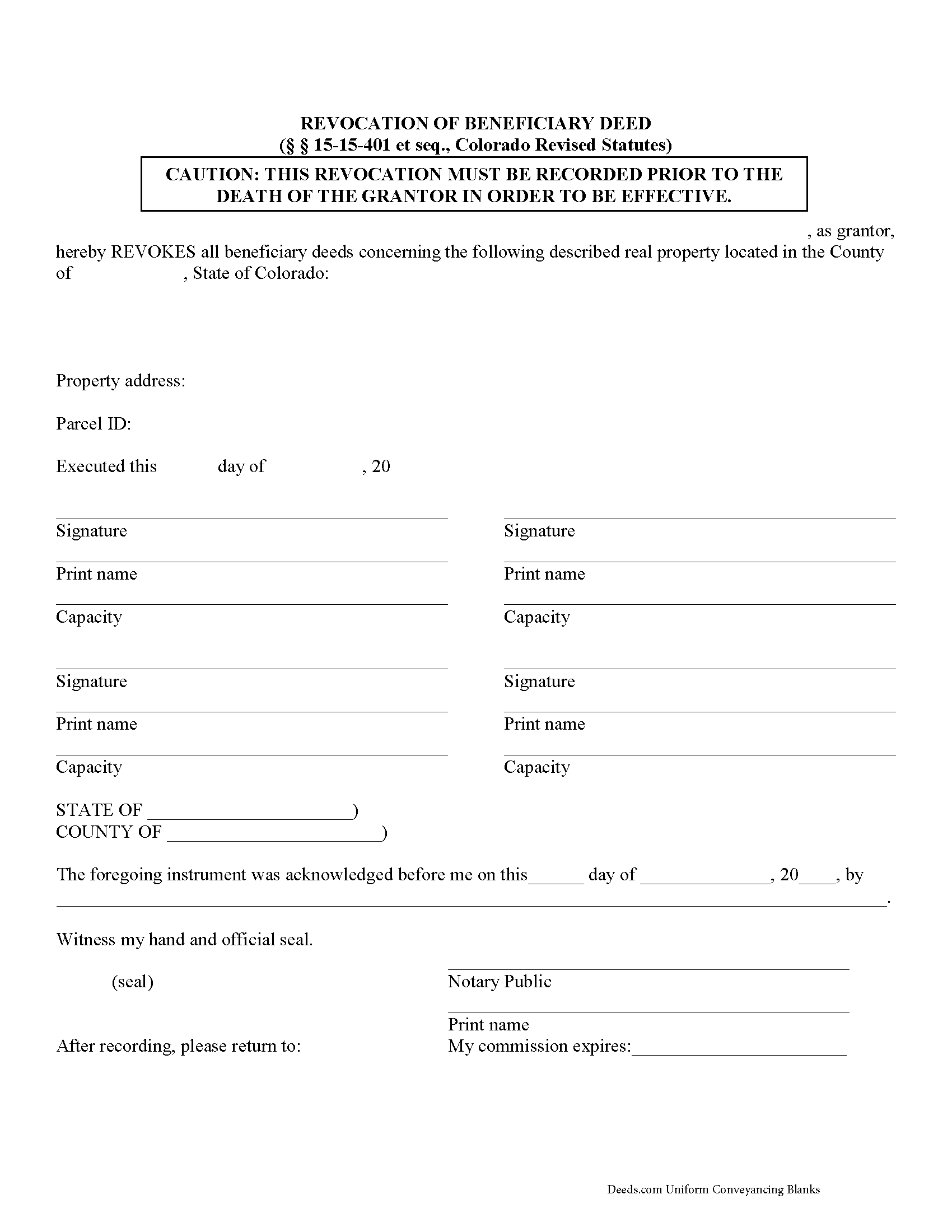

Logan County Beneficiary Deed Revocation Form

Logan County Beneficiary Deed Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

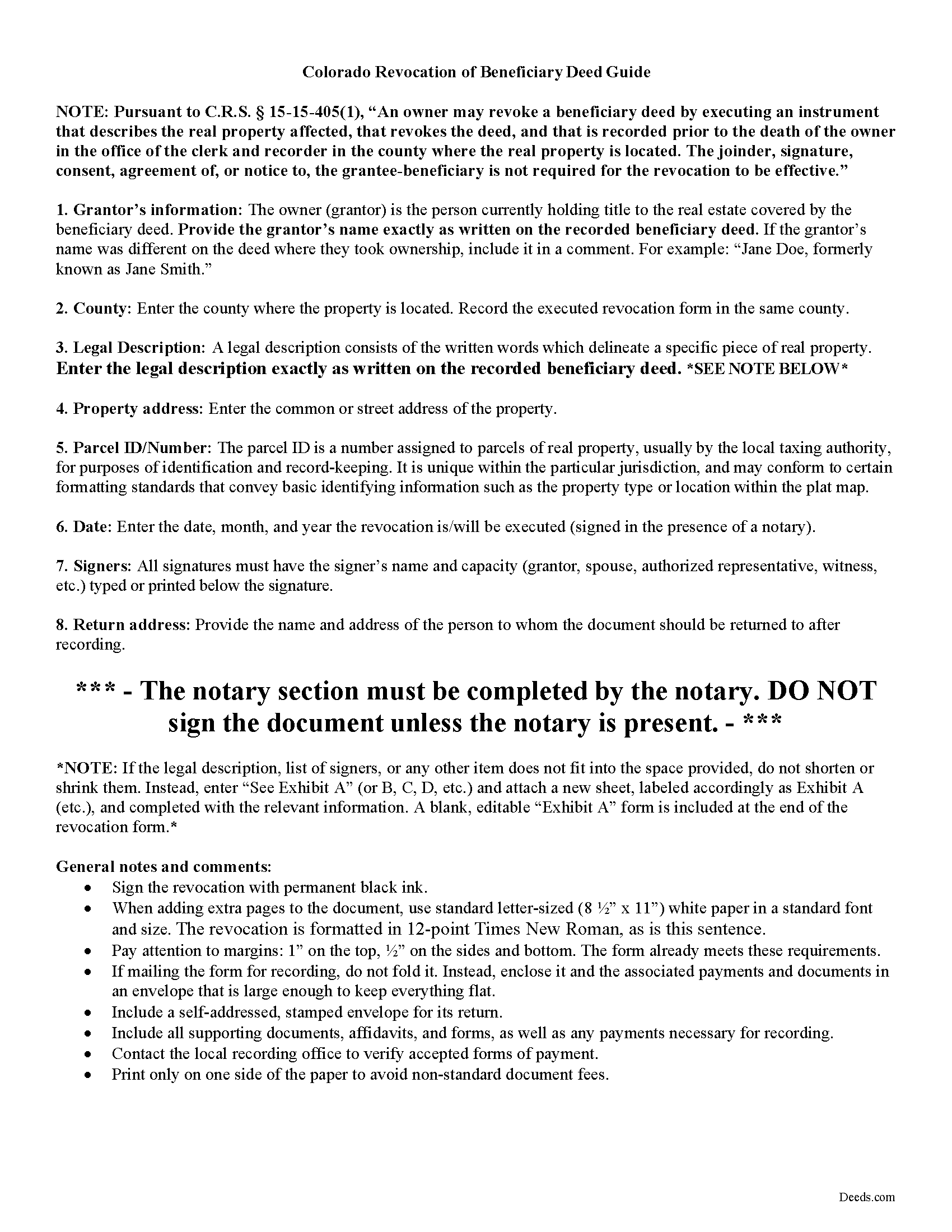

Logan County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

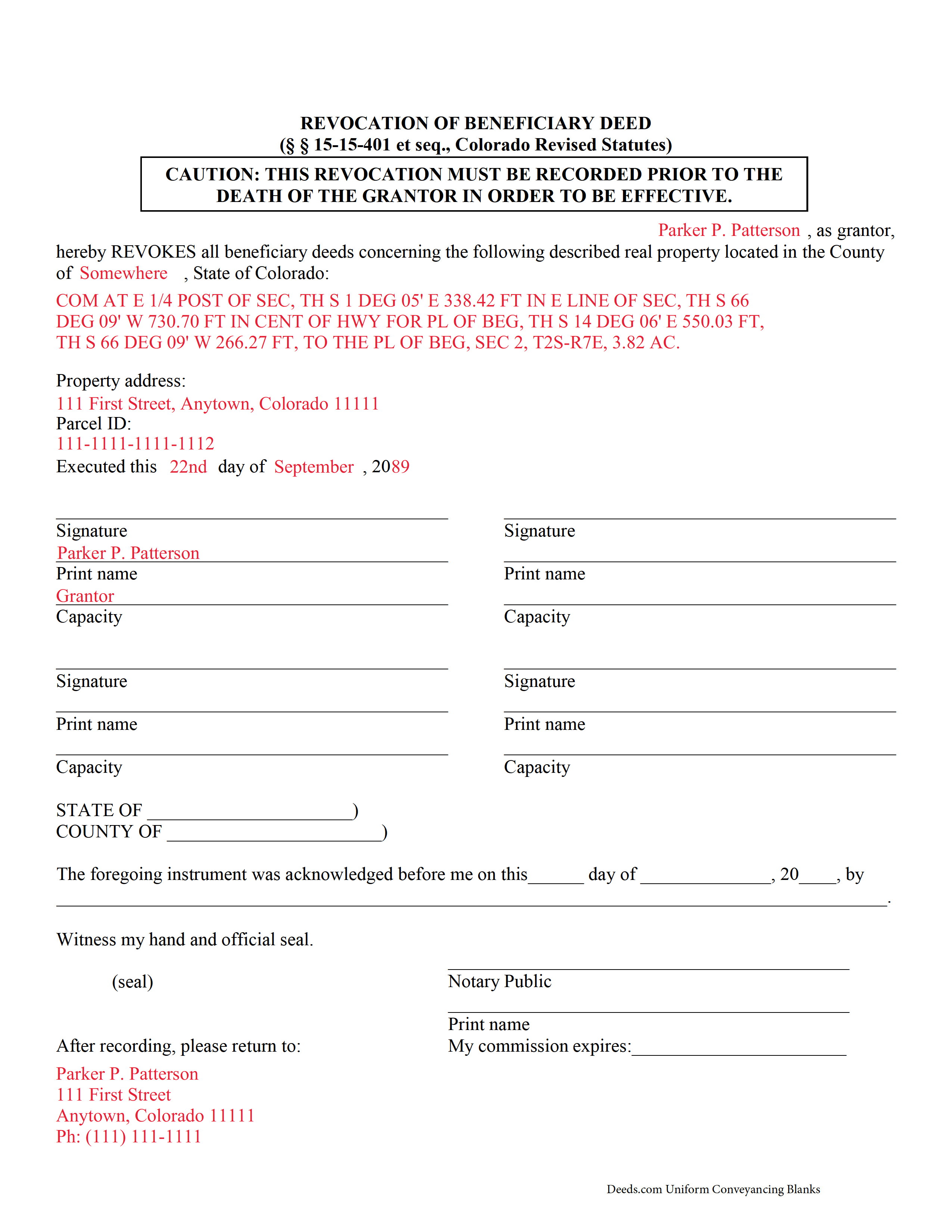

Logan County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Logan County documents included at no extra charge:

Where to Record Your Documents

Logan County Clerk and Recorder

Sterling, Colorado 80751

Hours: 8:00 to 4:00 Monday - Friday

Phone: (303) 522-1544 and 522-2063

Recording Tips for Logan County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Logan County

Properties in any of these areas use Logan County forms:

- Atwood

- Crook

- Fleming

- Iliff

- Merino

- Padroni

- Peetz

- Sterling

Hours, fees, requirements, and more for Logan County

How do I get my forms?

Forms are available for immediate download after payment. The Logan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Logan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Logan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Logan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Logan County?

Recording fees in Logan County vary. Contact the recorder's office at (303) 522-1544 and 522-2063 for current fees.

Questions answered? Let's get started!

Colorado's beneficiary deeds are governed by C.R.S. 15-15-401 et seq. Revocations are specifically discussed in 15-15-405, which also defines the requirements for a basic form.

Revocability is one of the many useful features of a Colorado beneficiary deed. There are two primary ways for a land owner to revoke a recorded beneficiary designation: executing and recording a revocation, or executing and recording a new beneficiary deed that changes the original designation or distribution (15-15-405(1), (2)).

Neither a modification nor a revocation requires notifying beneficiaries because they only have a potential future interest in the property; nothing is promised or owed to them until the grantor's death. Note, however, that Colorado beneficiary deeds may NOT be revoked or changed by any provisions of the owner's will (15-15-405(4)).

Valid revocations identify the grantor, the property, make reference to the recorded beneficiary deed, and include any other information necessary for the specific situation. The form must also meet state and local standards for recorded documents.

A revocation, when correctly completed and filed for record with the appropriate local agency (generally the recorder or register of deeds for the county where the real estate is located), cancels all prior beneficiary deeds.

IMPORTANT: Any modifications or cancellations to a previously recorded beneficiary deed must be submitted for filing while the grantor is alive. Any changes attempted after the grantor's death are void.

Contact an attorney with questions about revoking beneficiary deeds, or for any other issues related to real property or estate planning in Colorado.

(Colorado Beneficiary Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Logan County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Logan County.

Our Promise

The documents you receive here will meet, or exceed, the Logan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Logan County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Priscilla Z.

November 7th, 2022

Very user friendly and easy. I appreciated the sample deed that was provided. Definitely recommend!

Thank you!

Gene J.

September 6th, 2019

Easy to pay for, hard to download. A zip file containing all the forms would be a great addition. Your warning under the Review box needs help: see Your review may displayed publicly so please do not include any personal information.

Thank you for your feedback. We really appreciate it. Have a great day!

William B.

October 22nd, 2023

The forms, and other information, are all excellent. I would be giving a 5-star review if it were not for the fact that downloading a "bundle" about quitclaim deeds required I download every single file independently (15 files). I would far prefer a zip file, or one click to download the whole pile of independent files.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Amy C.

September 23rd, 2020

Easy enough to use the forms. Will probably get them reviewed before recording just to be sure.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie R.

August 31st, 2022

FIVE STARS !!! Clear instructions Easy to navigate Thanks for making this easy for those of us who are not tech savvy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris M.

April 21st, 2025

always helpful always informative always awesome

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Martine S.

July 29th, 2020

Very easy process and was recorded in a prompt manner. We will be using your services again in the future for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property. My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

Abram A.

February 26th, 2019

Very easy to navigate around and to obtain desired forms and service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra R.

June 2nd, 2023

This site was easy to use for access to State forms for filing in Montmorency County clerks office. Not only did I find claim form but a sample claim was available for assisting on how to complete your form correctly. Found this so very useful for us (public resident) to fill in the form as a .PDF file that prints out typed form - rather than handwritten entries. There is a fee but your access is always available on internet to this site in the future. Saved me time using this site and My filed form looks professional. You have access to several other forms if needed.

Thank you for the kind words Sandra, we appreciate you. Glad we could help!

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Hanne R.

November 17th, 2020

excellent

Thank you!

Ena D.

May 5th, 2021

Very easy process. great customer service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shawn S.

August 30th, 2019

Seems to be exactly whst j needed. Great job!

Thank you!

Margo W.

June 11th, 2022

Very easy to understand and complete the process. This is the third attempt to download a Quit Claim Deed and the only one we had success with. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!