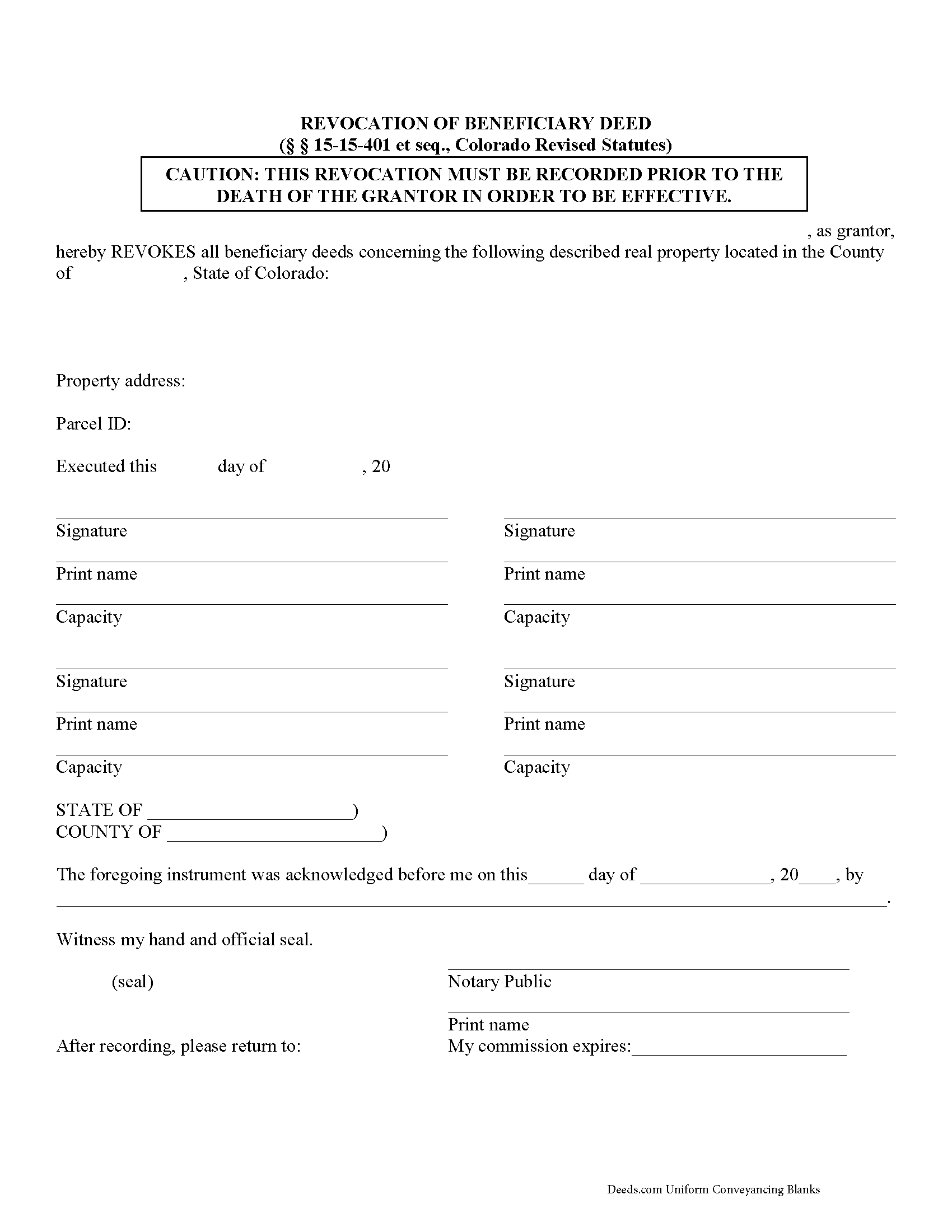

Garfield County Beneficiary Deed Revocation Form

Garfield County Beneficiary Deed Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

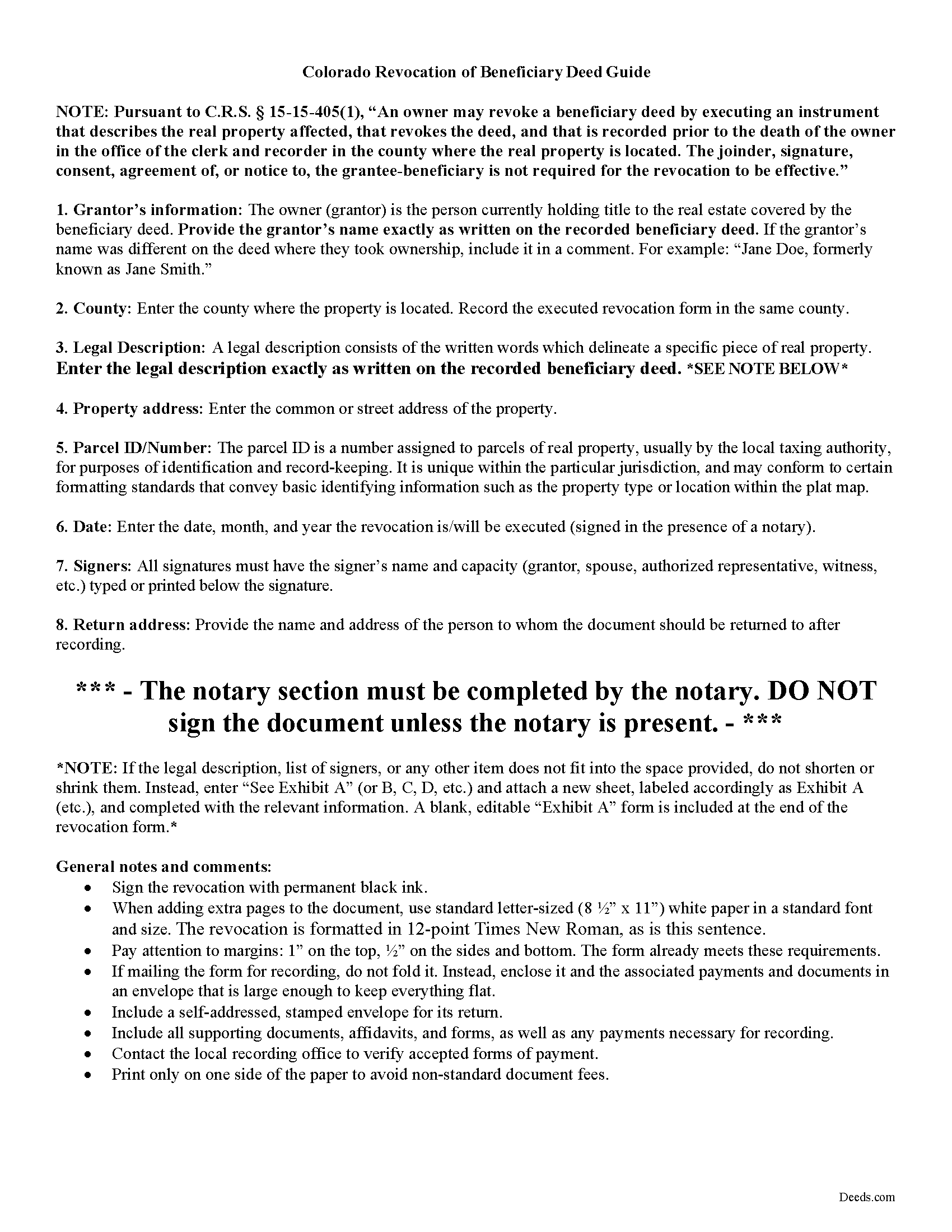

Garfield County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

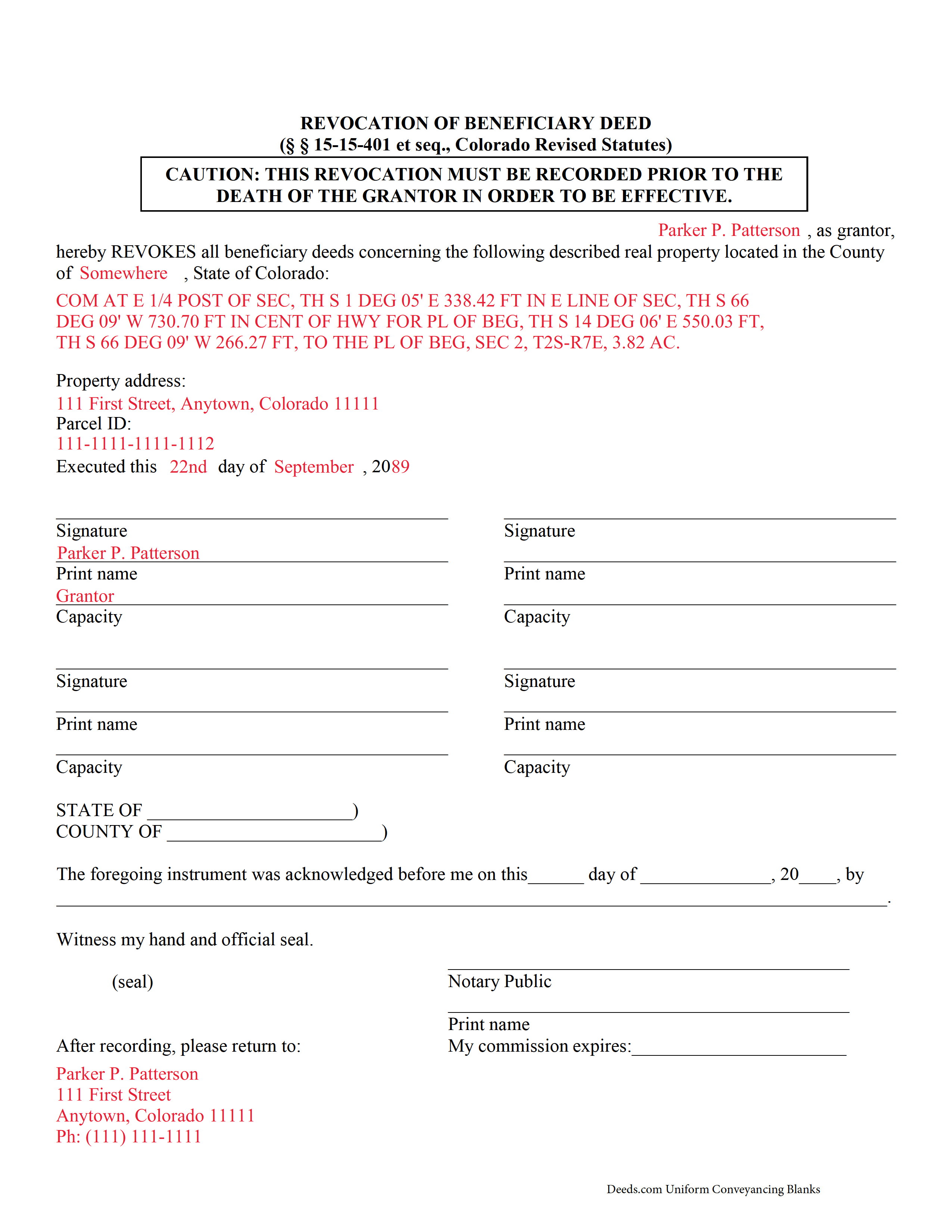

Garfield County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Garfield County documents included at no extra charge:

Where to Record Your Documents

Garfield Clerk and Recorder

Glenwood Springs, Colorado 81601

Hours: 8:30am to 5:00pm Monday through Friday

Phone: 970-384-3700

Recording Tips for Garfield County:

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Garfield County

Properties in any of these areas use Garfield County forms:

- Battlement Mesa

- Carbondale

- Glenwood Springs

- New Castle

- Parachute

- Rifle

- Silt

Hours, fees, requirements, and more for Garfield County

How do I get my forms?

Forms are available for immediate download after payment. The Garfield County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Garfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Garfield County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Garfield County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Garfield County?

Recording fees in Garfield County vary. Contact the recorder's office at 970-384-3700 for current fees.

Questions answered? Let's get started!

Colorado's beneficiary deeds are governed by C.R.S. 15-15-401 et seq. Revocations are specifically discussed in 15-15-405, which also defines the requirements for a basic form.

Revocability is one of the many useful features of a Colorado beneficiary deed. There are two primary ways for a land owner to revoke a recorded beneficiary designation: executing and recording a revocation, or executing and recording a new beneficiary deed that changes the original designation or distribution (15-15-405(1), (2)).

Neither a modification nor a revocation requires notifying beneficiaries because they only have a potential future interest in the property; nothing is promised or owed to them until the grantor's death. Note, however, that Colorado beneficiary deeds may NOT be revoked or changed by any provisions of the owner's will (15-15-405(4)).

Valid revocations identify the grantor, the property, make reference to the recorded beneficiary deed, and include any other information necessary for the specific situation. The form must also meet state and local standards for recorded documents.

A revocation, when correctly completed and filed for record with the appropriate local agency (generally the recorder or register of deeds for the county where the real estate is located), cancels all prior beneficiary deeds.

IMPORTANT: Any modifications or cancellations to a previously recorded beneficiary deed must be submitted for filing while the grantor is alive. Any changes attempted after the grantor's death are void.

Contact an attorney with questions about revoking beneficiary deeds, or for any other issues related to real property or estate planning in Colorado.

(Colorado Beneficiary Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Garfield County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Garfield County.

Our Promise

The documents you receive here will meet, or exceed, the Garfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Garfield County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Lynette D.

July 29th, 2020

I planned to use an attorney for this process but deeds.com made it so easy I was able to do it myself and I saved $330 in the process. I really appreciated the instructions and example provided on the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothea H.

November 23rd, 2020

I am so glad I chose Deeds.com for my forms! The directions were clear and comprehensive, and the form allowed for customization far beyond the free forms I had looked at before. I highly recommend this site!

Thank you for your feedback. We really appreciate it. Have a great day!

LOUISE W.

April 28th, 2019

Thank you for your help on my Quit Claim deed. I am very pleased with your patience and the resolving of the deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Leo b.

March 26th, 2019

Awesome site great paperwork EZ Forms great.

Thank you Leo.

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls. Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!

Maureen M.

January 3rd, 2021

Easy to use and download. Will use in the future, if ever needed.

Thank you for your feedback. We really appreciate it. Have a great day!

David S.

October 20th, 2020

I downloaded the quit claim deed form and saved it on my computer. I opened it with Adobe and filled it out. The space for the legal description was too small (2 lines only) which did not allow enough room for the long property description that I had.

Thank you for your feedback. We really appreciate it. Have a great day!

Cathy F.

March 2nd, 2022

Glad I found you. After much searching, you had the right form that I needed. Quick and easy. Cathy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Neil S.

January 3rd, 2019

Very impressive. The only change I would suggest is a smaller font on the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa C.

July 2nd, 2020

Great. Thank you. Received information quickly. Helped out a lot.

Thank you!

Gregory K.

October 18th, 2021

Easy to work with. Fair price. Nice, efficient service. Would definitely use Deeds.com again for any legal documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John S.

January 9th, 2023

You dont really know what your buying until after you spend the money. Cant use any of them

Thank you for your feedback. Best practice is to know what you need before purchasing. Buying legal documents should not be a exploratory endeavor. Your order has been canceled. We do hope that you find something more suitable to your needs elsewhere.

Evaristo R.

October 6th, 2020

I was very excited to use the website but unfortunately they had a problem retrieving my Deed but thank you for the opportunity.

Thank you for your feedback. We really appreciate it. Have a great day!

James S.

September 21st, 2021

The affidavit guidance was a great help and helped reduce the stress that usually comes with dealing with legalese. The Preliminary Change of Ownership that CA requires is quite complex since it covers a hoard of situations. I was left with a bit of uncertainty, but I definitely wouldn't want to try it without guidance.

Thank you for your feedback. We really appreciate it. Have a great day!