Sarasota County Decedent Interest in Homestead Affidavit Form

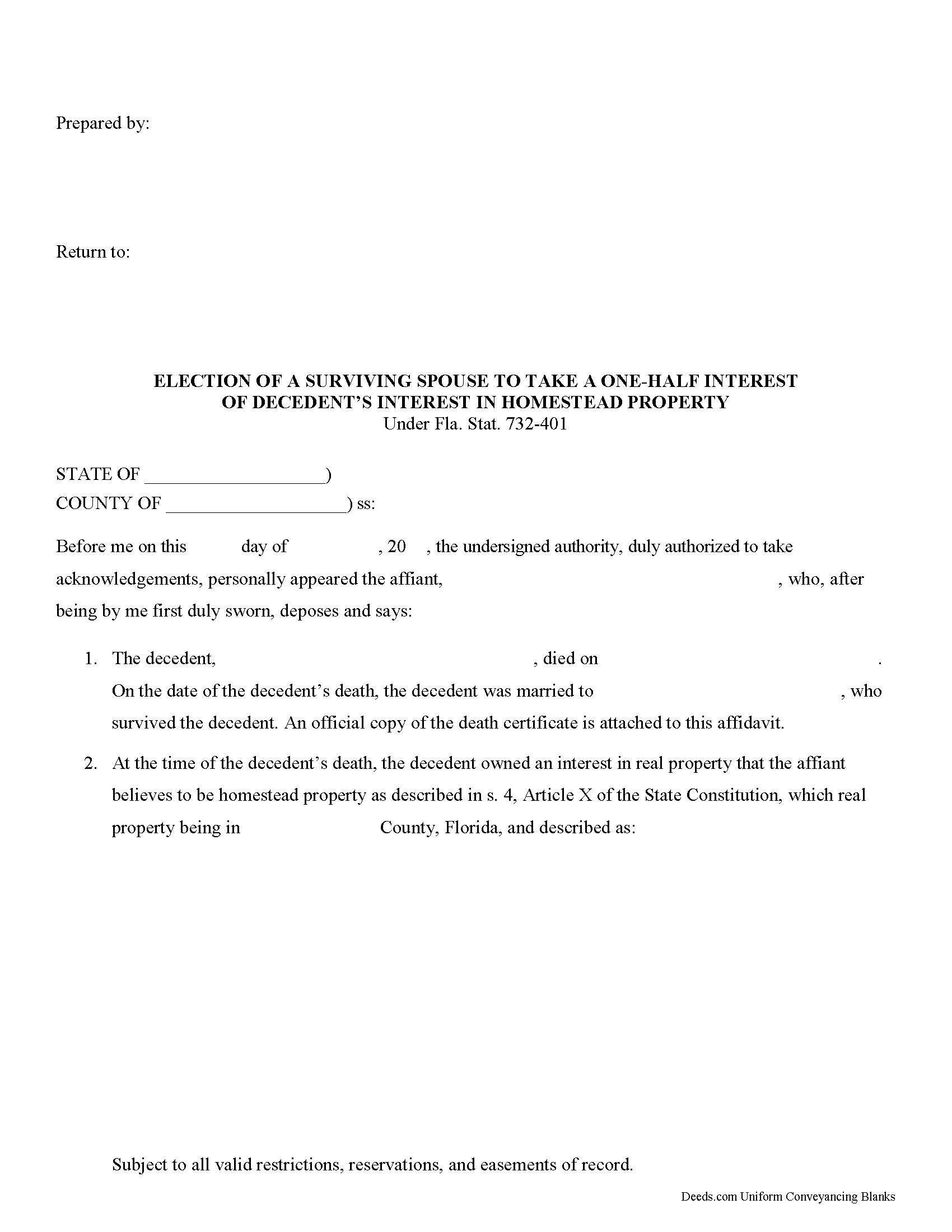

Sarasota County Decedent Interest in Homestead Affidavit Form

Fill in the blank Decedent Interest in Homestead Affidavit form formatted to comply with all Florida recording and content requirements.

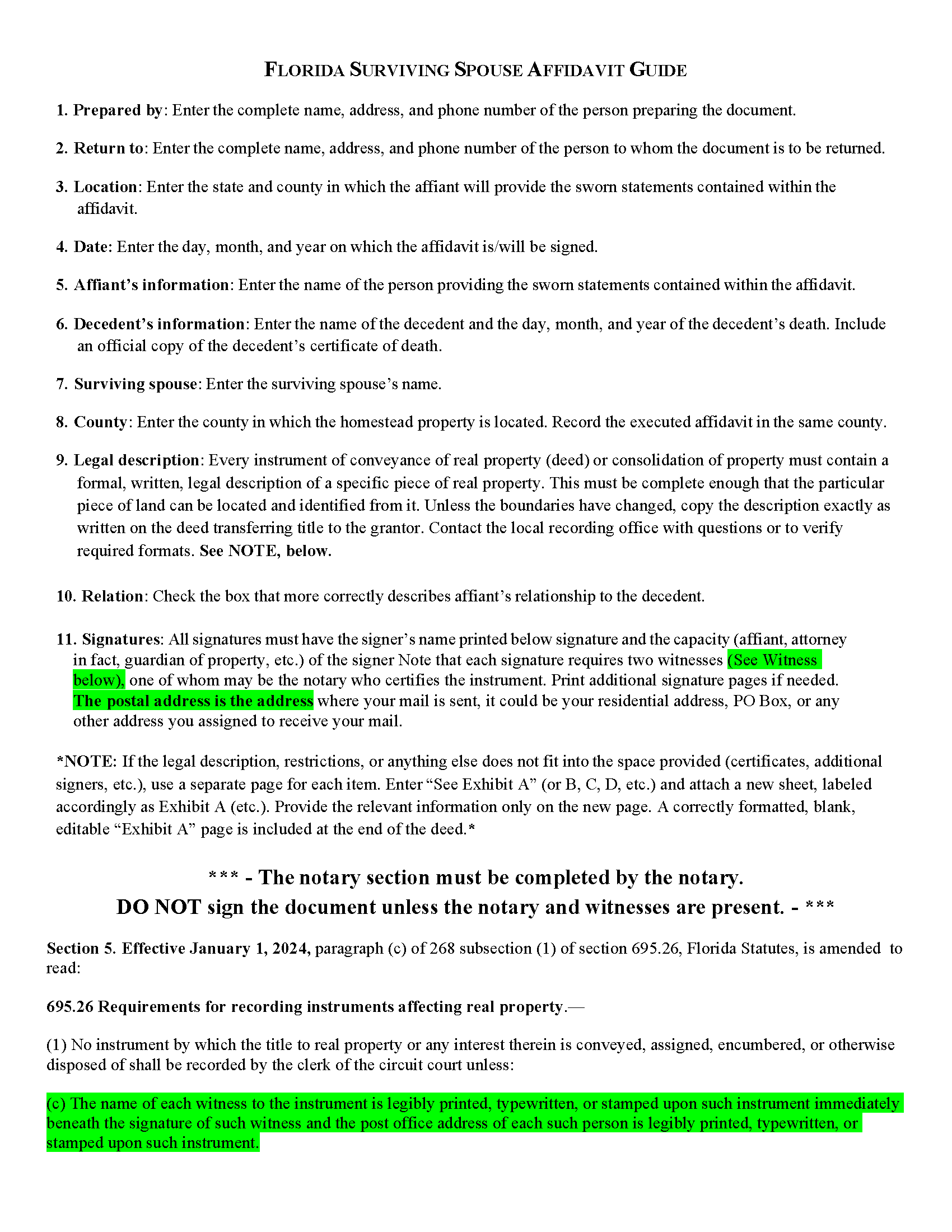

Sarasota County Decedent Interest in Homestead Affidavit Guide

Line by line guide explaining every blank on the Decedent Interest in Homestead Affidavit form.

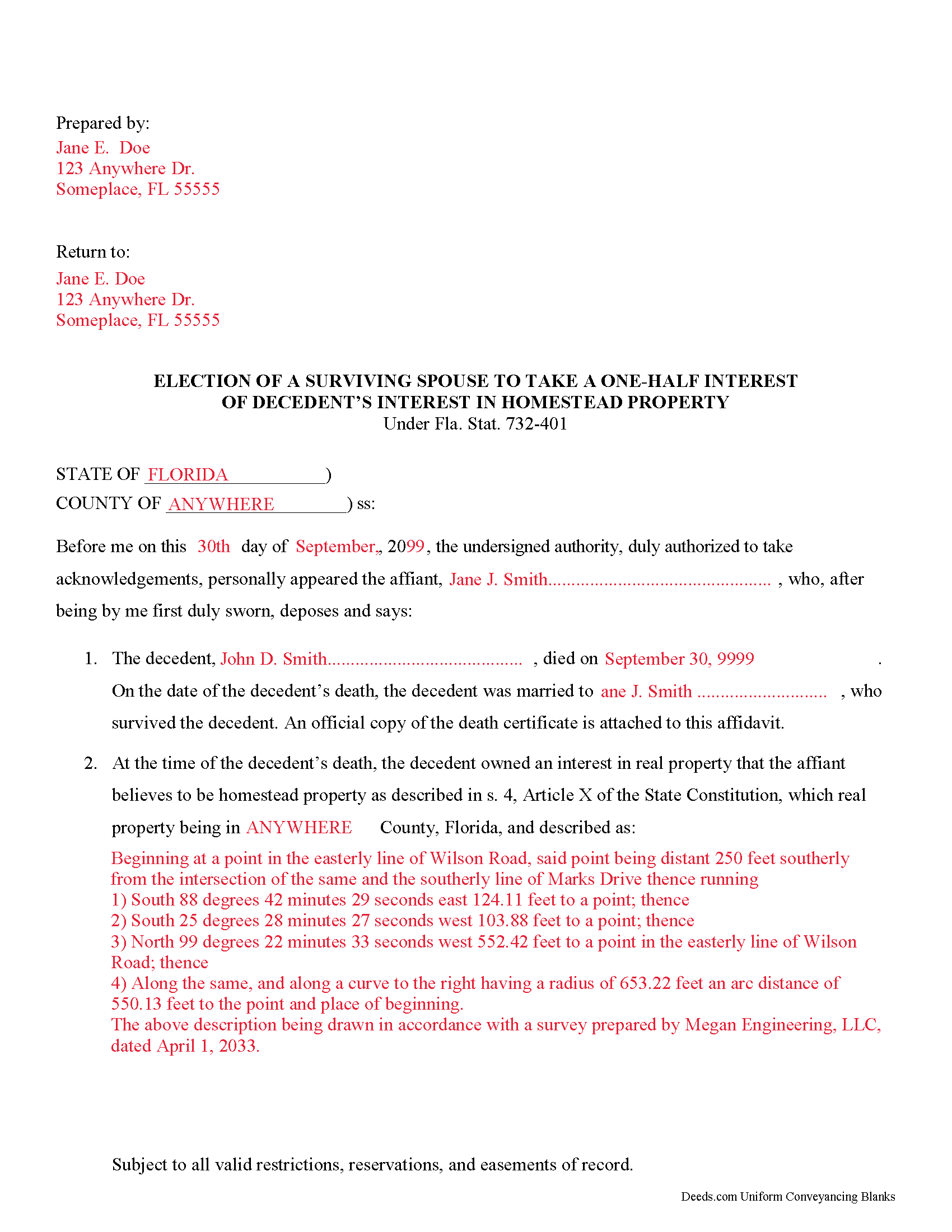

Sarasota County Completed Example of the Decedent Interest in Homestead Affidavit Document

Example of a properly completed Florida Decedent Interest in Homestead Affidavit document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Sarasota County documents included at no extra charge:

Where to Record Your Documents

Clerk/Comptroller - Main Office

Sarasota, Florida 34237

Hours: 8:30am - 5:00pm M-F

Phone: 941-861-7436

Venice Branch Office

Venice, Florida 34293

Hours: 8:30am - 5:00pm M-F

Phone: (941) 861-7436

Recording Tips for Sarasota County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Sarasota County

Properties in any of these areas use Sarasota County forms:

- Englewood

- Laurel

- Nokomis

- North Port

- Osprey

- Sarasota

- Venice

Hours, fees, requirements, and more for Sarasota County

How do I get my forms?

Forms are available for immediate download after payment. The Sarasota County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sarasota County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sarasota County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sarasota County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sarasota County?

Recording fees in Sarasota County vary. Contact the recorder's office at 941-861-7436 for current fees.

Questions answered? Let's get started!

Decedent's interest in homestead affidavit

Under Florida law, real estate that is identified as a homestead but is not included in a deceased owner's will passes to beneficiaries in the same manner as other intestate property. If the decedent is survived by a spouse and one or more descendants, however, the surviving spouse has three main options as set out in section 732.401 of the Florida Statutes:

- take a life estate in the homestead, with a vested remainder to the descendants alive at the time of the decedent's death per stirpes (according to Black's Law Dictionary, 8th ed., "proportionately divided between beneficiaries according to their deceased ancestor's share").

- take an undivided one-half interest in the late spouse's homestead as a tenant in common, with the remaining one-half interest held by any descendants per stirpes.

- disclaim the interest as directed in chapter 739.

When a surviving spouse chooses to take the one-half interest in the property, he/she files a decedent's interest in homestead affidavit. This document allows the spouse to waive the marital rights to a life estate in the property. Instead, the surviving spouse and any descendants hold title as tenants in common. As tenants in common, each party can independently sell his/her interests to the property without notice or joinder from the others.

In most cases, the affidavit must be filed within six months of the decedent's death. The affidavit can be made by the surviving spouse him/herself or, with the court's approval, an attorney in fact or guardian of the property of the surviving spouse. The document is then filed in the county or counties in which the homestead property is located. Once recorded, the surviving spouse's decision is irrevocable.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Product description:

Use this document when the owner of homestead property dies without including the real estate in the will and the surviving spouse elects to forego his/her life estate interest in favor of one-half share and convert his/her interest in a life estate to a tenancy in common with the descendants.

(Florida Decedent Interest in Homestead Package includes form, guidelines, and completed example)

Important: Your property must be located in Sarasota County to use these forms. Documents should be recorded at the office below.

This Decedent Interest in Homestead Affidavit meets all recording requirements specific to Sarasota County.

Our Promise

The documents you receive here will meet, or exceed, the Sarasota County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sarasota County Decedent Interest in Homestead Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

spencer d.

February 9th, 2023

Great and quick service!

Thank you!

James B.

March 10th, 2021

Was a lot easier than driving to the County Building and faster than expected. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ralph H.

October 22nd, 2022

They must have busy when I applied. The screen said it should be done in under10 mins unless heavier traffic. I was a little nervous because of a time deadline. It was completed in 45 mins and for under $30 it was worth every penny to have my deed details at my fingertips. So I give it a 5 on ease of use and quick handling. You can get it done less expensively, but great in a time crunch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas W.

June 30th, 2020

Fast, efficient, and helpful. I don't often have documents that need recording but I found Deeds.com incredibly handy. It cost me no more and probably less than if I'd gone in to do it myself. It was especially helpful during this Covid-19 stay-at-home time. It all happened within a couple of hours and I had my recorded copies in my hands.

Thank you for your feedback. We really appreciate it. Have a great day!

Maureen F.

January 27th, 2021

Forms were delivered quickly and were easily filled out. State specific!

Thank you!

Dianna K.

August 14th, 2019

Excellent customer service - couldnt have been any more helpful, with a smile I could hear through the phone!

Thank you!

JOE M.

August 31st, 2024

The form I needed were easy to find. And very affordable. Great service.

Thank you for your feedback. We really appreciate it. Have a great day!

Joan S.

May 21st, 2020

Thanks for providing this service. We had searched for weeks for the correct documents. It might help clients to find you soon if the banks and mortgage companies can refer clients to you. They require the forms but offer no direct source to obtain them. You are 5 star in every way.

Thank you!

YU LI K.

December 27th, 2023

Very easy to find the document I need and easy to download

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

nancy h.

April 10th, 2019

Once I figured out what I wanted it was great!

Thank you Nancy.

Kathleen M.

July 21st, 2021

Wow, this was a breeze!! Best experience and fast. Great way to record documents in a matter of minutes. I recommend Deeds.com for anyone who needs to record documents quickly and conveniently.

Thank you for your feedback. We really appreciate it. Have a great day!

Roger E.

August 30th, 2019

I have not yet used the product, but am confident that I will like it, because of this prompt request for a product review.

Thank you for your feedback. We really appreciate it. Have a great day!

James N.

December 14th, 2018

The purchasing process was very slick and my credit card was charged IMMEDIATELY. The deliver went well as the link was provided immediately. However I asked a question via the "Contact Us" link and days later I get a survey but no reply. I may have been directed to the wrong forms via my County and I wanted to confirm that...but still no answer. What would that deserve as a rating???

Also, your history on our site shows no messages sent via our contact us page.

Marlene B.

February 21st, 2024

I appreciated the fact that the forms were by Texas County and I knew I had the right form. The form were fairly easy to complete. I had trouble completing the form because the property description was long and kept disappearing and I had to re-type. It would also have helped it I could have saved and not had to start over every time.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!