Minidoka County Substitution of Trustee and Deed of Full Reconveyance Form

Minidoka County Substitution of Trustee and Deed of Full Reconveyance Form

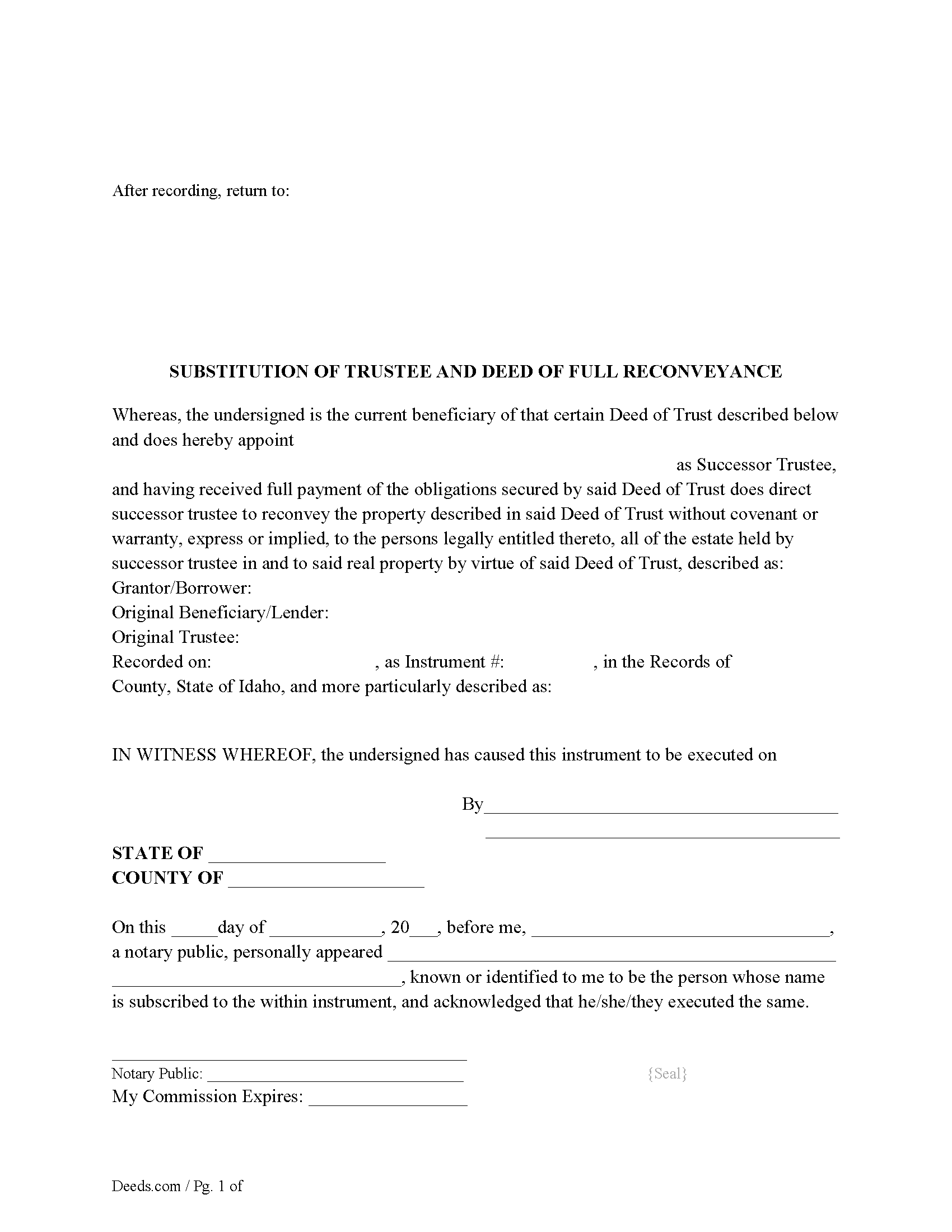

Fill in the blank form formatted to comply with all recording and content requirements.

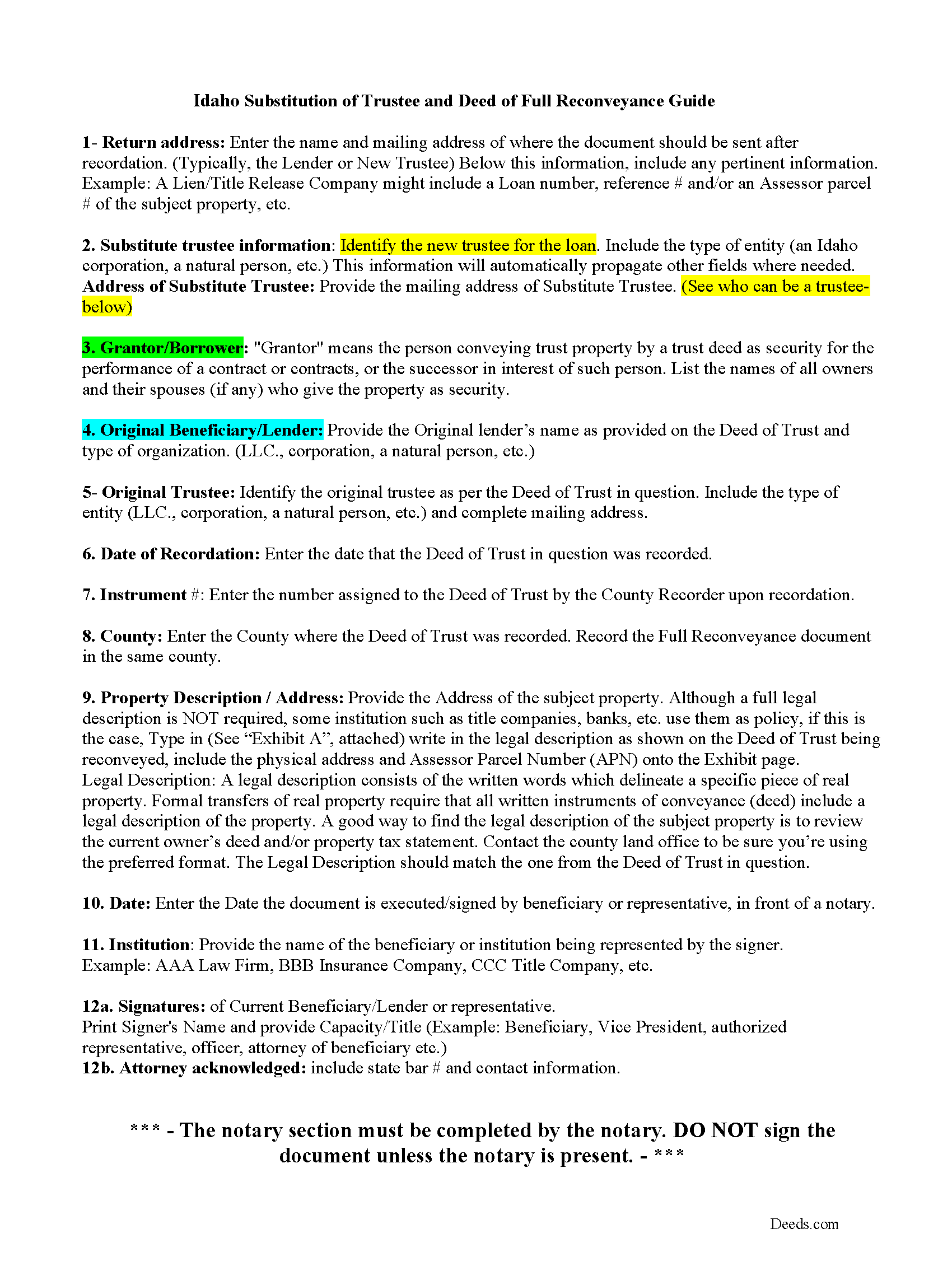

Minidoka County Guidelines for Substitution of Trustee and Deed of Full Reconveyance Form

Line by line guide explaining every blank on the form.

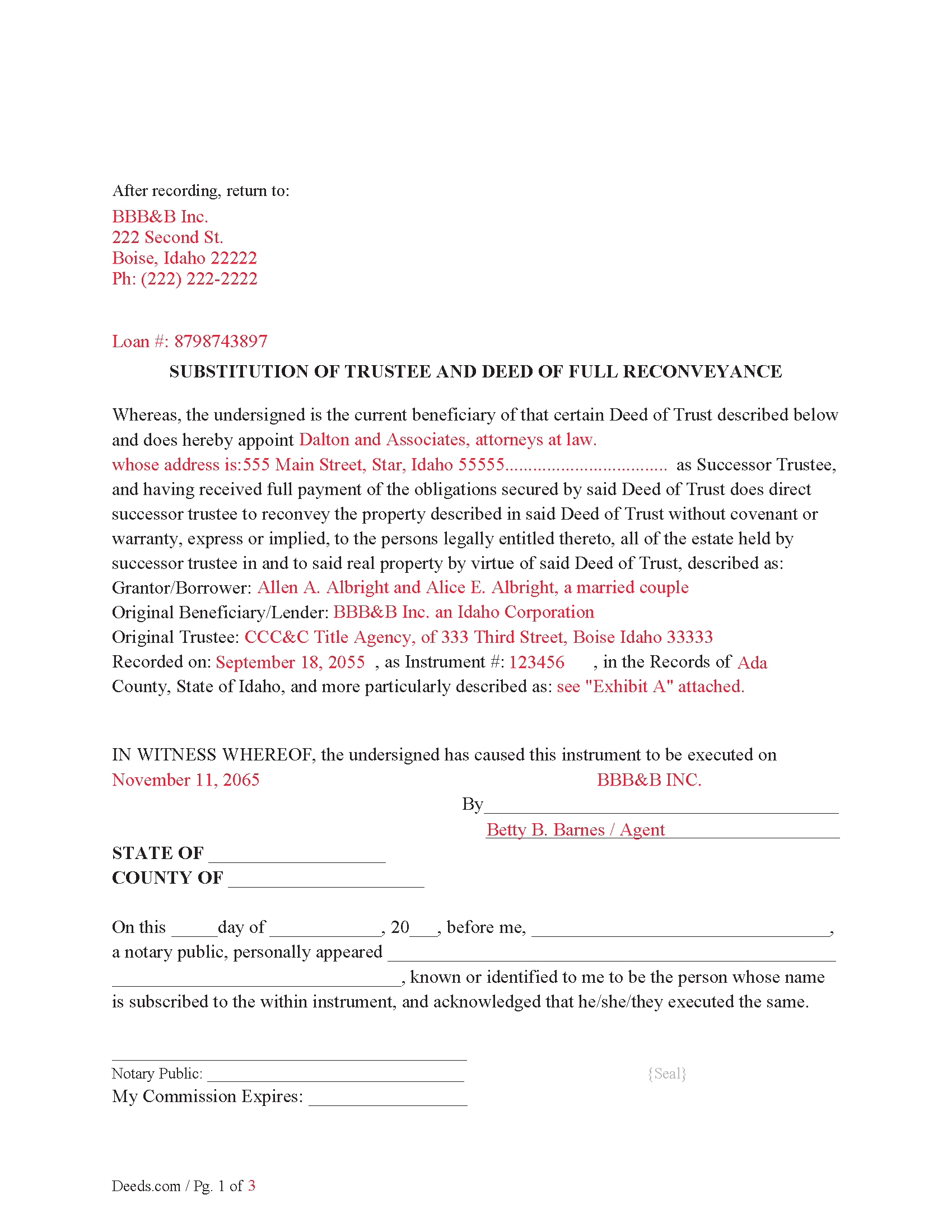

Minidoka County Completed Example of the Substitution of Trustee and Deed of Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Minidoka County documents included at no extra charge:

Where to Record Your Documents

Minidoka County Clerk-Auditor-Recorder

Rupert, Idaho 83350

Hours: 8:30 a.m. - 4:30 p.m. Monday - Friday

Phone: (208) 436-9511

Recording Tips for Minidoka County:

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Minidoka County

Properties in any of these areas use Minidoka County forms:

- Heyburn

- Minidoka

- Paul

- Rupert

Hours, fees, requirements, and more for Minidoka County

How do I get my forms?

Forms are available for immediate download after payment. The Minidoka County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Minidoka County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Minidoka County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Minidoka County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Minidoka County?

Recording fees in Minidoka County vary. Contact the recorder's office at (208) 436-9511 for current fees.

Questions answered? Let's get started!

This form is used by the current beneficiary/lender to substitute an existing trustee with a successor trustee who then has the power to reconvey the Deed of Trust back to the grantor/borrower(s). This is typically performed when the loan/note has been satisfied and the current trustee can't or won't act, or the beneficiary/lender decides to choose a different trustee to reconvey the Deed of Trust in question. This form includes the required written request from the beneficiary to the trustee to reconvey the property. Acknowledgments are required from the current beneficiary/lender and the appointed successor trustee, included are two notary statements, allowing flexibility of the beneficiary acknowledging at one time and place and the successor trustee acknowledging at another time and place if need be.

45-1514. RECONVEYANCE UPON SATISFACTION OF OBLIGATION.

Upon performance of the obligation secured by the deed of trust, the trustee upon written request of the beneficiary shall reconvey the estate of real property described in the deed of trust to the grantor; providing that in the event of such performance and the refusal of any beneficiary to so request or the trustee to so reconvey, as above provided, such beneficiary or trustee shall be liable as provided by law in the case of refusal to execute a discharge or satisfaction of a mortgage on real property.

For use in Idaho only.

Important: Your property must be located in Minidoka County to use these forms. Documents should be recorded at the office below.

This Substitution of Trustee and Deed of Full Reconveyance meets all recording requirements specific to Minidoka County.

Our Promise

The documents you receive here will meet, or exceed, the Minidoka County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Minidoka County Substitution of Trustee and Deed of Full Reconveyance form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Jacqueline G.

October 10th, 2019

Great site, user friendly. Exactly what we needed and the detailed instructions/completed sample were a nice touch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance G.

January 12th, 2021

Fast and dependable service, which is so critical in the real estate business. Excellent experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

diana l.

July 19th, 2024

Easy to use & got my one question answered in less than 5 minutes! Excellence.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

William O.

June 13th, 2025

form worked great but was over priced for such a simple form , should be around $10 and most people could easily create this themselves.

Hi William, thank you for your review. We’re glad the form worked well for you. We understand it may seem simple on the surface, but Transfer on Death Deeds—especially in New York—require precise language and adherence to both state and county-level rules. Our forms are attorney-prepared, regularly reviewed for legal compliance, and include helpful instructions to reduce the risk of costly filing errors. We appreciate your feedback and hope the document serves its purpose smoothly.

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Cathy S.

October 15th, 2022

Great forms! Repeat customer here, wouldn't go anywhere else.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

William A.

September 11th, 2019

I was able to get the documents I wanted, and very quickly. Good service.

Thank you!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer. I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Raymond R C.

September 10th, 2019

Old document deeds were not available and my cost was returned. Was referred to another location and was able to get some help there.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer M P.

December 14th, 2022

Locating the deed I needed was not too hard. I love that you can download and complete it on your time frame.

Thank you!

Craig H.

February 26th, 2022

Worked exactly like it was supposed to. No glitches

Thank you for your feedback. We really appreciate it. Have a great day!

Sol B.

February 13th, 2020

Got me all the info I was looking for Thanks you deeds.com

Thank you!

Debra B.

April 14th, 2020

I was very glad to have this option for filing a form as it would have taken 4 days due to offices being closed to the public during the COVID 19 epidemic. I found the process to be fairly simple and I was able to file the document within 24 hours.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald S.

August 15th, 2022

The paperwork for our transfer on death deed was easy to fill out and the county has excepted it for recording Very satisfied.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!