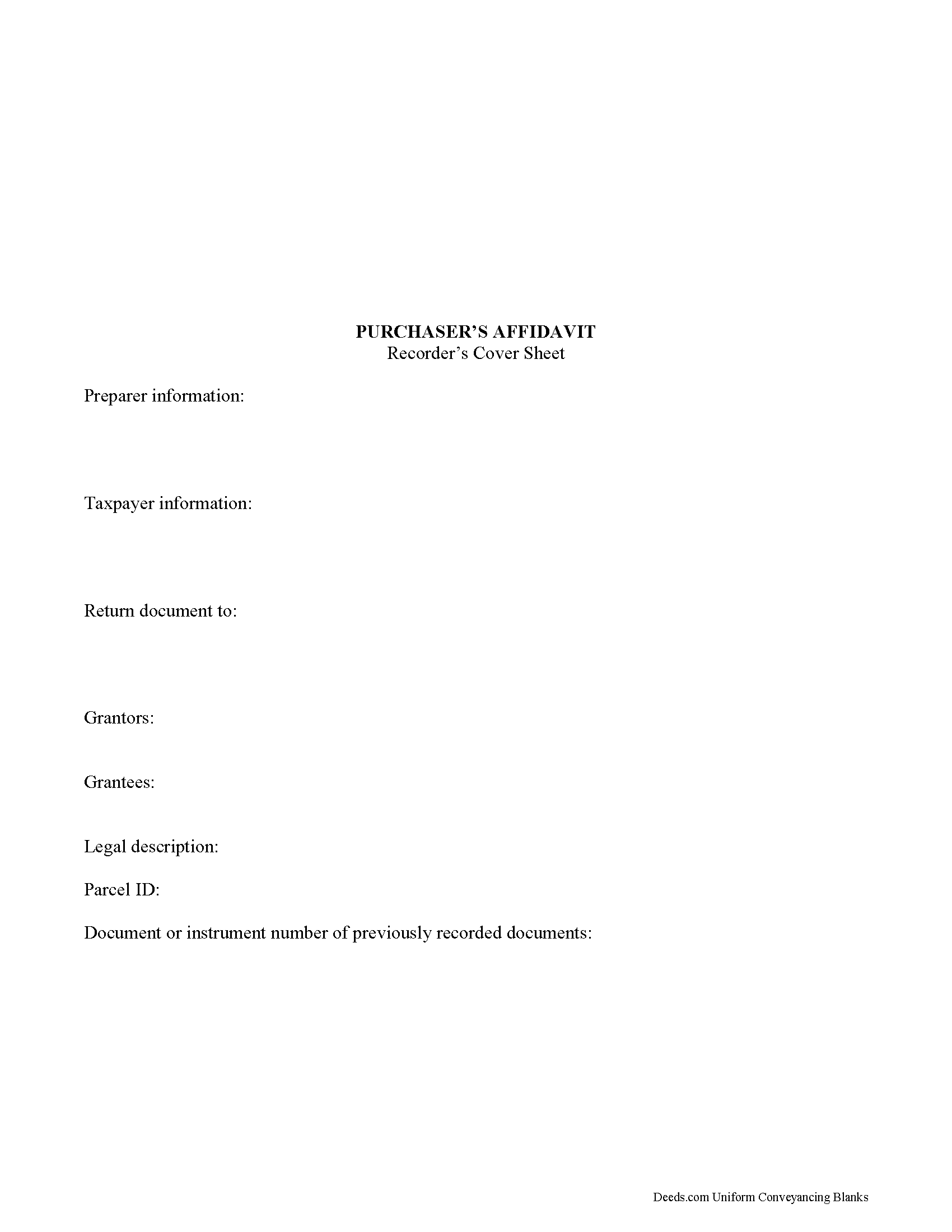

Hardin County Purchaser Affidavit Form

Hardin County Purchasers Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

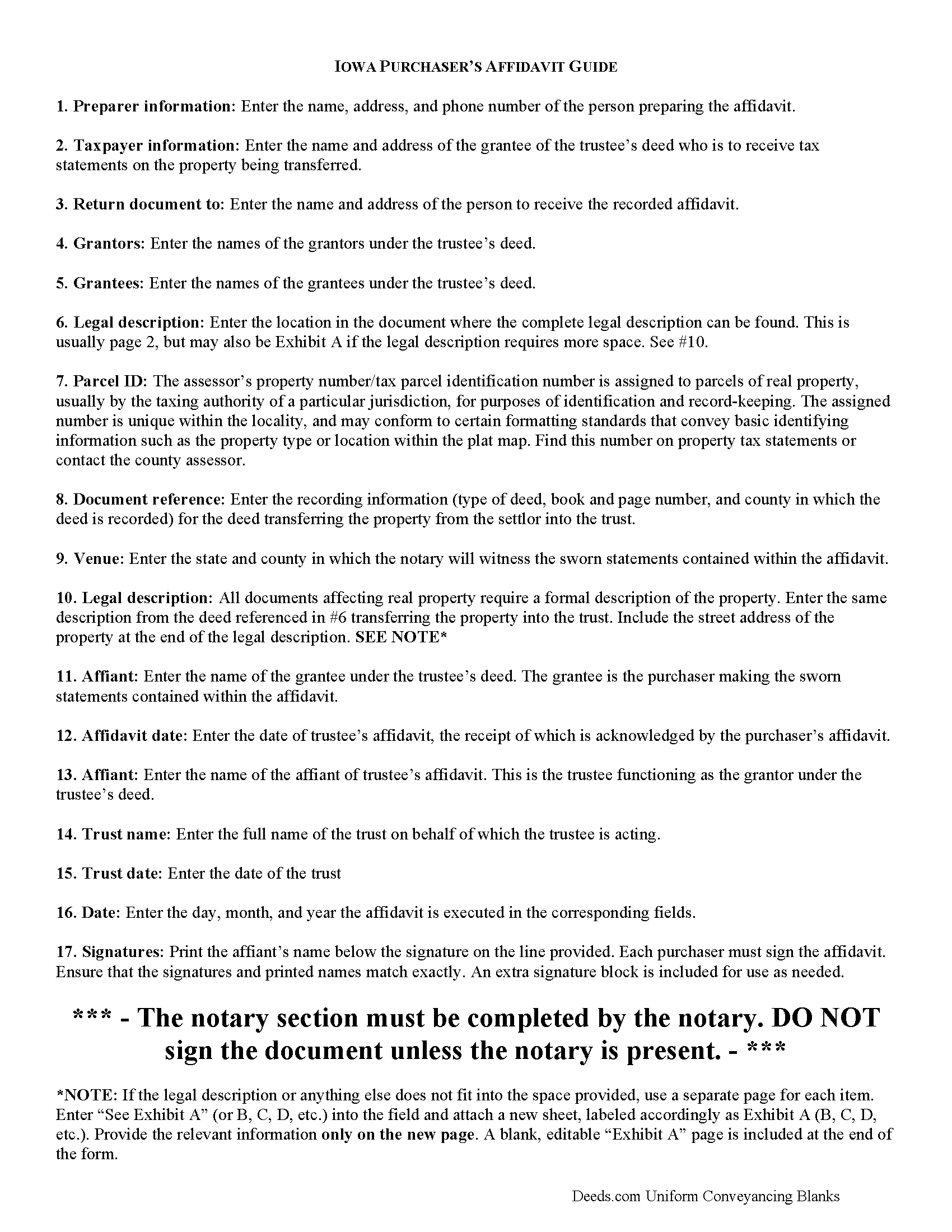

Hardin County Purchaser Affidavit Guide

Line by line guide explaining every blank on the form.

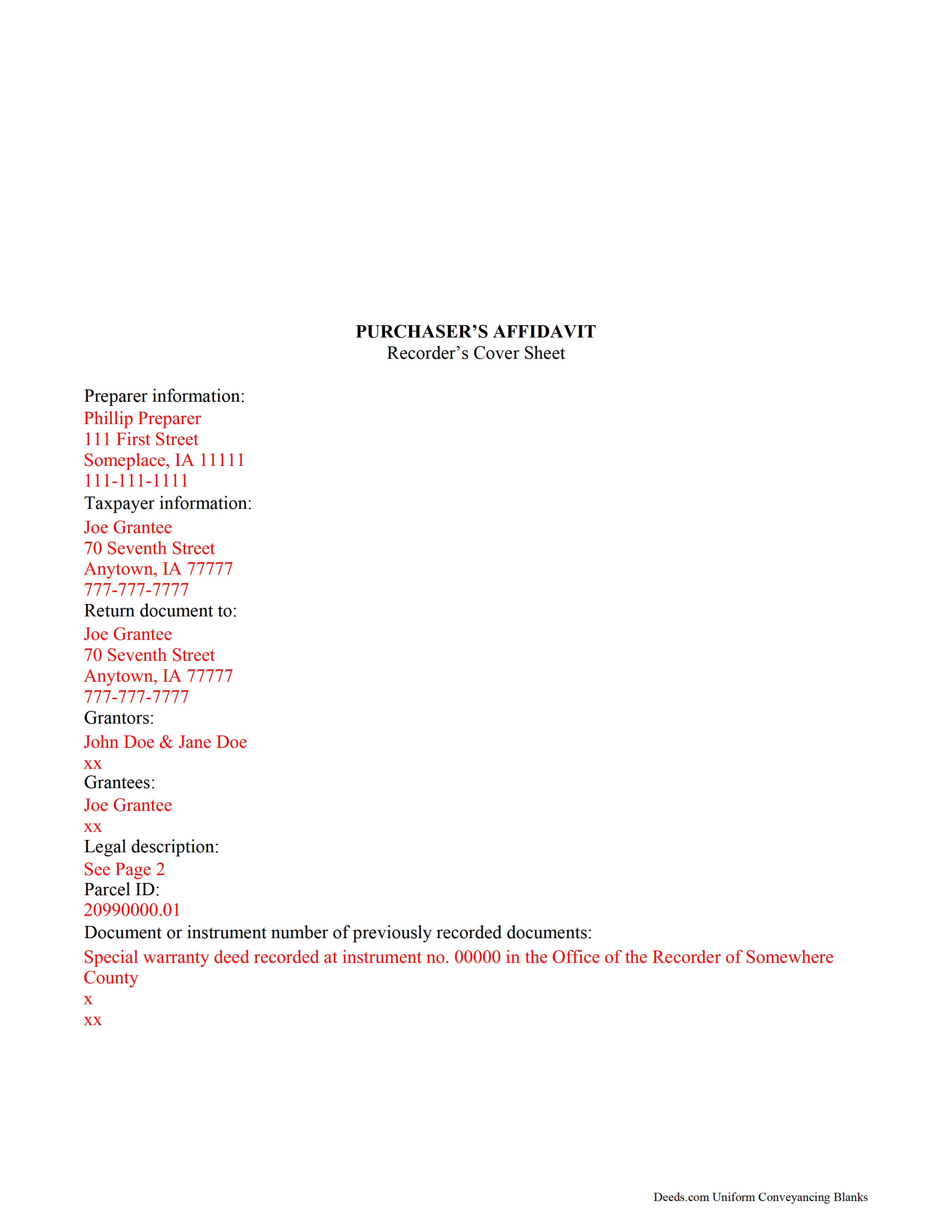

Hardin County Completed Example of the Purchaser Affidavit document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Recorder

Eldora, Iowa 50627

Hours: 8:00am to 4:30pm Monday through Friday

Phone: 641-939-8178

Recording Tips for Hardin County:

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Ackley

- Alden

- Buckeye

- Eldora

- Garden City

- Gifford

- Hubbard

- Iowa Falls

- New Providence

- Radcliffe

- Steamboat Rock

- Union

- Whitten

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at 641-939-8178 for current fees.

Questions answered? Let's get started!

Some situations may require the purchaser under a trustee's deed to record a purchaser's affidavit along with the trustee's deed and trustee's affidavit.

The purchaser's affidavit is executed by the grantee of a trustee's deed and acknowledges receipt of a trustee's affidavit under Iowa Code 614.14.

(Iowa Purchasers Affidavit Package includes form, guidelines, and completed example) Consult a lawyer with questions about trustee's deeds and affidavits.

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Purchaser Affidavit meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Purchaser Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Beverly D.

January 12th, 2021

Thank You, Job well done. So nice not to have to leave house and drive all over to record these documents. Very satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey G.

December 31st, 2020

Nice an easy. Just wondered if I can come back and still have my order (forms) available to get again, if I have an issue with saving them.

Thank you for your feedback. We really appreciate it. Have a great day!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Caroline E.

June 28th, 2024

Very easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Dianna B.

July 23rd, 2020

Amazingly easy! I absolutely love it because it is so efficient and I only have to pay for when I use it. I use to have to drive to the recorders office or to a Kiosk station. The turn-around time was really quick as well.

Thank you!

Andrew D.

August 12th, 2019

I was very pleased with the entire package we received. It will certainly make my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Felicia T.

May 30th, 2023

Great service with all the added resources on the form I requested. Question: How long do the forms stay available on my account?

Thanks for the feedback Felicia. Our goal is to keep the documents available in your account indefinitely. It's a good idea to download the documents and store them yourself just in case.

Mark M.

October 20th, 2022

Quick, easy everything that i was looking for and then some.

Thank you for your feedback. We really appreciate it. Have a great day!

Jayne J.

May 21st, 2025

We have used this service two times and now going for third. Would recommend. So glad this service is available.

Thank you for your positive words! We’re thrilled to hear about your experience.

Catherine E.

January 7th, 2021

I was referred to your company, but when i tried to process the recording of a deed to a property in City of Philadelphia my service was rejected. I appreciated the feedback i received from one of your representatives who instructed me in the right process for recording a deed in philadelphia. Thank you for all your help. The deed that needed to be recorded was overnighted yesterday. Stay safe and mask up

Thank you!

Regina G.

May 18th, 2022

Very good customer service. Would recommend them highly.

Thank you!

Charles F.

November 19th, 2020

Quick and Easy

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri S.

July 3rd, 2019

Appreciate your diligent assistance.

Thank you!

Stephen P.

July 20th, 2021

Quick and Easy

Thank you!