Clay County Trustee Deed with Warranty Form

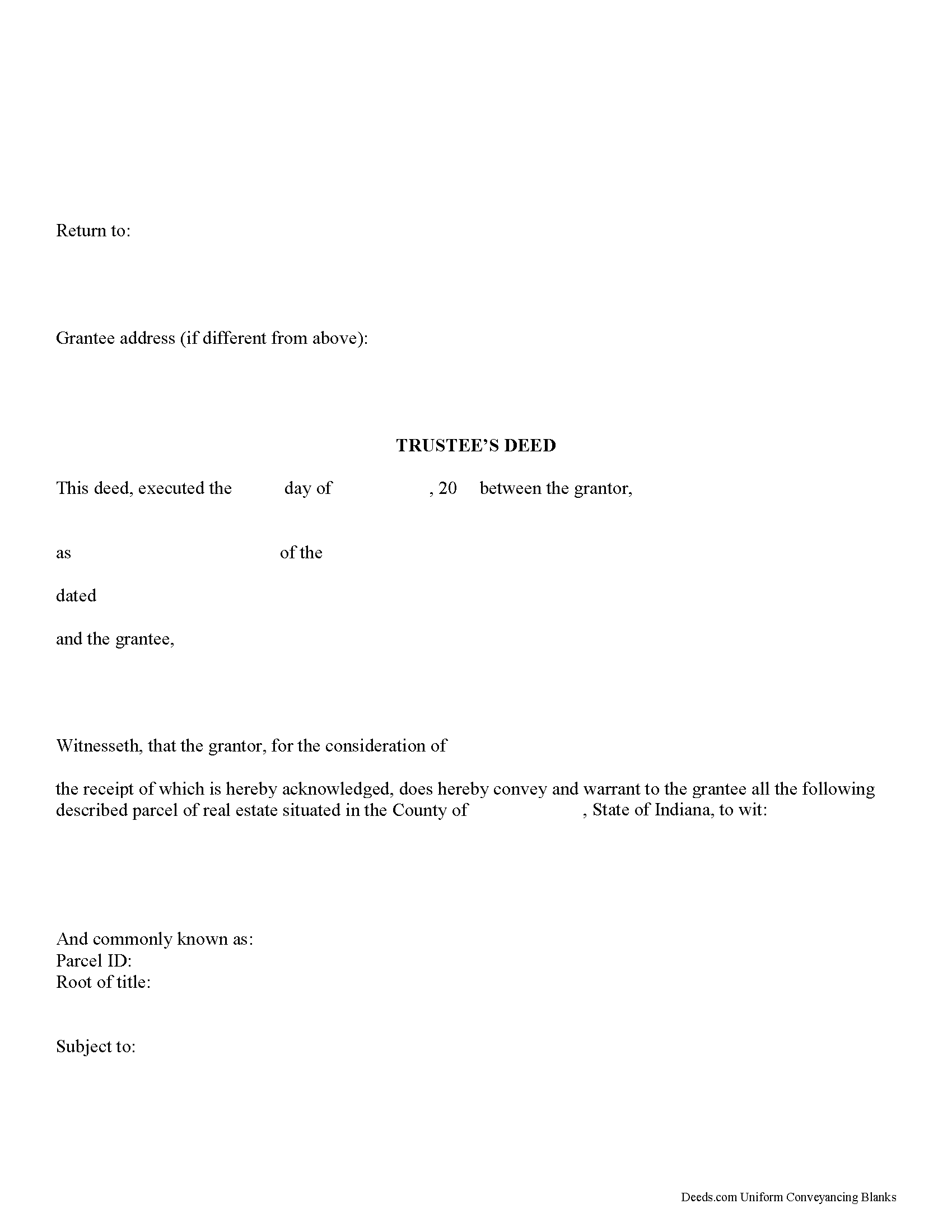

Clay County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

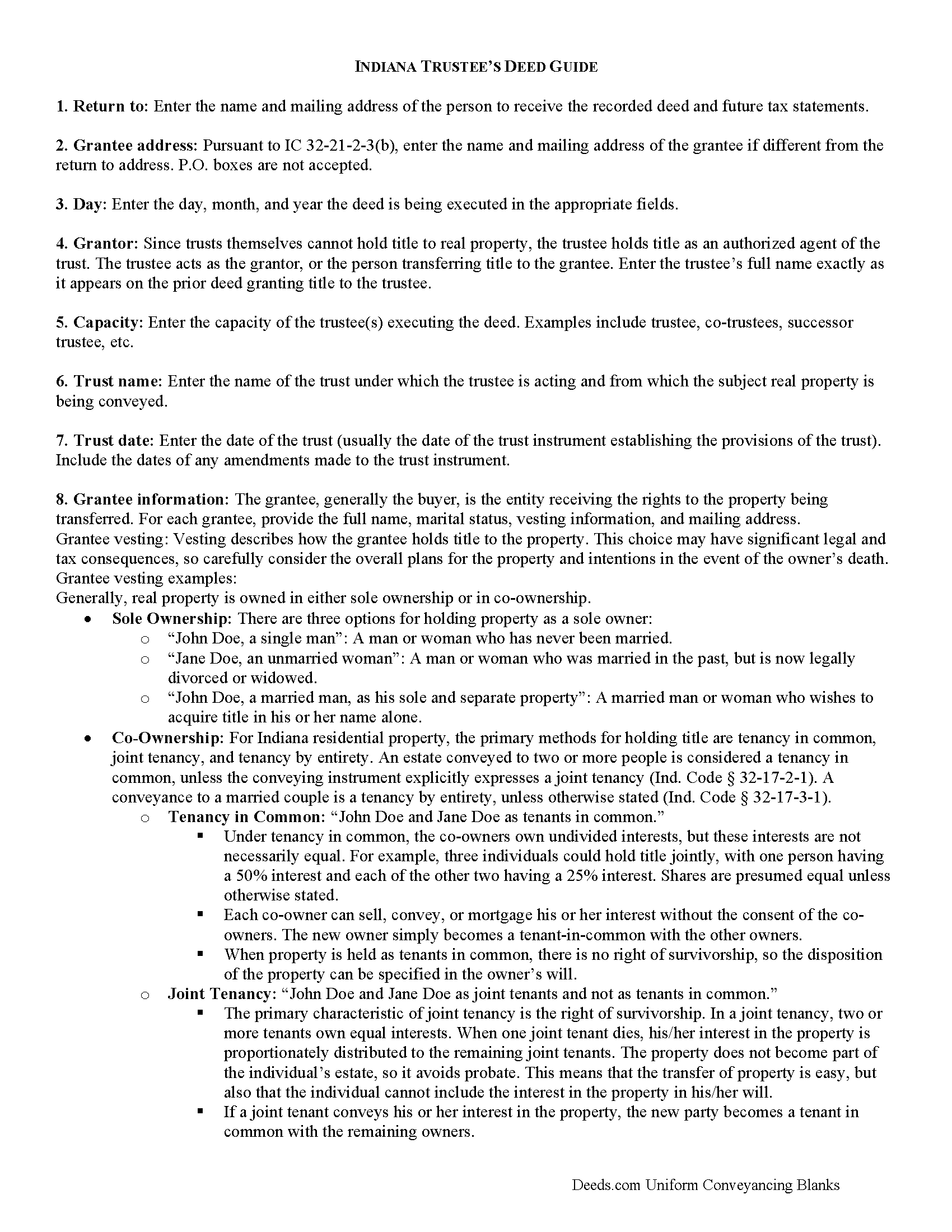

Clay County Trustee Deed Guide

Line by line guide explaining every blank on the form.

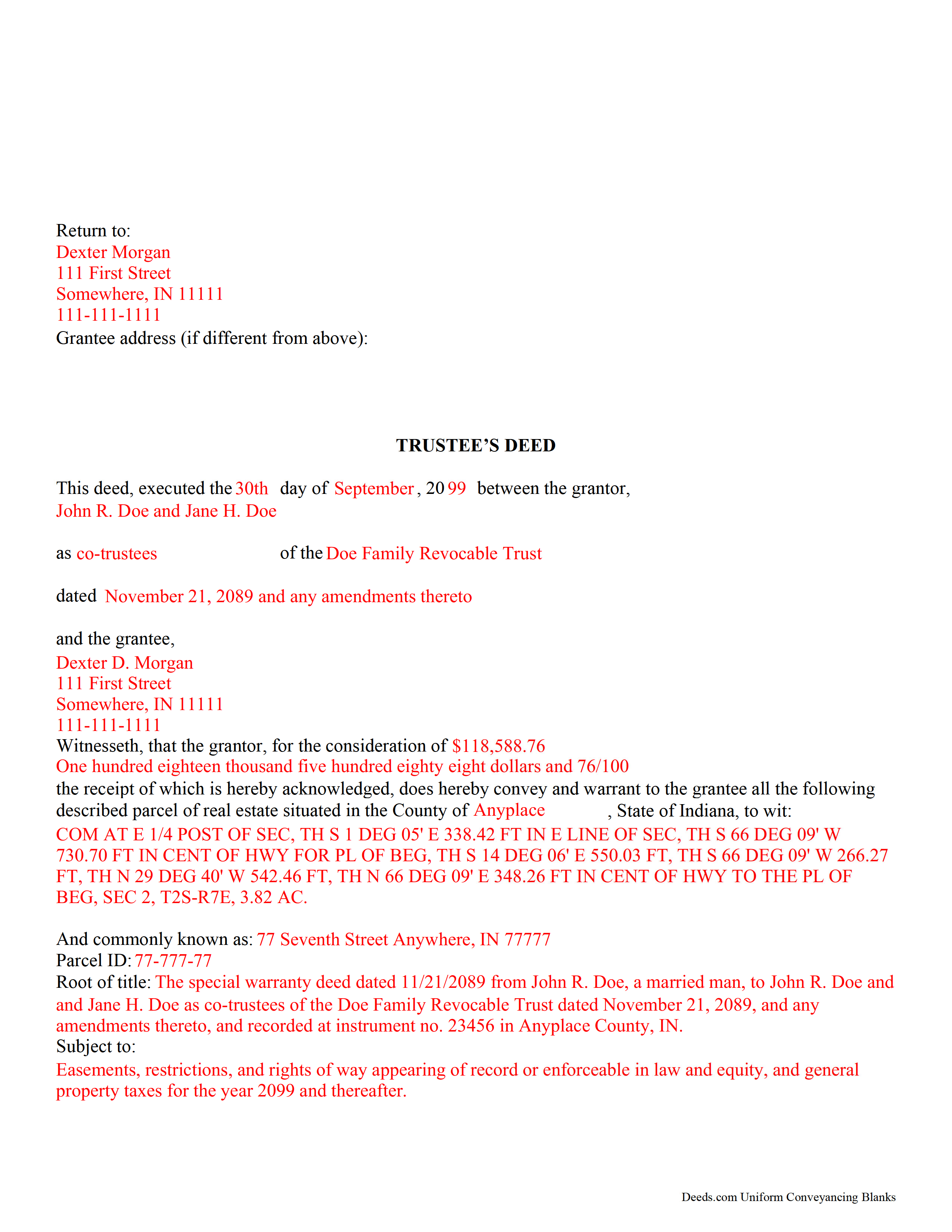

Clay County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Clay County documents included at no extra charge:

Where to Record Your Documents

Clay County Recorder

Brazil, Indiana 47834

Hours: 8:00am-4:00pm M-F

Phone: (812) 448-9005

Recording Tips for Clay County:

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Clay County

Properties in any of these areas use Clay County forms:

- Bowling Green

- Brazil

- Carbon

- Centerpoint

- Clay City

- Coalmont

- Cory

- Harmony

- Knightsville

- Staunton

Hours, fees, requirements, and more for Clay County

How do I get my forms?

Forms are available for immediate download after payment. The Clay County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clay County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clay County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clay County?

Recording fees in Clay County vary. Contact the recorder's office at (812) 448-9005 for current fees.

Questions answered? Let's get started!

Trustees use this form to transfer real property located in Indiana out of trust, with warranties of title as set out in Ind. Code 32-17-1-2. The deed should be executed by the trust's acting trustee(s).

A trustee's deed is an instrument used in trust administration to convey real property out of a trust. Unlike other forms of conveyance, which are named for the type of warranties they carry, the trustee's deed is named after the executing trustee.

The trustee is the administrator of a trust who is appointed by the settlor. The settlor is the person who funds the trust with assets -- in this case, real property. The settlor executes a trust instrument, which contains the provisions of the trust, including a designation of the trust's beneficiaries. This document is generally not of public record.

The trustee serves as the grantor in the trustee's deed. If there are multiple trustees or the trustee appears as a successor, this information is included also. The settlor does not enter directly into the transaction. In addition, the deed states the trust name and date under which the trustee is appearing, as well as any amendments made to the trust instrument.

All instruments of conveyance in Indiana require a legal description of the property begin conveyed, the grantee's information, and the root of title, as well as a "prepared by" statement and affirmation statement regarding the redaction of Social Security Numbers. All acting trustees must sign the deed in the presence of a notary public before the deed is recorded in the county in which the real property is situated.

Because trustees act in a fiduciary capacity, they may be asked to provide a certification of trust, demonstrating that the trust exists and their authority to enter into transactions on behalf of the trust.

The trustee's deed may require additional information depending on the situation. These instruments may or may not include warranties of title, so make sure to use the correct form for the situation. Consult a lawyer with specific questions or guidance in preparing a trustee's deed.

Important: Your property must be located in Clay County to use these forms. Documents should be recorded at the office below.

This Trustee Deed with Warranty meets all recording requirements specific to Clay County.

Our Promise

The documents you receive here will meet, or exceed, the Clay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clay County Trustee Deed with Warranty form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Linda L.

July 14th, 2019

Excellent service. Very quick response.

Thank you Linda, we appreciate your feedback.

Melody P.

November 10th, 2021

Great service, as always!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Duane R.

May 12th, 2019

Your site was very easy to use and provided all the information needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Iryna D.

March 31st, 2020

Exelent work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael F.

March 12th, 2020

Very useful and right at your fingers when you need a form. Recommend these forms highly. Thank you!!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Arturo P.

August 16th, 2021

Super easy to use! Totally satisfied. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John S.

June 29th, 2021

Your service is refreshingly clear, simple, and free of superfluous claims or unnecessary marketing. And, more affordable than other online legal document providers I've looked at. So nice! I forgot I had used it some years ago for another deed so glad you are still around for this time.

Thank you for the kind words John. Have a fantastic day!

Tong B.

May 7th, 2020

hi, It is very easy to do it. tanks.

Thank you!

maria b.

November 1st, 2020

really easy and and helpful.

Thank you!

James S.

April 22nd, 2019

easy to use

Thank you James.

Susan A.

April 18th, 2019

Very convenient. Instructions and samples are a plus because I often see documents incorrectly completed. Take the time to do it right.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer A.

May 18th, 2022

All I needed to do was changed from my previously married name to my now maiden name and a Quit Claim Deed was all I needed. I loved that they offered a sample along with very detailed directions. Great site! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael T.

July 6th, 2020

Quick, simple and easy.

Thank you!

David M.

April 24th, 2019

Why is Dade County not listed for the Lady Bird Deed?

Because on November 13, 1997, voters changed the name of the county from Dade to Miami-Dade.

Dennis M.

November 26th, 2020

Very quick and easy to use. Deeds.com saved me a lot of money!

Thank you!