Oconee County Revocation of Transfer on Death Deed Form

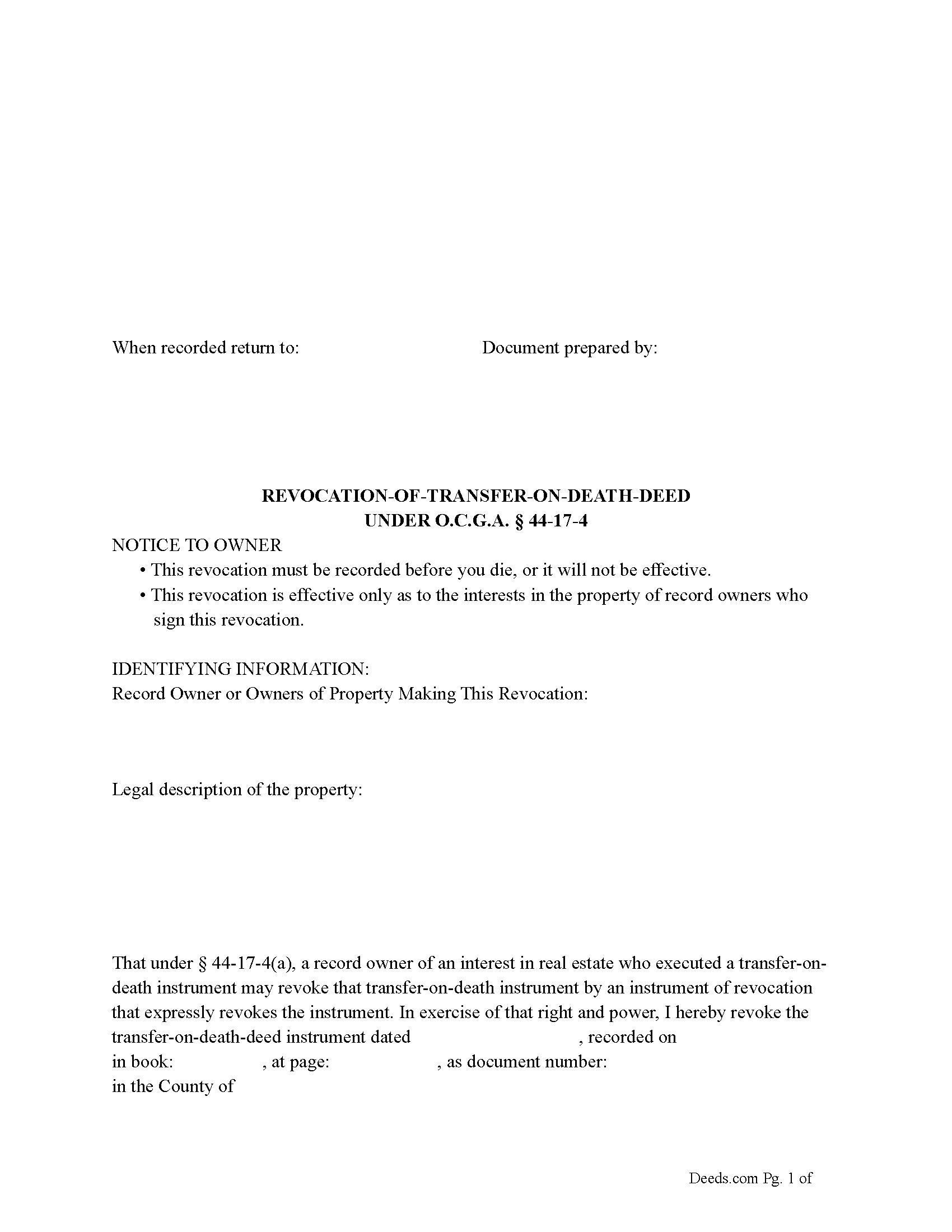

Oconee County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

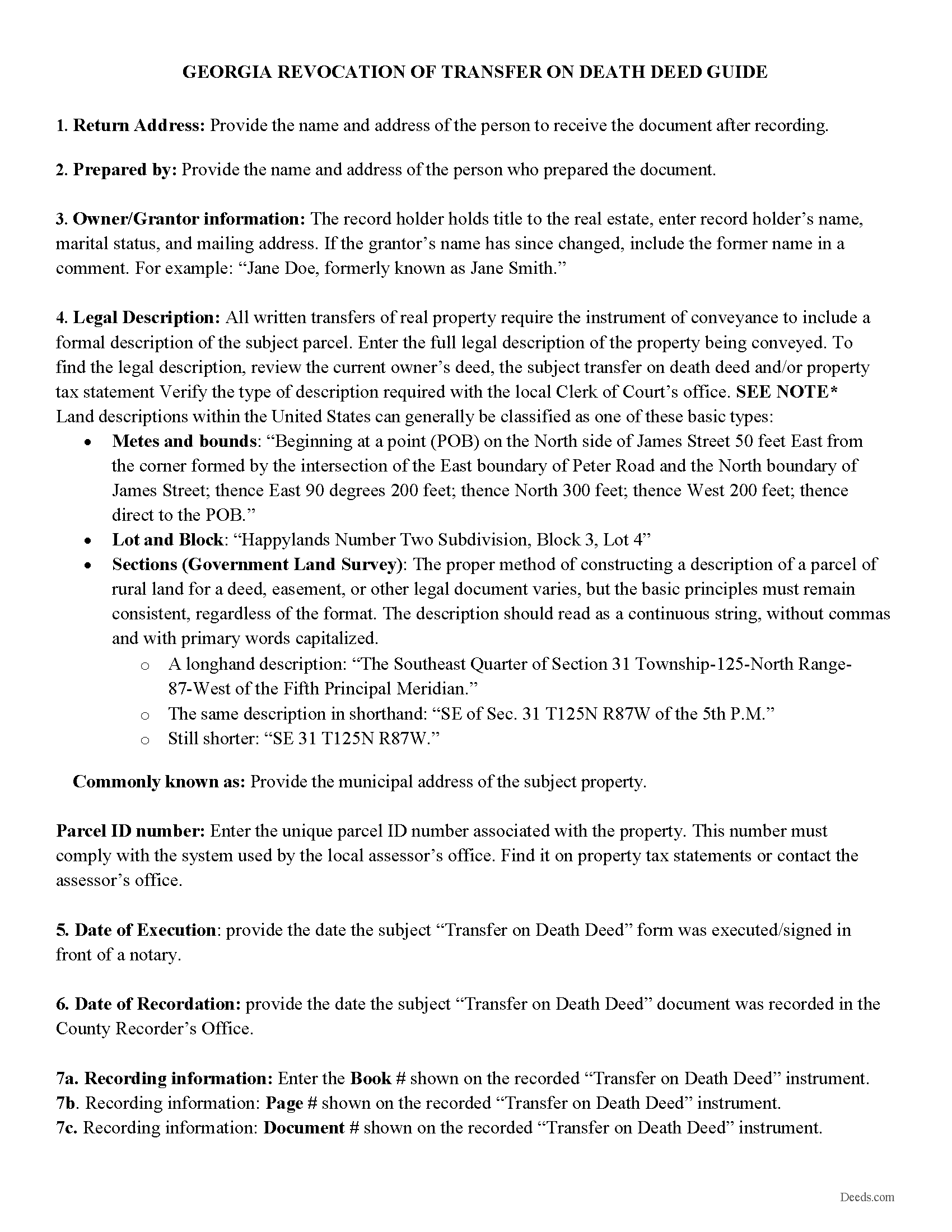

Oconee County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

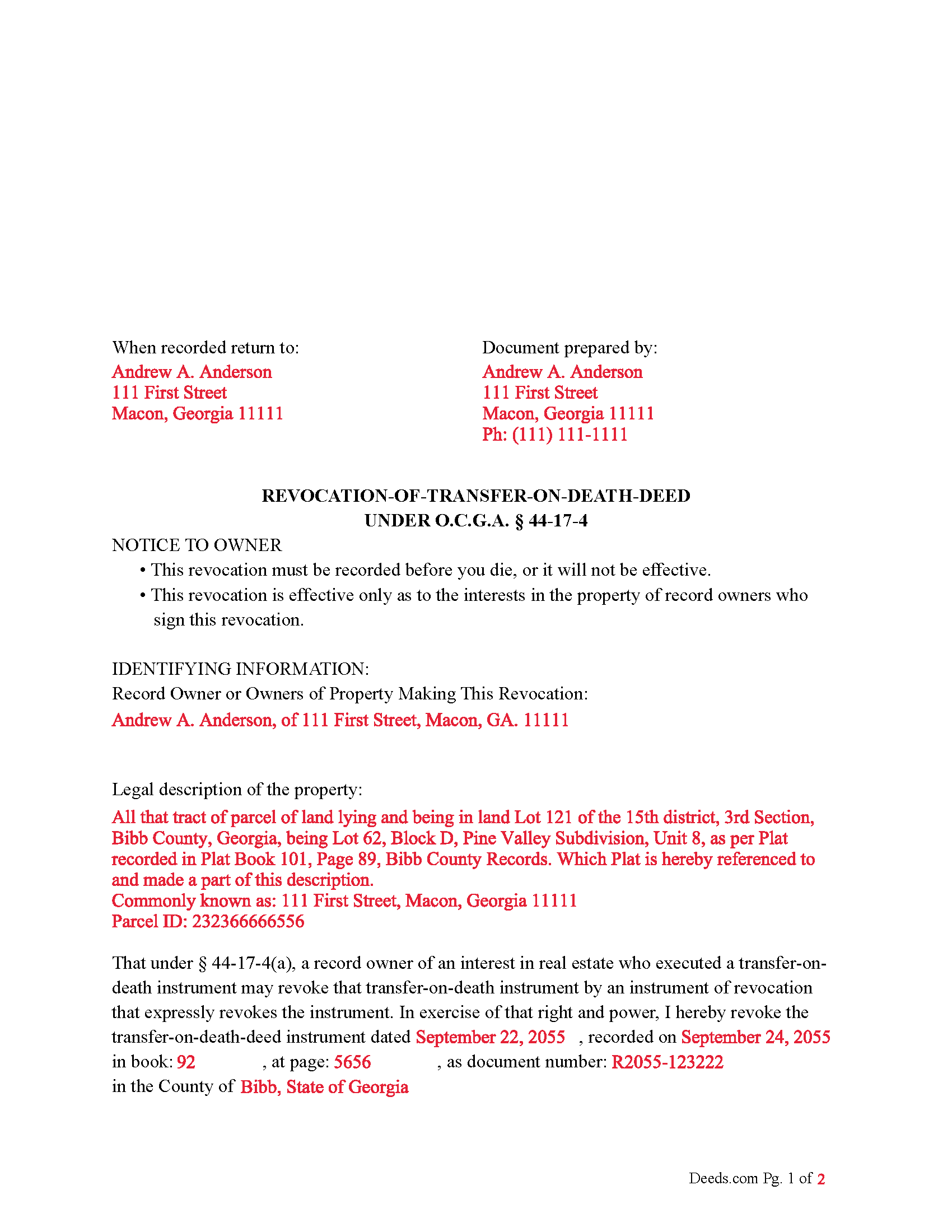

Oconee County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Oconee County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Watkinsville, Georgia 30677

Hours: 8:00am-5:00pm M-F

Phone: (706) 769-3940

Recording Tips for Oconee County:

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Oconee County

Properties in any of these areas use Oconee County forms:

- Bishop

- Bogart

- Farmington

- Watkinsville

Hours, fees, requirements, and more for Oconee County

How do I get my forms?

Forms are available for immediate download after payment. The Oconee County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Oconee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Oconee County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Oconee County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Oconee County?

Recording fees in Oconee County vary. Contact the recorder's office at (706) 769-3940 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Oconee County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Oconee County.

Our Promise

The documents you receive here will meet, or exceed, the Oconee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Oconee County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!

Terri B.

April 5th, 2021

It's worth the money. I would like to have seen a variety of examples showing different scenarios for completing a quitclaim deed.

Thank you!

Jacqueline J.

May 12th, 2020

Unable to use.

Sorry to hear that Jacqueline.

John S.

June 4th, 2019

It was very user friendly site. I was able to complete the package and mail out all within a few hours. I definitely recommend to any and all.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Edith T.

August 20th, 2021

this was wonderful. I found everything very easy to understand. And great examples.

Thank you!

David K.

August 9th, 2021

My 1st trip to your site. I give it a full 5-star rating! Thank you. I'll be back.

Thank you for your feedback. We really appreciate it. Have a great day!

Roger M.

January 22nd, 2021

EASY. WORKED WITH PROBLEMS.

Thank you!

Rodney S.

October 7th, 2021

Good service; thank you.

Thank you!

Diane G.

August 5th, 2022

easy to use

Thank you!

Donald B.

November 21st, 2021

Pretty good forms, they would probably be better if I read the directions but...

Thank you!

Christine S.

February 27th, 2019

Very good site! I found everything I needed right here on Deeds.com. Excellent quality forms, easy access, perfect delivery, reasonable price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori N.

August 16th, 2022

I ordered the document I needed and it was available for download within a half hour. Very pleased, thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dominick D.

October 21st, 2020

Deed.com was easy to work with, not just a website, they have real people that speak to you. They were extremely helpful with a VERY difficult Northeast county. They made the process smooth and effortless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexis B.

December 31st, 2018

Highly Pleased- Strongly Recommend Deeds.com Long review... sorry:-) Originally I was very skeptical due to the enormous amount of the scams going on now days and the number of online sources that "claim" to provide you with deed forms for free or for a few. Nothing that you need and want done is free. There is always a cost. So luckily I came across deeds.com. This was the only site that appeared to be simple, to the point, and made no crazy promises. So before selecting this site, I did a little more checking around/price checking to ensure I am getting the best price for the product I needed. I even checked Staples and Amazon to find that they do indeed sell these forms but I do not think the products they provide are specific for my state and county. They claim their forms provided are for all states but my state is specific and I prefer to have forms provided by Deeds.com that is based on Indiana statute that Deed.com clearly identifies on each form. Deeds.com price of $20 seemed a little high at first but when I saw the products provided, the $20 cost is more than reasonable and fair. You not only get the deed form specific for my state and my specific "county" but also the other various/supplemental forms that may be required. Being familiar with my state and knowing how tedious and anal my state is on everything, I was pleasantly please to see the info and extra supplemental forms provided. For example, a person new to the State who recently had property deeded to them, would not necessarily know about the Homestead tax exemption provided if property is your primary residents, over 65 exemption etc. I would highly recommend this site for anyone needing these documents because Deeds.com has you covered on any and all forms/info you could ever need! A bonus is that there is one flat fee and not monthly cost that you have to worry about canceling later unless you superficially select a monthly package. I love the fact that Deeds.com is nothing fancy. There is not a bunch of elaborate graphics etc. They only provide what you need and what they provide is very accurate. Deeds.com has a customer for life.

Thank you so much Alexis. We appreciate you, have a fantastic day.

CARRIE T.

March 10th, 2022

Thought it was pretty simple to use.

Thank you!