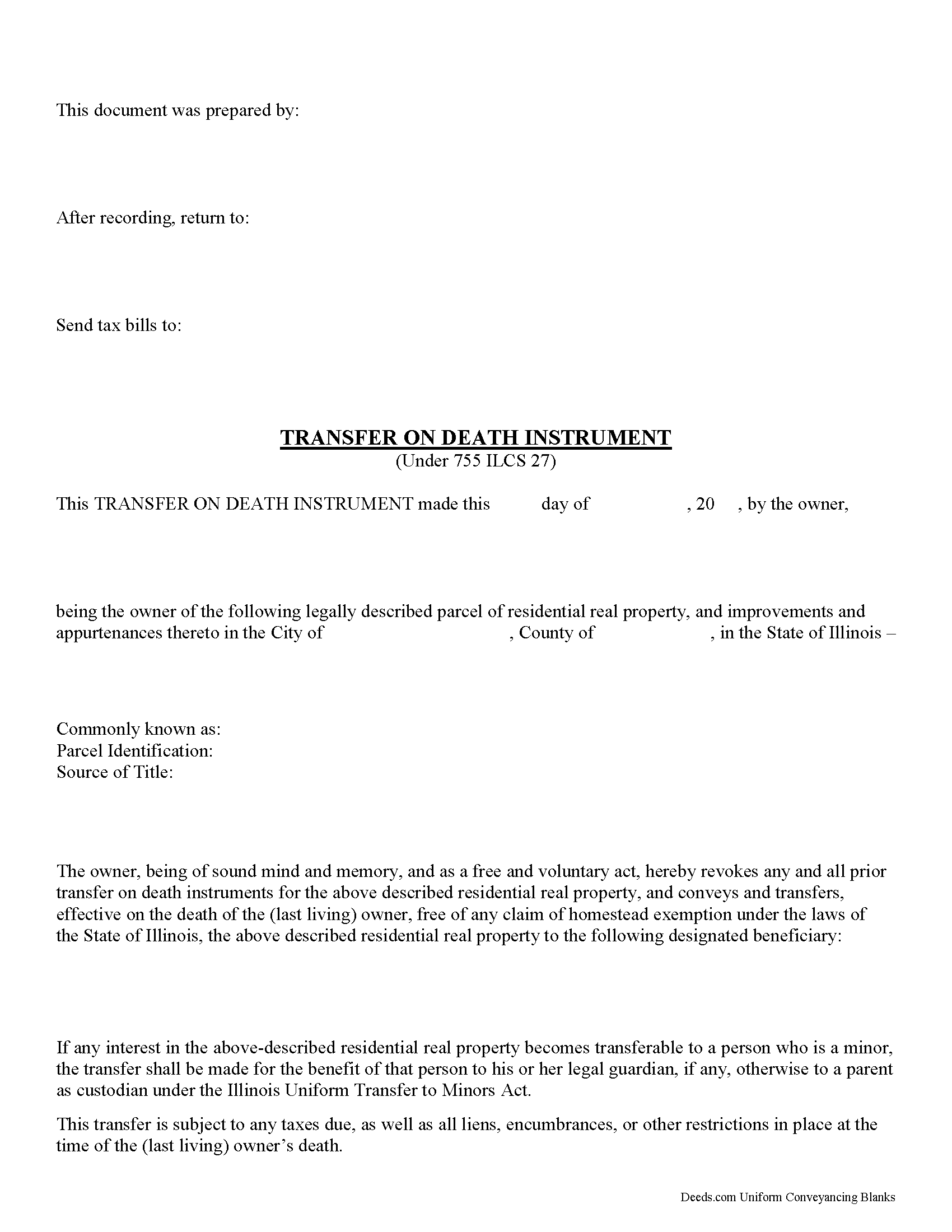

Union County Transfer on Death Instrument Form

Union County Transfer on Death Instrument

Fill in the blank form formatted to comply with all recording and content requirements.

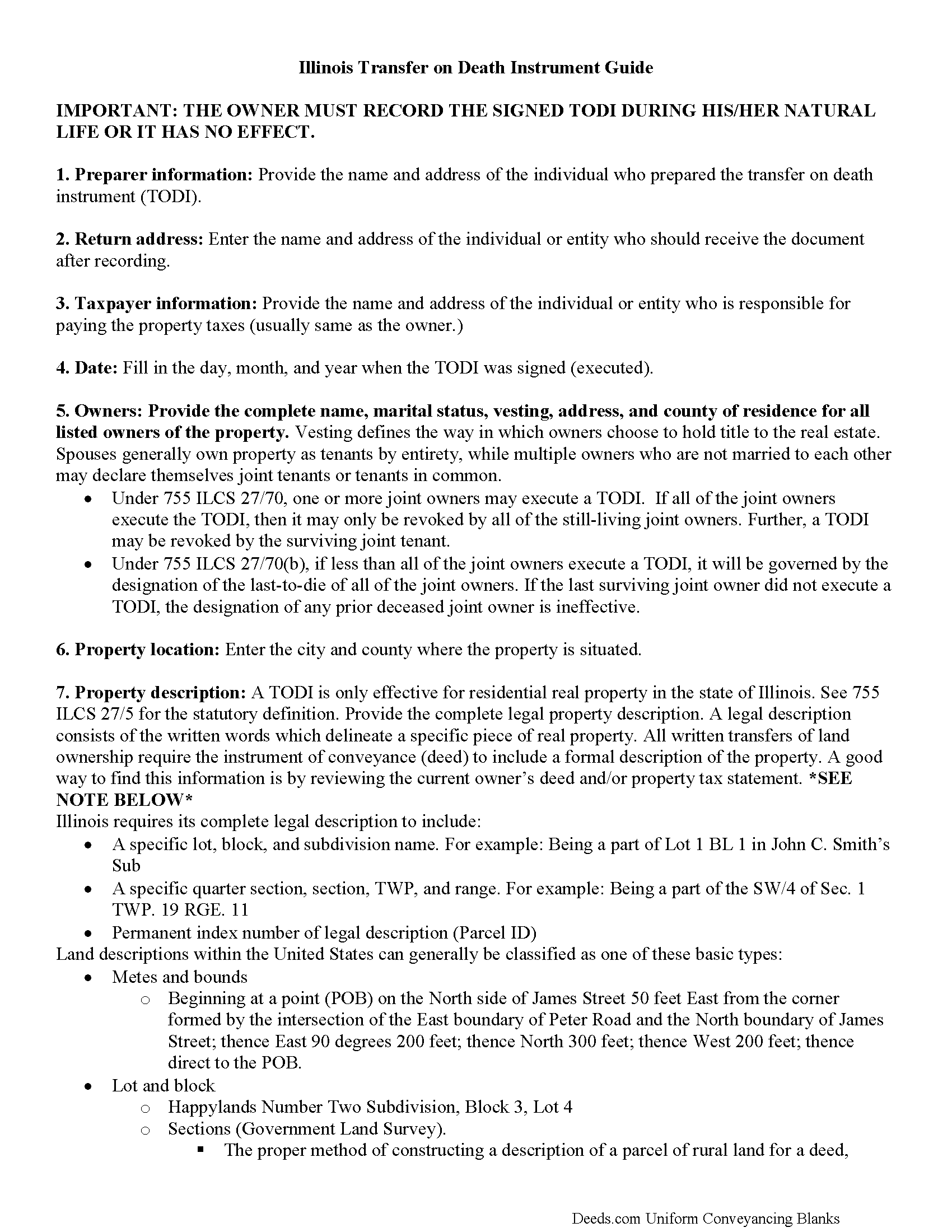

Union County Transfer on Death Instrument Guide

Line by line guide explaining every blank on the form.

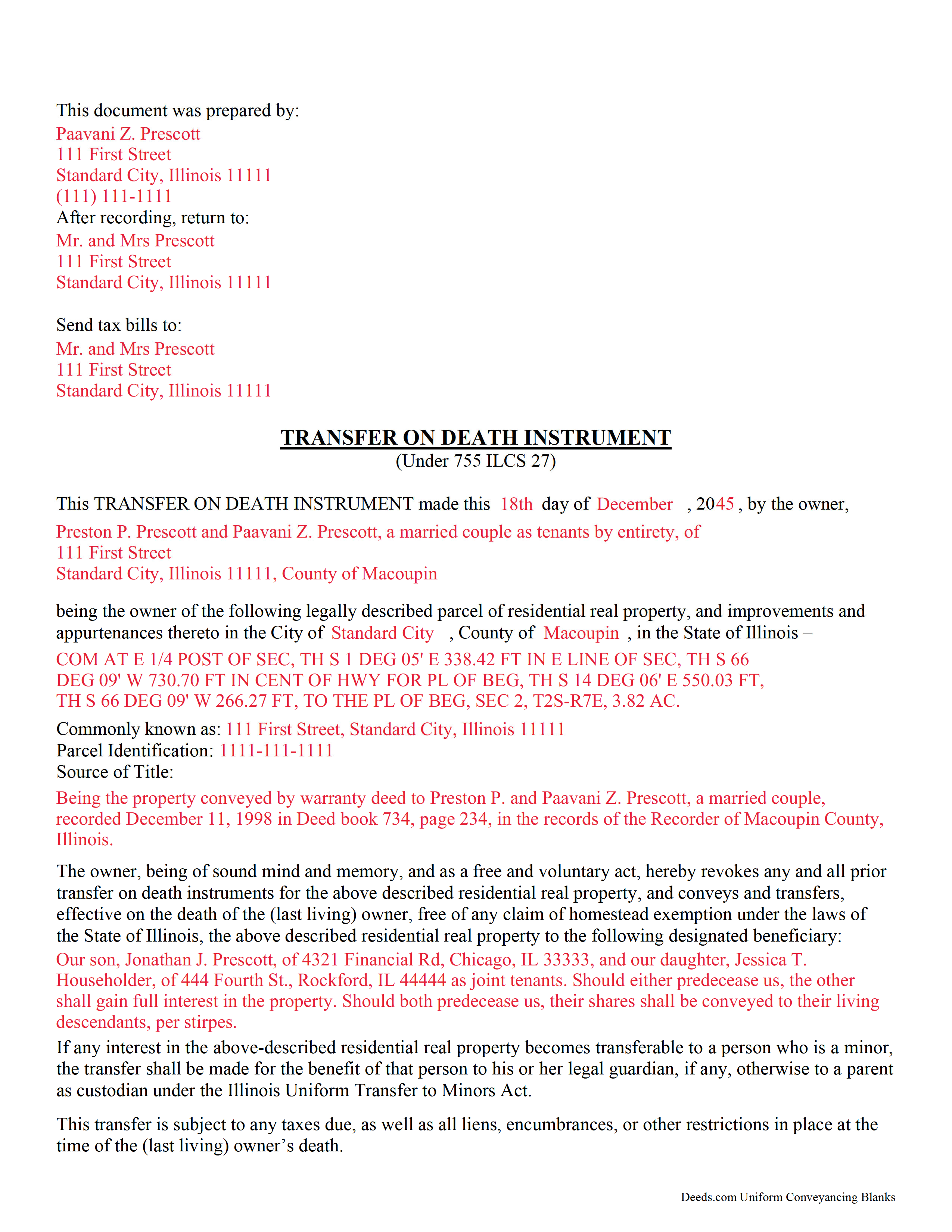

Union County Completed Example of the Transfer on Death Instrument Document

Example of a properly completed Illinois Transfer on Death Instrument document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Union County documents included at no extra charge:

Where to Record Your Documents

Union County Clerk/Recorder

Jonesboro, Illinois 62952

Hours: 8:00 to 4:00 M-F

Phone: (618) 833-5711

Recording Tips for Union County:

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Union County

Properties in any of these areas use Union County forms:

- Alto Pass

- Anna

- Cobden

- Dongola

- Jonesboro

- Millcreek

- Wolf Lake

Hours, fees, requirements, and more for Union County

How do I get my forms?

Forms are available for immediate download after payment. The Union County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Union County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Union County?

Recording fees in Union County vary. Contact the recorder's office at (618) 833-5711 for current fees.

Questions answered? Let's get started!

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)

Important: Your property must be located in Union County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Instrument meets all recording requirements specific to Union County.

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Transfer on Death Instrument form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Julie A.

December 17th, 2018

After receiving the forms online and reviewing them, it was very easy to fill this out and the additional information was very helpful. Saved a lot of money by not having to use a lawyer/paralegal to do this simple task. Will definitely use Deeds.com in the future for any further needs. Thank you

Thank you Julie. We appreciate you taking the time to leave your review. Have a wonderful day.

April C.

June 24th, 2020

Great service fast and patience great team their staff kvh was very great part of team .I need it filed the same day . I will recommend them to others

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin R.

August 22nd, 2023

I have been using Deeds.com for the last 2 years and find them very easy to use and expedient on all my recordings. Highly recommend.

Thank you for the kind words Kevin. We appreciate you.

Michael F.

March 12th, 2020

Very useful and right at your fingers when you need a form. Recommend these forms highly. Thank you!!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori W.

January 24th, 2020

Disclaimer letter was just what I needed. Download worked without a hitch.

Thank you for your feedback Lori, we really appreciate it. Have a fantastic day!

Judith D.

November 25th, 2022

If my availability does not coincide with your business hours it should not prevent me from uploading my documents and making payment. You should allow people to upload their documents at any time with the understanding that you will process them on your next business day.

Thank you!

Kathryn L.

July 27th, 2020

I went to the recorders office. Had no problem was finished in about 10 minutes .The forms was excellent . With the instructions it was easy for me to fill out. Thank you, Kathryn L

Thank you for your feedback. We really appreciate it. Have a great day!

sara g.

June 10th, 2019

THIS WAS A USER FRIENDLY FORM, WAS ABLE TO COMPLETE WITHIN A SHORT TIME. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Veronica T.

September 14th, 2021

Great Service! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jim F.

April 9th, 2024

Site was easy to navigate and helped me to quickly locate the documents I was searching for. Thank you!

Your appreciative words mean the world to us. Thank you.

Cynthia S.

January 19th, 2019

Good find, provides guide to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Francine B.

March 25th, 2020

Looks like all forms are available. Hope they are as easy to use as it was to obtain. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie P.

December 9th, 2020

So far Deeds.com has done everything they say they'll do and very promptly.

Thank you for your feedback. We really appreciate it. Have a great day!

Kay C.

December 22nd, 2021

Thank you for your patience and help with filing the documents needed. You were helpful, prompt, courteous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!