Cerro Gordo County Conditional Lien Waiver upon Progress Payment Form

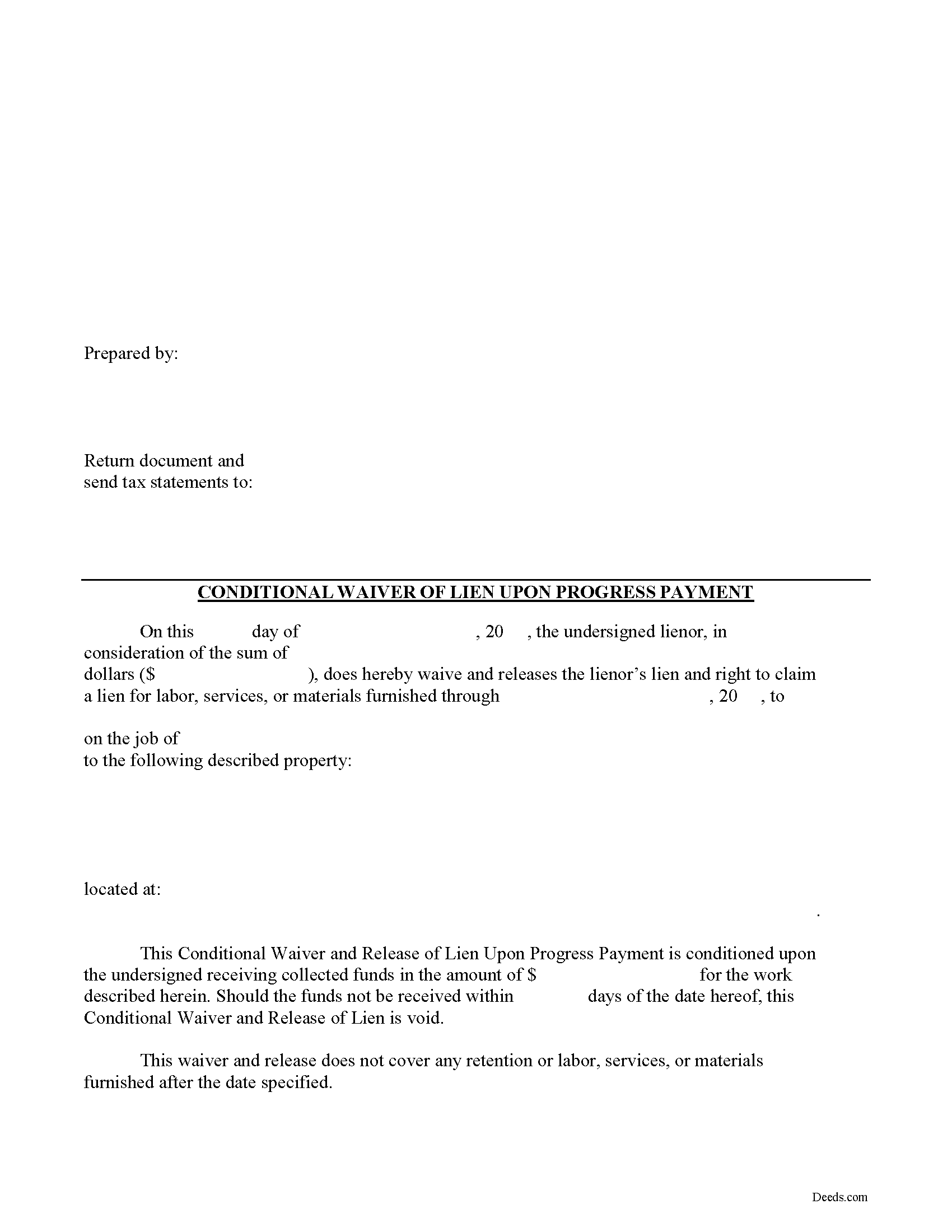

Cerro Gordo County Conditional Lien Waiver upon Progress Payment Form

Fill in the blank Conditional Lien Waiver upon Progress Payment form formatted to comply with all Iowa recording and content requirements.

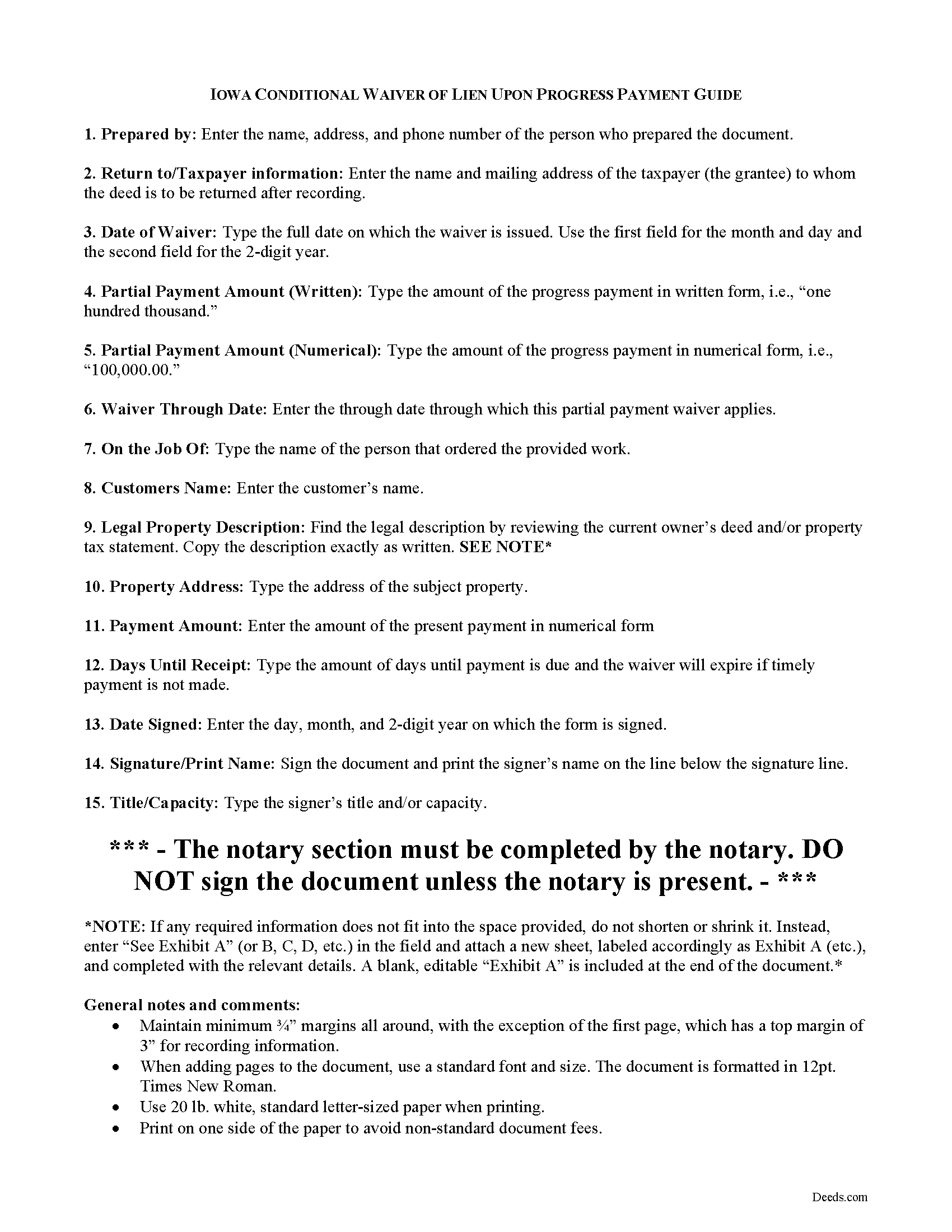

Cerro Gordo County Conditional Lien Waiver upon Progress Payment Guide

Line by line guide explaining every blank on the Conditional Lien Waiver upon Progress Payment form.

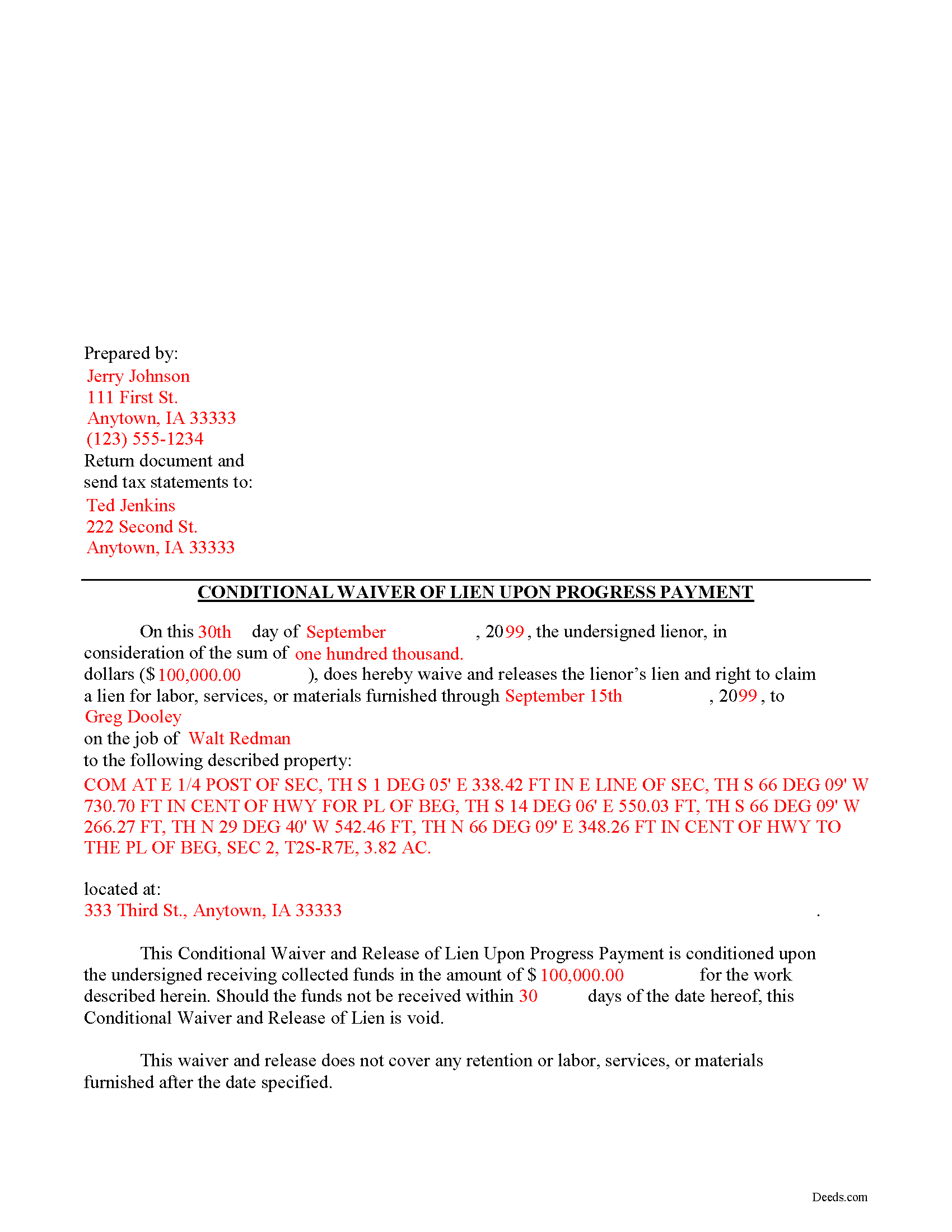

Cerro Gordo County Completed Example of the Conditional Lien Waiver upon Progress Payment Document

Example of a properly completed Iowa Conditional Lien Waiver upon Progress Payment document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Cerro Gordo County documents included at no extra charge:

Where to Record Your Documents

Cerro Gordo County Recorder

Mason City, Iowa 50401

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (641) 421-3056

Recording Tips for Cerro Gordo County:

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Cerro Gordo County

Properties in any of these areas use Cerro Gordo County forms:

- Clear Lake

- Dougherty

- Mason City

- Meservey

- Plymouth

- Rock Falls

- Rockwell

- Swaledale

- Thornton

- Ventura

Hours, fees, requirements, and more for Cerro Gordo County

How do I get my forms?

Forms are available for immediate download after payment. The Cerro Gordo County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cerro Gordo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cerro Gordo County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cerro Gordo County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cerro Gordo County?

Recording fees in Cerro Gordo County vary. Contact the recorder's office at (641) 421-3056 for current fees.

Questions answered? Let's get started!

Mechanic's liens are governed under Chapter 572 of Iowa Code. A waiver is a conscious relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Iowa, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Generally, waivers come in four varieties: conditional or unconditional, and based on a partial/progress or final payment. Conditional waivers only become effective after the responsible party's check clears the bank on which it was drawn, and provide more protection for the claimants. Unconditional waivers go into effect immediately, tend to favor the owners' interests, and should only be used after payment is confirmed. Waiving lien rights after a partial payment allows the claimant to retain some lien rights, but to release others based on the amount paid on the overall balance due. Waivers upon final payments remove the claimant's eligibility to place a lien because they state that the account is paid in full.

Regardless of the nature, waivers must identify the parties, the location of the project, relevant dates, and payments.

Partial waivers are used to waive a lien for up to the partial or progress payment amount. A conditional waiver means the waiver is conditioned upon the claimant receiving the amount due. Use the partial conditional waiver when the owner makes less than the full or final payment and the payment method does not guarantee receipt of the money (such as a check that hasn't cleared yet).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Important: Your property must be located in Cerro Gordo County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver upon Progress Payment meets all recording requirements specific to Cerro Gordo County.

Our Promise

The documents you receive here will meet, or exceed, the Cerro Gordo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cerro Gordo County Conditional Lien Waiver upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Lesley B.

May 6th, 2022

It was so quick and easy to access.. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Carol S.

May 7th, 2022

Needed a Quit Claim Deed and am so happy I went to Deeds.com. Completed my forms - they looked professional and had no problem submitting them to Assessor's office. PERFECT!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Greg M.

March 16th, 2020

This is a great site! Very easy to use and has all the documents I required. Thank you!

Thank you!

Ronald P.

August 18th, 2020

Very easy to use... awaiting info

Thank you for your feedback. We really appreciate it. Have a great day!

carrie m.

March 3rd, 2020

I was excited because I really wanted to see and get a copy of the Deed to my property. The personal/Staff responsible for setting up that plan did an excellent/outstanding job. Thanks so much and keep up the great work. Carrie

Thank you for your feedback. We really appreciate it. Have a great day!

Gretchen N.

February 8th, 2019

The filled out form could have been placed on the real form then deleted with current info. Form quite simplified but example & help good.

Thank you for your feedback Gretchen.

Barbara M.

November 21st, 2020

We love this service - so easy to use and quick. It is the second time we have used Deeds.com, in two different states. Wonderful service!

Thank you for your feedback. We really appreciate it. Have a great day!

John M.

September 16th, 2022

Easy to use site with a good selection of documents

Thank you!

Dennis D.

November 7th, 2019

Downloaded perfect. Can hardly wait to get them done.

Thank you!

Lindsey W.

March 7th, 2019

The service was great but after I did all my work and uploaded the documents they canceled my stuff because the county they had on the list doesnt take/or have set up e-recording yet. It was a bit disappointing because thats the only reason I was on here is because it brought me here from that countys sight.

Thank you for your feedback, sorry we were not able to provide the service for you. Hope you have a great day.

Terrence R.

January 24th, 2020

So far so good I was able to find the documents I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Doris S.

September 12th, 2021

Pleased with efficiency and expediency of website. Added value is the respective county requirements for Florida. I needed a quitclaim deed between family members. Highly recommended. We hope to record signed and executed document next week in Florida. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shari N.

April 9th, 2025

Deeds.com provides a valuable resource to efficiently file documents for recordation.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Catherine V.

January 29th, 2023

I love simple and easy! This is the model that many businesses should use!

Thank you!

Angela W.

March 12th, 2022

Very helpful and very quick to respond. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!