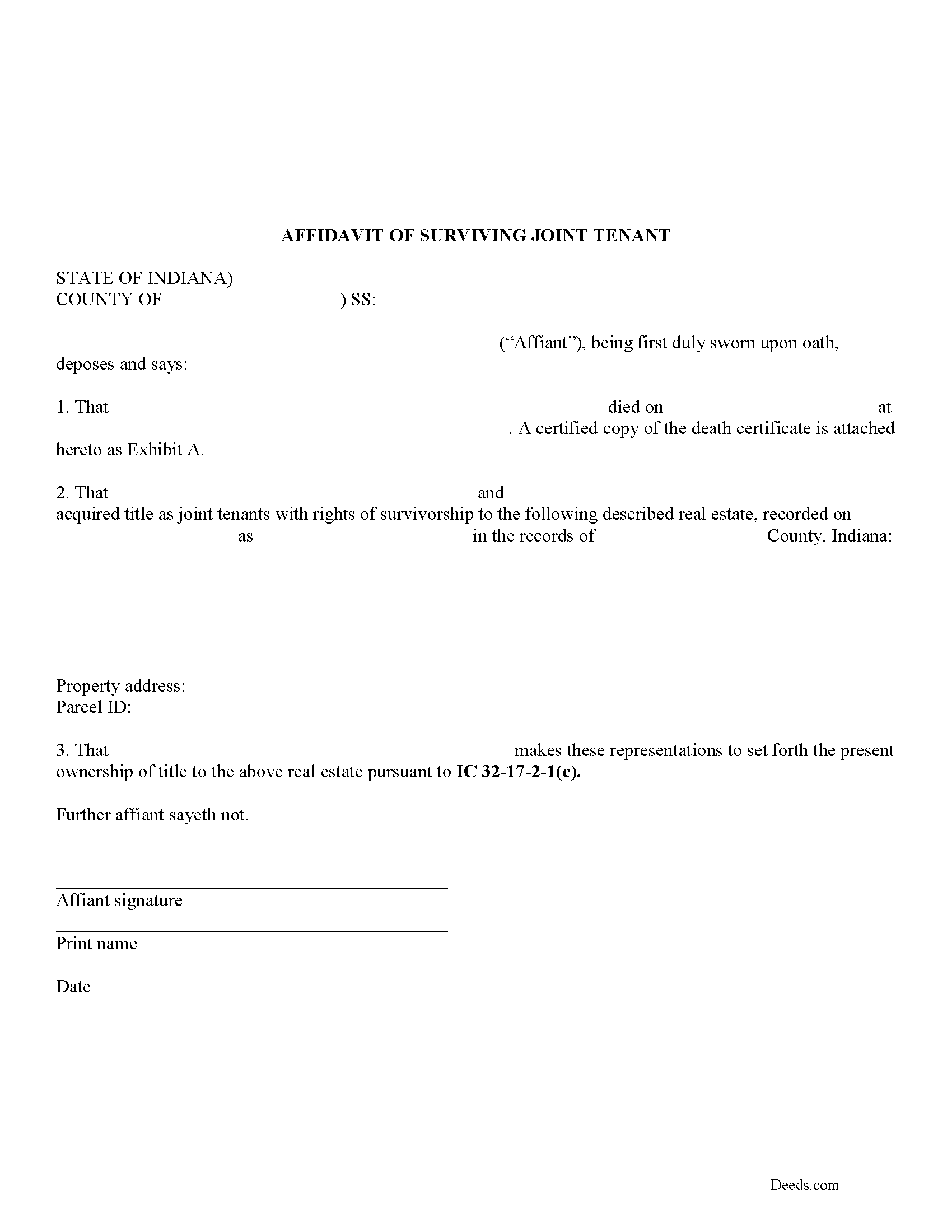

Allen County Affidavit of Surviving Joint Tenant Form

Allen County Affidavit of Surviving Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

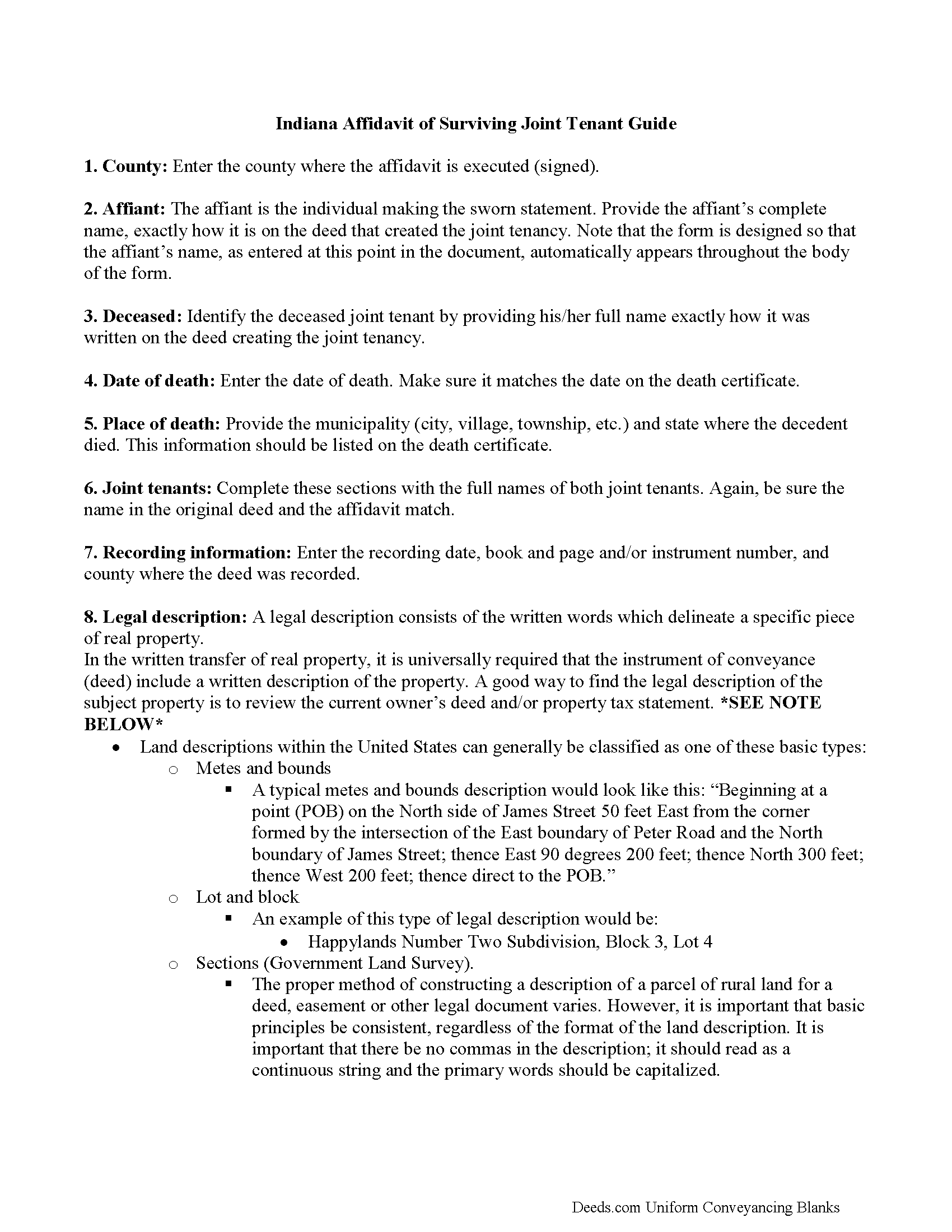

Allen County Affidavit of Surviving Joint Tenant Guide

Line by line guide explaining every blank on the form.

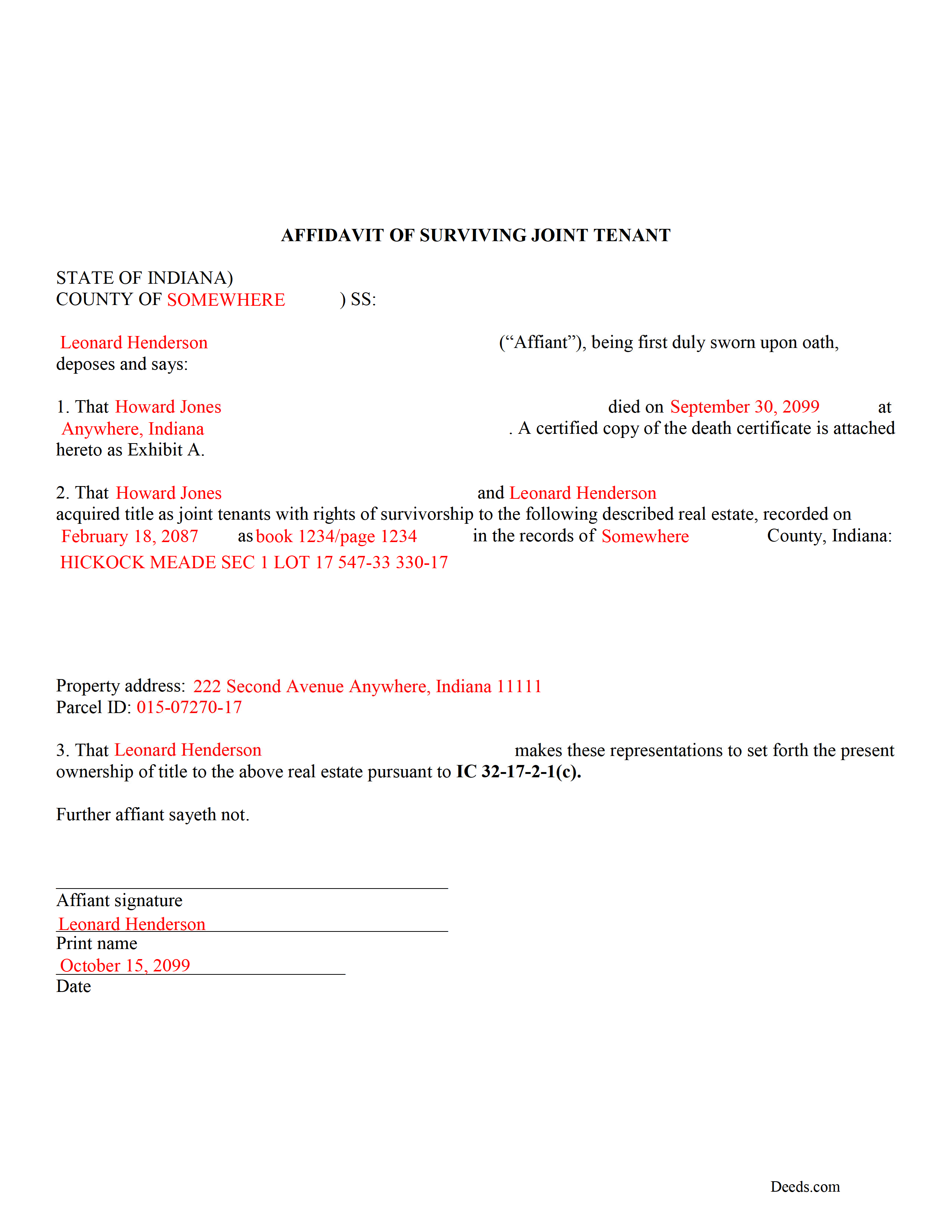

Allen County Completed Example of the Affidavit of Surviving Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Allen County documents included at no extra charge:

Where to Record Your Documents

Allen County Recorder's Office

Fort Wayne, Indiana 46802

Hours: 8:00am to 5:00pm M-F

Phone: (260) 449-7165

Recording Tips for Allen County:

- Documents must be on 8.5 x 11 inch white paper

- Ask if they accept credit cards - many offices are cash/check only

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Allen County

Properties in any of these areas use Allen County forms:

- Arcola

- Fort Wayne

- Grabill

- Harlan

- Hoagland

- Huntertown

- Leo

- Monroeville

- New Haven

- Spencerville

- Woodburn

- Yoder

- Zanesville

Hours, fees, requirements, and more for Allen County

How do I get my forms?

Forms are available for immediate download after payment. The Allen County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Allen County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Allen County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Allen County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Allen County?

Recording fees in Allen County vary. Contact the recorder's office at (260) 449-7165 for current fees.

Questions answered? Let's get started!

Use this instrument to formalize the acceptance of ownership rights conveyed when another joint tenant dies. Complete and sign the affidavit and submit it, along with a certified copy of the decedent's death certificate, to the recorder for the county where the real estate is located.

Holding title to real property in a survivorship tenancy is a convenient way to transfer ownership in land without probate. The Indiana Revised Code specifies the rules for co-ownership of real property in IC 32-17-2-1. This statute explains that two or more people who are not married to each other may own real estate as joint tenants with rights of survivorship as long as this intent is clearly stated in the text of the deed conveying title to them.

In order to gain full ownership, the surviving joint tenant need only submit a completed affidavit of surviving joint tenant, along with an official copy of the death certificate of the other owner, to the recorder for the county where the land is located.

This does not, however, remove the deceased's name from the deed. To accomplish that, the surviving tenant must execute and record a new deed from the original joint tenants to the remaining tenant only. After completing this final step, the public record and current deed will contain the most up-to-date information.

(Indiana Affidavit of Surviving Joint Tenant Package includes form, guidelines, and completed example)

Important: Your property must be located in Allen County to use these forms. Documents should be recorded at the office below.

This Affidavit of Surviving Joint Tenant meets all recording requirements specific to Allen County.

Our Promise

The documents you receive here will meet, or exceed, the Allen County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Allen County Affidavit of Surviving Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Laura H.

August 25th, 2020

I was very impressed with how quickly I was provided the data.

Thank you!

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Arthur H.

March 17th, 2022

Deeds.com was informative, quick, and complete. Found everything I needed complete with instructions and examples. Easy to use and understand. And VERY reasonably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra W.

January 13th, 2021

I was trying to get a lien released for the last 3 month with Maricopa County and once I utilized your system it was complete within 24 hours of my filing. Great company and customer service, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Maria D.

May 22nd, 2020

Deeds.com has done a great job. I really recommend to everyone who needs this service, fast & reliable. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas G.

December 16th, 2019

fast and easy

Thank you!

Jason B.

January 15th, 2022

You saved me $275.00 perfect! Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johannah H.

May 20th, 2022

Deeds.com made my experience recording a Deed in Weld County, CO so easy! The representative went above and beyond by assisting me with the preparation of a high-quality digital document for recording. Highly Recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dan B.

June 6th, 2022

Excellent service even faster then I expected. Very pleased and a reasonable priced document. I encourage people too use Deeds.Com

Thank you for your feedback. We really appreciate it. Have a great day!

Bennie W.

January 9th, 2021

I used the Quitclaim form. The form was easy to complete without using the example or guide. $21 was a fair price compared to paying a lawyer.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly S.

April 21st, 2022

I wasted a lot of my time because I didn't do any research to know what I needed. Nobody fault but mine.

Thank you!

Tim R.

May 9th, 2019

Quick and efficient

Thank you Tim, we appreciate your feedback.

Lisa W.

May 25th, 2022

The easiest thing to use ever. Amazing and extremely prompt support. They get the job done with all the information you might need

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Agnes I H.

January 28th, 2019

Good knowing the price right up front...and not a FREE one you pay at the end....

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert K.

September 6th, 2022

Easy site to use. Well worth the time spent to complete the form.

Thank you!