Johnson County Transfer on Death Revocation Form

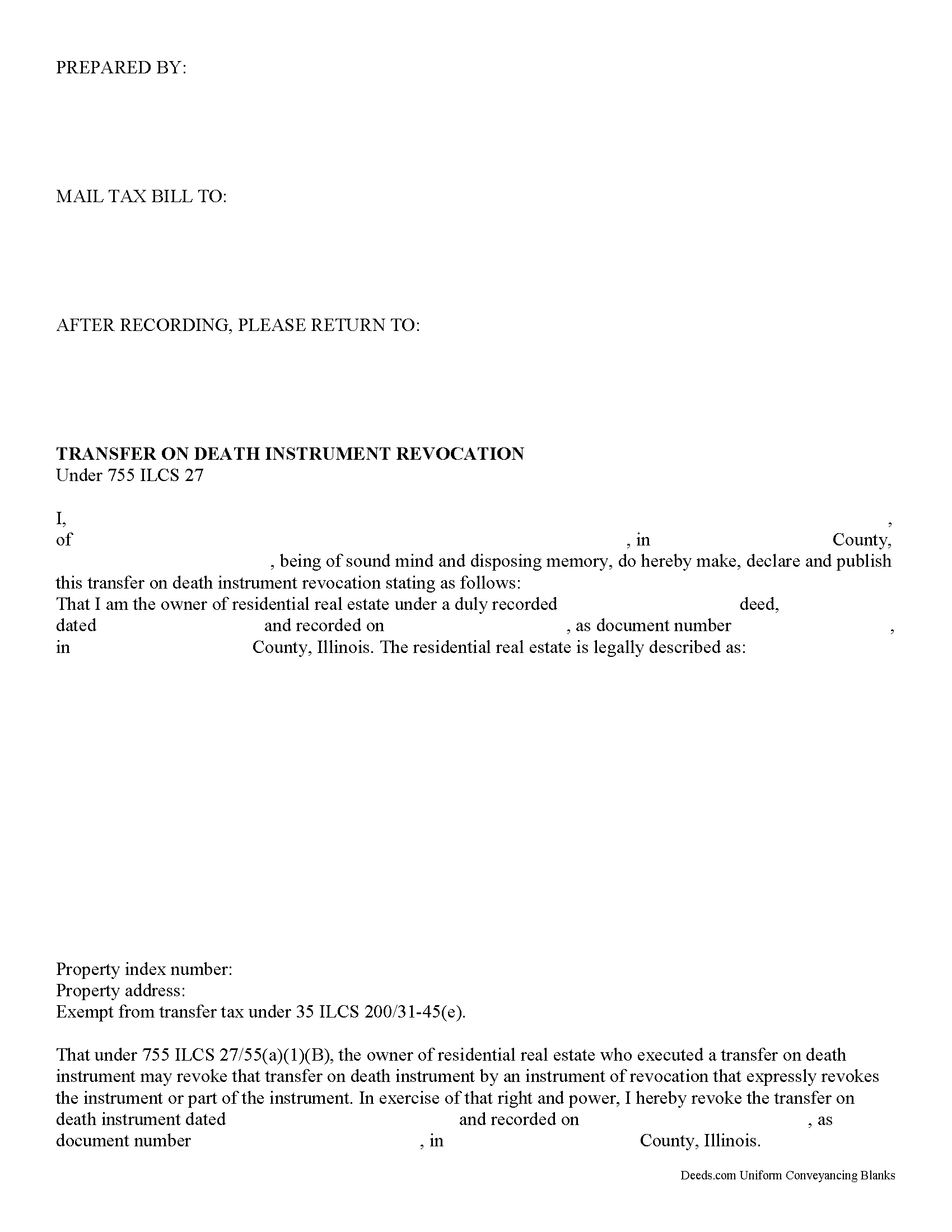

Johnson County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

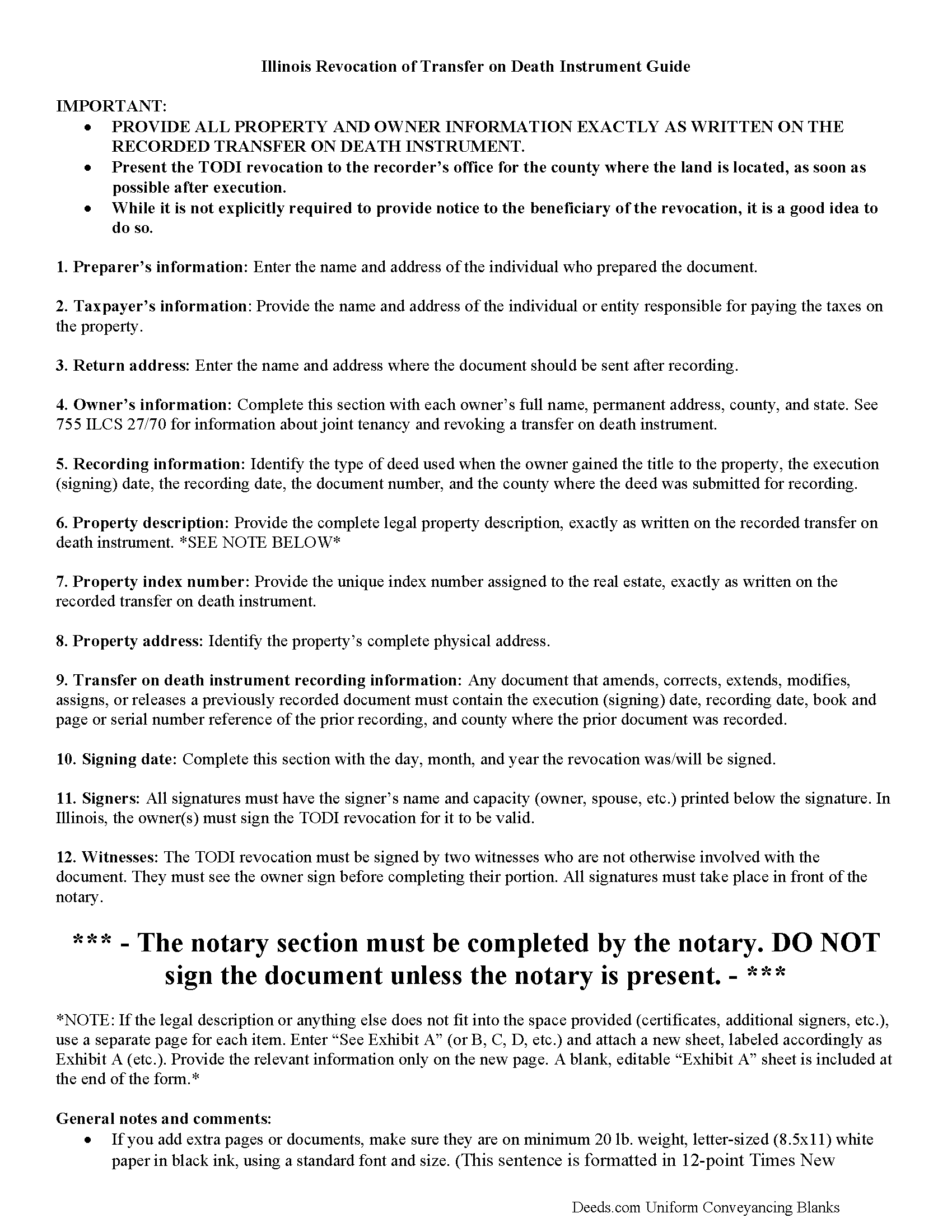

Johnson County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

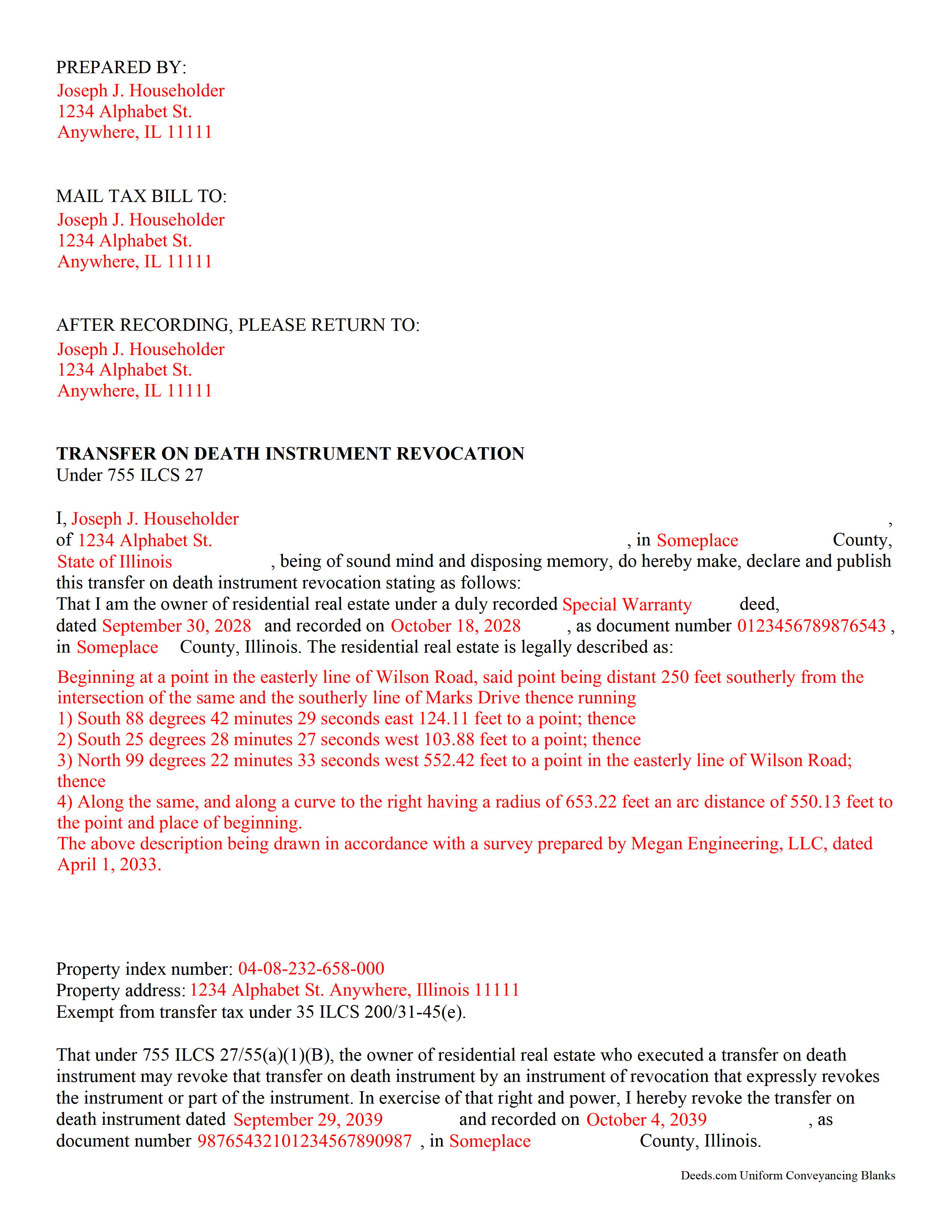

Johnson County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Clerk/Recorder

Vienna, Illinois 62995

Hours: 8 AM-Noon -1PM-4PM Monday-Friday

Phone: (618) 658-3611 and (618) 967-9528

Recording Tips for Johnson County:

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Belknap

- Boles

- Buncombe

- Cypress

- Goreville

- Grantsburg

- New Burnside

- Ozark

- Simpson

- Vienna

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (618) 658-3611 and (618) 967-9528 for current fees.

Questions answered? Let's get started!

Revoking an Illinois transfer on death instrument is governed by 755 ILCS 27.

One of the many useful aspects of the Illinois transfer on death instrument (TODI) is the ability to revoke it with no penalty to the owner and no obligation to the beneficiary. If the owner, who already executed and recorded a TODI, decides, for any reason, to cancel the future transfer, completing, executing, and recording a revocation will negate the prior document and prevent the former beneficiary from gaining ownership of the residential real property covered by the TODI.

Complete, sign, and record this form to revoke a previously executed and recorded transfer on death instrument for residential real property in the state of Illinois.

Note that the requirements for executing a revocation are similar to those of the TODI. The owner must sign the revocation in the presence of two adult witnesses who are not otherwise involved with the transaction. Additionally, a notary public or other individual who is authorized by the courts to administer oaths must be present to certify the identities and signatures of the owner and the witnesses.

(Illinois Transfer on Death Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

Dorien C.

March 25th, 2023

Easy to use, thank you.

Thank you!

Filomena G.

March 8th, 2025

very helpful

Thank you!

Harry C.

February 11th, 2019

I got the wrong state and now they want to charge me again for the proper state. My fault, BUT!!!!

Sorry to hear that Harry. We've gone ahead and canceled the order you made in error. Have a wonderful day.

John G.

July 25th, 2022

I was actually quite pleased with the ease of use of this site. I really, really liked the step by step instructions and examples of the finished product !!

Thank you!

JOSE E.

March 19th, 2019

Thanks

Thank you!

Susan G.

January 7th, 2023

I was pleased with the example of a completed beneficiary deed and instructions. It made filling out the deed very easy.

Thank you!

Richard M.

January 9th, 2020

Needed some help at the beginning but once I was into the program it was smooth sailing.

Thank you!

Carmen R.

November 14th, 2021

I was able to get the form I needed but it would not adjust properly on the page.

Thank you!

Yvette G.

February 18th, 2021

We were extremely satisfied with DEEDS.COM. We spent countless hours trying to contact the Queens County Clerk's Office without succeeding to get through. We needed to obtain an Executor's Deed to transfer the name on my beloved deceased father's property to my name as the executrix of his will. DEEDS.COM is the most efficient and painless way to get the forms you need. To top it all off, they send you, free of charge, additional forms that you may need for your filing purposes. We are truly thankful for their kind assistance!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Tammy S.

October 6th, 2022

Easy to download, great guidelines, and samples of each form needed.

Thank you!

Tamica D.

April 22nd, 2020

Exceptional service. Thank you for your assistance.

Thank you!

alena t.

September 16th, 2019

It was quick and easy to print and download the forms I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Audra W.

December 16th, 2021

Excellent source for obtaining documents and instructions.

Thank you!