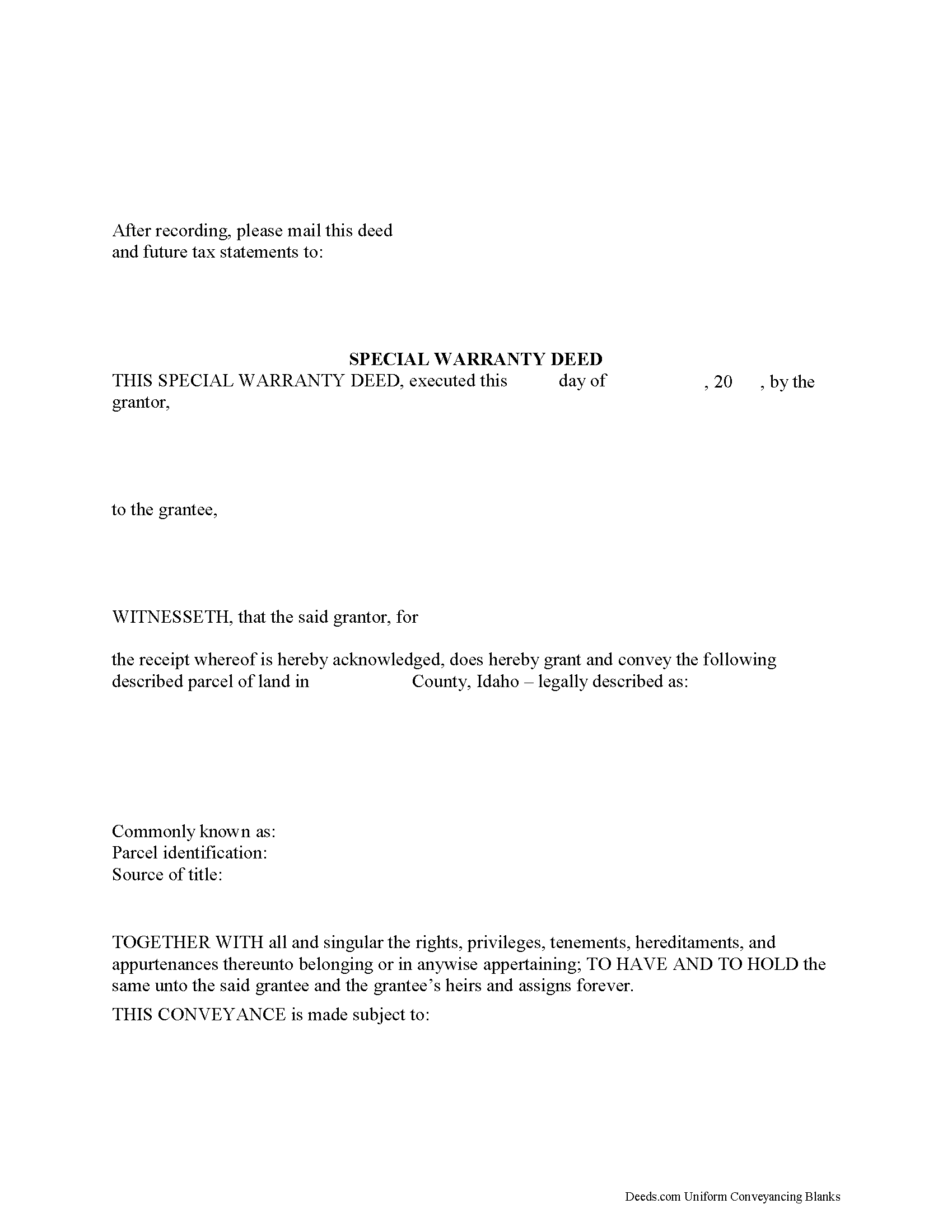

Clearwater County Special Warranty Deed Form

Clearwater County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

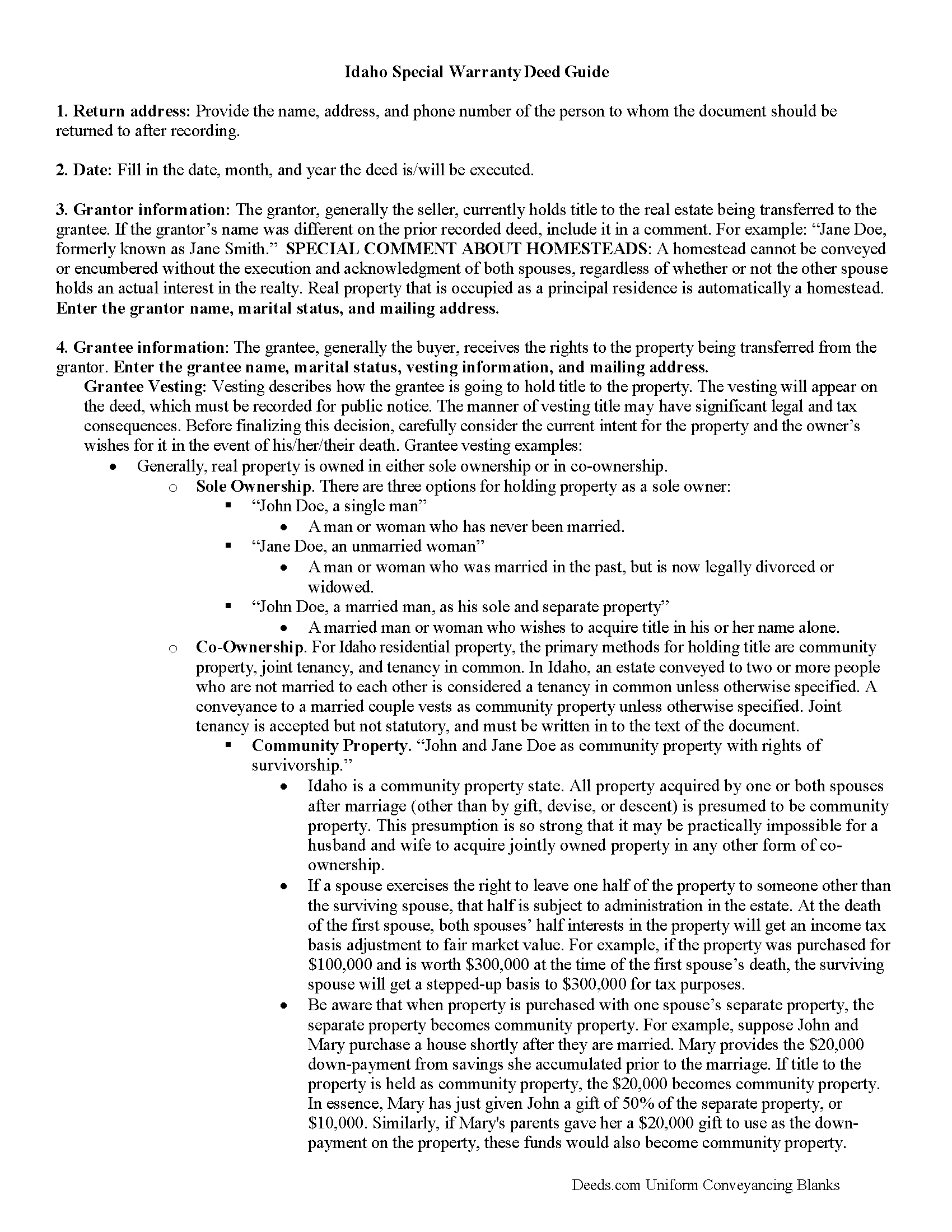

Clearwater County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

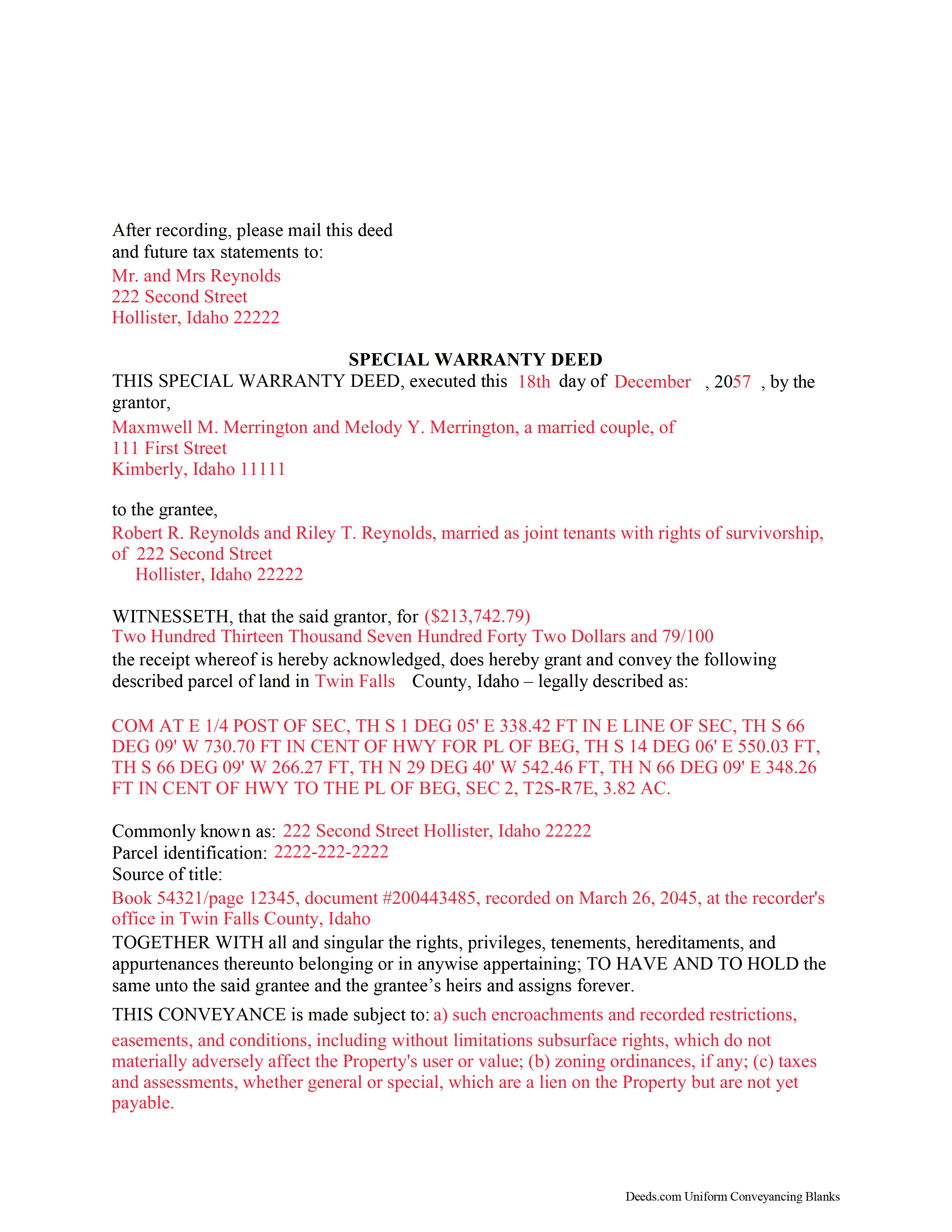

Clearwater County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Clearwater County documents included at no extra charge:

Where to Record Your Documents

Clearwater County Clerk-Auditor-Recorder

Orofino, Idaho 83544

Hours: 8:00am-5:00pm M-F

Phone: (208) 476-5615

Recording Tips for Clearwater County:

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Clearwater County

Properties in any of these areas use Clearwater County forms:

- Ahsahka

- Elk River

- Lenore

- Orofino

- Pierce

- Weippe

Hours, fees, requirements, and more for Clearwater County

How do I get my forms?

Forms are available for immediate download after payment. The Clearwater County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clearwater County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clearwater County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clearwater County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clearwater County?

Recording fees in Clearwater County vary. Contact the recorder's office at (208) 476-5615 for current fees.

Questions answered? Let's get started!

Title to real estate in Idaho can be made by a duly executed special warranty deed. This type of deed must meet statutory requirements for a conveyance of real property.

The Idaho Statutes do not offer a statutory form for a special warranty deed. A special warranty deed includes a covenant from the grantor to defend the title against only the claims and demands of the grantor and those claiming by, through, or under the grantor.

A special warranty deed must be signed and acknowledged by the grantor before the deed can be recorded, or the execution must be proved, and the acknowledgement or proof should be certified in the manner provided by statute. If an instrument has been executed and acknowledged in any other state or territory of the United States according to the laws of the state wherein such acknowledgment was taken, the deed will be entitled to record in Idaho (55-805). All special warranty deeds must contain a proper certificate of acknowledgment in order to be recorded in Idaho. Acknowledgements may be made at any place within the state of Idaho, before a justice or clerk of the Supreme Court, or a notary public, of the Secretary of State, or United States commissioner (55-701). Acknowledgements must meet the requirements set forth in 55-707 of the Idaho Revised Statutes. When not acknowledged, the proof of the execution of the instrument can be made by the parties executing it or by either of them, by subscribing witnesses, or by other witnesses (55-718).

Duly executed and acknowledged special warranty deeds should be recorded by the county recorder of the county where the property is located (55-808). Every deed that is recorded as prescribed by law, from the time it is filed with the recorder, is constructive notice of the contents to subsequent purchasers and mortgagees. Further, every conveyance of real property that is duly acknowledged or proved, certified, and recorded, and which is executed by one who thereafter acquires an interest in said real property by a conveyance which is constructive notice as aforesaid, is, from the time the latter conveyance is recorded, constructive notice of the contents to subsequent purchasers and mortgagees (55-811). An unrecorded special warranty deed is void as against any subsequent purchaser or mortgagee of the same property, or part thereof, in good faith and for a valuable consideration, whose conveyance is first duly recorded (55-812). However, the unrecorded deed is valid between the parties to it and those who have notice of it (55-815).

Important: Your property must be located in Clearwater County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Clearwater County.

Our Promise

The documents you receive here will meet, or exceed, the Clearwater County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clearwater County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Charles H.

December 8th, 2020

Website is user-friendly and very helpful, butI will have to wait until I submit my documents to the Clerk of Court to see if they are acceptable.

Thank you for your feedback. We really appreciate it. Have a great day!

sharon s.

October 22nd, 2020

great site for downloading forms

Thank you!

Anita M.

March 10th, 2019

This was a very easy process to find the correct documents and download them. The price was also reasonable.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly H.

June 24th, 2021

Excellent and Helpful as well as patient. Great Service.

Thank you!

Kevin M.

May 14th, 2019

All I can say is WOW. They were so fast and professional. I received my copy of my deed that same day I requested it. There was some confusion on my part but within minutes it was explained.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chad S.

April 1st, 2019

GREAT SERVICE. A MUST HAVE FOR EVERY REAL ESTATE TRANSACTION!!THANK YOU FOR PROVIDING SUCH A CONVIENIENT EASY TO UNDERSTAND SERVICE.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!

silvia m.

November 5th, 2019

Used the forms for a quitclaim deed. Worked great! Also, big bonus to have the extra forms available, needed a couple of them. Highly recommend...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ariel S.

June 3rd, 2020

Awesome....love the ease of use and response.

Thank you for the kinds words Ariel, we appreciate you! Have a fantastic day!

Thomas W.

June 30th, 2020

Fast, efficient, and helpful. I don't often have documents that need recording but I found Deeds.com incredibly handy. It cost me no more and probably less than if I'd gone in to do it myself. It was especially helpful during this Covid-19 stay-at-home time. It all happened within a couple of hours and I had my recorded copies in my hands.

Thank you for your feedback. We really appreciate it. Have a great day!

Helen M.

May 19th, 2020

The forms are very confusing when there is so much to download! Trying to keep track and make sure you have everything needed is terrible! I think I have everything but I was under the impression I would be filling it out online and with instructions... I am very disappointed to say the least!

Sorry to hear of your disappointment Helen. We have gone ahead and canceled your order and payment. We do hope that you are able to find something more suitable to your needs elsewhere. Have a wonderful day.

Robert H.

March 17th, 2021

Just what I needed to file in Orange County. East to use and reasonably priced. Will use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Travis S.

February 25th, 2020

Glad this existed.

Thank you!