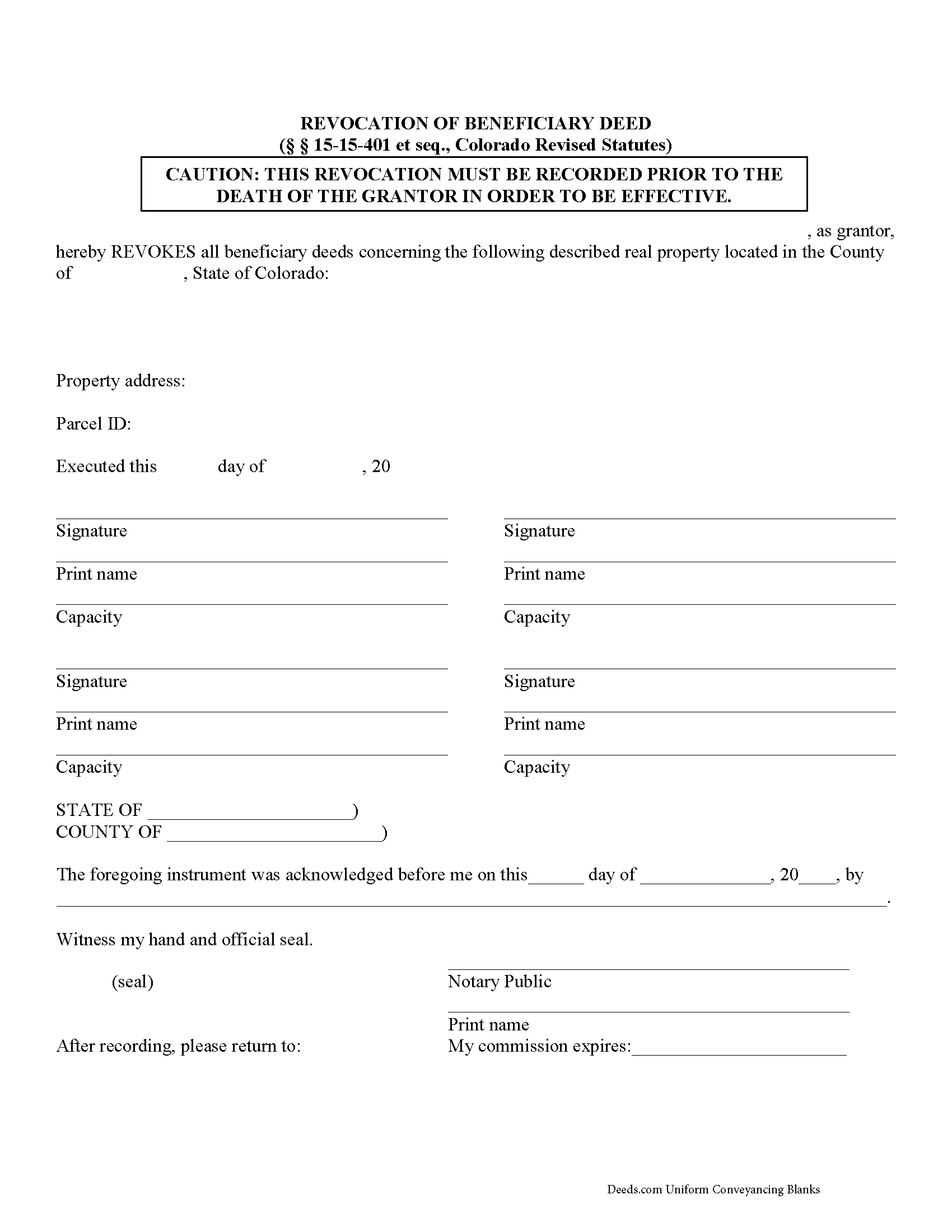

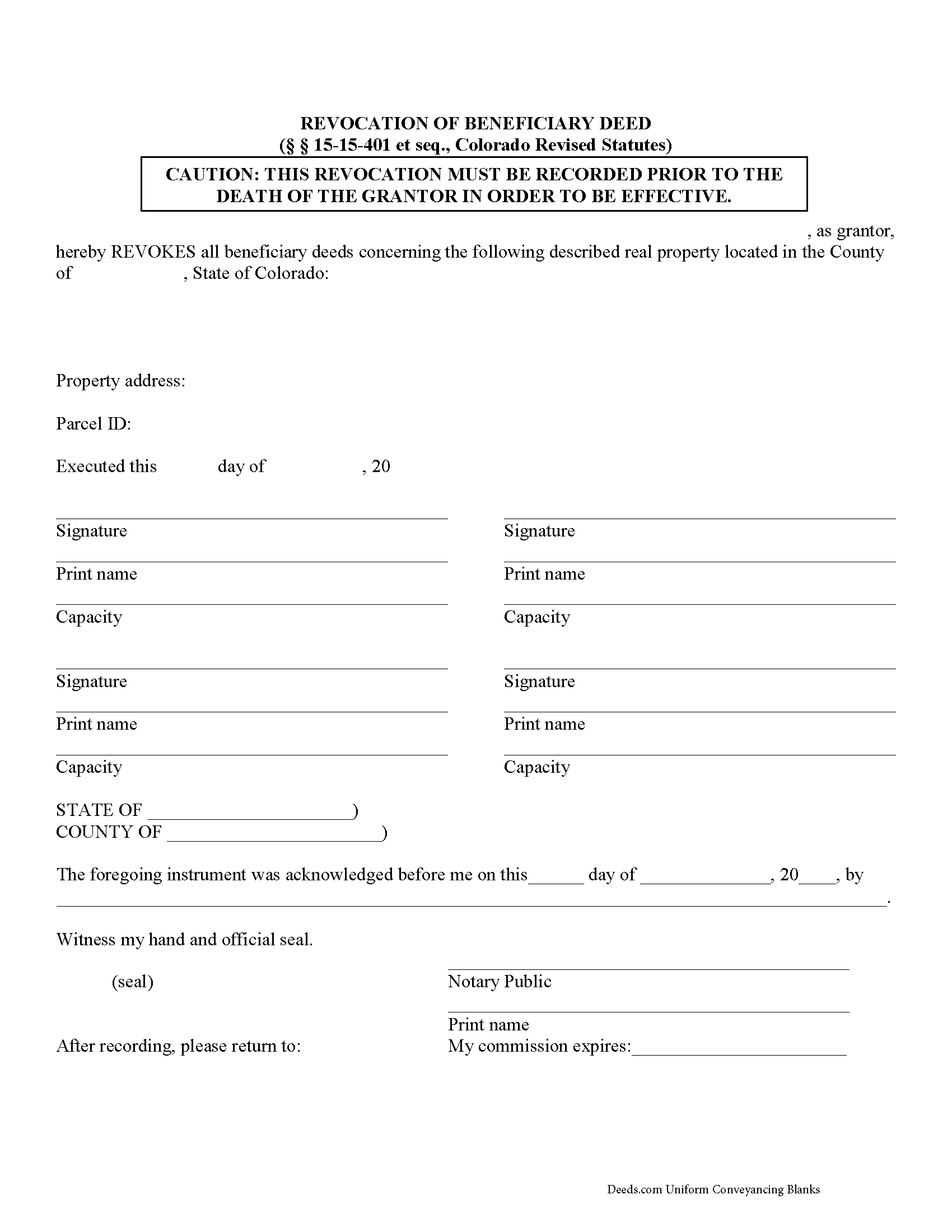

Colorado's beneficiary deeds are governed by C.R.S. 15-15-401 et seq. Revocations are specifically discussed in 15-15-405, which also defines the requirements for a basic form.

Revocability is one of the many useful features of a Colorado beneficiary deed. There are two primary ways for a land owner to revoke a recorded beneficiary designation: executing and recording a revocation, or executing and recording a new beneficiary deed that changes the original designation or distribution (15-15-405(1), (2)).

Neither a modification nor a revocation requires notifying beneficiaries because they only have a potential future interest in the property; nothing is promised or owed to them until the grantor's death. Note, however, that Colorado beneficiary deeds may NOT be revoked or changed by any provisions of the owner's will (15-15-405(4)).

Valid revocations identify the grantor, the property, make reference to the recorded beneficiary deed, and include any other information necessary for the specific situation. The form must also meet state and local standards for recorded documents.

A revocation, when correctly completed and filed for record with the appropriate local agency (generally the recorder or register of deeds for the county where the real estate is located), cancels all prior beneficiary deeds.

IMPORTANT: Any modifications or cancellations to a previously recorded beneficiary deed must be submitted for filing while the grantor is alive. Any changes attempted after the grantor's death are void.

Contact an attorney with questions about revoking beneficiary deeds, or for any other issues related to real property or estate planning in Colorado.

(Colorado Beneficiary Deed Revocation Package includes form, guidelines, and completed example)