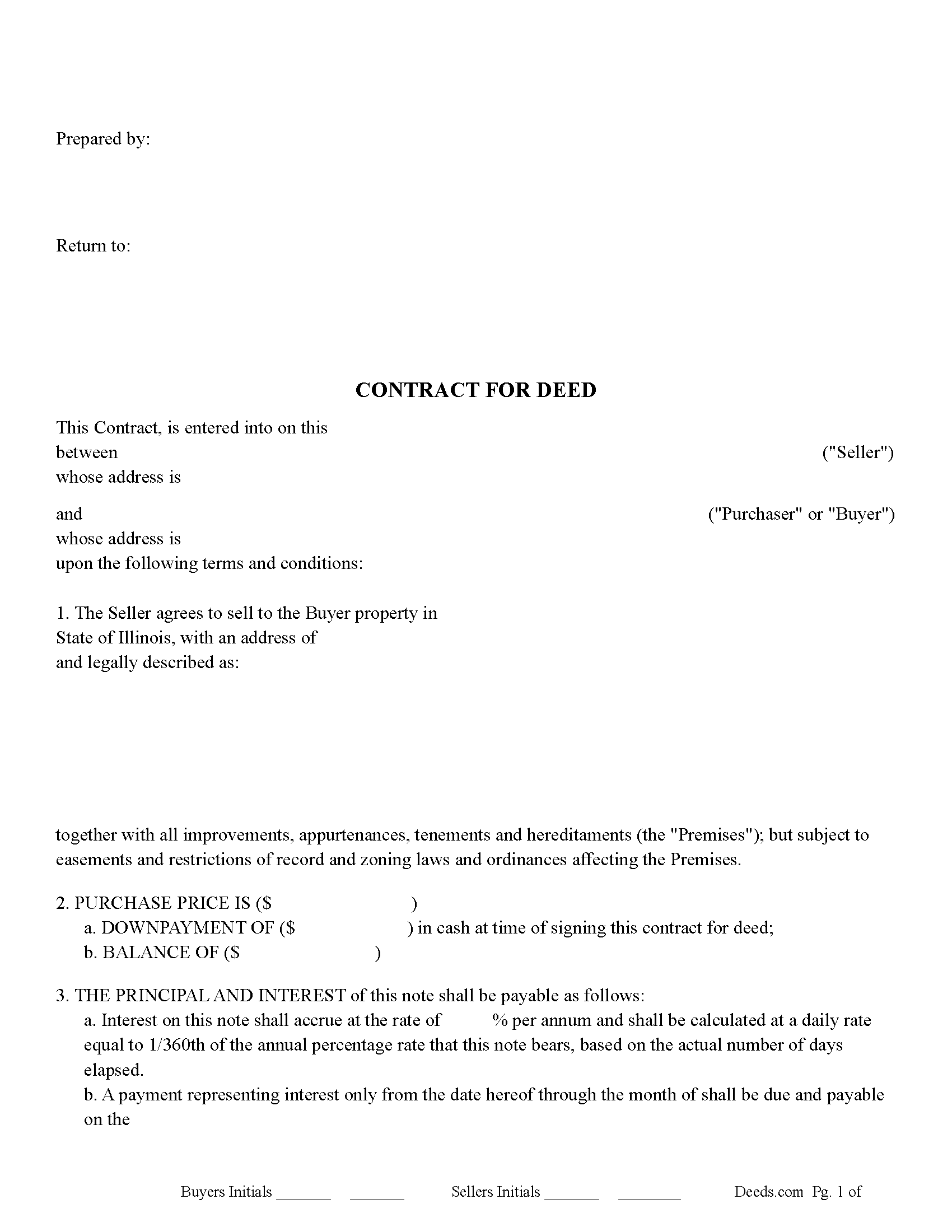

Knox County Contract for Deed Form

Knox County Contract for Deed Form

Fill in the blank Contract for Deed form formatted to comply with all Illinois recording and content requirements.

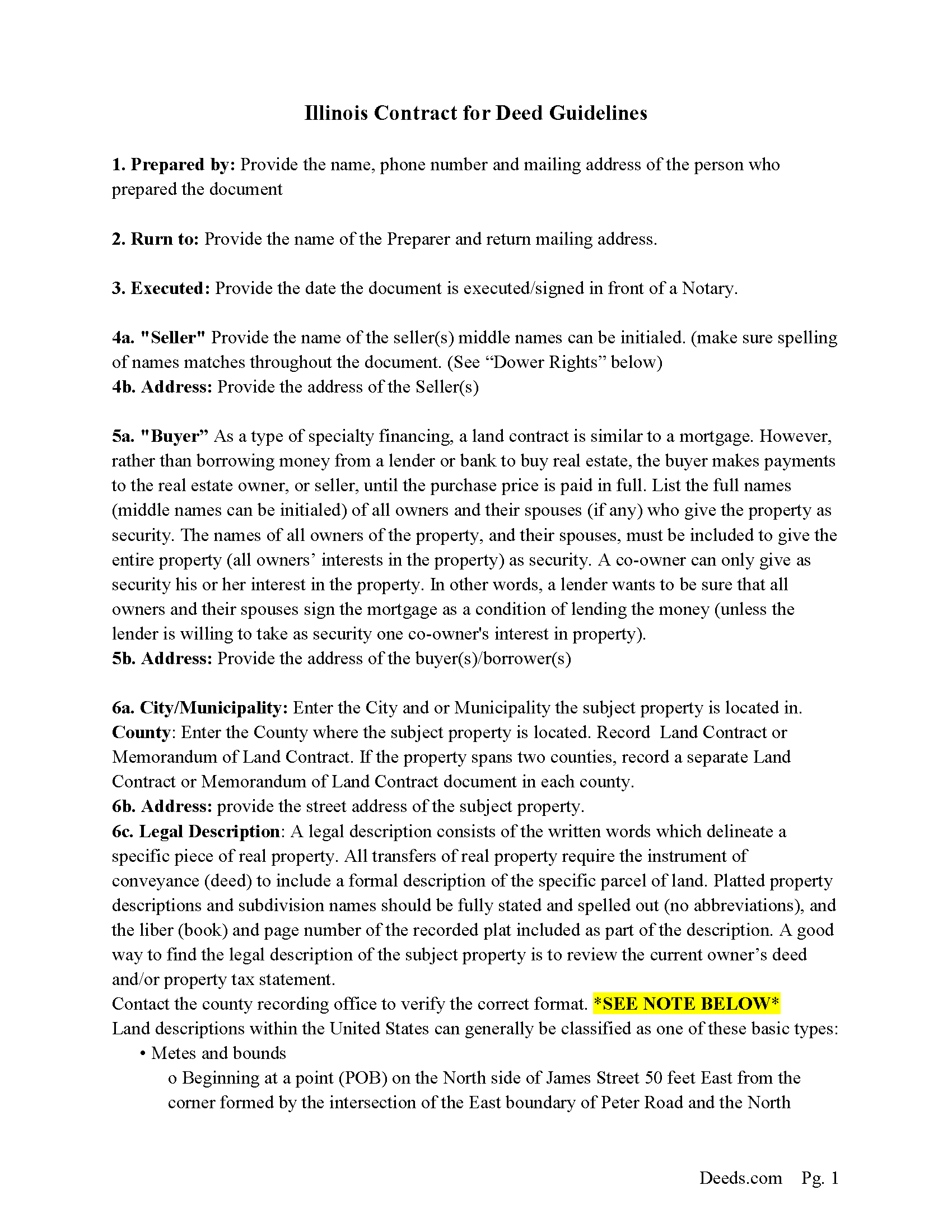

Knox County Contract for Deed Guide

Line by line guide explaining every blank on the Contract for Deed form.

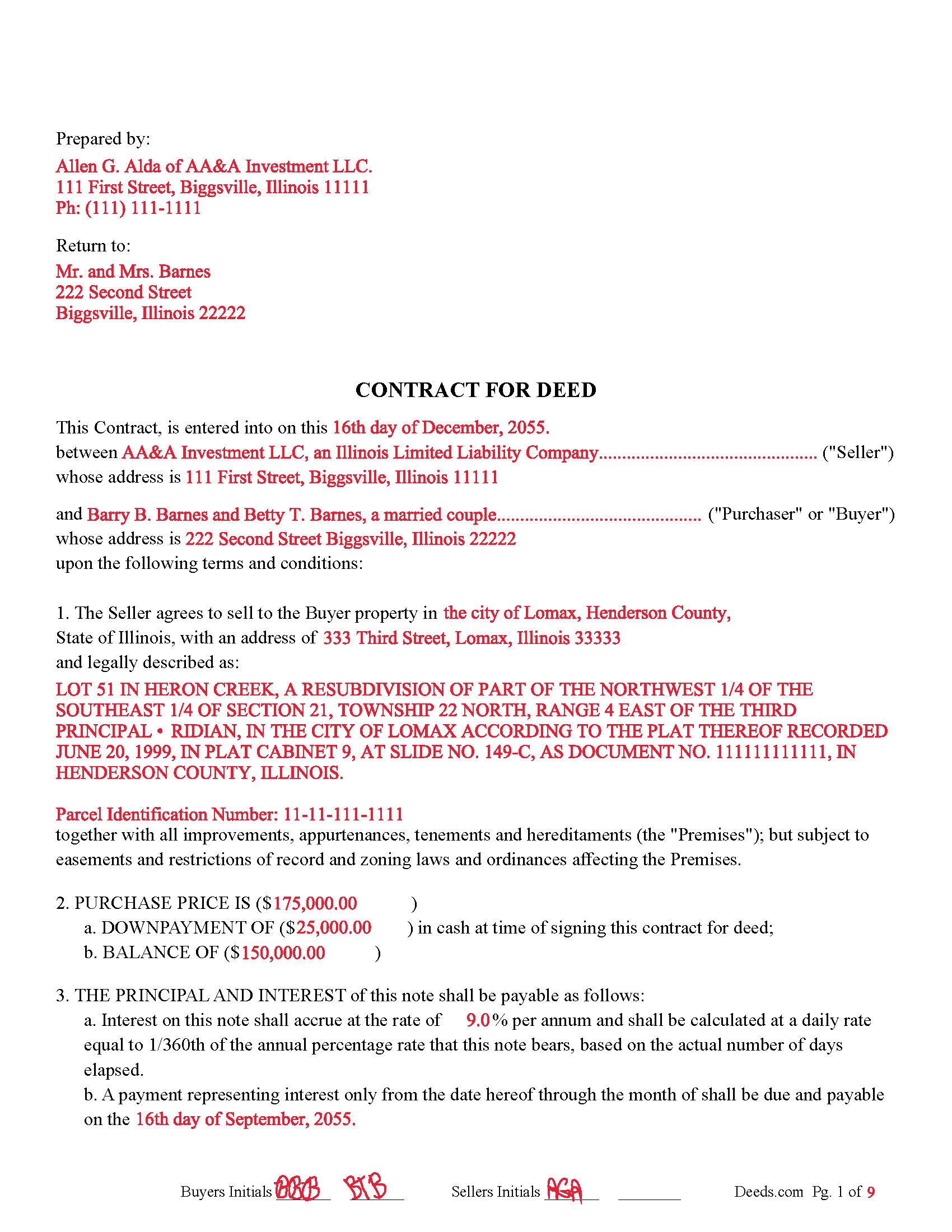

Knox County Completed Example of the Contract for Deed Document

Example of a properly completed Illinois Contract for Deed document for reference.

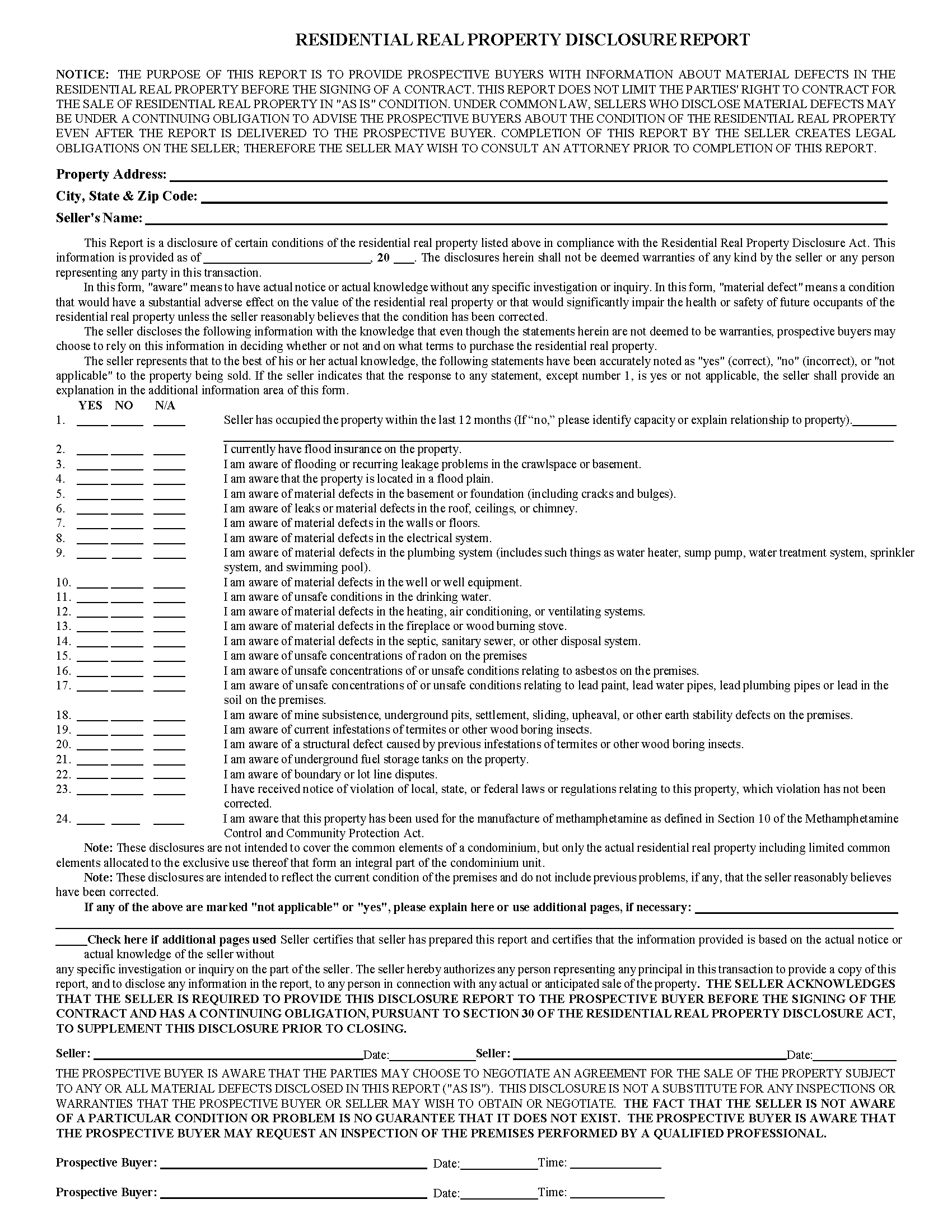

Knox County Real Property Disclosure Form

An executed installment sales contract shall include a statement acknowledging that the seller provided the buyer with the installment sales contract disclosure

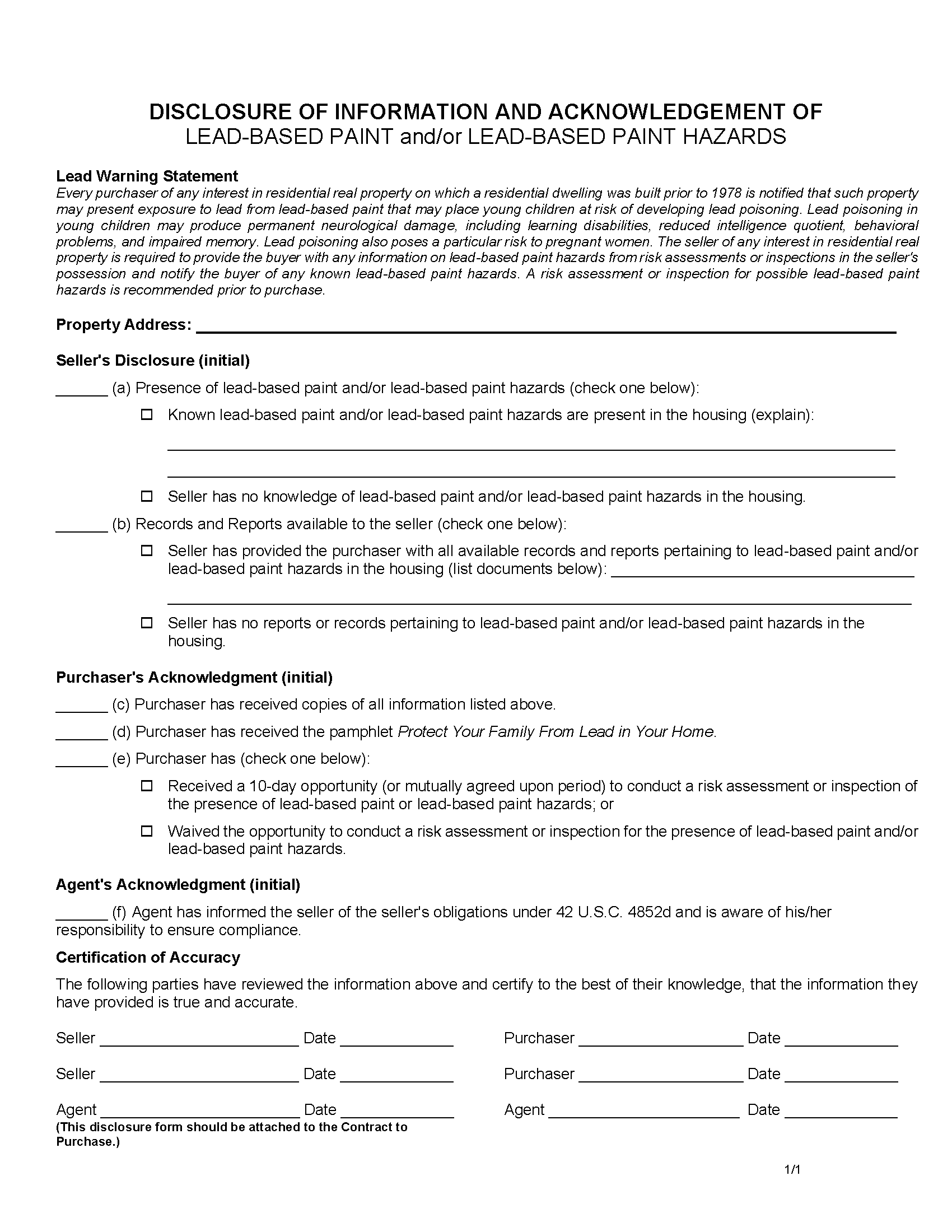

Knox County Lead Based Paint Disclosure Form

A Contract for Deed is subject to the Lead Poisoning Prevention Act

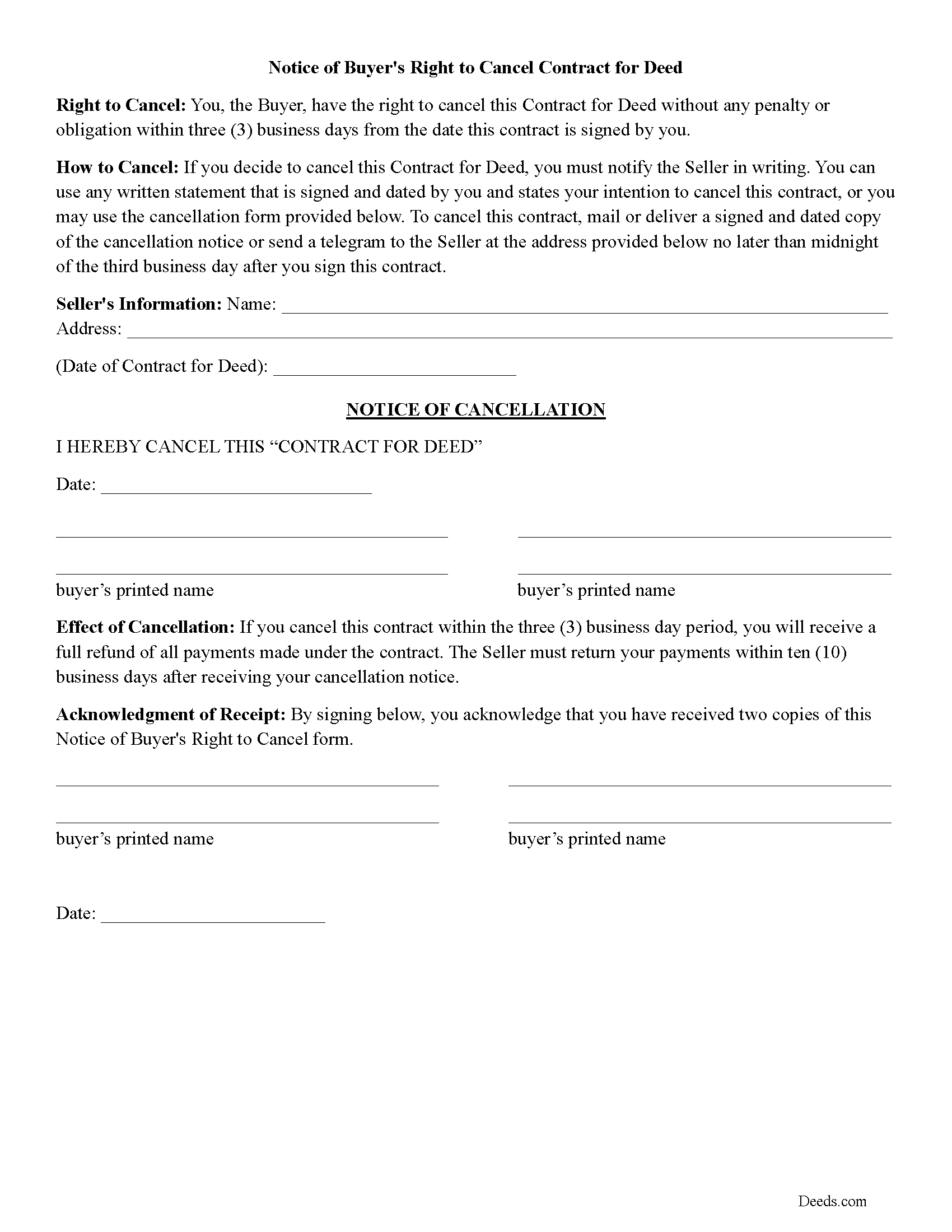

Knox County 3-day Cancellation Notice Form

Illinois State law requires a 3-day cooling-off period for installment sales contracts

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Knox County documents included at no extra charge:

Where to Record Your Documents

Knox County Recorder

Galesburg, Illinois 61401

Hours: 8:30 to 4:30 M-F

Phone: (309) 345-3818

Recording Tips for Knox County:

- Ensure all signatures are in blue or black ink

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Knox County

Properties in any of these areas use Knox County forms:

- Abingdon

- Altona

- Dahinda

- East Galesburg

- Galesburg

- Gilson

- Henderson

- Knoxville

- Maquon

- Oneida

- Rio

- Saint Augustine

- Victoria

- Wataga

- Williamsfield

- Yates City

Hours, fees, requirements, and more for Knox County

How do I get my forms?

Forms are available for immediate download after payment. The Knox County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Knox County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Knox County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Knox County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Knox County?

Recording fees in Knox County vary. Contact the recorder's office at (309) 345-3818 for current fees.

Questions answered? Let's get started!

In Illinois, ("Installment sales contract" or "contract" means any contract or agreement, including a contract for deed, bond for deed, or any other sale or legal device whereby a seller agrees to sell and the buyer agrees to buy a residential real estate, in which the consideration for the sale is payable in installments for a period of at least one year after the date of sale, and the seller continues to have an interest or security for the purchase price or otherwise in the property.) ((765 ILCS 67/5) Sec. 5. Definitions)

Key requirements and considerations for a Contract for Deed in Illinois:

1. Written Agreement: The contract must be in writing and signed by both parties. It should include all the terms of the sale, such as the purchase price, payment schedule, interest rate, and responsibilities for taxes and maintenance.

2. Disclosure Requirements: The seller is required to provide certain disclosures to the buyer, including:

o Property Condition: Any known material defects in the property.

o Installment Payment Terms: Detailed terms of the installment payments, including interest rates and payment schedules.

3. Recording the Contract: The buyer should ensure the contract is recorded with the county recorder’s office to protect their interest in the property. This helps in providing notice to third parties and securing the buyer’s interest.

4. Equitable Title: While the seller retains legal title, the buyer receives equitable title, giving them the right to occupy and use the property.

5. Default and Forfeiture: The contract should outline what constitutes a default and the consequences, which may include forfeiture of the property. Illinois law provides some protections for buyers, such as requirements for notice and an opportunity to cure the default before forfeiture.

6. Interest and Fees: (The interest rate being charged, if any, expressed only as an annual percentage rate.) (765 ILCS 67/10) (5))

7. Compliance with Local Laws: Ensure the contract complies with all relevant local, state, and federal laws, including consumer protection laws.

8. Legal Description of Property: The contract should include a legal description of the property being sold.

9. Transfer of Title: The contract should specify that the seller will transfer the legal title to the buyer once all payments have been made and the terms of the contract are fulfilled.

10. Insurance and Taxes: The contract should specify who is responsible for paying property taxes and maintaining insurance on the property during the installment period.

11. Right to Prepay: (Prepayment penalties prohibited. The seller may not charge or collect a prepayment penalty or any similar fee or finance charge if the buyer elects to pay the outstanding principal balance of the purchase price under the contract before the scheduled payment date under the contract.) (765 ILCS 67/60)Sec. 60.)

12. (An amortization schedule, as defined in Section 5.) (765 ILCS 67/10)(23.)

[As used in this Act, unless the context otherwise requires:

"Amortization schedule" means a written schedule which sets forth the date of each periodic payment, the amount of each periodic payment that will be applied to the principal balance and the resulting principal balance, and the amount of each periodic payment that will be applied to any interest charged, if applicable, pursuant to the contract.] [765 ILCS 67/5] Sec. 5. Definitions]

13. A versatile Contract that can be used for installment payment and/or with ballon payment option. Use for residential, condominiums and rental properties. Residential property has additional requirements, a 3 day notice of Right to Cancel, RESIDENTIAL REAL PROPERTY DISCLOSURE REPORT, residential homes built before 1978 require a Disclosure of Information and Acknowledgement-Lead-Based Paint and/or Lead-Based Paint Hazards. Included for your convenience.

Important: Your property must be located in Knox County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Knox County.

Our Promise

The documents you receive here will meet, or exceed, the Knox County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Knox County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Colleen K.

September 15th, 2022

This product was easy to use and instructions were helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steve B.

February 6th, 2020

Good format. Timely response. Adding a photo of the property would be a good improvement.

Thank you for your feedback. We really appreciate it. Have a great day!

James C.

January 15th, 2021

Satisfactory. I was confused and somwhat lost on what to do and what I was getting.

Thank you!

Paul S.

March 18th, 2021

Very satisfactory

Thank you!

Joe F.

January 11th, 2021

TOOK ME SEVERAL DAYS TO FIND A SITE THAT DIDNT CHARGE $100 JUST TO USE ONE FORM. THANKS

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Ann P.

August 19th, 2025

Was hoping I would be sent copies on paper so I can fill them out without a desk computer

We appreciate your feedback. Our forms are delivered instantly as digital files, so customers can download and print as many copies as they need. This way, you have the flexibility to complete them by hand if you prefer.

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!

Albo A.

September 25th, 2020

Deeds.com was fast and easy to file documents

Thank you!

Arnold R.

March 11th, 2022

this online service worked efficiently and as quickly as the registry allowed it to record new deeds. Thank you for providing services

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Anne M.

June 2nd, 2020

good I think

Thank you!

Holly K.

November 4th, 2022

This is the simplest way to record a deed ever. Just uploaded the deed and the professionals at deed.com did the rest. Within 8 hours, I had my recorded deed back. The price is fantastic. It would have cost me more in gas to drive to the county where I had to record the deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Trent D.

April 17th, 2022

You Guys are Fantastic and the service you all provide. Is PRICELESS!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan K.

May 26th, 2022

First time using DEEDS.COM and very helpful with documents to fill out. I highly recommend this company for all your needs .Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RAYMOND W.

March 20th, 2019

Thank you for the comprehensive forms - very much appreciated!

Thank you Raymond.

barbara s.

May 2nd, 2020

you provided the service requested for a reasonable fee

Thank you!