Chatham County Executor Deed Form

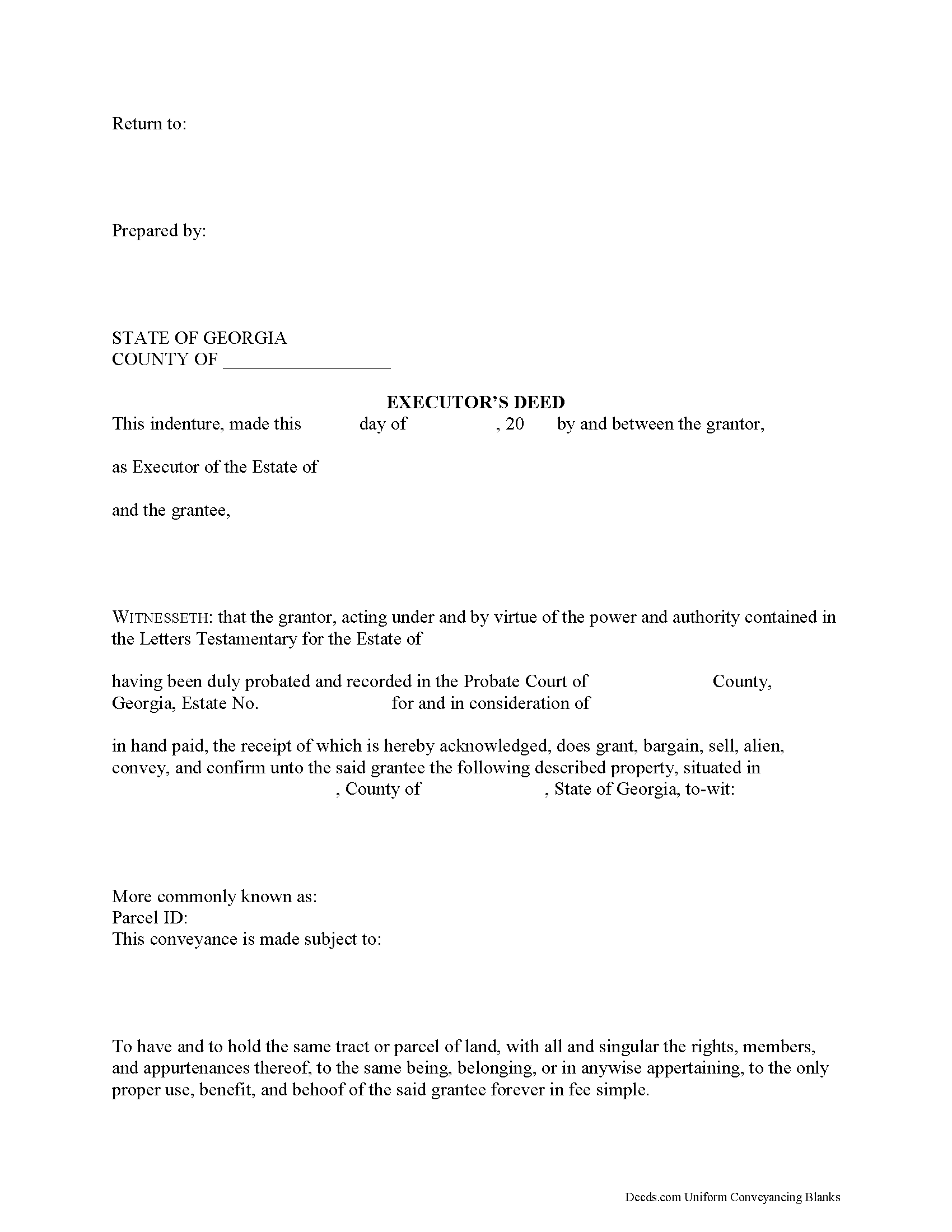

Chatham County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

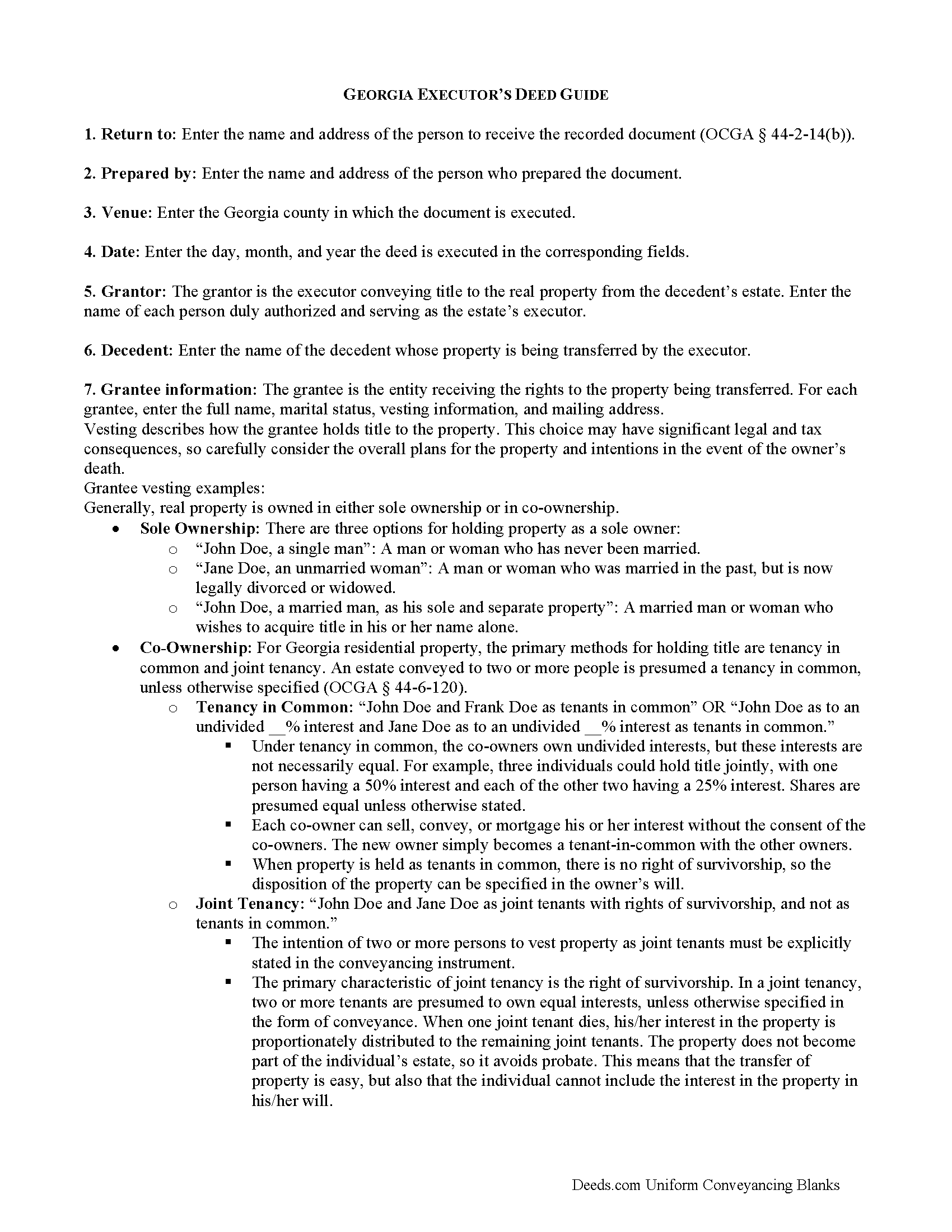

Chatham County Executor Deed Guide

Line by line guide explaining every blank on the form.

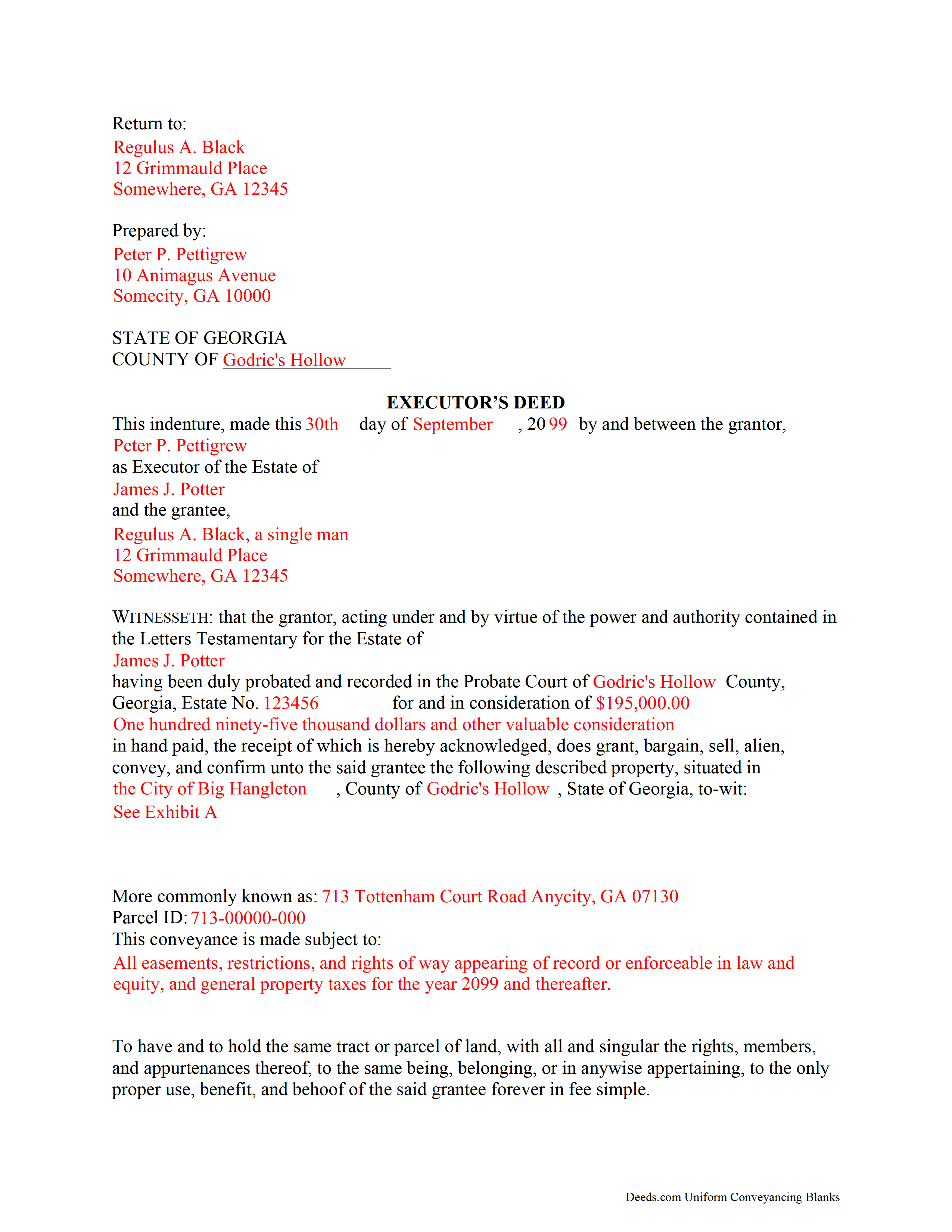

Chatham County Completed Example of the Executor Deed Document

Example of a properly completed form for reference

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Chatham County documents included at no extra charge:

Where to Record Your Documents

Southside Location

Savannah, Georgia 31406

Hours: 8:00am - 5:00pm Monday thru Friday

Phone: (912) 201-4351

Chatham Clerk of Superior Court

Savannah, Georgia 31412

Hours: 8:00am to 5:00pm M-F

Phone: (912) 652-7197

Recording Tips for Chatham County:

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Chatham County

Properties in any of these areas use Chatham County forms:

- Bloomingdale

- Pooler

- Savannah

- Tybee Island

Hours, fees, requirements, and more for Chatham County

How do I get my forms?

Forms are available for immediate download after payment. The Chatham County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Chatham County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Chatham County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Chatham County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Chatham County?

Recording fees in Chatham County vary. Contact the recorder's office at (912) 201-4351 for current fees.

Questions answered? Let's get started!

When people create their wills, they generally name one or more individuals to supervise the distribution of their assets. Georgia customarily uses the term "personal representative" to refer to both executors and administrators, but get more specific when it comes to conveying title to real estate. An executor is a personal representative designated in a will to manage a testate decedent's estate; an administrator is appointed by the probate court, and can be involved in either testate or intestate (without a will) processes.

During probate, the court may direct an executor to sell real property pursuant to the terms of the decedent's will, to pay the estate's debts, or to consolidate the decedent's estate for devise among multiple beneficiaries. The named personal representative uses an executor's deed to transfer real property from a testate estate. The executor's deed contains all the information required for a standard conveyance, such as a quitclaim or warranty deed, but also includes relevant details about the decedent and the probate case.

To transfer title to a buyer, record the completed executor's deed, along with any necessary supporting documents, with the real property records of the appropriate county.

Consult an attorney with questions about the executor's deed, or with any other issues related to probate in Georgia.

(Georgia Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Chatham County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Chatham County.

Our Promise

The documents you receive here will meet, or exceed, the Chatham County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Chatham County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Janette K.

May 17th, 2019

I ordered a Transfer of Deed on Death document. It was easy to fill in, came with a useful guide and was customized to my county/state. It got the job done and was well worth the money!

Thank you for your feedback. We really appreciate it. Have a great day!

Richard O.

February 18th, 2025

It has an easy-to-use interface and well-formatted, detailed forms. Consider adding AI agents to assist in completing these forms from data provided or available from public sources. Overall, I am very satisfied!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Joyce F.

March 31st, 2019

The forms are simple to follow. I was hoping I would be able to add my personal info. That would make the forms even more simple.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph N.

September 17th, 2020

The site is easy to navigate and exceptional services. Unfortunately, they could find no information on a tract of land that I own, and they canceled the search and refunded my payment.

Sorry we were unable to help you find what you were looking for Joseph.

Dorothy R.

August 27th, 2019

Actually, it was user friendly once I figured out where to go to get the forms. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Shana D.

June 9th, 2022

I ordered the wrong forms because I didn't do enough research to understand what I needed. Their customer service was more understanding than I deserved.

Thank you!

ALAN C.

April 22nd, 2019

Everything was as advertised, and easily downloaded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark C.

November 29th, 2023

WOW! I am so pleased the County Registrar’s office recommended Deeds.com. From start to a very quick finish Deeds.com worked to ensure my documents were correct and they immediately filed them. The Warranty Deed was accepted by the County and registered within a hour. Deeds.com’s communication was superb. I will use this handy resource every time I am in need.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Katherine M.

October 6th, 2022

Easy smooth process to get a legal Maine template - thanks for providing

Thank you for your feedback. We really appreciate it. Have a great day!

David P.

February 18th, 2019

re: Transfer Upon Death Deed For Valencia County, NM, why not have ONE button to download all necessary forms? Individual buttons are tedious.

Thank you for your feedback David. The short answer is because not everyone needs all the forms. We will look into adding an option for downloading all the provided documents at once.

Esther R.

February 25th, 2019

Very easy to follow and complete.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

November 22nd, 2019

Quick and easy download. Got everything I needed. I would recommend deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Suzanne R.

November 25th, 2020

I was very impressed with how user friendly, convenient, and efficient the whole process was. I will definitely use the service again sometime soon.

Thank you for your feedback. We really appreciate it. Have a great day!

Ernest B.

June 6th, 2021

Forms were perfect, recorded quickly with no issue.

Thank you!

Charles C.

August 29th, 2021

While most of the material is available elsewhere, this puts it all together and can save a lot of time. It included some additional information on California SB2 exemptions that was a big help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!