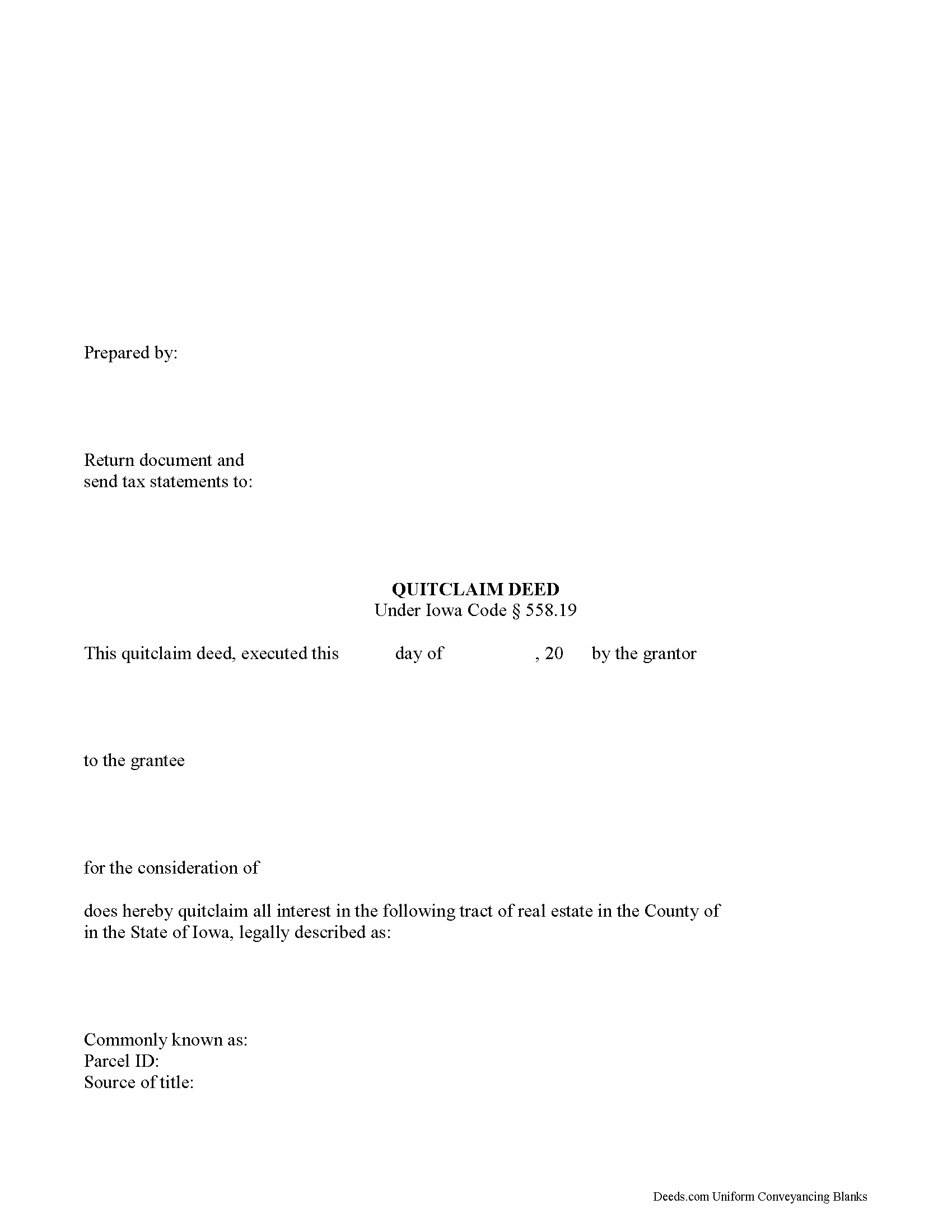

Taylor County Quitclaim Deed Form

Taylor County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Iowa recording and content requirements.

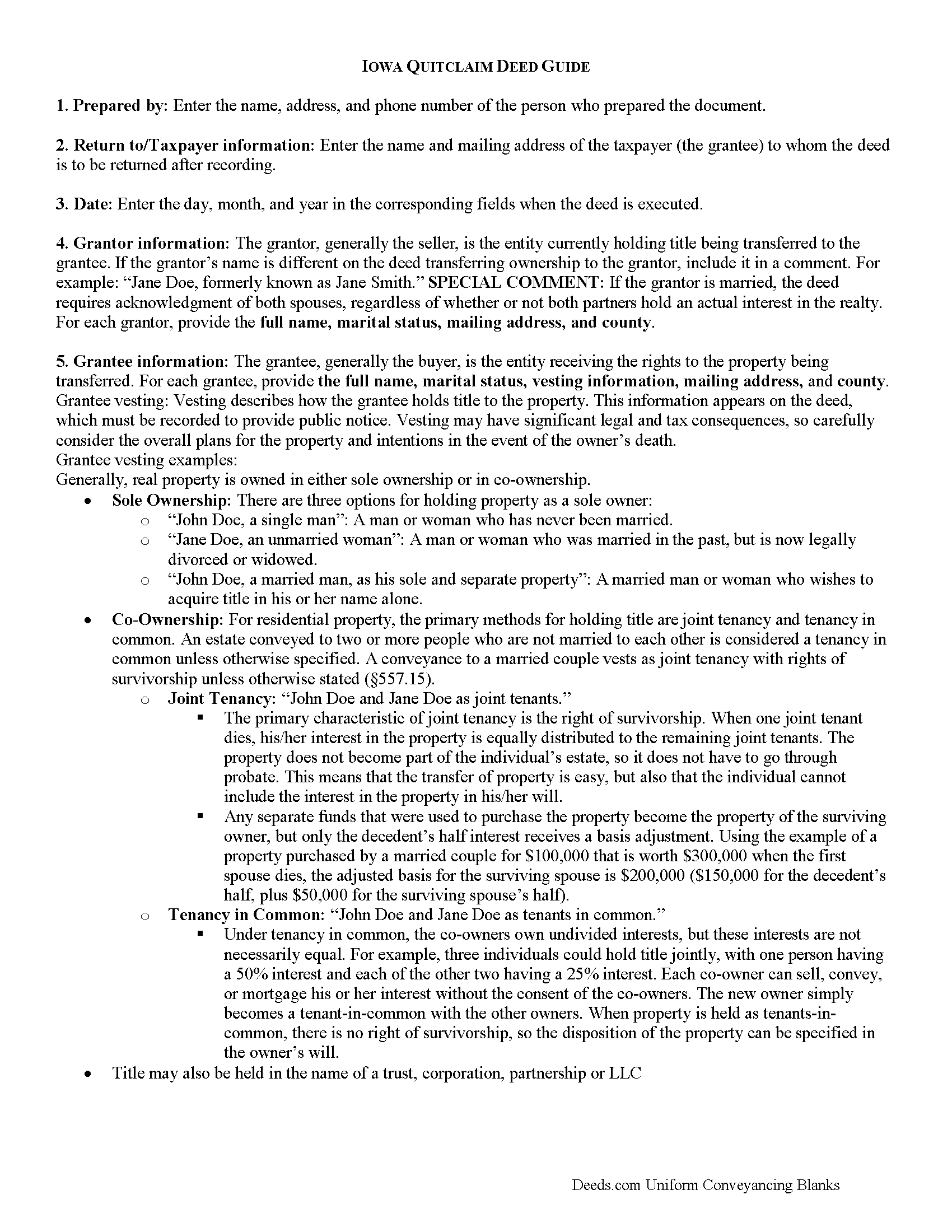

Taylor County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

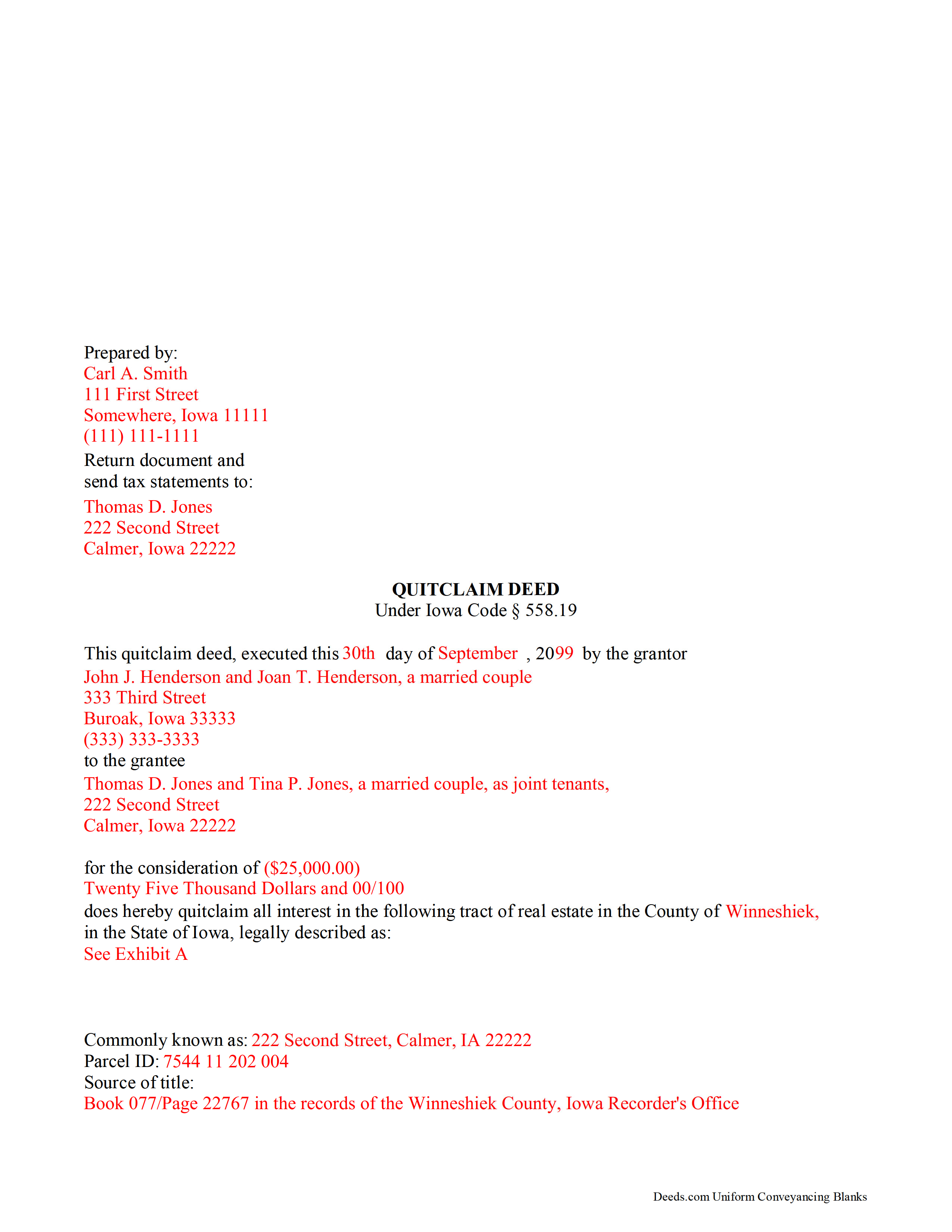

Taylor County Completed Example of the Quitclaim Deed Document

Example of a properly completed Iowa Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Taylor County documents included at no extra charge:

Where to Record Your Documents

Taylor County Recorder

Bedford, Iowa 50833

Hours: 8:00am to 4:30pm.M-F

Phone: (712) 523-2275

Recording Tips for Taylor County:

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Taylor County

Properties in any of these areas use Taylor County forms:

- Bedford

- Blockton

- Clearfield

- Gravity

- Lenox

- New Market

- Sharpsburg

Hours, fees, requirements, and more for Taylor County

How do I get my forms?

Forms are available for immediate download after payment. The Taylor County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Taylor County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Taylor County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Taylor County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Taylor County?

Recording fees in Taylor County vary. Contact the recorder's office at (712) 523-2275 for current fees.

Questions answered? Let's get started!

Iowa Code 558.19 provides the statutory form of a quitclaim deed. The minimum statutory contents are the names and addresses of all grantors and grantees, the consideration (usually money), and a complete legal description of the property. 561.13 adds the requirement for both spouses' signatures when conveying a property identified as a homestead, regardless of whether or not both have an ownership interest in the land. The grantor must sign the deed and all signatures must have the signor's name typed or printed underneath, and be acknowledged by a notary or other court-authorized individual. 331.606B lists the information that must be on the first page of every document submitted for recording. These include the name, address, and telephone number of the individual who prepared the quit claim deed, the name and address of the person to whom future tax statements should be mailed, a return address for use after recording, the title of the instrument (in this case, "Quitclaim Deed"), tax parcel ID, and a document number or book/page information for the conveyance that transferred the land to the grantor.

Recording:

Iowa Code 331.606B lists the statutory document formatting standards.

* The pages should not be permanently bound or connected to each other. Do not clip or attach anything to pages.

* Use minimum 10-point text in permanent black ink for all printing.

* Print all documents on minimum 20-pound weight, plain, white paper.

* All signatures should be original, and in permanent dark blue or black ink.

* Format the first page with a three-inch top margin, with " margins on the left, right, and bottom. All other pages should have " margins all around.

Iowa follows a "notice" recording statute, which is defined in Iowa Code 558.41. The statute states, in part, that an "instrument affecting real estate is of no validity against subsequent purchasers for a valuable consideration, without notice . . . , unless the instrument is filed and recorded in the county in which the real estate is located." 558.11 identifies the index of deeds, in which correctly recorded conveyances are listed, and which serves as formal constructive notice. So, a "notice" recording statute basically invalidates unrecorded deeds. For example, the grantor quit claims his/her interest in the property to grantee A for value, who fails to record the deed, and the grantor then quit claims the same property to grantee B for value, who records as directed by the statute. In most cases, grantee B retains ownership of the real estate. In short, recording the quit claim deed as soon as possible after it's executed is a simple and effective way to preserve everyone's interests.

(Iowa Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Taylor County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Taylor County.

Our Promise

The documents you receive here will meet, or exceed, the Taylor County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Taylor County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4602 Reviews )

Arletta B.

September 16th, 2021

Fantastic service, saved me a ton of time and running around. Thanks!

Thank you!

rich b.

September 3rd, 2021

Had pretty much everything I needed. Had to slice and dice a bit.

Thank you!

Christopher B.

October 3rd, 2020

The service was simple and easy enough but the UI isn't the easiest on the eyes and the process is a tad strange.

Thank you for your feedback. We really appreciate it. Have a great day!

Elexis C.

November 14th, 2019

Easy, fast & amazing descriptions of all forms needed.

Thank you!

Georgana T.

May 28th, 2019

Not clear information on ownership, which is what I wanted.

Sorry to hear that we were unable to find the information you need Georgana. Your account has been credited. Have a wonderful day.

Debbie G.

February 2nd, 2019

Easy to use, I would recommend deeds.com. I would recommend visiting your county recorder before having document notarized. They will review document and make sure everything you need is on the deed, before having notarized.

Thank you Debbie. Have a fantastic day!

Melody P.

February 23rd, 2021

Thanks again for such excellent service, and always a pleasure!

Thank you!

Erika H.

December 14th, 2018

The service was fast and efficient. So glad I stumbled upon this website!

Thank you for your feedback. We really appreciate it. Have a great day!

Mallah B.

October 7th, 2021

I think this company offers a great service that is non-discriminatory and allows me to save time going downtown and hassle dealing with different personalities.

Thank you for your feedback. We really appreciate it. Have a great day!

Delia C.

November 18th, 2019

Your service is a life saver! I'm a paralegal and new to lien releases especially in Platte Co., MO. The clerk was not helpful and I so appreciate your service in accomplishing this very important task!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard N.

November 27th, 2020

It went well. The proof will be when I complete the forms and submit to the County Clerk.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lenore B.

January 13th, 2019

Thank you for making this deed available. The guide was such a big help.

Thanks Lenore, have a great day!

James J.

October 4th, 2021

I couldn't be more pleased or more impressed with the e-recording services I received from deeds.com and from my service representative, KVH. I was able to record documents in approximately half a dozen different counties easily and seamlessly, with a minimum of fuss. The turn around time was incredibly fast. The pricing was incredibly reasonable. I know I have alternatives because, in the past, I have used a competitor service for my recording needs. I won't do that again -- this was an exceptional experience. Thank you for your help!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnathan D.

March 30th, 2021

Very helpful and quick responses

Thank you!

Kerrin S.

April 11th, 2020

Wow, this was so easy & helpful. I didn't get it finished in time for recording, so I'm still waiting on that part, but the rest was simple and straight-forward. Thanks!

Thank you!