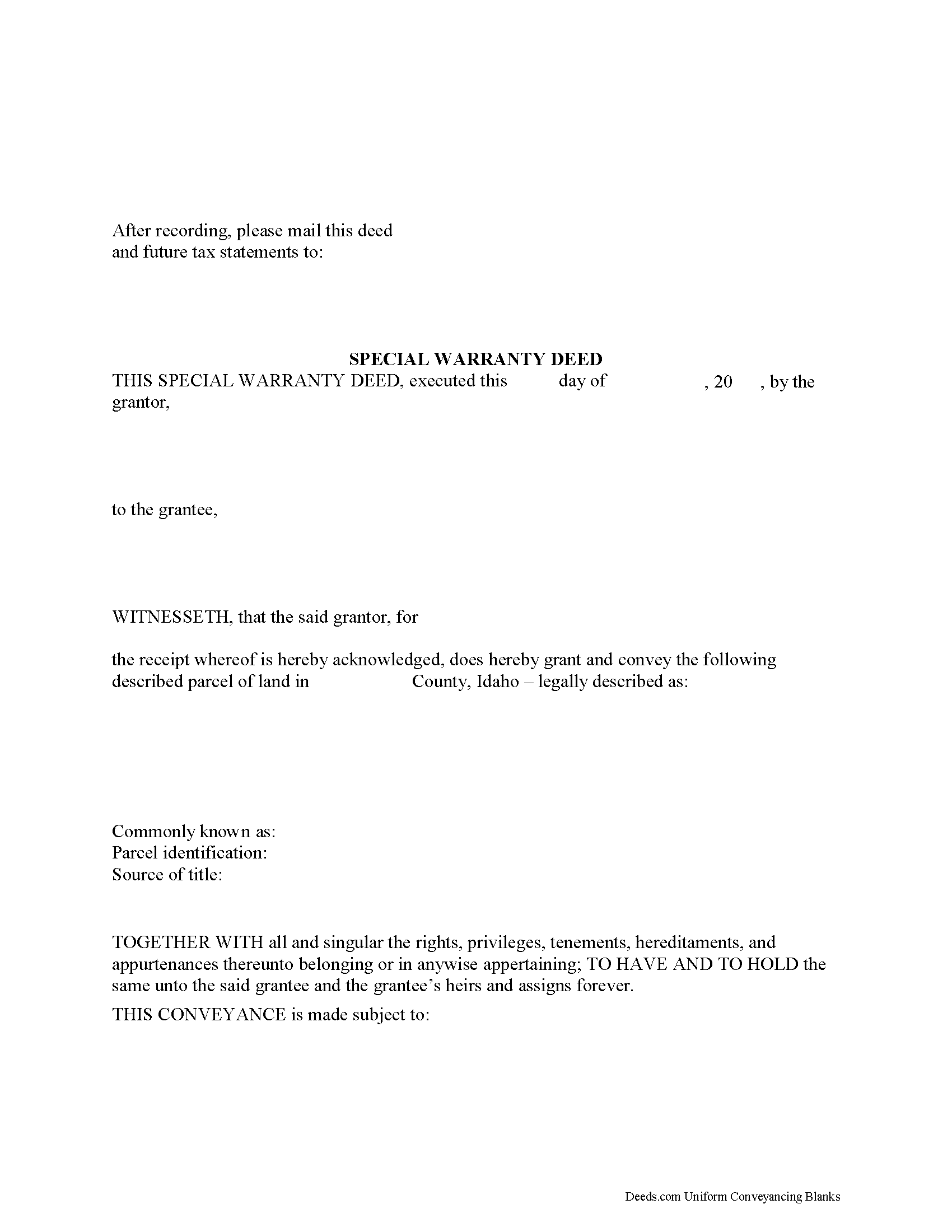

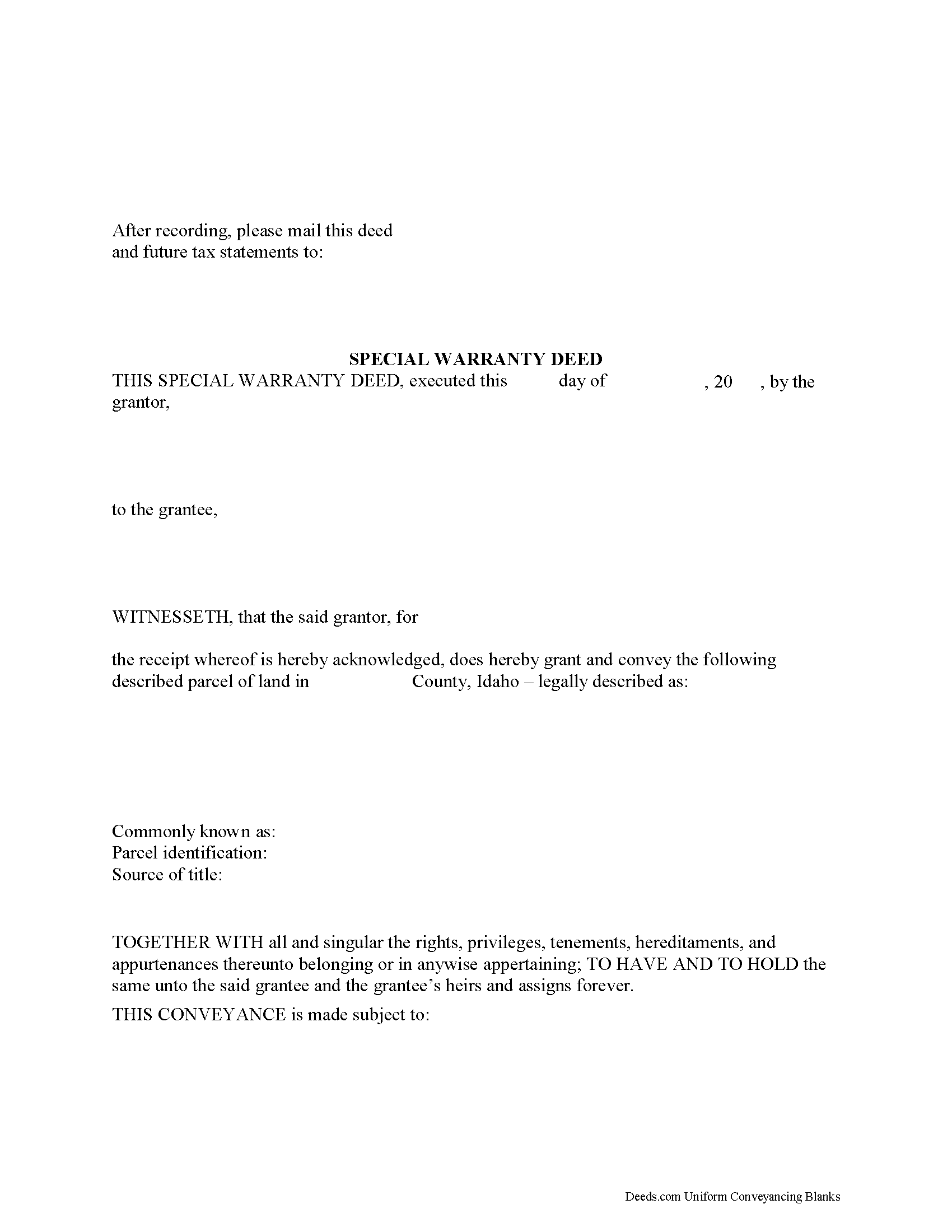

Download Idaho Special Warranty Deed Legal Forms

Idaho Special Warranty Deed Overview

Title to real estate in Idaho can be made by a duly executed special warranty deed. This type of deed must meet statutory requirements for a conveyance of real property.

The Idaho Statutes do not offer a statutory form for a special warranty deed. A special warranty deed includes a covenant from the grantor to defend the title against only the claims and demands of the grantor and those claiming by, through, or under the grantor.

A special warranty deed must be signed and acknowledged by the grantor before the deed can be recorded, or the execution must be proved, and the acknowledgement or proof should be certified in the manner provided by statute. If an instrument has been executed and acknowledged in any other state or territory of the United States according to the laws of the state wherein such acknowledgment was taken, the deed will be entitled to record in Idaho (55-805). All special warranty deeds must contain a proper certificate of acknowledgment in order to be recorded in Idaho. Acknowledgements may be made at any place within the state of Idaho, before a justice or clerk of the Supreme Court, or a notary public, of the Secretary of State, or United States commissioner (55-701). Acknowledgements must meet the requirements set forth in 55-707 of the Idaho Revised Statutes. When not acknowledged, the proof of the execution of the instrument can be made by the parties executing it or by either of them, by subscribing witnesses, or by other witnesses (55-718).

Duly executed and acknowledged special warranty deeds should be recorded by the county recorder of the county where the property is located (55-808). Every deed that is recorded as prescribed by law, from the time it is filed with the recorder, is constructive notice of the contents to subsequent purchasers and mortgagees. Further, every conveyance of real property that is duly acknowledged or proved, certified, and recorded, and which is executed by one who thereafter acquires an interest in said real property by a conveyance which is constructive notice as aforesaid, is, from the time the latter conveyance is recorded, constructive notice of the contents to subsequent purchasers and mortgagees (55-811). An unrecorded special warranty deed is void as against any subsequent purchaser or mortgagee of the same property, or part thereof, in good faith and for a valuable consideration, whose conveyance is first duly recorded (55-812). However, the unrecorded deed is valid between the parties to it and those who have notice of it (55-815).