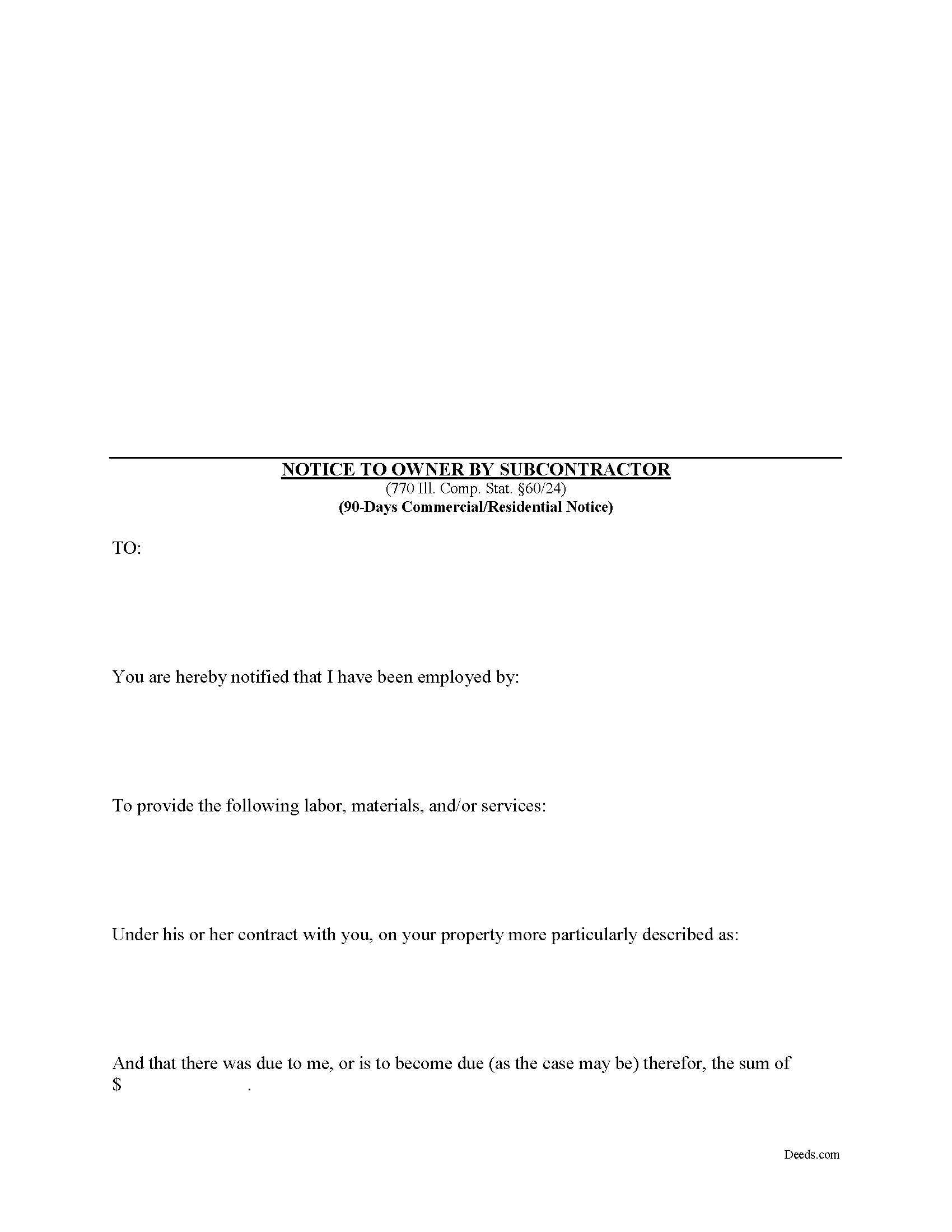

Knox County Mechanics Lien Preliminary 90 Day Notice Form

Knox County Mechanics Lien Preliminary 90 Day Notice Form

Fill in the blank Mechanics Lien Preliminary 90 Day Notice form formatted to comply with all Illinois recording and content requirements.

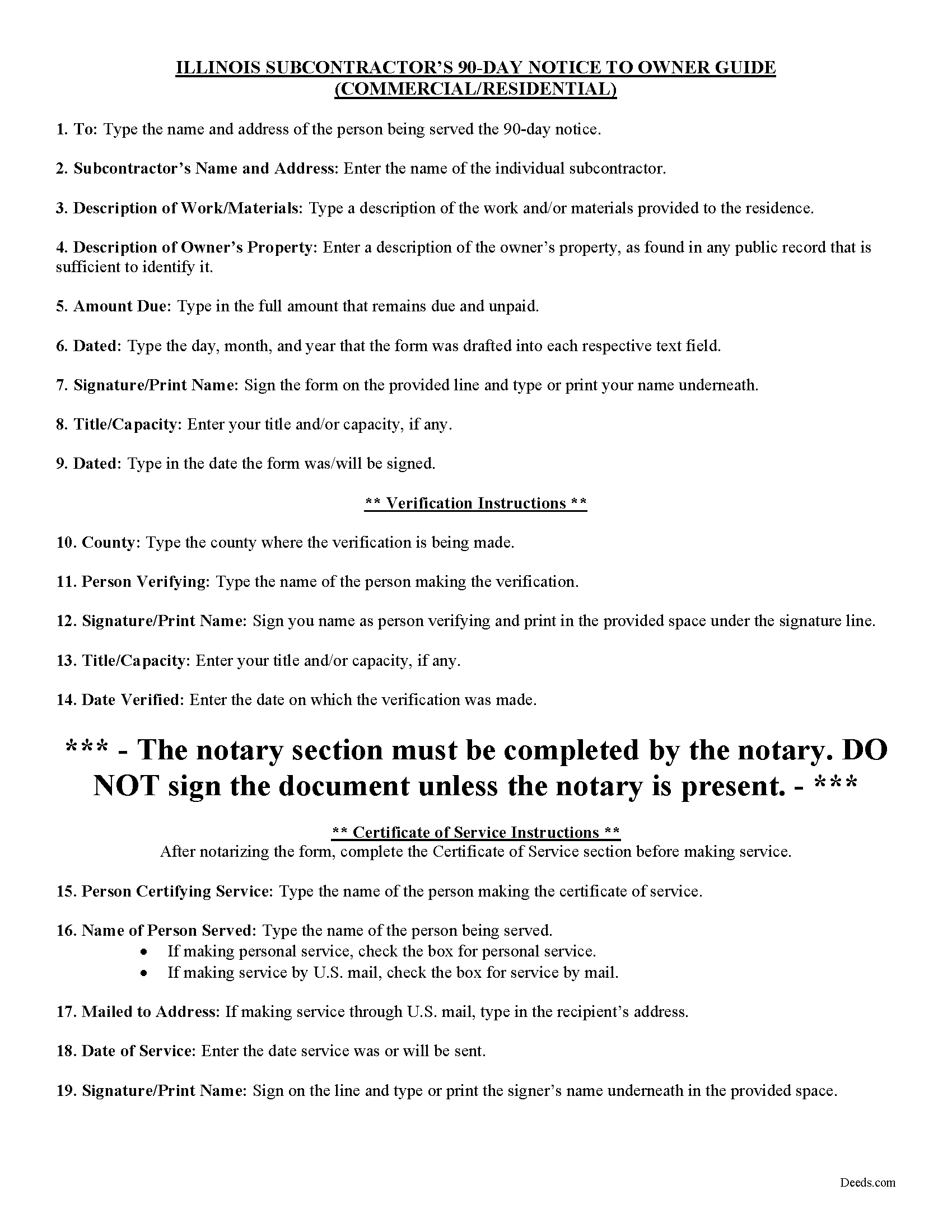

Knox County Preliminary 90 Day Notice Guide

Line by line guide explaining every blank on the form.

Knox County Completed Example of the Preliminary 90 Day Notice Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Knox County documents included at no extra charge:

Where to Record Your Documents

Knox County Recorder

Galesburg, Illinois 61401

Hours: 8:30 to 4:30 M-F

Phone: (309) 345-3818

Recording Tips for Knox County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Knox County

Properties in any of these areas use Knox County forms:

- Abingdon

- Altona

- Dahinda

- East Galesburg

- Galesburg

- Gilson

- Henderson

- Knoxville

- Maquon

- Oneida

- Rio

- Saint Augustine

- Victoria

- Wataga

- Williamsfield

- Yates City

Hours, fees, requirements, and more for Knox County

How do I get my forms?

Forms are available for immediate download after payment. The Knox County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Knox County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Knox County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Knox County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Knox County?

Recording fees in Knox County vary. Contact the recorder's office at (309) 345-3818 for current fees.

Questions answered? Let's get started!

This statutory form is meant for use by subcontractors or others who are not directly contracted for work with the property owner.

For residential, owner-occupied projects, the 90-day notice form is the second preliminary notice sent in anticipation of filing a lien (the 60-day notice must be served beforehand sent via certified mail within 60 days from the first furnishing). For a commercial project, the 90-day form is the first notice sent to the owner. Either way, both commercial and residential jobs require the 90-day notice prior to filing a lien. 770 Ill. Comp. Stat. 60/24(a).

The 90-day notice is a demand for payment that must be sent by all contractors, subcontractors, laborers, and material/equipment suppliers who have not directly contracted with the owner or the owner's agent. Note that all eligible workers must send the notice within 90 days after the final furnishing of work or delivery of materials to the jobsite. Id. Any substantial additional or extra work can enlarge the time, but mere corrections of previously completed work will not affect the end date. Be aware the time is 90 days, not three months, so count 90 days from the date labor or materials were last furnished.

Serve the notice either through personal service by using a process server, or use the easier and less expensive option of certified mail. The notice does not have to be recorded but keep track of all dates and confirmations of receipt of service to help create a paper trail if a lien becomes necessary. If the deadlines are near, consider a process server. If mailing, serve the notice by certified mail, return receipt requested on the owner, the mortgage lenders, and the general contractor.

The 90-day notice must be verified which means the contractor's signature represents the contents of the notice are accurate and true. The notice must also be notarized by signing it in front of a licensed Notary Public who affixes his or her seal to the document.

This article is provided for informational purposes only and does not constitute legal advice. If you have any questions about mechanic's liens, including the preliminary notices, please consult an attorney.

Important: Your property must be located in Knox County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien Preliminary 90 Day Notice meets all recording requirements specific to Knox County.

Our Promise

The documents you receive here will meet, or exceed, the Knox County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Knox County Mechanics Lien Preliminary 90 Day Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Terry S.

March 23rd, 2022

Worked well for us except for not being able to edit. Got it completed and recorded with the county clerk! Having the instructions and example made it easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia P.

December 10th, 2019

Not user friendly despite additional guide. There are other products out there that are superior. A waste of $20.

Sorry to hear that Virginia. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Steve M.

January 24th, 2020

I was only able to download the QC form. Had to print the other docs

Thank you for your feedback. We really appreciate it. Have a great day!

Larry L.

July 12th, 2022

Great product, worked as it advertised.

Thank you!

Ruth L.

June 4th, 2020

Extremely convenient for a moderate fee. Will definitely use Deeds.com for my recording needs going forward. Will also share with my team on their projects. Thanks a bunch!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret A.

April 30th, 2021

Thank for the help. Needed that disclaimer to avoid filing a full ITR tax return to get an L-9

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

tom s.

May 13th, 2021

Easier than I had expected. Was looking for the 'I have to get information that I don't understand' part which never appeared. Thank you

Thank you!

Patricia W.

August 30th, 2022

I am working with the document to complete it. It's taking me some time but I'll get it.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda C.

February 23rd, 2019

If I hadn't spent my career as an escrow officer (albeit in another state), I may have had a hard time figuring out exactly which deed I needed and how to prepare them, even with the back-up informational, how-to pdf documents, without an attorney. My experience speaks to how much the general public doesn't understand and how confusing it can be. Nonetheless, the access to so many documents at a fairly reasonable cost, the basic how-to docs made available along with the purchased doc makes all the difference. I appreciate having such things available to the public. Many thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ben C.

December 8th, 2024

Easy and Quick,Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin R.

August 22nd, 2023

I have been using Deeds.com for the last 2 years and find them very easy to use and expedient on all my recordings. Highly recommend.

Thank you for the kind words Kevin. We appreciate you.

Charles F.

January 15th, 2021

I am happy with the document but did not know that it would still have to go before the court. Thought it could be handled by the recorder of deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn S.

August 20th, 2022

I was pleased with the service and product.

Thank you!

Betty Z.

June 21st, 2023

Thank you so much for giving us a service so important to many. I will pass on this pertinent process to all who need it. again, thank you. bz

Thanks so much Betty. We appreciate you. Have a spectacular day!

Eduardo A.

January 22nd, 2022

Perfect, blank forms, just what I ordered. Easy to download, understand, and complete.

Thank you!