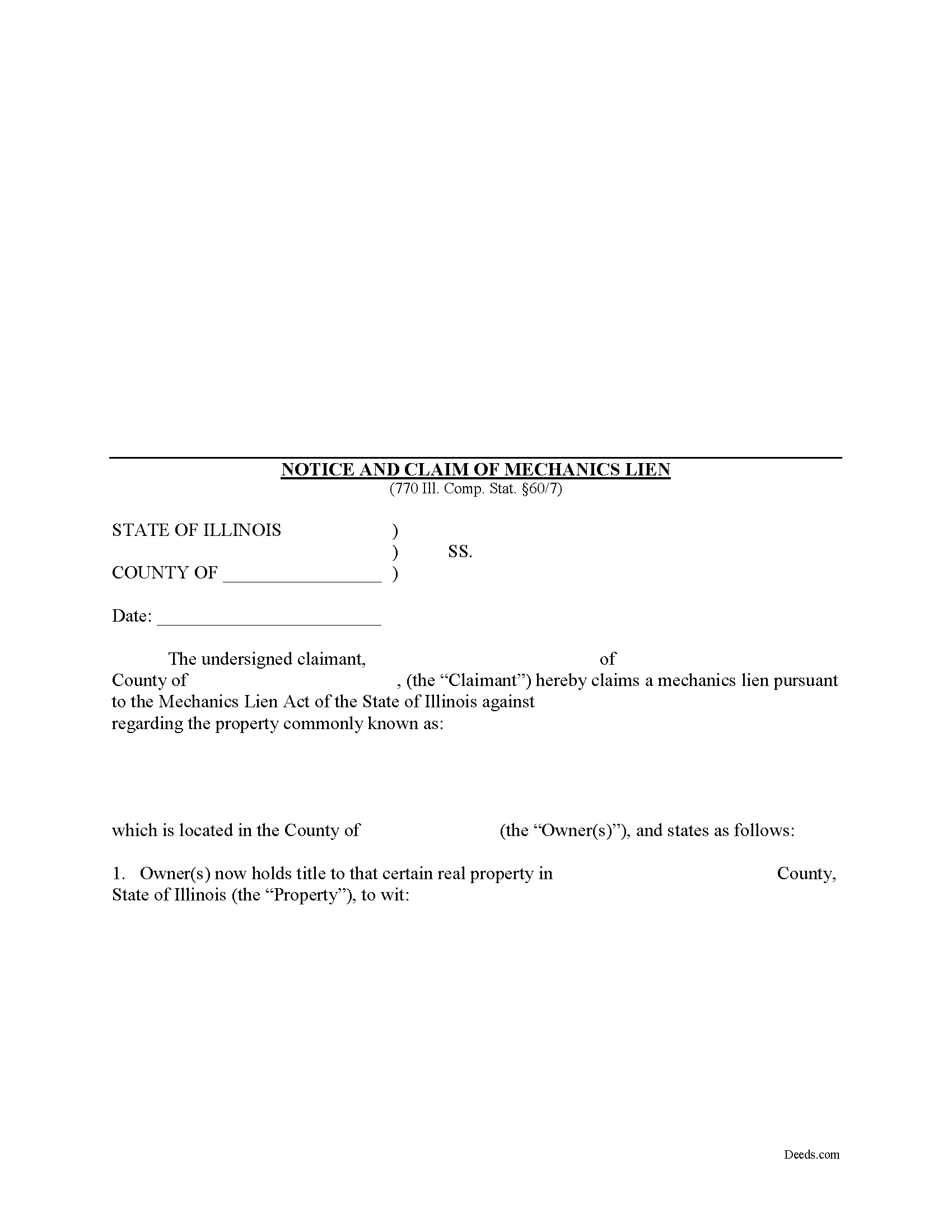

Brown County Mechanics Lien Form

Brown County Mechanics Lien Form

Fill in the blank Mechanics Lien form formatted to comply with all Illinois recording and content requirements.

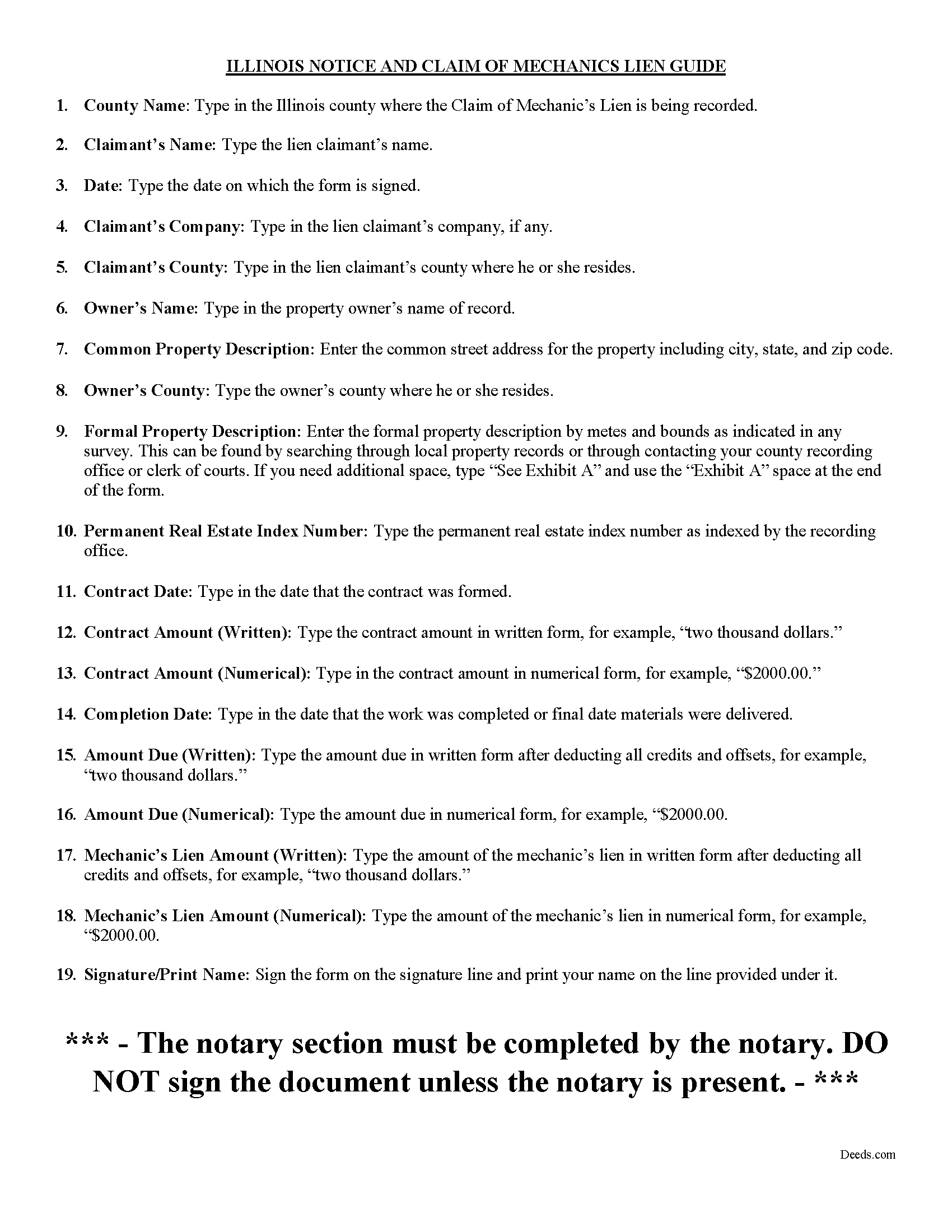

Brown County Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

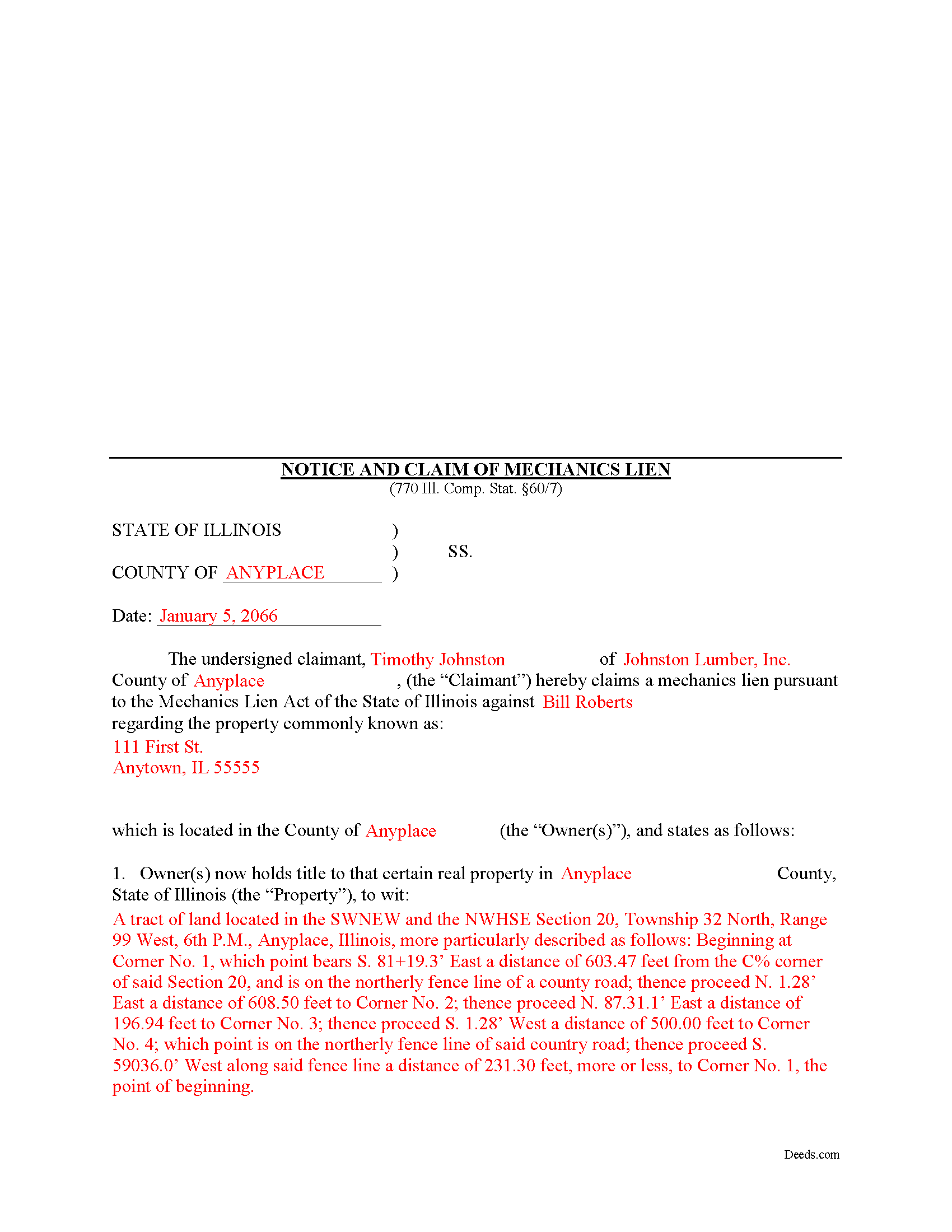

Brown County Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Brown County documents included at no extra charge:

Where to Record Your Documents

County Clerk/Recorder

Mt. Sterling, Illinois 62353

Hours: 8:30 to 4:30 M-F

Phone: (217) 773-3421 Ext. 206

Recording Tips for Brown County:

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Brown County

Properties in any of these areas use Brown County forms:

- Mount Sterling

- Timewell

- Versailles

Hours, fees, requirements, and more for Brown County

How do I get my forms?

Forms are available for immediate download after payment. The Brown County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Brown County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Brown County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Brown County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Brown County?

Recording fees in Brown County vary. Contact the recorder's office at (217) 773-3421 Ext. 206 for current fees.

Questions answered? Let's get started!

Mechanic's liens are available in Illinois pursuant to the Mechanic's Lien Act compiled under 770 ILCS 60 for contractors, subcontractors, material or equipment suppliers, architects, and other design professionals.

A lien is a type of property interest, like a mortgage, in which the lienor retains a claim against the property if it is later sold. The lienor can also force a sale through foreclosure. Illinois only authorizes mechanic's liens on private projects, not those associated with public (government) entities.

When you provide labor or materials on a contract job and the client never pays the invoice, filing a mechanic's lien is the next step in recovering the amount due. NOTE: Subcontractors must individually file 60-day (owner-occupied residential projects only) and 90-day notices to access their lien rights.

Mechanic's liens demand strict deadlines and missing the filing date by even one day can cost you your right to a lien. In Illinois, the time to file a lien arises within four months from the last date you or any of your employees furnished labor or delivered materials to the jobsite. The four-month period applies to your right against all third parties and subsequent owners. You have two years to file suit against the original owner to foreclose on a mechanic's lien. 770 ILCS 60/9.

The claim for lien must state the parties to the contract and its terms, identify the general contractor and all upper tier subcontractors, include a description of the work completed or materials delivered, state a legal description of the owner's property, and state the total amount due and unpaid as of the date the notice is recorded. The lien amount includes the invoice amount owed minus all credits and offsets. A lienor may not include extras such as attorney's fees or lost profits, but may charge interest measured by the legal rate in Illinois. 770 ILCS 60/1(a).

Before recording the lien, sign it in the presence of a notary public who then notarizes it with his or her seal. The lien should be recorded at the recording office for the county where the property is situated. For residential projects, you must serve the owner with a copy of the recorded lien within ten days' time.

The deadlines for filing a lien are set in stone, and failure to file on time will cost you your right to a lien. Additionally, putting in improper amounts or exaggerating the claim will invalidate the lien. If you lose your lien rights, the only remedy is to sue the property owner under contract law.

Each case is unique. Contact an attorney with specific questions regarding filing a claim or any other issues related to mechanic's liens in Illinois.

Important: Your property must be located in Brown County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien meets all recording requirements specific to Brown County.

Our Promise

The documents you receive here will meet, or exceed, the Brown County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Brown County Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

franklin m.

October 14th, 2020

good format, helpful instructions

Thank you!

Dana H.

September 8th, 2021

Thanks for making this process a seamless one! I love Deeds.com and will recommend it to others!

Thank you for your feedback. We really appreciate it. Have a great day!

george k.

March 6th, 2019

Thank u the site helped me get the quick deed forms I needed for TN.i will use it in the furture.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheryl G.

November 27th, 2021

Simple way to complete documents with very detailed instructions. And to be able to e-file them is great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John C.

December 1st, 2020

Great site and information. Very useful.

Thanks John, we appreciate your kind words.

Rasheedah M.

October 9th, 2020

Excellent service. Received the exact quit claim form and additional information promptly. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James W.

August 29th, 2019

Thank-you for your excellent services

Thank you!

Michael W.

August 27th, 2021

This was really easy and very helpful. Thanks,

Thank you!

Gabriel R.

August 24th, 2022

So far the service seems good, simple to use. One criticism, the password change feature should require the user to re-enter their old password, new password, and re-enter the new password to make sure there is no typos. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie L.

January 20th, 2024

Ordered a Quitclaim deed and worked perfectly at Register of Deed office. Liked the instructions and copy of one example filled out made it so much easier to understand. One price is great as most of other companies wanted a membership to join. Will use Deeds.com again if I ever need different forms. Thanks!!!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Elvira N.

January 6th, 2021

Very useful, it even includes a guide on filling out the deed form!

Thank you!

bruce t.

May 16th, 2022

Much good information provided. Forms easy to use. Price is a bargain.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shawn B.

December 26th, 2020

Very convenient and easy to use. The quick response time was very much appreciated!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph R.

July 23rd, 2022

Deeds.com has saved me quite a bit in attorney fees by making legal forms available on line. Easy to use, just fill in the blanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Lan S.

November 23rd, 2020

extremely satisfied with the service. I could not get file size correctly at the beginning. I received quick responses pointing out specific problem, which was very helpful for me to correct the mistake. It took 5 or 6 times due to different errors to finally achieve the qualified version. The customer care team was very patient walking me through the process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!