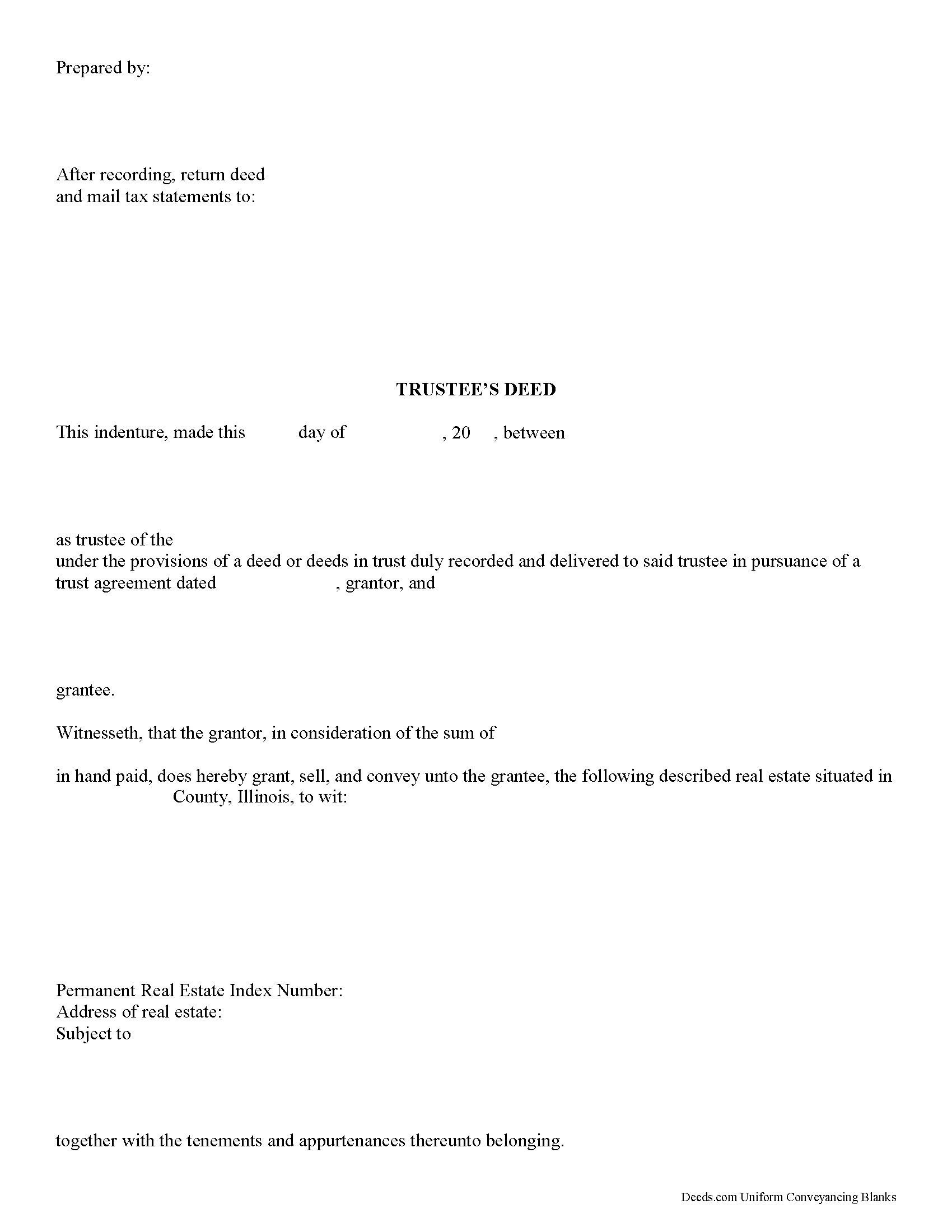

Clinton County Trustee Deed Form

Clinton County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

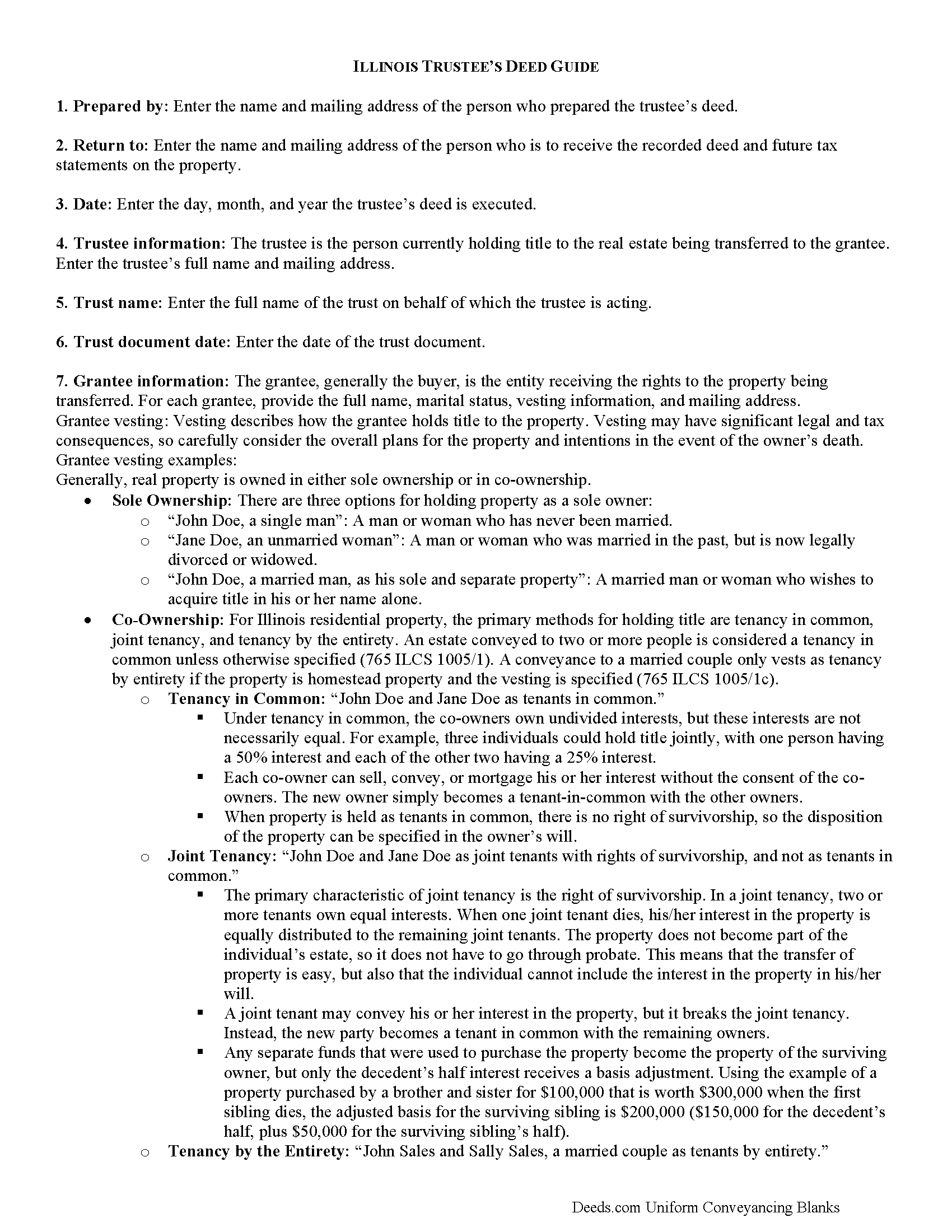

Clinton County Trustee Deed Guide

Line by line guide explaining every blank on the form.

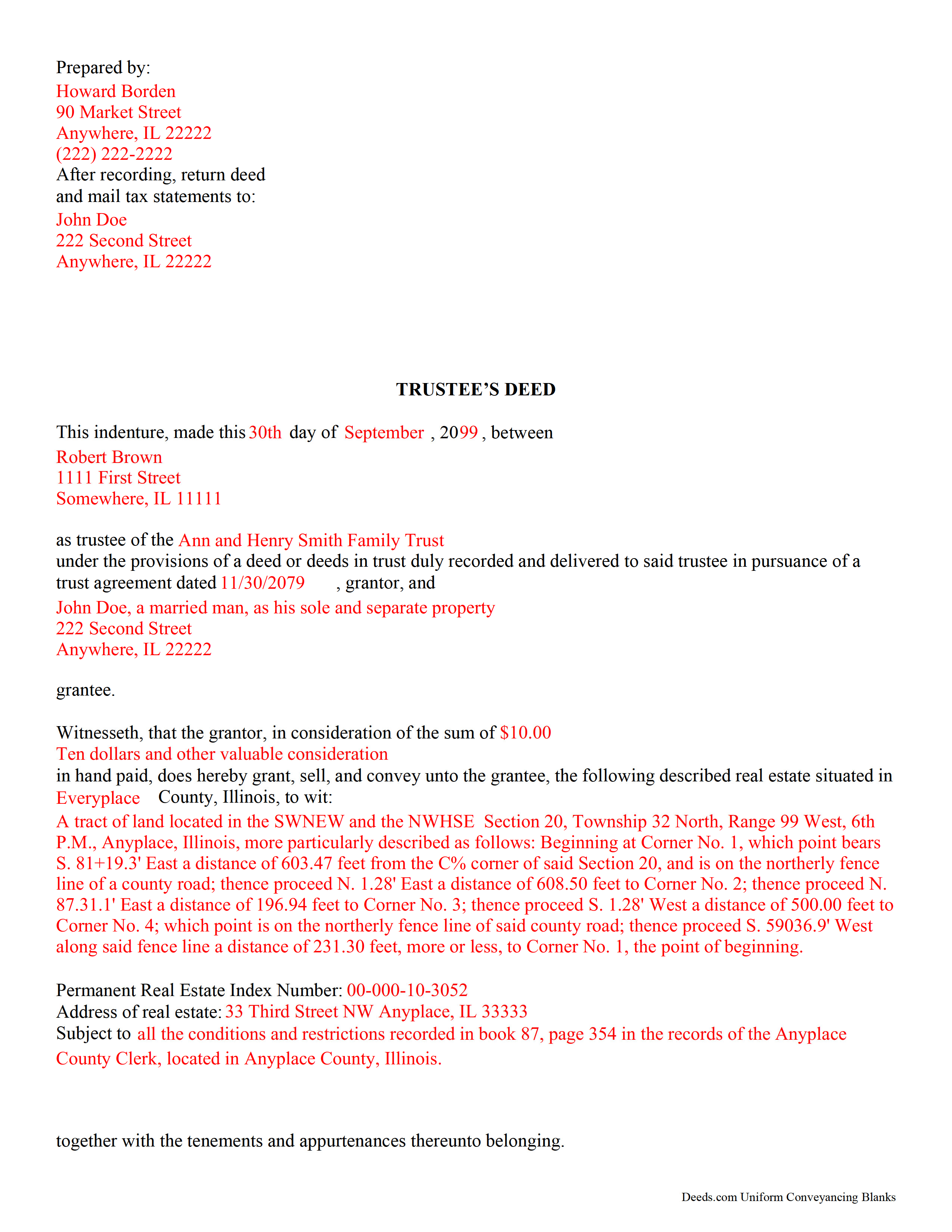

Clinton County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Clinton County documents included at no extra charge:

Where to Record Your Documents

Clinton County Clerk & Recorder

Carlyle, Illinois 62231

Hours: 8:00 to 4:30 Monday through Friday

Phone: (618) 594-6620

Recording Tips for Clinton County:

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Bring extra funds - fees can vary by document type and page count

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Clinton County

Properties in any of these areas use Clinton County forms:

- Albers

- Aviston

- Bartelso

- Beckemeyer

- Breese

- Carlyle

- Germantown

- Hoffman

- Huey

- Keyesport

- New Baden

- New Memphis

- Trenton

Hours, fees, requirements, and more for Clinton County

How do I get my forms?

Forms are available for immediate download after payment. The Clinton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clinton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clinton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clinton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clinton County?

Recording fees in Clinton County vary. Contact the recorder's office at (618) 594-6620 for current fees.

Questions answered? Let's get started!

In Illinois, a trustee's deed is used to transfer real property out of a trust. The deed is named for the person executing it -- the trustee. According to Black's Law Dictionary, 8th ed., a trustee is someone who, having legal title to property, holds it in trust for the benefit of another and owes a fiduciary duty to that beneficiary. A fiduciary is someone who must exercise a high standard of care in managing another's money or property.

The trustee's deed establishes basic information about the trust, such as the name and date of the trust document. The trustee serves as the grantor in the deed, and transfers the title into the grantee's name. As with all other conveyances of real property, the deed requires a legal description of the property being conveyed, as well as a Property Identification Number (PIN) and commonly known address. For a valid transfer, the trustee must sign the deed in the presence of a notary, who confirms (notarizes) the signature.

(Illinois Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Clinton County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Clinton County.

Our Promise

The documents you receive here will meet, or exceed, the Clinton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clinton County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4606 Reviews )

Thomas J.

March 3rd, 2021

I'm pleased with the service

Thank you!

Charles F.

November 20th, 2020

Fantastic service. I purchased the form one day, had it filled out, notarized and e-filed the next day. The following day I received the recorded document back. It was really overnight service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joan P.

March 18th, 2020

Thank you for combining all necessary documents in one simple location.

Thank you!

Roger G.

March 23rd, 2023

was difficult to find the location on the website to actually download the form I needed. Initially was directed only to information pages related to the form I needed

Thank you for your feedback. We really appreciate it. Have a great day!

Pauletta C.

February 12th, 2022

worked like a charm

Thank you!

Jacqueline B.

August 23rd, 2021

The service was very clear and direct. I was able to get everything I need right now. Your website is set up well. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Alfred D.

February 28th, 2023

The material was very usable and site was easy to navigate. Well worth the money. If I have similar needs, I'll ber back.

Thank you for your feedback. We really appreciate it. Have a great day!

Bertha V. G.

May 17th, 2019

Great information and very easy to understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqueline S.

May 4th, 2021

Outstanding service. The quit claim Deed form was great. Very easy to use and explained very clearly. Definitely recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

lindsey r.

October 18th, 2021

easy to use

Thank you!

Andre H.

June 19th, 2025

World class forms, great for someone like me that has no clue what I'm doing! Always better to let the pros do it than think one knows it all and gets themselves in trouble!

Thank you for your feedback. We really appreciate it. Have a great day!

ian a.

September 28th, 2022

Your website advertising was somewhat deceptive regarding doing a quitclaim on a name change. "If you are transferring the property to yourself under your new name, all you have to do is update the deed from your former name to your current one." This made this sound easy. But when I downloaded the material for my state, expecting to find an example, there was no example of how to do a name change quitclaim deed! I therefore had to figure this out myself. You might have provided a warning about certain uses that were not covered in the material so that people know ahead of time that the use they needed to know about wasn't covered in the material.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen E.

May 6th, 2020

Thank you for your great response on my needs. In less than 24 hours I had my documents in hand as needed. Looking forward to working with Deeds.com again. Steve Esler

Thank you for your feedback Steve, glad we could help.

calvin b.

February 21st, 2023

They offer a great service. Also they have been responsive and professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra H.

February 26th, 2019

I am a retired attorney. I chanced upon this website while looking for a Florida Lady Bird Deed Form. It conforms to Florida Law and was exactly what I needed. The forms are easy to obtain and even easier to use and print out.

Thank you so much Sandra, we really appreciate your feedback.