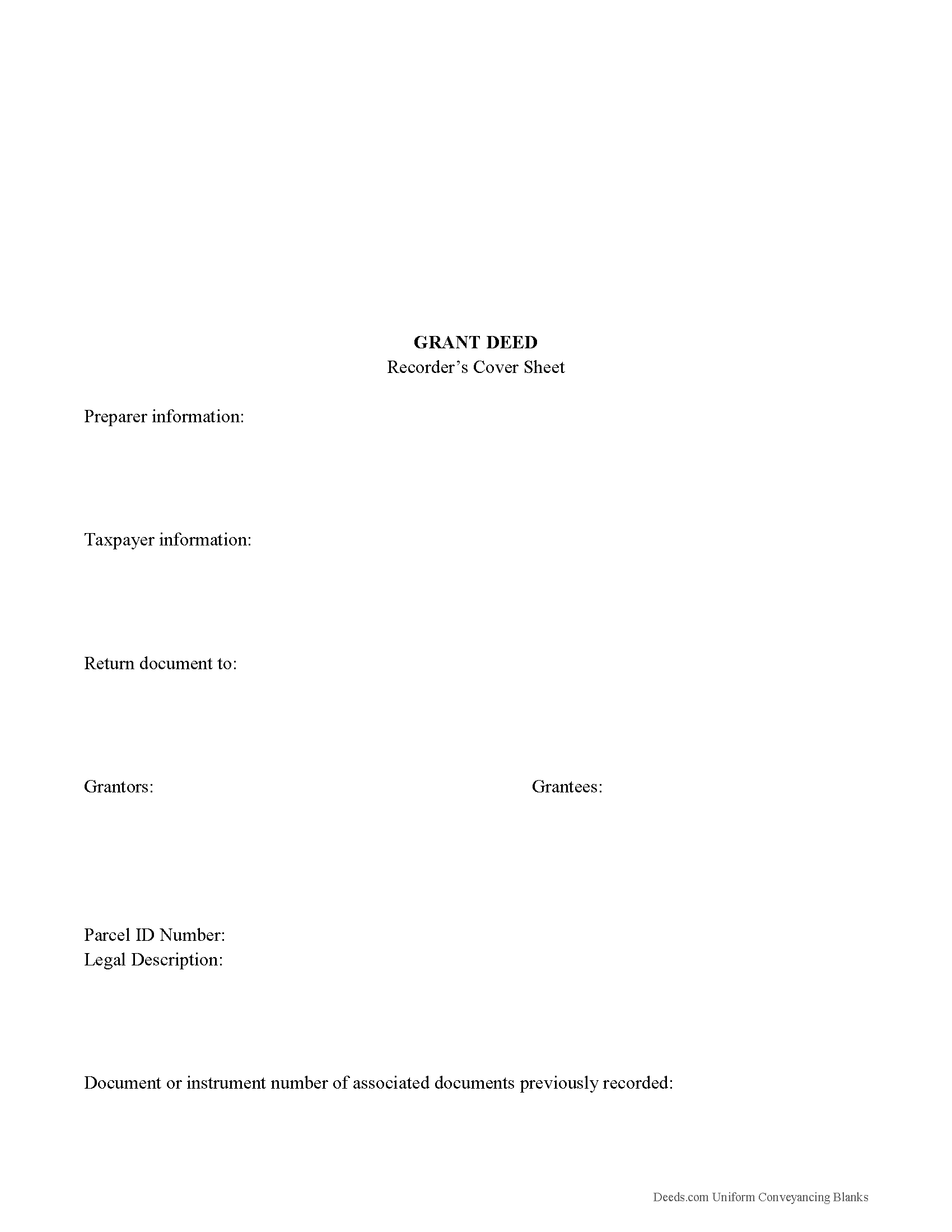

Dallas County Grant Deed Form

Dallas County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

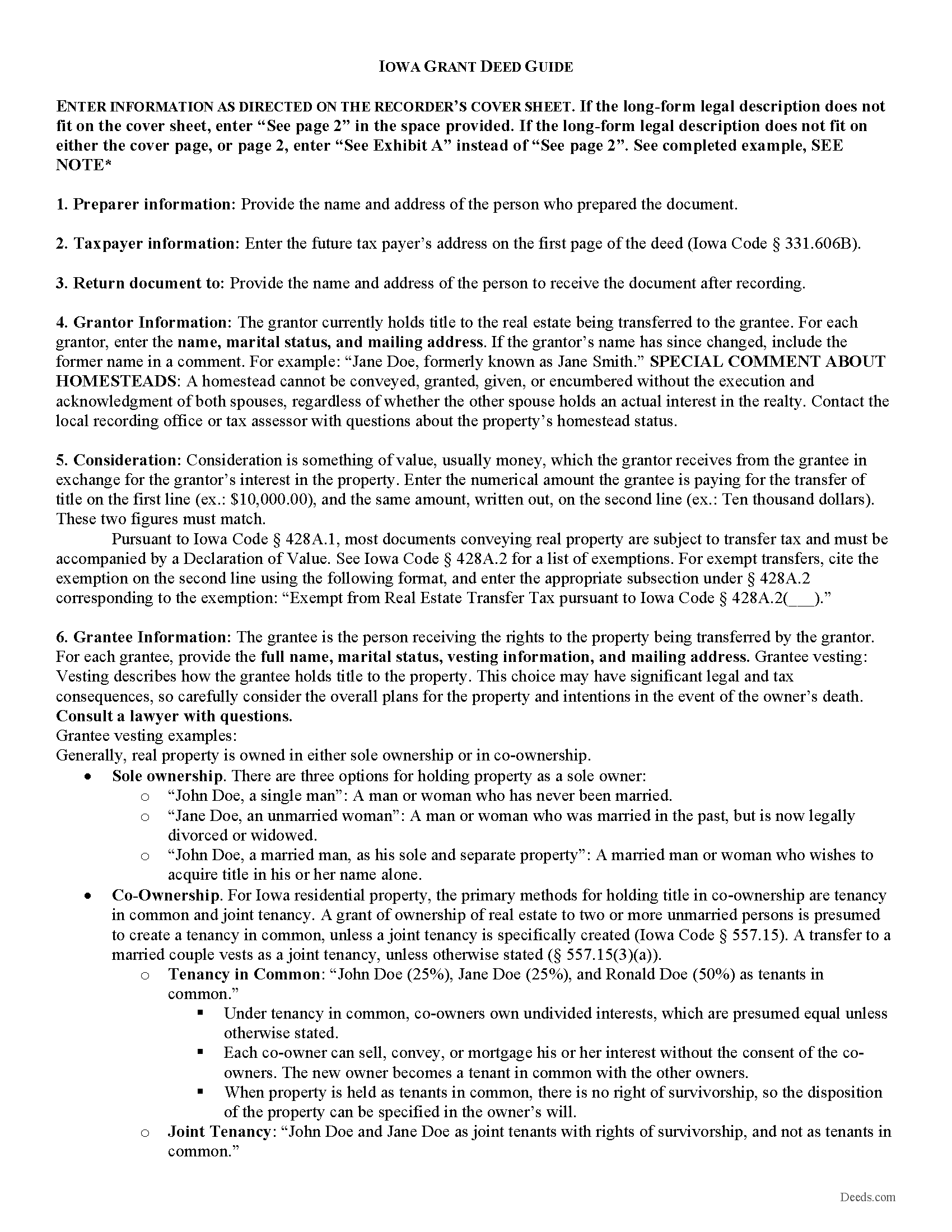

Dallas County Grant Deed Guide

Line by line guide explaining every blank on the form.

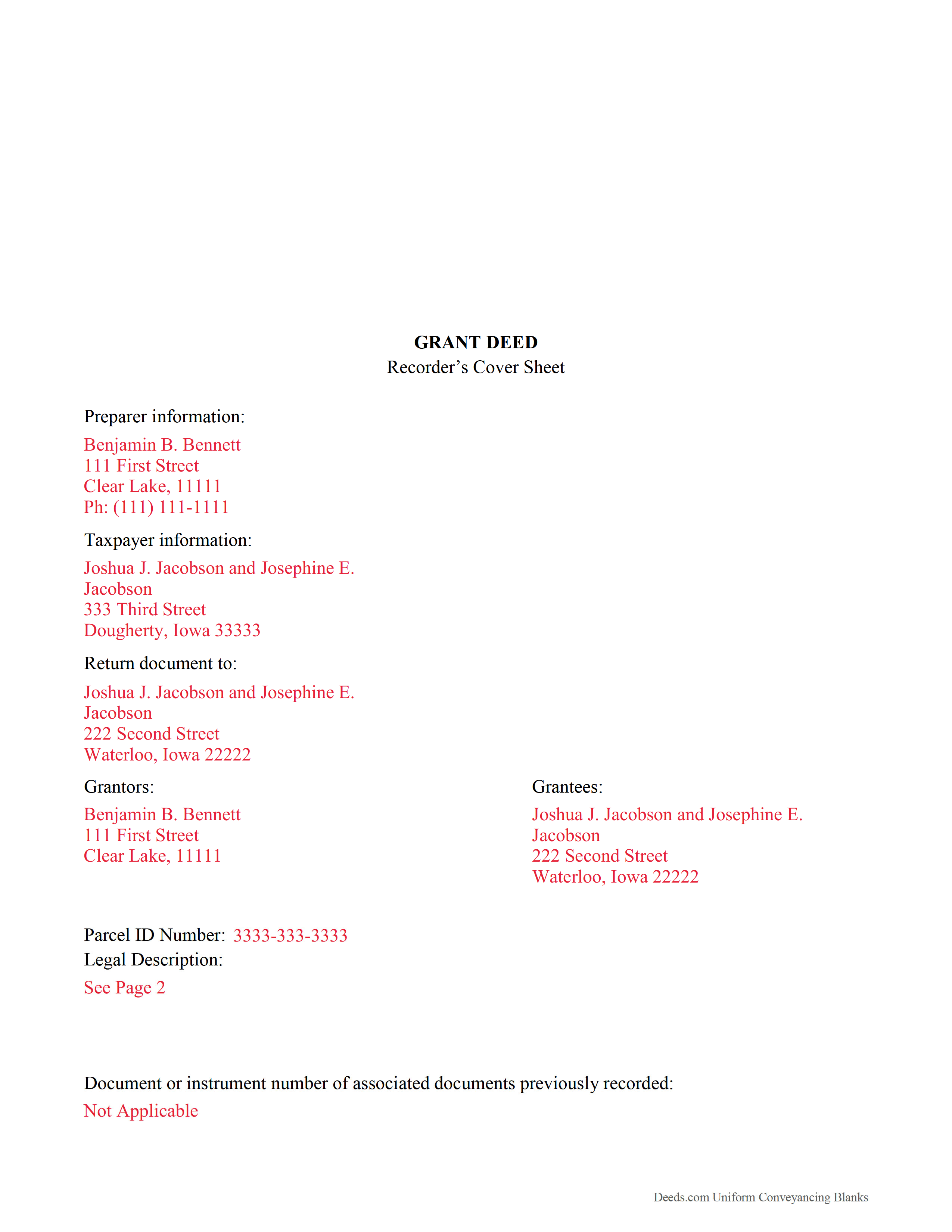

Dallas County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Dallas County documents included at no extra charge:

Where to Record Your Documents

Dallas County Recorder

Adel, Iowa 50003

Hours: Mon-Fri 8am to 4:30pm / No transactions after 3:30pm

Phone: (515) 993-5804

Recording Tips for Dallas County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Dallas County

Properties in any of these areas use Dallas County forms:

- Adel

- Booneville

- Bouton

- Dallas Center

- Dawson

- De Soto

- Dexter

- Granger

- Linden

- Minburn

- Perry

- Redfield

- Van Meter

- Waukee

- Woodward

Hours, fees, requirements, and more for Dallas County

How do I get my forms?

Forms are available for immediate download after payment. The Dallas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dallas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dallas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dallas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dallas County?

Recording fees in Dallas County vary. Contact the recorder's office at (515) 993-5804 for current fees.

Questions answered? Let's get started!

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). It contains implied covenants that the grantor has not previously sold the real property interest now being conveyed, and that the property is being conveyed without any undisclosed liens or encumbrances. Grant deeds typically do not require the grantor to defend claims against the title.

A lawful deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Iowa residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is specifically created (Iowa Code 557.15). A transfer to a married couple vests as a joint tenancy, unless otherwise stated (Iowa Code 557.15(3)(a)).

As with any conveyance of real estate, a grant deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Finally, the deed must meet all state and local standards for recorded documents.

Deeds in Iowa must be signed by the grantor. The acknowledgment (notary) of the deed, whether made within the State of Iowa, outside the state, outside the United States, or under federal authority, should comply with the provisions of chapter 9b of the Iowa Statutes. Once acknowledged, file it in the recorder's office for the county where the property is located.

Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording. For example, most deeds require a Real Estate Transfer Groundwater Hazard Statement (Iowa Code Section 558.69). The local recording office can help determine which supplemental documentation, if any, is necessary for the transaction.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an attorney with any questions about grant deeds, or for other issues related to the transfer of real property in Iowa.

(Iowa Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Dallas County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Dallas County.

Our Promise

The documents you receive here will meet, or exceed, the Dallas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dallas County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Jules S.

May 6th, 2020

I can't believe I haven't been using this service since inception. The only thing I would recommend is to allow us to delete an erroneous upload. I accidentally uploaded the same document twice but I saw no way for me to correct my mistake other than to send an email.

Thank you for your feedback. We really appreciate it. Have a great day!

GINA G.

April 15th, 2020

Excelente service!

Thank you!

Brenda B.

March 4th, 2023

Disappointed. Did not get the information requested.

Sorry we were unable to pull the documents you requested. We do hope that you found what you were looking for elsewhere. Have a wonderful day.

Michelle K.

August 20th, 2020

Excellent service! Easy to use, great communication, quick response time and very helpful with any questions I had. I would recommend to anyone seeking the services they provide.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Trina F.

November 13th, 2020

Easy to purchase. Everything you need to get the job done!

Thank you!

Sven S.

April 10th, 2019

great experience so far! Im using Deeds.com for e-recording. Easy to use website, document upload is a snap, you are walked through and reminded if theres something missing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John H.

April 22nd, 2019

Re: Idaho Affidavit of Successor: Decedent's residence may be a state other than Idaho. Death certificate documnet# field is too small.

Thank you for your feedback. We have emailed you an amended document to address your specific needs outlined in your feedback, hope this helps. Have a wonderful day.

Sylvia L.

January 10th, 2024

Very easy...found what I was looking for

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hoang N.

June 18th, 2020

Thank you for helping. Deeds online service is so good. I would refer to my friends or whoever if they need this services. once again you guy is doing great work

Thank you!

JOHN H.

July 20th, 2022

It was simple and fast thanks so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vicki G.

November 24th, 2020

Thank you for this service, saved me from driving down town. It was quick and very easy to navigate. Have a great Thanksgiving break.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Franklin W.

February 5th, 2019

I am not so happy. I did find and purchase the document I needed. But there is one problem. It is in Adobe PDF format only. I cannot enter information into the form.

Sorry to hear that. Sounds like you may have been trying to complete the document in your browser instead of downloading the PDF and completing it on your computer. The PDF forms are fill in the blank, that's one of the reasons we use that format.

Ron S.

April 5th, 2019

Fair price and beneficiary deed was recorded without issue. Completion instructions provided were insufficient in some cases.

Thank you!

Terry S.

February 14th, 2023

I was very happy with the document package that I purchased. It contained all of the necessary documents and a few extras I had not thought about. Perhaps if you provided a link to download all of the documents with one click, it would make it a little easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Jacquelyn W.

February 4th, 2022

Great site with great info. Almost made the job seamless but form would not adjust to my longer than usual legal description -- I ended up having to recreate the form in word processing software (Libre). But could not have done it without the guidelines.

Thank you!