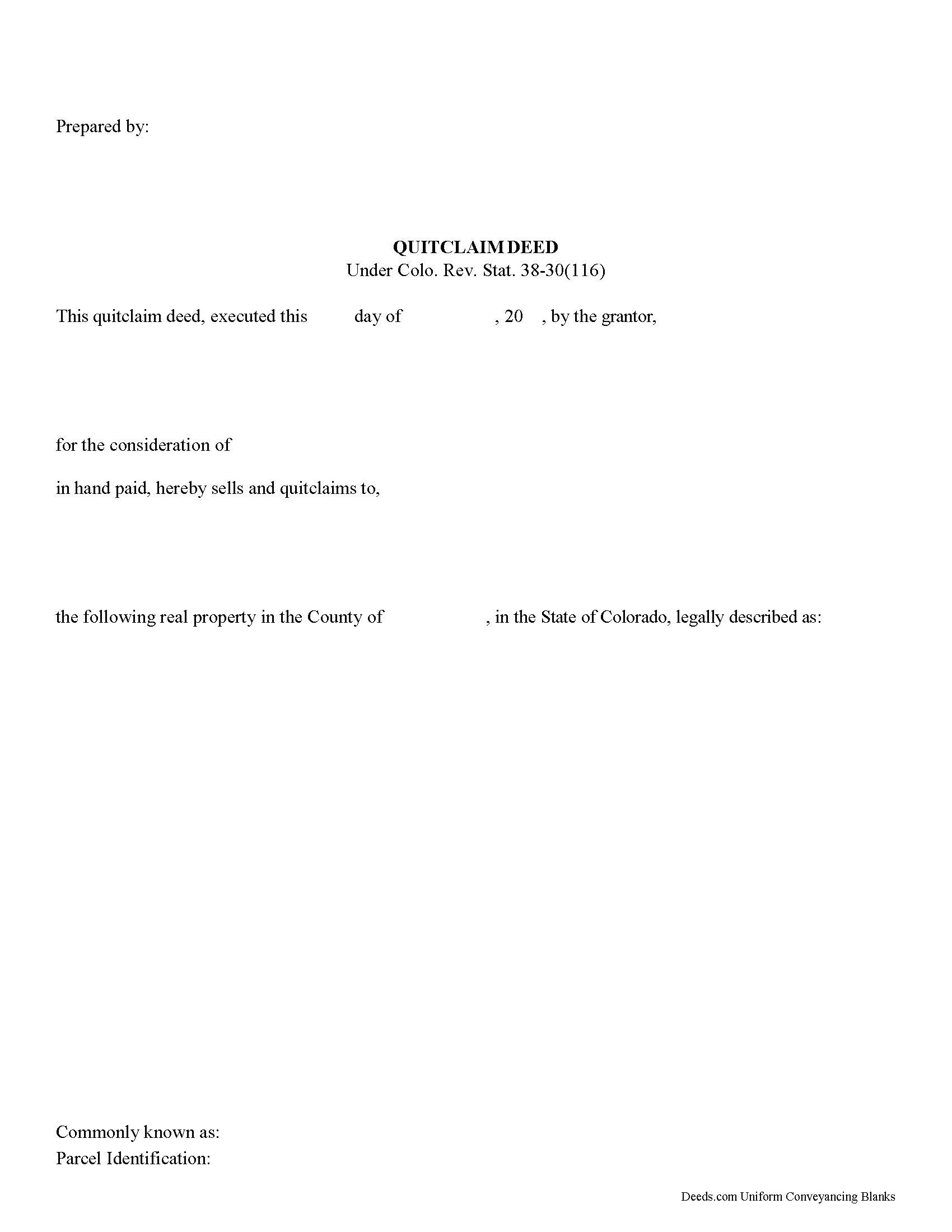

Park County Quitclaim Deed Form

Park County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Colorado recording and content requirements.

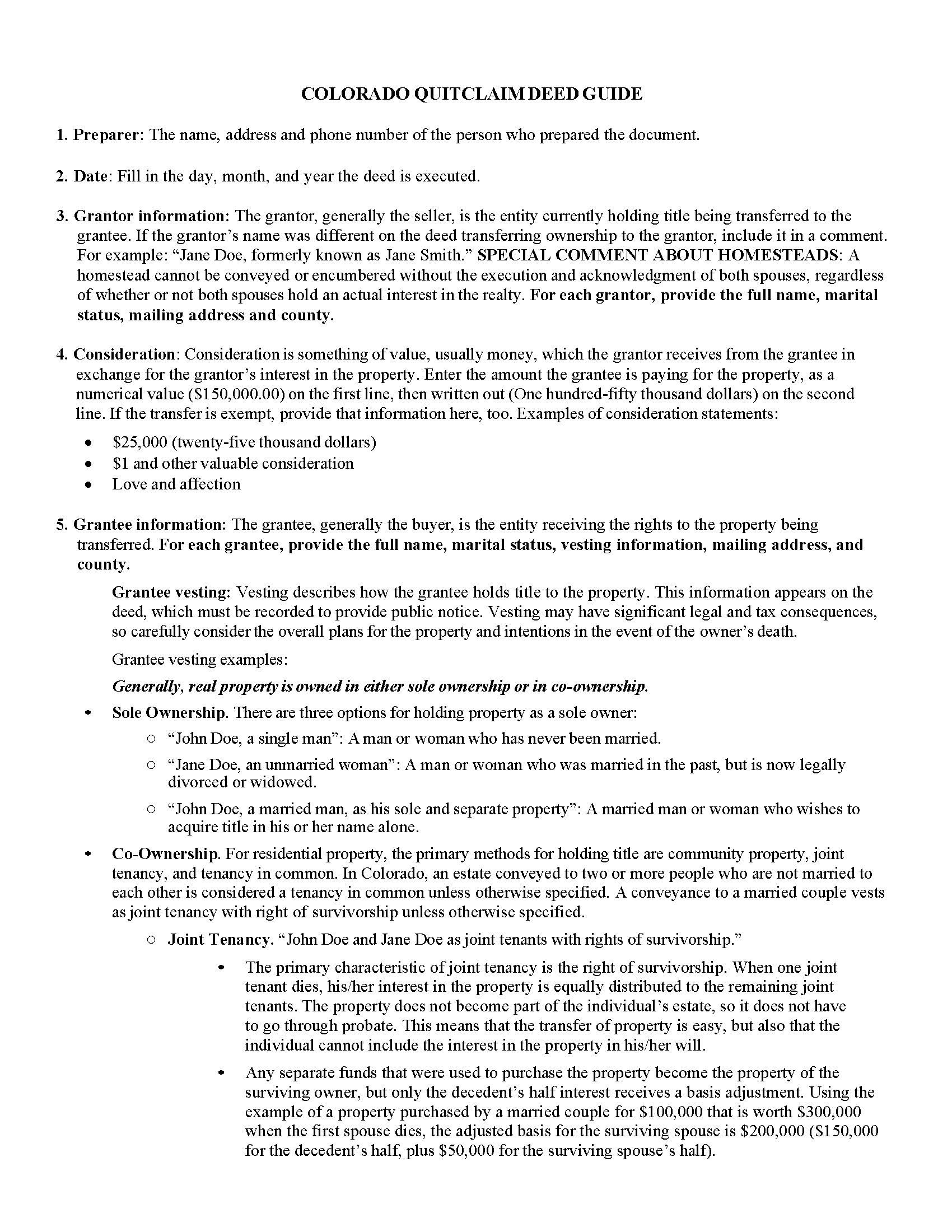

Park County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

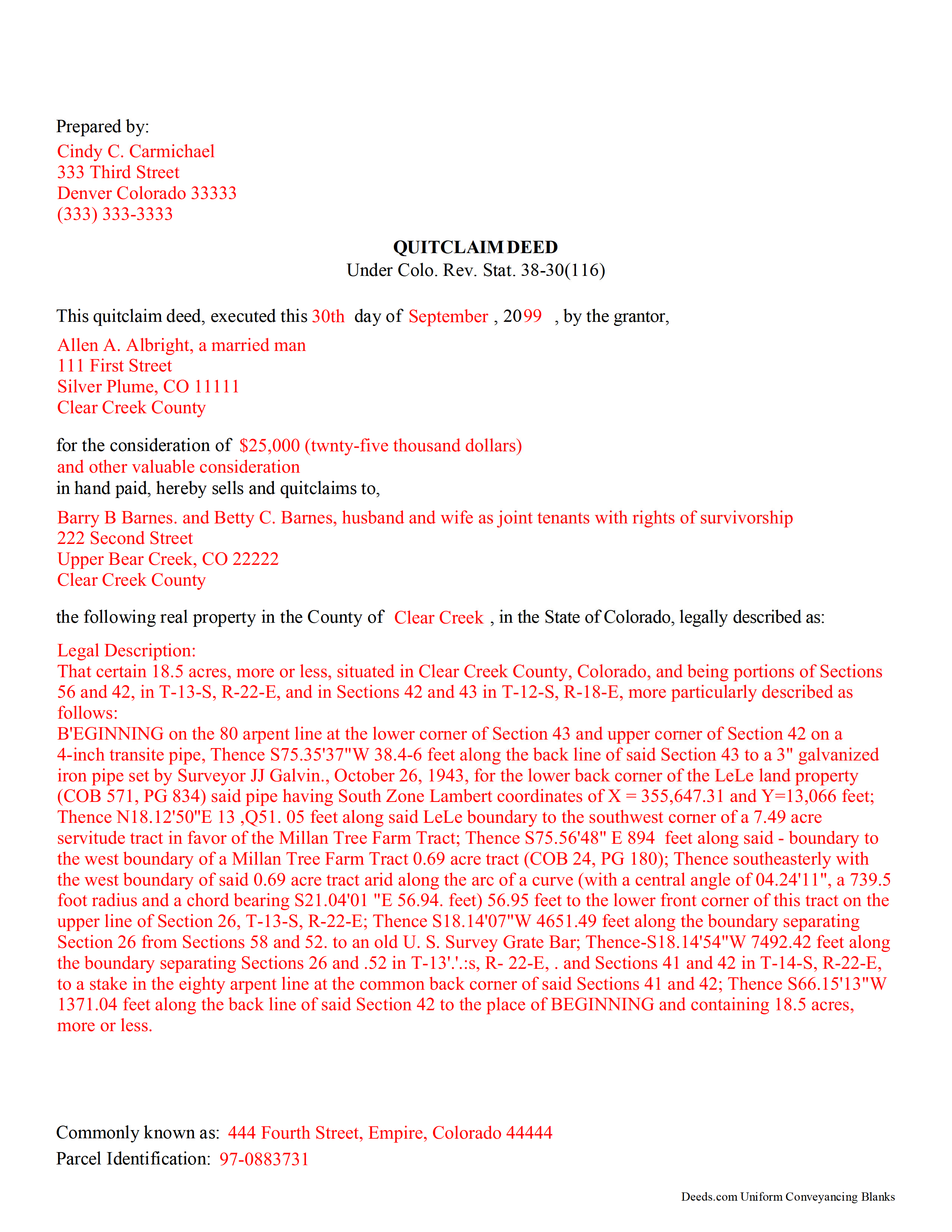

Park County Completed Example of the Quitclaim Deed Document

Example of a properly completed Colorado Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Park County documents included at no extra charge:

Where to Record Your Documents

Clerk & Recorder

Fairplay, Colorado 80440

Hours: Monday - Thursday 7:00 to 6:00

Phone: 719-836-4225

Recording Tips for Park County:

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Park County

Properties in any of these areas use Park County forms:

- Alma

- Bailey

- Como

- Fairplay

- Grant

- Guffey

- Hartsel

- Jefferson

- Lake George

- Shawnee

Hours, fees, requirements, and more for Park County

How do I get my forms?

Forms are available for immediate download after payment. The Park County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Park County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Park County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Park County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Park County?

Recording fees in Park County vary. Contact the recorder's office at 719-836-4225 for current fees.

Questions answered? Let's get started!

Properly executed quitclaim deed documents in the state of Colorado must conform to specific statutory requirements.

Content:

Valid quitclaim deeds require the name, address, and county of both the grantor and the grantee; the amount of consideration paid for the real property (usually money); a formal legal description and address for the parcel; the assessor's ID number if available; date of execution; and an acknowledged signature of the grantor. See C.R.S. 38-30-113, 114, 116; C.R.S. 38-35-122. In addition, the language in the statutory form should be modified so that "quitclaim" replaces "convey" and "warrant title to the same" is omitted.

Recording:

C.R.S. 38-35-109 governs recording quitclaim deeds in Colorado. After the deed is executed, record it in the office of the county clerk where the land is situated. This preserves the continuous chain of title and allows future prospective owners to review the property's ownership history. Colorado adheres to a "race-notice" recording statute. This means that if a transfer of real property ownership is signed and acknowledged but not entered into the public record by recording, and the original grantor reconveys the same property to another bona fide grantee (someone who purchases the parcel for value, usually money), who then records the quit claim deed, the later grantee generally retains the rights to the property. In short, record the quit claim deed as soon as possible to protect the rights of all parties.

(Colorado Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Park County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Park County.

Our Promise

The documents you receive here will meet, or exceed, the Park County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Park County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4606 Reviews )

Jan C.

May 20th, 2020

Wow - finding your service was a lifesaver! I know my forms, but I don't have the time right now to draft them from "scratch". So once I found this site it was a couple of quick clicks and VOILA!! almost a done deal. Thanks for the assistance.

Thank you for your feedback. We really appreciate it. Have a great day!

Jan David F.

January 5th, 2019

Your data doesn't go deep enough in time to be useful to me. I needed deeds from 1911 to 1966.

Thank you for your feedback Jan. It does look like staff canceled your order after discussing your needs with you.

Terrill M.

January 10th, 2020

Great forms and information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

OLGA R.

October 30th, 2020

Excellent Service for E-Recording. They work with you and guide you on every aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane S.

May 13th, 2020

Money well spent. I used the example and filled out with no problem.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jany F.

November 8th, 2021

Great and quick service.

Thank you!

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Mary D.

March 29th, 2021

LOVE this site.. easy to use and very very quick to record

Thank you for your feedback. We really appreciate it. Have a great day!

Thaddeus E.

January 5th, 2025

Quick assistance with same day recording. The tech identified barriers to successful Recordation such as image quality and worked with me to get them resolved for timely submission.

We are delighted to have been of service. Thank you for the positive review!

Wanda B.

July 22nd, 2022

Great prompt and efficient service!

Thank you for your feedback. We really appreciate it. Have a great day!

Sawnie A.

July 29th, 2020

the deeds and related materials themselves are excellent but the PDF application is awful plus there is no way to customize the documents for specific purposes, so I had to type them from scratch in each instance.

Thank you for your feedback. We really appreciate it. Have a great day!

rita t.

November 4th, 2019

Thanks for asking, everything was fine. Forms worked as expected, no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph S.

November 27th, 2023

THIS IS MY FIRST EXPERIENCE WITH DEEDS.COM. I DLED THE ESTATE DEED FORM THAT I HOPE WILL GO THROUGH OK WITH THE COUNTY. IT WILL BE SOMETIME UNTIL I HAVE IT FILLED IN AND ALL THE NAMES IN, NORARIZED AND FILED. CAN I RECONTACT YOU FOLKS IF THERE IS A PROBLEM? THANK YOU, JOE SEUBERT

We are motivated by your feedback to continue delivering excellence. Thank you!

Erlinda M.

August 14th, 2019

Very convenient & easy to use this website. Information was helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela G.

January 29th, 2019

This is an easily navigated site and the forms came with detailed directions. I have already recommended Deeds.com to a family member.

Thank you so much Pamela, we really appreciate it!