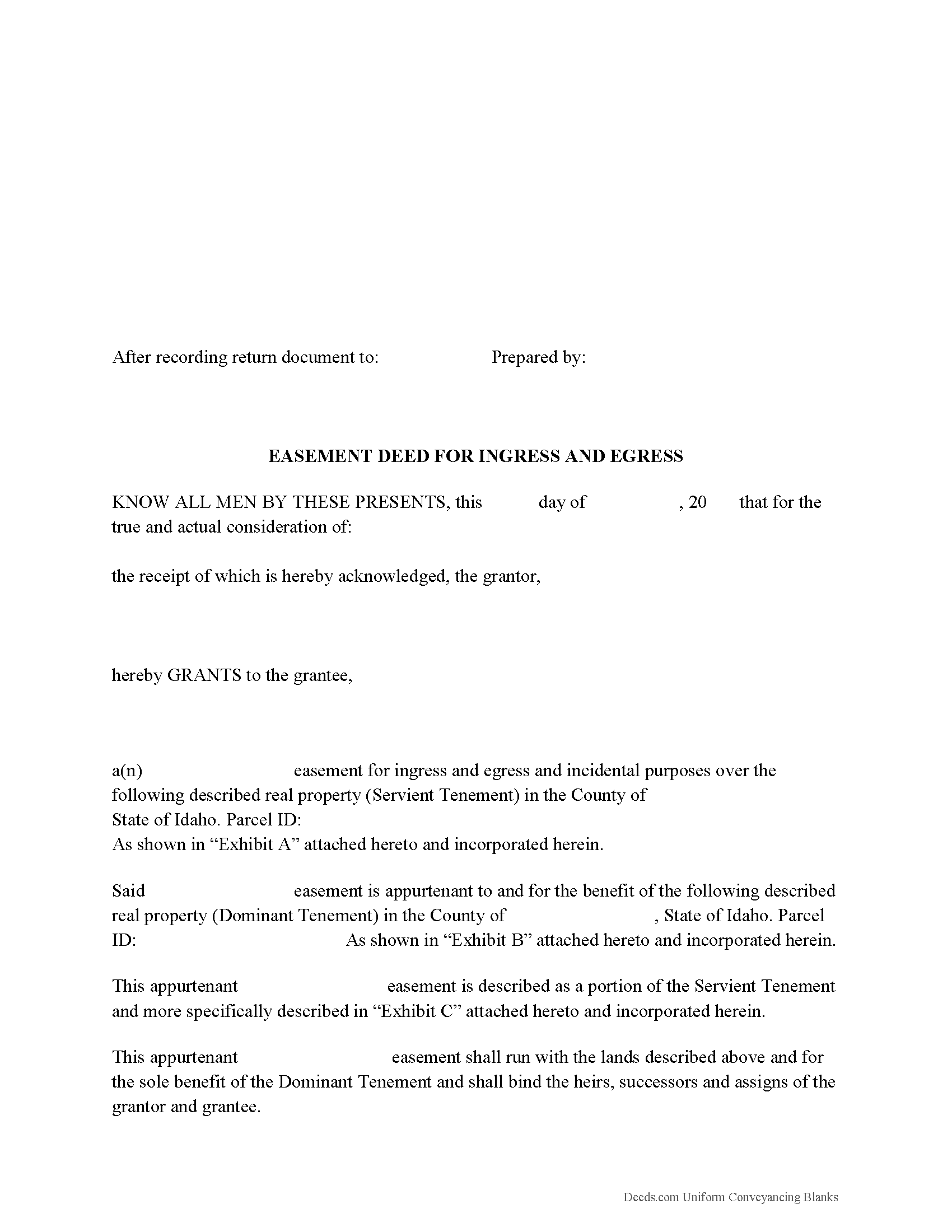

Kootenai County Easement Deed Form

Kootenai County Easement Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

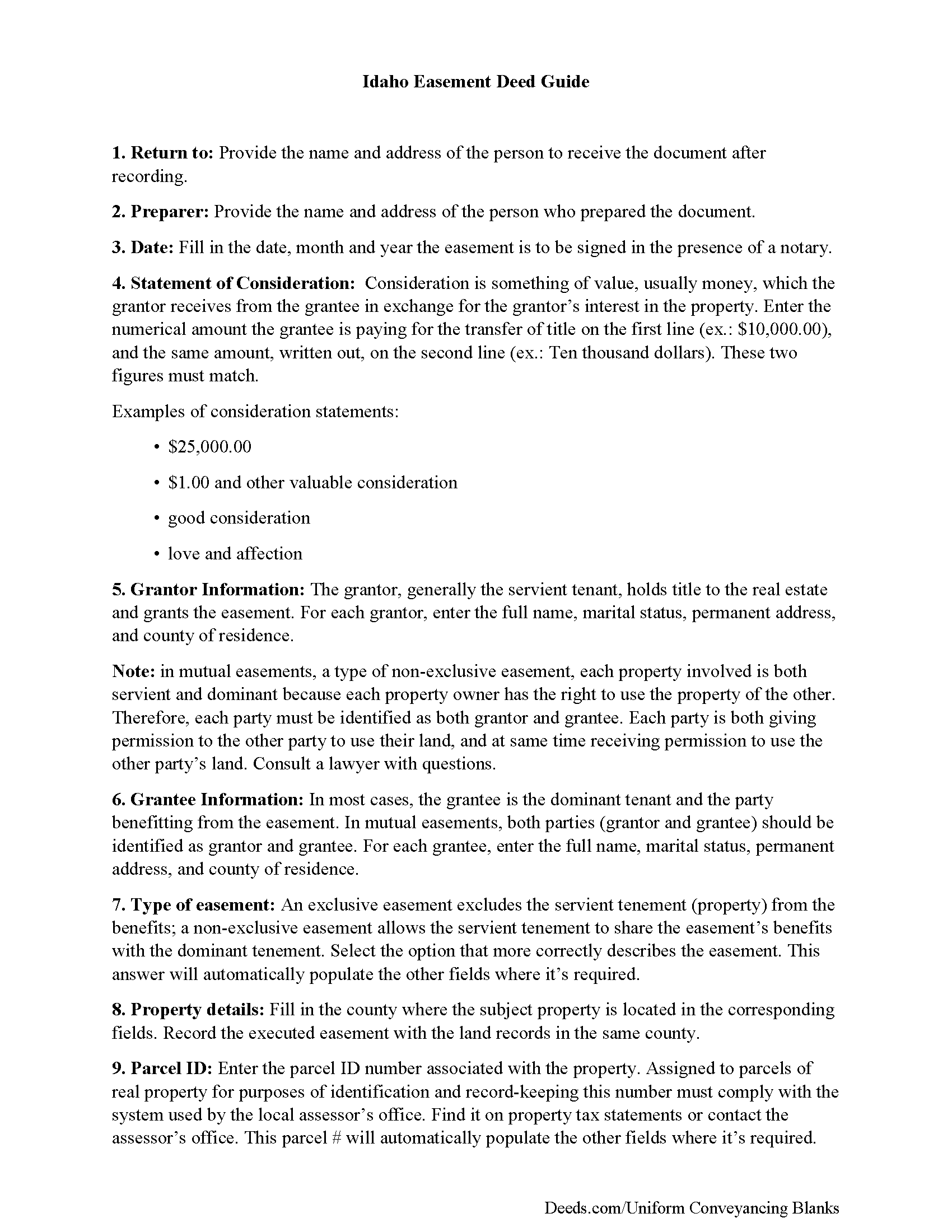

Kootenai County Easement Deed Guide

Line by line guide explaining every blank on the form.

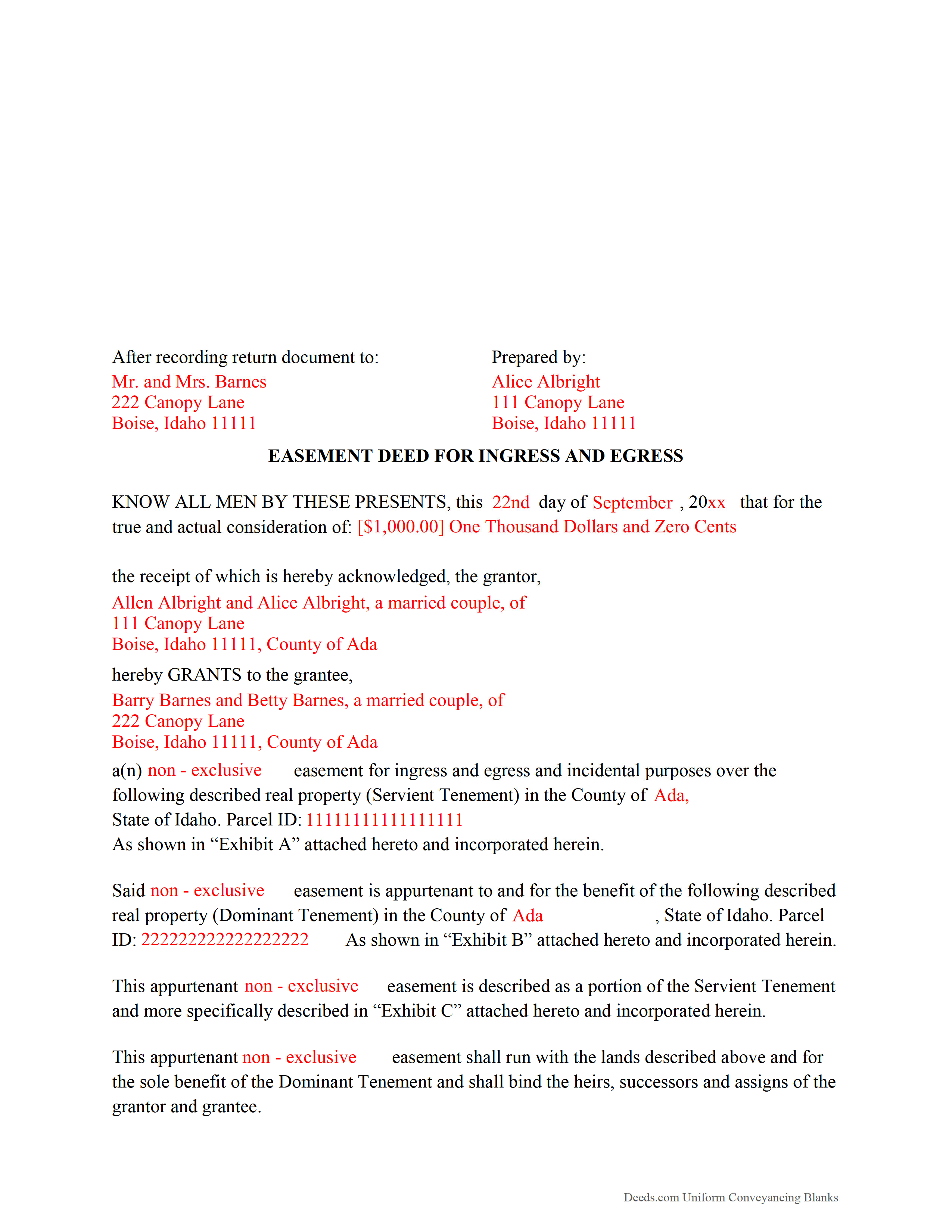

Kootenai County Completed Example of the Easement Deed Document

Example of a properly completed form for reference.

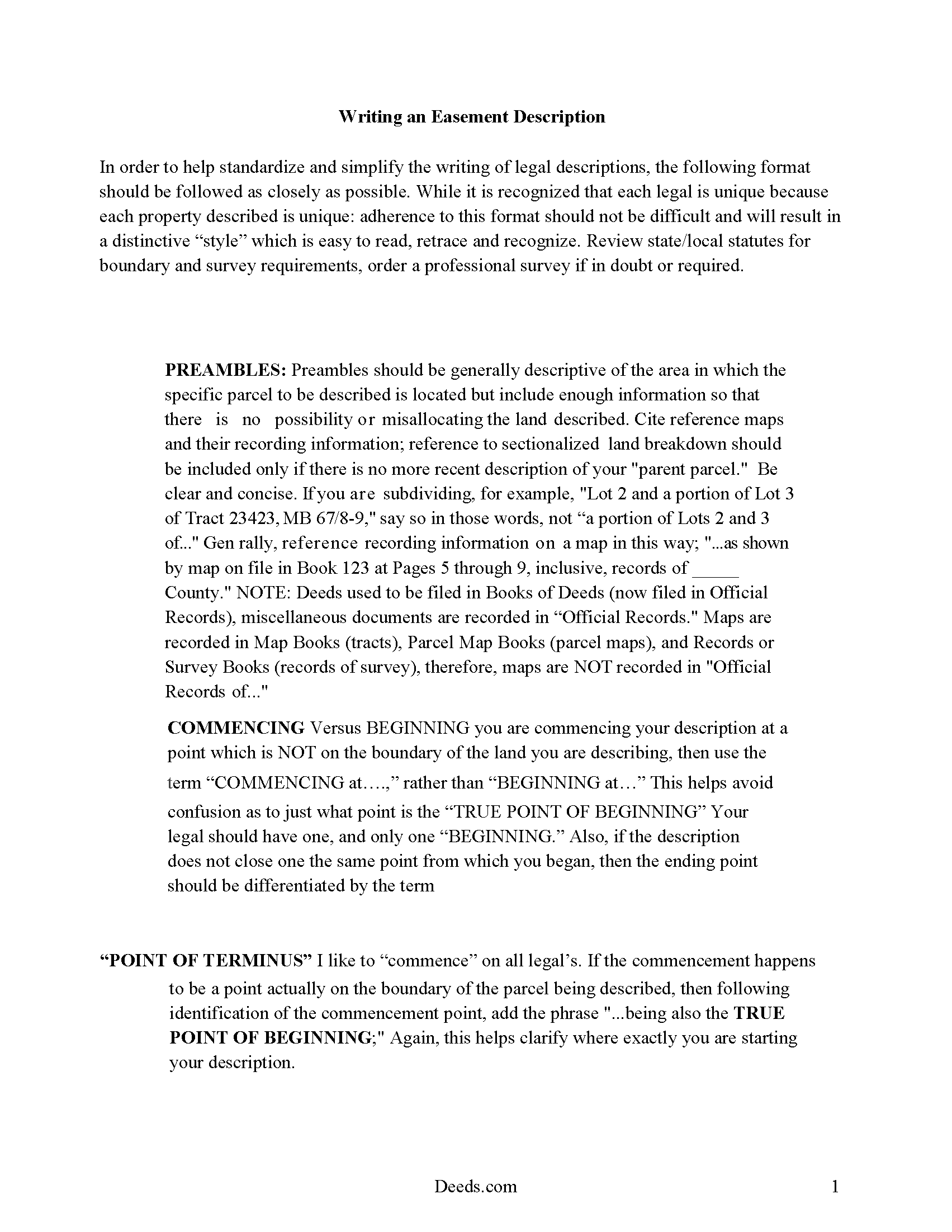

Kootenai County Guide to Writing an Easement Description

A Description of the Easement will be required. This will show how to write an acceptable description for a Right of Way Easement, which gives access, to and from - point A to point B.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Kootenai County documents included at no extra charge:

Where to Record Your Documents

Kootenai County Recorder

Coeur d'Alene, Idaho 83814 / 83816-9000

Hours: Mon - Fri 9:00 to 5:00; Sat 9:00 to 2:00

Phone: (208) 446-1480

Recording Tips for Kootenai County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Kootenai County

Properties in any of these areas use Kootenai County forms:

- Athol

- Bayview

- Cataldo

- Coeur D Alene

- Harrison

- Hayden

- Medimont

- Post Falls

- Rathdrum

- Spirit Lake

- Worley

Hours, fees, requirements, and more for Kootenai County

How do I get my forms?

Forms are available for immediate download after payment. The Kootenai County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kootenai County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kootenai County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kootenai County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kootenai County?

Recording fees in Kootenai County vary. Contact the recorder's office at (208) 446-1480 for current fees.

Questions answered? Let's get started!

An easement is the right or interest to use another's land for a specific purpose. An easement deed is the instrument in writing which entitles the holder to a privilege or benefit, such as to place access points, pipe lines, or roads on another's land. Easements can be temporary or permanent. An easement in Idaho can also be obtained for the purpose of exposure of a solar energy device to sunlight, which is known as a solar easement. This type of easement is created in writing and is subject to the same requirements as other easements (55-615). A conservation easement can also be created in Idaho, and must also conform to the laws for other easements and conveyances (55-2101).

A transfer of real property in this state will pass all the easements attached to the land, and will create in favor thereof an easement to use other real property of the person whose estate is transferred, in the same manner and to the same extent as such property was obviously and permanently used by the person whose estate is transferred, for the benefit thereof, at the time when the transfer was completed or agreed upon (55-603).

In order for an easement deed to be eligible for recording, it must be signed by the grantor and acknowledged according to law. If not acknowledged, the execution of the easement deed can be proved in a manner dictated by statute (55-718). Easement deeds that have been executed and acknowledged in a state other than Idaho are entitled to be recorded by a county recorder in Idaho if they have been executed and acknowledged according to the laws of the state wherein such acknowledgements were made (55-805). Easements deeds must contain a proper certificate of acknowledgement in order to be recorded in this state, regardless of where they were acknowledged. Acknowledgements can be made before any of the officers listed in 55-701 of the Idaho Revised Statutes and must also meet the requirements as set forth in 55-707.

If left unrecorded, an easement deed is void as against any subsequent purchaser or mortgagee of the same property, or part thereof, in good faith and for a valuable consideration, whose conveyance is first duly recorded (55-812). However, an unrecorded easement deed is valid between the parties to it and those who have notice of it (55-815). Easement deeds and other instruments affecting the title to real property that are acknowledged or proved, and certified, and recorded as prescribed by law, from the time they are filed with the recorder, are constructive notice of the contents to subsequent purchasers and mortgagees. Easement deeds should be recorded by the county recorder of the county where the property is located (55-808).

Important: Your property must be located in Kootenai County to use these forms. Documents should be recorded at the office below.

This Easement Deed meets all recording requirements specific to Kootenai County.

Our Promise

The documents you receive here will meet, or exceed, the Kootenai County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kootenai County Easement Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Mario G.

November 3rd, 2021

Very courteous staff, and helpful didn't take any time for someone to assist me on my needs Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

John S.

May 20th, 2023

Easy to use website and reasonably priced forms. I recommend it.

Thank you for the kind words John.

ROBERT H.

September 13th, 2020

Quick and easy. A very good value even without COVID complications. Since we DO have COVID complications this is perfect.

Thank you for your feedback. We really appreciate it. Have a great day!

Warren B.

June 11th, 2022

Outstanding. There is nothing worse than finding the correct forms or having to hire an atty to do what most people can do on their own. I cant speak for all but these forms are fairly easy. The addition of guides and supplement forms are excellent. I just saved quite a bit of money with your site. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca Q.

January 19th, 2019

Very helpful! Unfortunately, they didn't have what I needed, but they got back to me quickly and didn't charge me anything. Easy to work with.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark M.

November 5th, 2020

Deeds was easy to use and worked as specified; they got the recording I needed done finished in one day!

Thank you for your feedback. We really appreciate it. Have a great day!

oscar r.

December 17th, 2021

VERY MUCH HELPFUL SAVED ME 600 on not having to hire attorney

Thank you!

Audra W.

December 16th, 2021

Excellent source for obtaining documents and instructions.

Thank you!

Rose H.

March 22nd, 2021

I am so glad I found this resource! As the Executor of a family members estate I wanted to save money by bypassing a lawyer as it seemed pretty straight forward to tranfer a Life Estate to the remainderman. (I had original deeds). But talking with 3 different states and 4 different counties - none of which seemed to need the same documents, I was almost ready to dump this in a lawyer's lap. This resource makes it simple!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel S.

February 11th, 2019

It was easy to find the forms I was looking for and the guided steps and examples of how to use the form were beneficial.

Thank you for your feedback. We really appreciate it. Have a great day!

Delroy S.

July 2nd, 2019

Simple and complete. I found all the forms and Instructions I was looking for. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathryn L.

July 27th, 2020

I went to the recorders office. Had no problem was finished in about 10 minutes .The forms was excellent . With the instructions it was easy for me to fill out. Thank you, Kathryn L

Thank you for your feedback. We really appreciate it. Have a great day!

Hans S.

April 22nd, 2022

This is my first time using this service so having not yet filed the documents I purchased, I will say that I am impressed at how comprehensive the instructions are that accompany the document I purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wilma M.

August 7th, 2020

Amazingly easy. Thank you

Thank you!

Edward L.

March 6th, 2019

Excellent web site with just the right documents. Filled a very important need in less tha 2 minutes time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!