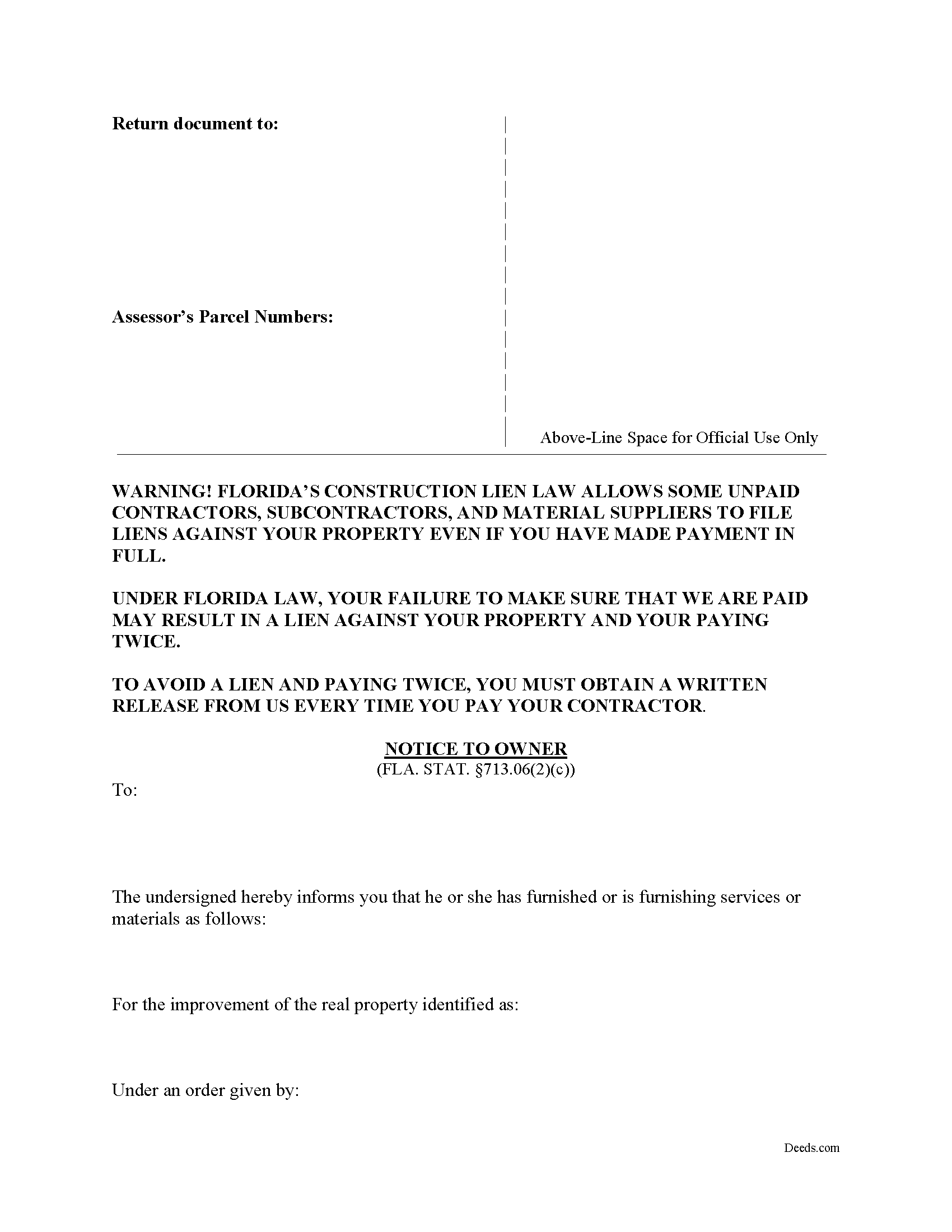

Pasco County Notice to Owner Form

Pasco County Notice to Owner Form

Fill in the blank form formatted to comply with all recording and content requirements.

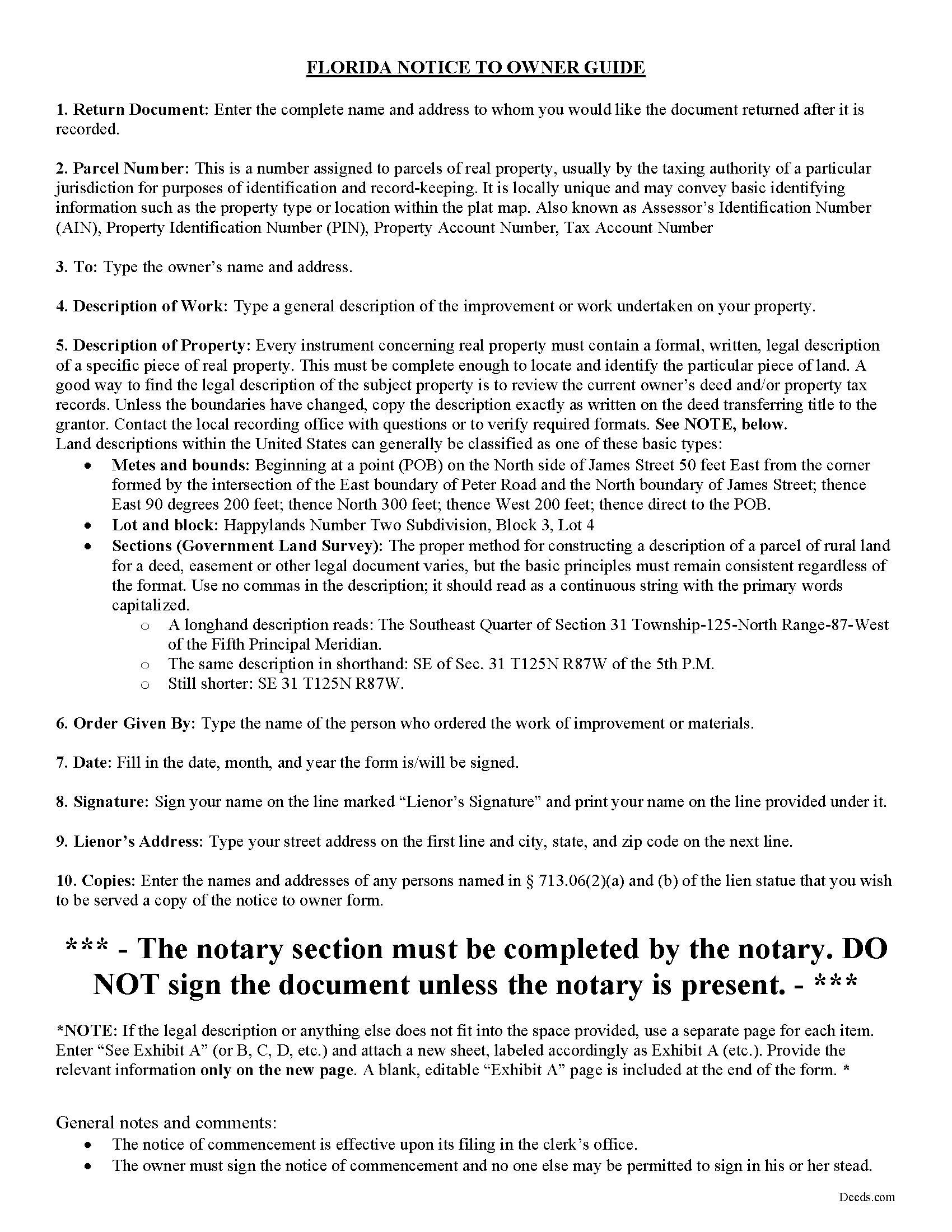

Pasco County Notice to Owner Guide

Line by line guide explaining every blank on the form.

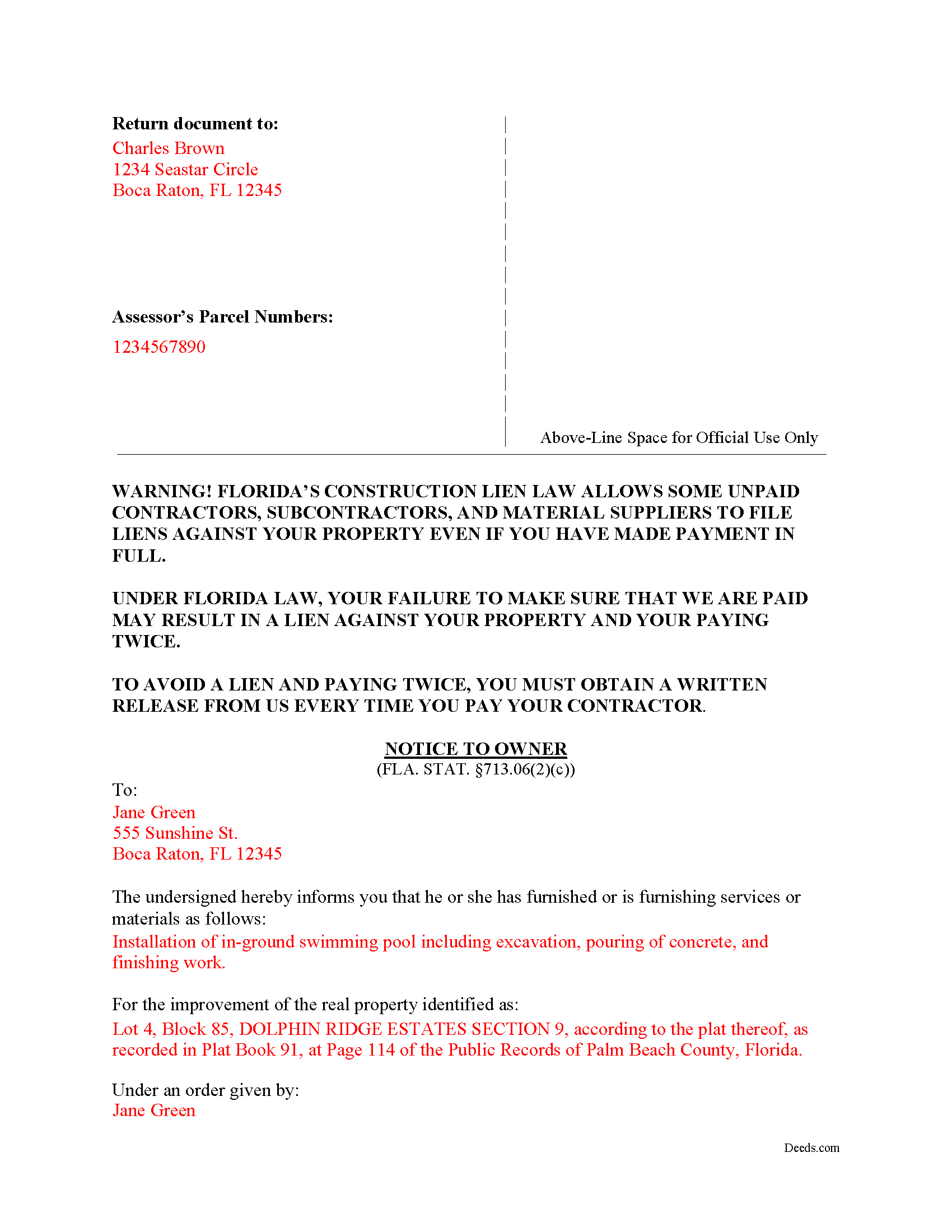

Pasco County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Pasco County documents included at no extra charge:

Where to Record Your Documents

Clerk & Comptroller - East Pasco Government Center

Dade City, Florida 33523

Hours: 8:30 to 5:00 M-F

Phone: (352) 521-4408

Clerk & Comptroller - West Pasco Government Center

New Port Richey, Florida 34654

Hours: 8:30 to 5:00 M-F

Phone: (352) 521-4408

Recording Tips for Pasco County:

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Pasco County

Properties in any of these areas use Pasco County forms:

- Aripeka

- Crystal Springs

- Dade City

- Elfers

- Holiday

- Hudson

- Lacoochee

- Land O Lakes

- New Port Richey

- Port Richey

- Saint Leo

- San Antonio

- Spring Hill

- Trilby

- Wesley Chapel

- Zephyrhills

Hours, fees, requirements, and more for Pasco County

How do I get my forms?

Forms are available for immediate download after payment. The Pasco County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pasco County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pasco County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pasco County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pasco County?

Recording fees in Pasco County vary. Contact the recorder's office at (352) 521-4408 for current fees.

Questions answered? Let's get started!

A statutory Notice to Owner (NTO) form, under section 713.06 of the Florida Revised Statutes, is a fairly simple document. Sent to an owner by any lienor (subcontractor, sub-subcontractor or material supplier without a direct contract between the two parties), this document informs the owner that the lienor has or will commence the supply of labor, services, or materials for the purpose of improving their real property. The NTO is a first step in securing a mechanics lien on the property.

Florida's lien statute requires lienors as defined at 713.01(18-20) to serve the owner with a NTO form, even if the claimant is not a direct party to a contract with the owner. The lien law sets forth the required contents of the NTO, which must include the lien claimant's name and address, a description of the property, and a description of the services or materials furnished. The claimant must serve the owner either before commencement of the work or furnishing of materials, or within 45 days of such furnishing. Failure to serve the NTO in accordance with the lien statute renders associated liens invalid.

The NTO should be served on the owner in accordance with service methods prescribed under Florida law. The easiest (and least expensive) method is to use certified mail. Other acceptable methods include personal service and posting the notice at the jobsite as a final alternative.

Each case is unique, so contact an attorney with specific questions or for complex situations involving a Notice to Owner or other issue related to Florida's Construction Lien Law.

Important: Your property must be located in Pasco County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Pasco County.

Our Promise

The documents you receive here will meet, or exceed, the Pasco County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pasco County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

michael o.

July 17th, 2019

After trying to get help locally I found your website. Very easy

Thank you for your feedback. We really appreciate it. Have a great day!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janice S.

August 31st, 2022

All instructions and forms are very easy to read and fill-out. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Shaaron Z.

August 29th, 2019

So far, this is working well. However, I don't see a form to change name due to marriage.

Thank you!

Peter W.

February 28th, 2019

Thanks worked out great

Thank you for the follow up Peter. Have a great day!

Taylor Z.

January 1st, 2021

I was frustrated by Orange County and all the other options they gave me to submit my paperwork. Deeds.com was the easiest to sign up for and I was impressed with how smoothly everything went. The price is well worth the convenience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine S.

February 27th, 2019

Very good site! I found everything I needed right here on Deeds.com. Excellent quality forms, easy access, perfect delivery, reasonable price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joshua W.

May 9th, 2021

Very efficient and easy to use, worth the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Ann E Grace S.

June 22nd, 2021

Forms and instructions are very easy to access. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Debra W.

December 24th, 2018

I found this site a must. It provided all the forms I needed to file a Quit Claim Deed. I filed what use to be called a Quick Claim Deed 30 years ago. You only had to file the one form. Today it is called a Quit Claim Deed. The pack provided forms that I had no idea had to be filed with the Quit Claim Deed. I would not have known this otherwise if the option hadn't presented itself. Thank you!

Thanks for taking the time to leave your feedback Debra, we really appreciate it.

Omar F.

February 1st, 2021

Great! Thank you!

Thank you!

David S.

March 7th, 2022

Very good website. All government should be that clear and efficient.

Thank you!

Cary C.

February 8th, 2021

I am very grateful for this service! But I was quite surprised to see the fees went up over 50%! The last 5 or 6 recordings I have done we each only $25.00. Thank you, Sally Center

Thank you for your feedback. We really appreciate it. Have a great day!

Valerie S.

July 16th, 2020

The service was easy, fast, and cheap and we were able to close our sale 2 days after we downloaded the deed! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

GARY S.

March 16th, 2021

The forms were just what i needed and for the county i needed thankyou so much

Thank you!