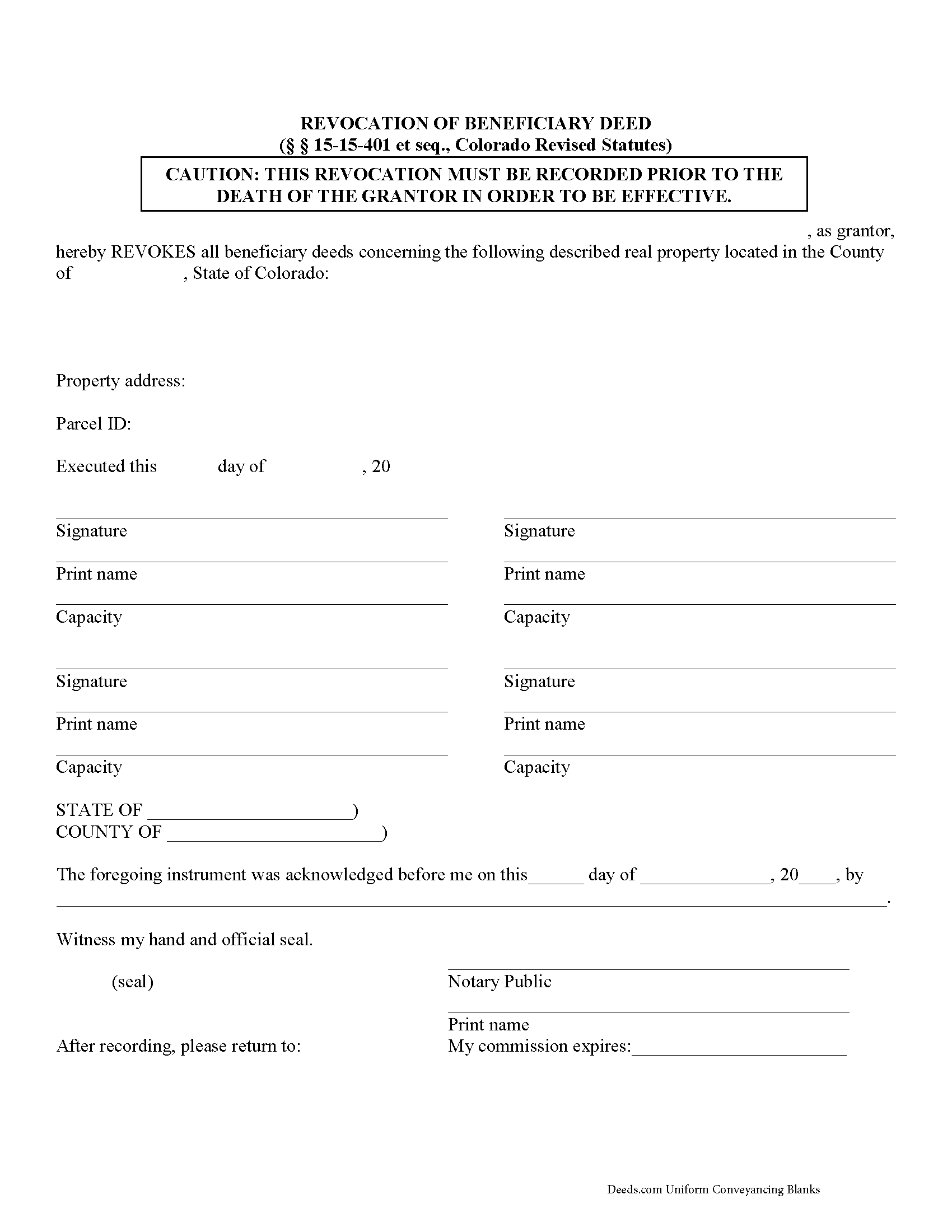

Routt County Beneficiary Deed Revocation Form

Routt County Beneficiary Deed Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

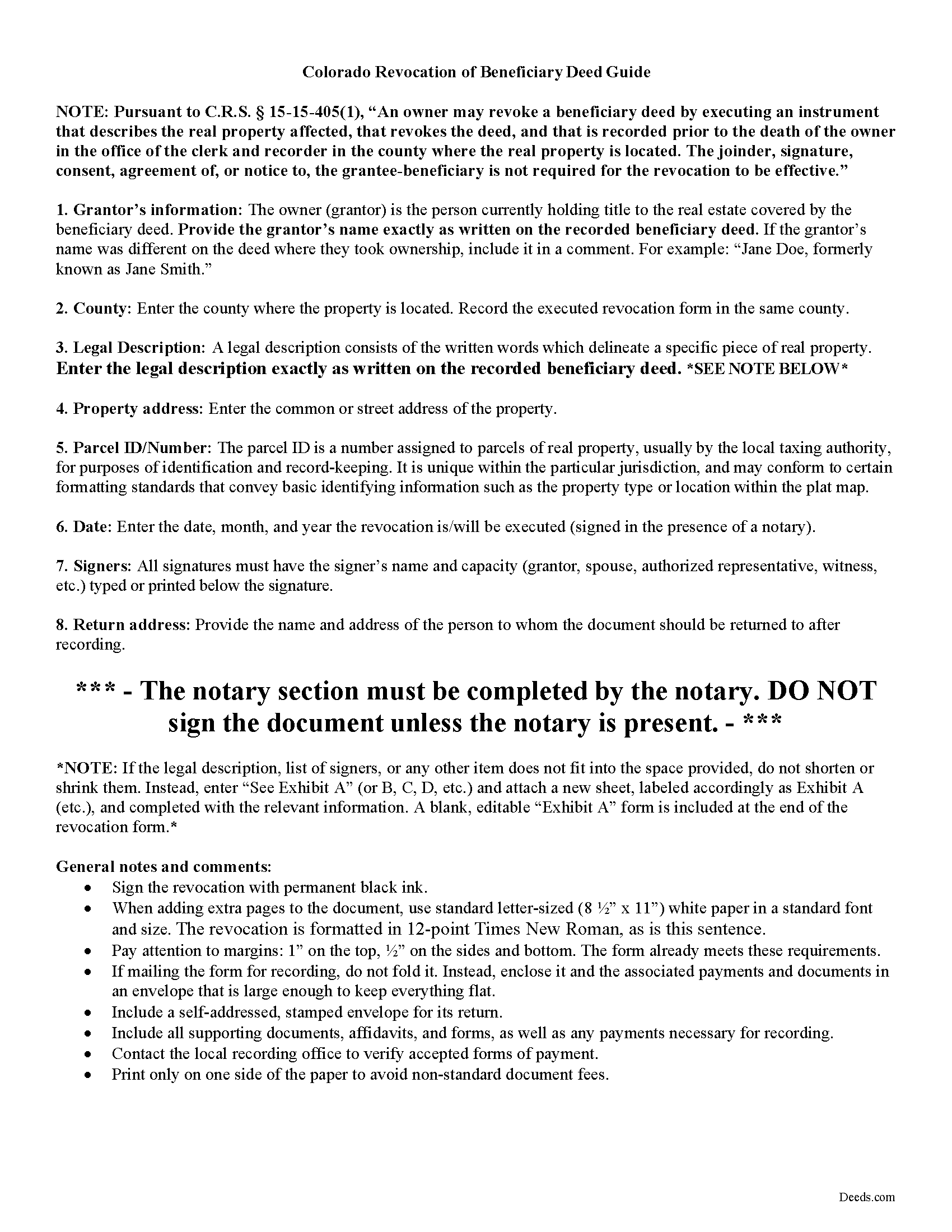

Routt County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

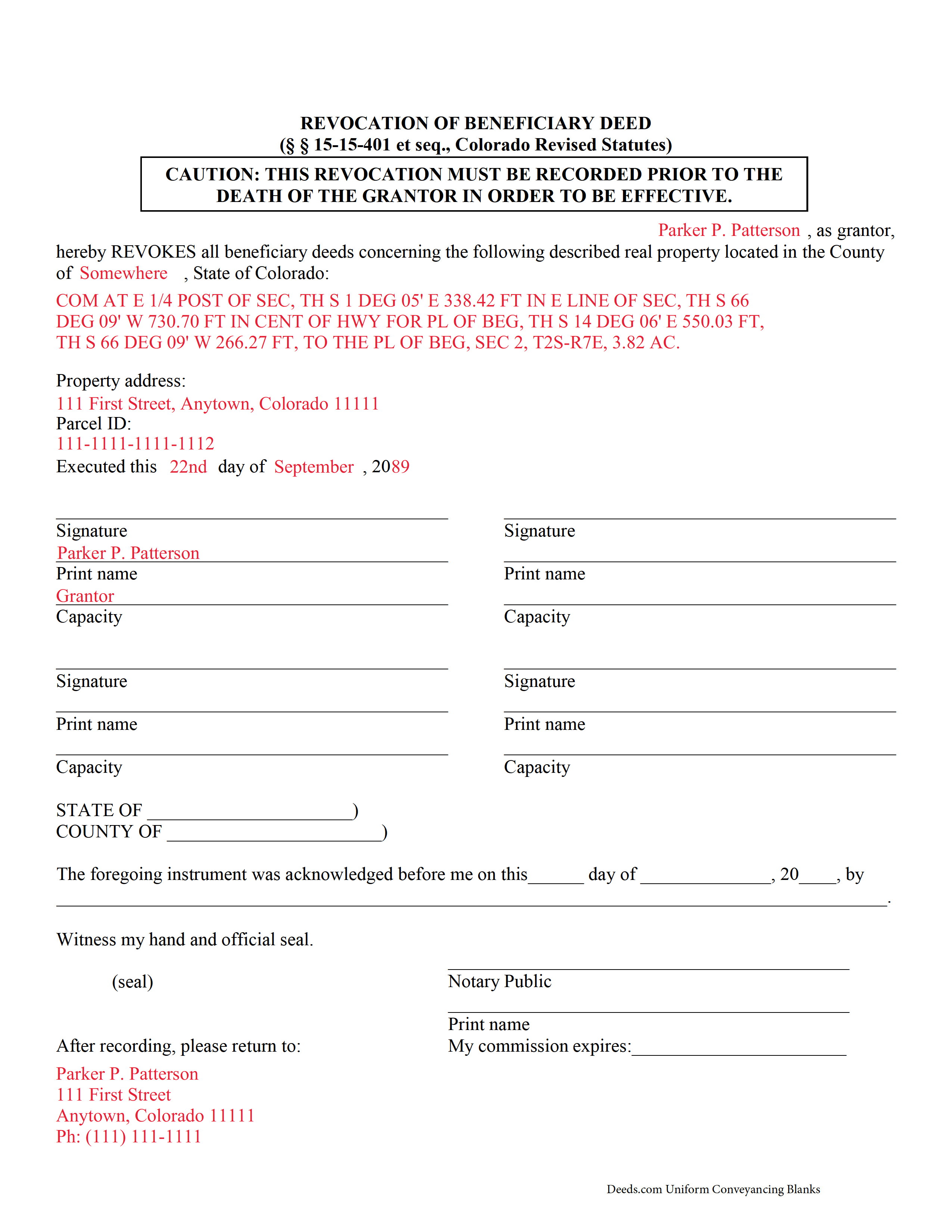

Routt County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Routt County documents included at no extra charge:

Where to Record Your Documents

Routt County Clerk and Recorder

Steamboat Springs, Colorado 80477

Hours: 8:00 to 4:30 Monday - Friday

Phone: (970) 870-5556

Recording Tips for Routt County:

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Routt County

Properties in any of these areas use Routt County forms:

- Clark

- Hayden

- Oak Creek

- Phippsburg

- Steamboat Springs

- Toponas

- Yampa

Hours, fees, requirements, and more for Routt County

How do I get my forms?

Forms are available for immediate download after payment. The Routt County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Routt County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Routt County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Routt County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Routt County?

Recording fees in Routt County vary. Contact the recorder's office at (970) 870-5556 for current fees.

Questions answered? Let's get started!

Colorado's beneficiary deeds are governed by C.R.S. 15-15-401 et seq. Revocations are specifically discussed in 15-15-405, which also defines the requirements for a basic form.

Revocability is one of the many useful features of a Colorado beneficiary deed. There are two primary ways for a land owner to revoke a recorded beneficiary designation: executing and recording a revocation, or executing and recording a new beneficiary deed that changes the original designation or distribution (15-15-405(1), (2)).

Neither a modification nor a revocation requires notifying beneficiaries because they only have a potential future interest in the property; nothing is promised or owed to them until the grantor's death. Note, however, that Colorado beneficiary deeds may NOT be revoked or changed by any provisions of the owner's will (15-15-405(4)).

Valid revocations identify the grantor, the property, make reference to the recorded beneficiary deed, and include any other information necessary for the specific situation. The form must also meet state and local standards for recorded documents.

A revocation, when correctly completed and filed for record with the appropriate local agency (generally the recorder or register of deeds for the county where the real estate is located), cancels all prior beneficiary deeds.

IMPORTANT: Any modifications or cancellations to a previously recorded beneficiary deed must be submitted for filing while the grantor is alive. Any changes attempted after the grantor's death are void.

Contact an attorney with questions about revoking beneficiary deeds, or for any other issues related to real property or estate planning in Colorado.

(Colorado Beneficiary Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Routt County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Routt County.

Our Promise

The documents you receive here will meet, or exceed, the Routt County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Routt County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

jeann p.

September 19th, 2024

The site was extremely helpful.

We are delighted to have been of service. Thank you for the positive review!

Carol R.

February 19th, 2023

I found the site to be useful,informative and very accessable. Thank You

Thank you!

Gary J.

September 15th, 2020

Whomever "KCH" is, that person was of great help. It took me several tries due my inexperience with ADOBE SCAN, but that certainly is no fault of yours!! KVH was very patient with me, and in fact resolved the things I was doing wrong for me, without my even requesting the assistance.

Thank you!

Richard G.

August 28th, 2022

I was not able to add more linea to the deed and add up to four people and their addresses. The document should be able to be expanded.

Thank you for your feedback. We really appreciate it. Have a great day!

William B.

October 22nd, 2023

The forms, and other information, are all excellent. I would be giving a 5-star review if it were not for the fact that downloading a "bundle" about quitclaim deeds required I download every single file independently (15 files). I would far prefer a zip file, or one click to download the whole pile of independent files.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Johannah H.

May 20th, 2022

Deeds.com made my experience recording a Deed in Weld County, CO so easy! The representative went above and beyond by assisting me with the preparation of a high-quality digital document for recording. Highly Recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela B.

June 18th, 2023

Very easy to use. Time will tell if I have any issues getting it recorded. Beats using an attorney who won't return calls and emails like I used before. I like the form plus instructions and an example of the completed form.

Thank you for your feedback. We really appreciate it. Have a great day!

Gertrude M.

January 31st, 2023

Rating 5 stars

Thank you!

Kathleen M.

July 21st, 2021

Wow, this was a breeze!! Best experience and fast. Great way to record documents in a matter of minutes. I recommend Deeds.com for anyone who needs to record documents quickly and conveniently.

Thank you for your feedback. We really appreciate it. Have a great day!

Rohini L.

January 31st, 2024

This is the first time I am filling out a legal form downloaded from a website. Throughly impressed with the detailed explanation along with sample forms to help a novice like me to fill out the actual form. I will remember to go to your site if I need in the future and have already recommended your site to others. Thanks for an excellent job.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Mary G.

March 7th, 2021

Deeds.com was a fast and easy site to use the staff answered my questions online efficiently

Thank you!

Dennis M.

April 24th, 2022

Deeds was responsive and got back to me right away suggesting I go to the county and retrieve copies of the deed there. It's a couple of hundred miles away so was hoping I could do it online. A pretty good website though. Sorry we couldn't do business.

Thank you for your feedback. We really appreciate it. Have a great day!

William G.

July 21st, 2023

Exactly what I needed and saved me a bundle by not having to hire an attorney. My county clerk said it was exactly correct.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott P.

March 15th, 2021

The site was easy to use and find what I needed. The purchase and download were very easy.

Thank you!

Miranda C.

August 16th, 2023

very expensive

Thank you for your continued trust and repeated purchases with us over the past year. We deeply value our loyal customers and understand the importance of providing value for your investment. Our pricing reflects the meticulous care, research, and expertise we put into each of our legal forms. However, we always strive to improve and genuinely value your feedback.