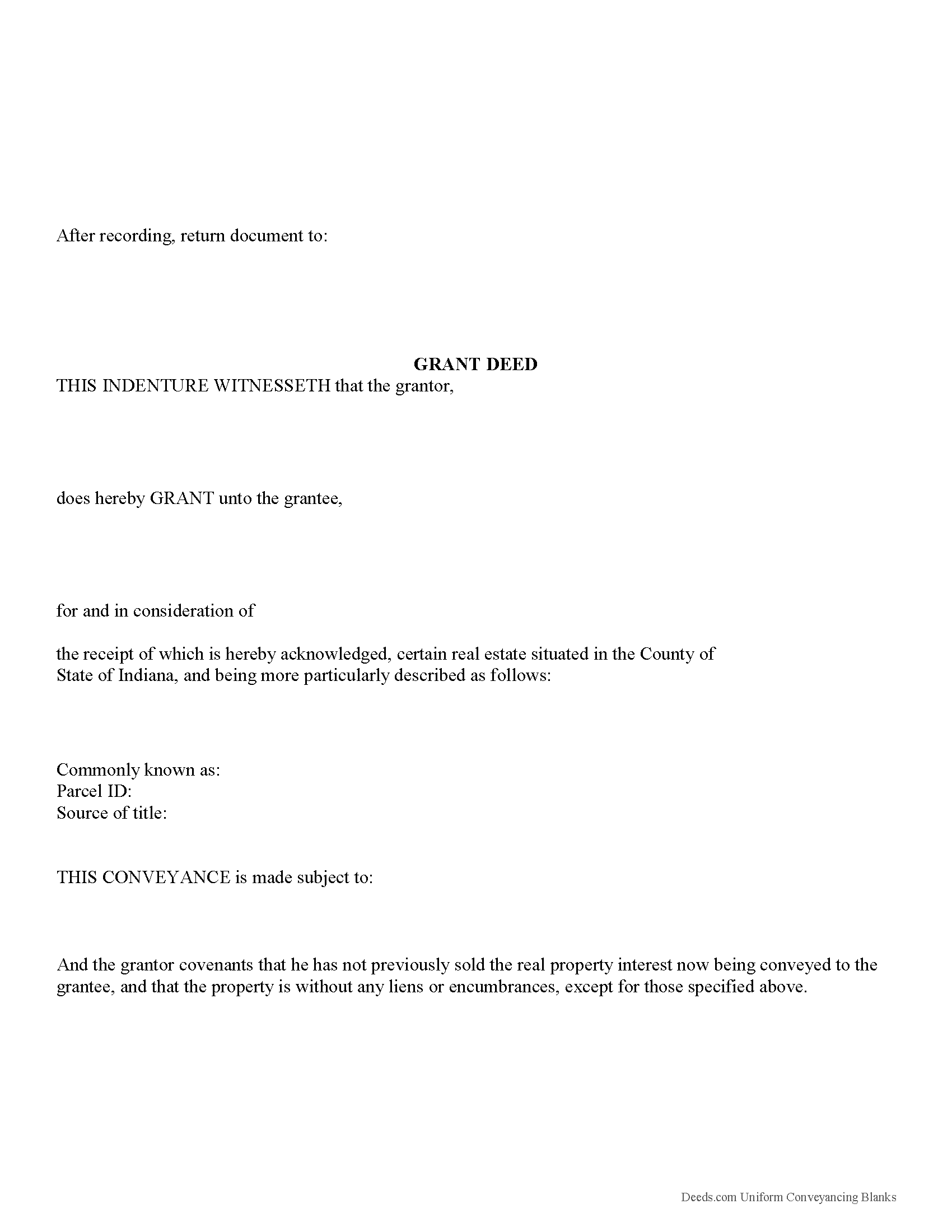

Monroe County Grant Deed Form

Monroe County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

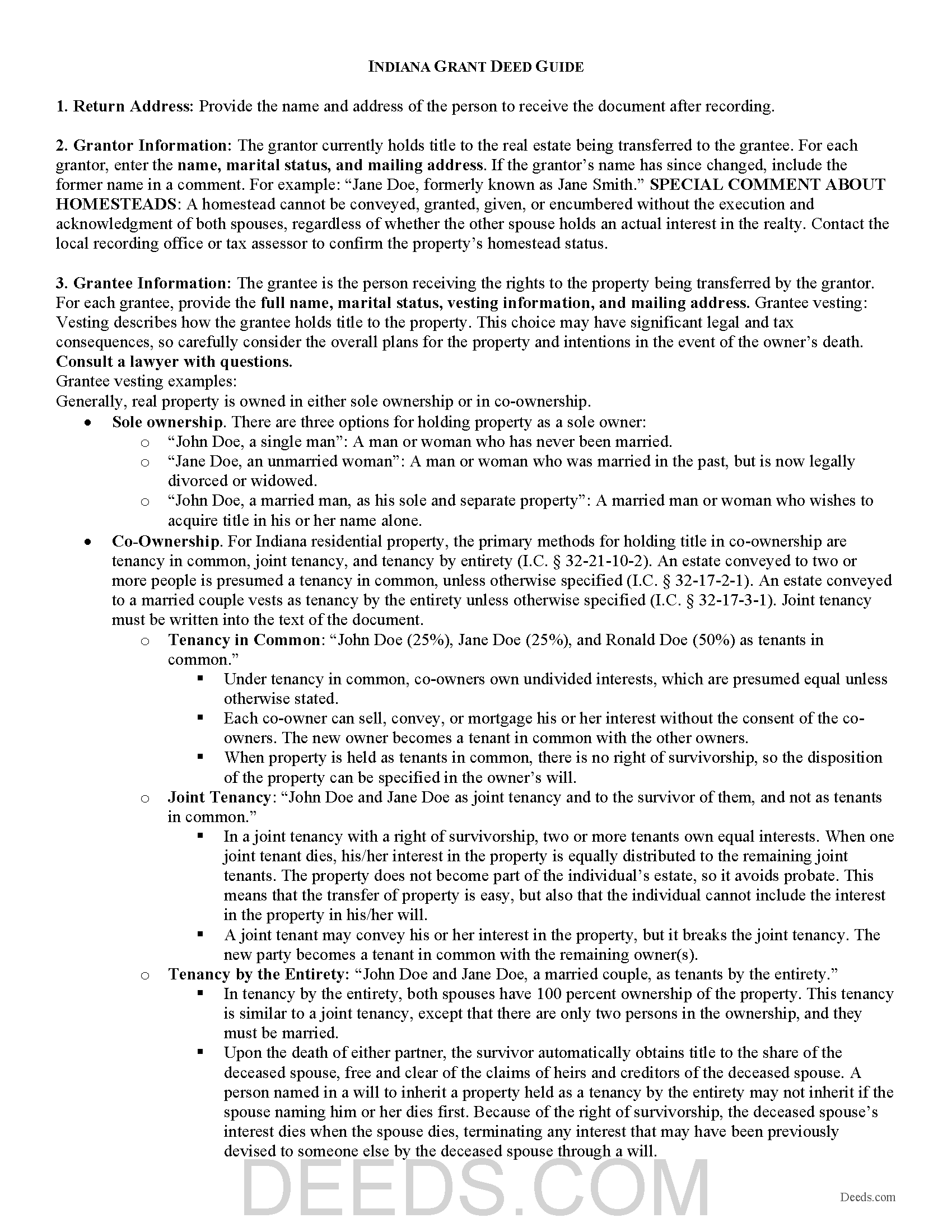

Monroe County Grant Deed Guide

Line by line guide explaining every blank on the form.

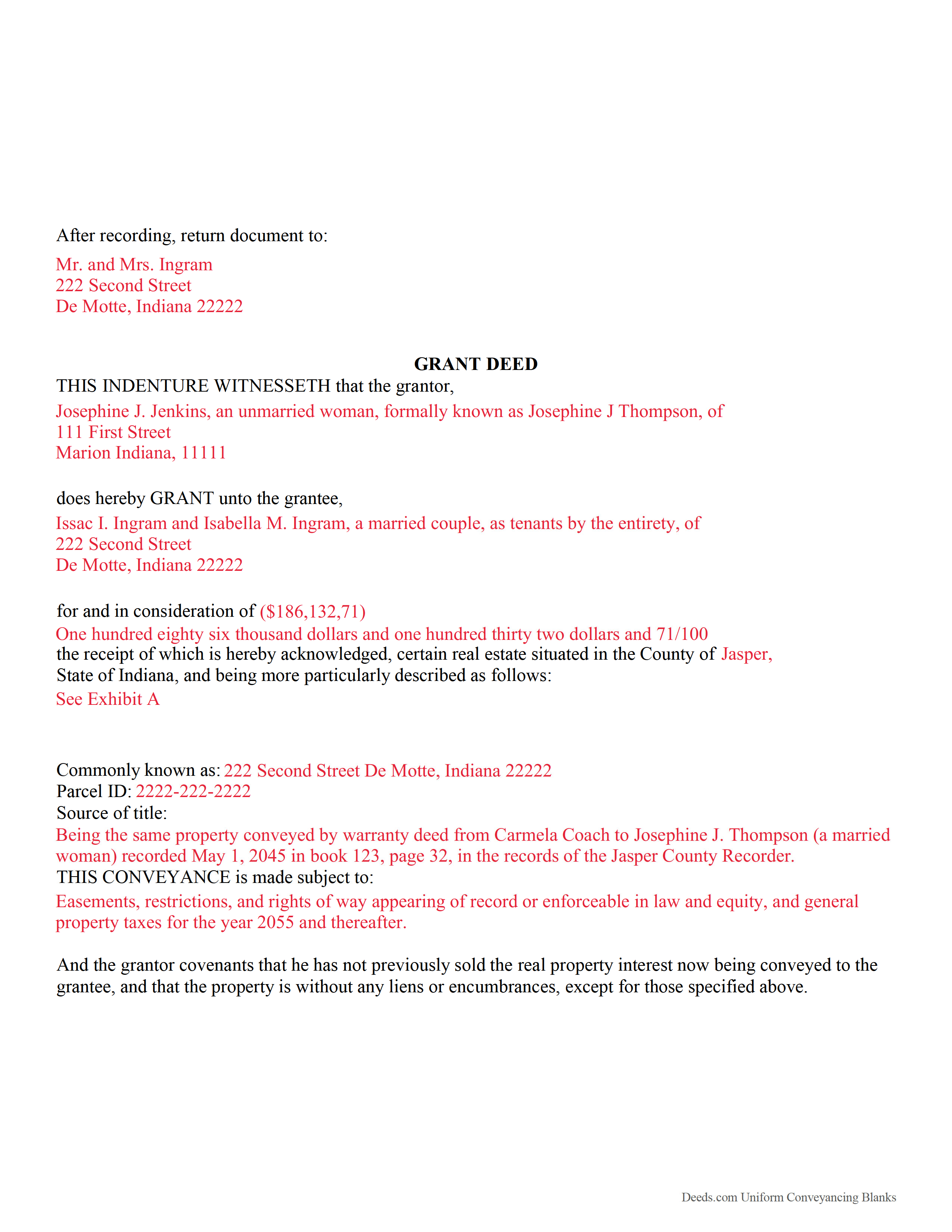

Monroe County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Monroe County documents included at no extra charge:

Where to Record Your Documents

Monroe County Recorder

Bloomington, Indiana 47404 /47402

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 349-2520

Recording Tips for Monroe County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Consider using eRecording to avoid trips to the office

- Have the property address and parcel number ready

Cities and Jurisdictions in Monroe County

Properties in any of these areas use Monroe County forms:

- Bloomington

- Clear Creek

- Ellettsville

- Harrodsburg

- Smithville

- Stanford

- Stinesville

- Unionville

Hours, fees, requirements, and more for Monroe County

How do I get my forms?

Forms are available for immediate download after payment. The Monroe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Monroe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Monroe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Monroe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Monroe County?

Recording fees in Monroe County vary. Contact the recorder's office at (812) 349-2520 for current fees.

Questions answered? Let's get started!

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). It contains implied covenants that the grantor has not previously sold the real property interest and that the property is conveyed without any undisclosed liens or encumbrances. Grant deeds typically do not require the grantor to defend title claims.

A lawful deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Indiana residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and tenancy by entirety (I.C. 32-21-10-2). An estate conveyed to two or more people is presumed a tenancy in common, unless otherwise specified (I.C. 32-17-2-1). An estate conveyed to a married couple vests as tenancy by the entirety unless otherwise specified (I.C. 32-17-3-1). Joint tenancy must be written into the text of the document.

As with any conveyance of real estate, a grant deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. The amount of consideration does not need to be in writing on the deed, but may be proved (I.C. 32-21-1-2). Finally, the form must meet all state and local standards for recorded documents.

Before submitting a grant deed to a county recorder in Indiana, the grantor must sign it in the presence of a notary public. Record the completed and signed deed, along with any supplemental documentation necessary for the specific transaction, in the recorder's office in the county where the property is located. Unless a deed is recorded in the manner provided by the Indiana Code, it is not valid against any person other than the grantor, the grantor's heirs and devisees, and those with notice of the conveyance (I.C. 32-21-3-3). Indiana gives priority of title to the party that records first, but only if the party also lacked notice of prior unrecorded claims on the same property.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with questions about grant deeds or for any other issues related to the transfer of real property in Indiana.

(Indiana Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Monroe County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Monroe County.

Our Promise

The documents you receive here will meet, or exceed, the Monroe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Monroe County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Ming Z.

September 28th, 2022

Definitely 5 Stars !

Thank you!

Ricardo M.

December 30th, 2021

easy to use

Thank you!

star v.

July 19th, 2019

i have used you guys once and i am happy with the service i will be using you guys again

Thank you for your feedback. We really appreciate it. Have a great day!

Spencer A.

January 25th, 2019

Deeds.com made it so easy to file my paper work with the county. It saved me half a days travel and cost me about a tank of gas. This service was well worth the saved travel time and energy. I would highly recommend this service to other individuals. The other companies I spoke with only service law firms, title companies & banks etc. Thanks deed.com, I'll be back and will refer all my friends too.

Thank you so much Spencer, we really appreciate your feedback!

Charles G.

August 14th, 2022

Easy to request. Fast response

Thank you!

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

Sharon S.

June 18th, 2021

very satisfied...

Thank you!

Deidre E.

November 18th, 2024

Best thing since sliced bread. Do your homework. Find the documents with Deeds.com and bypass expensive and unnecessary lawyers fees.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

CHERYL G.

April 11th, 2022

After my county rejected a deed from another company, I researched better and purchased my Lady Bird Deed from Deeds.com. Very simple, received everything immediately. Printed out sample and guide sheets and filled out my deed. Very thorough and easy to understand. All the additional forms were awesome. And the best part is, my county recorded my deed this morning! WooHoo! Very happy customer! Thank you!

Glad to hear! Thanks for taking the time to leave your review. We appreciate you. Have a great day.

Gertrude H.

October 1st, 2019

I used this form and guide a couple years ago and found it helpful and easy to fill out. Had good results at the Recorder's Office. Would recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Keri C.

June 10th, 2020

It was confusing at first, but the customer service was excellent and fast and I got everything taken care of right away. I'll use Deeds.com even after the recorder's office is open to the public.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin R.

January 4th, 2024

Deeds.com made a very difficult time in our lives much easier to deal with. So happy that we found this app when we did!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Mark M.

November 5th, 2020

Deeds was easy to use and worked as specified; they got the recording I needed done finished in one day!

Thank you for your feedback. We really appreciate it. Have a great day!

Phillip B.

March 14th, 2020

Nice. Quick and very easy to find and download the exact forms I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Jose D.

January 27th, 2021

A little difficult in the beginning but with the messaging back and forth it was very simple and fast. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!