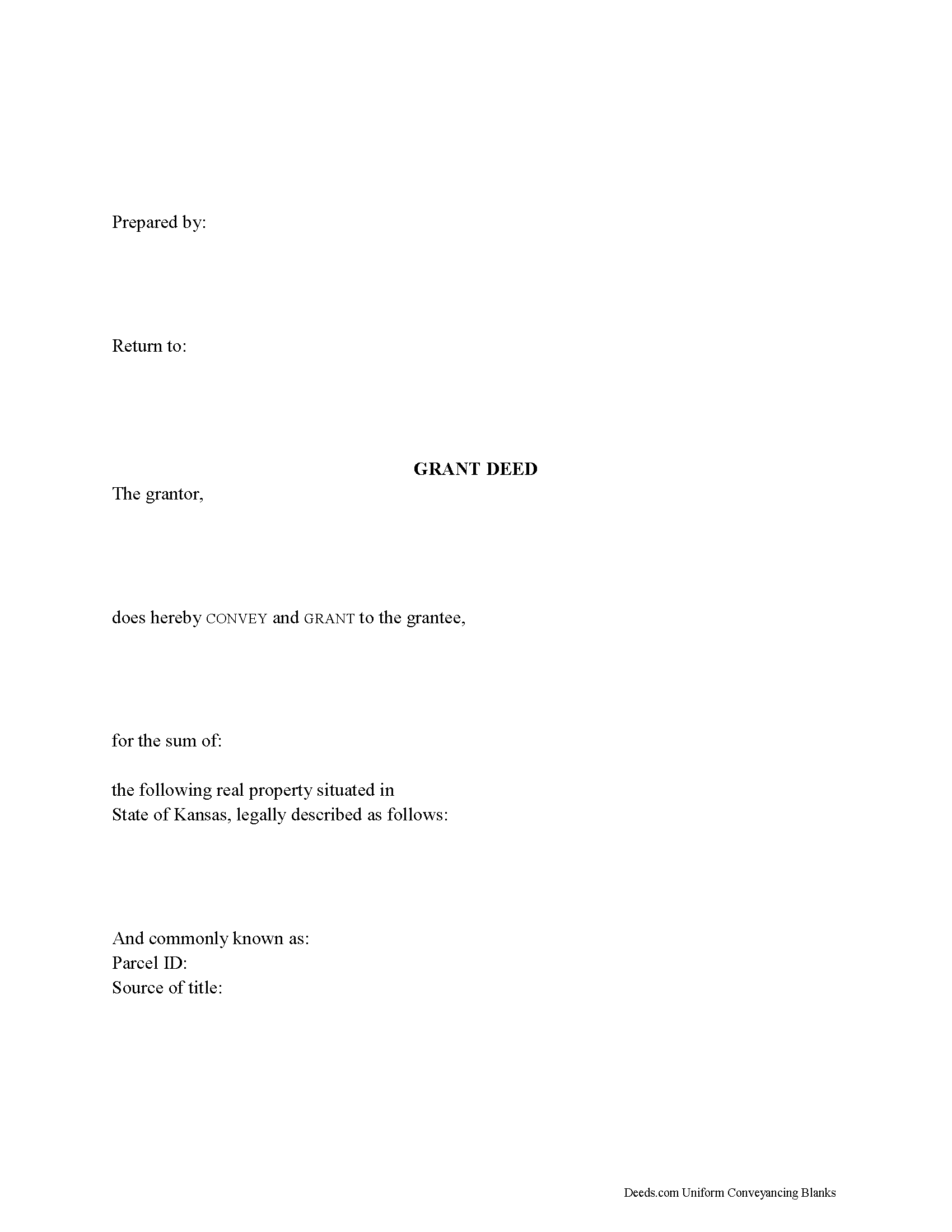

Greenwood County Grant Deed Form

Greenwood County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

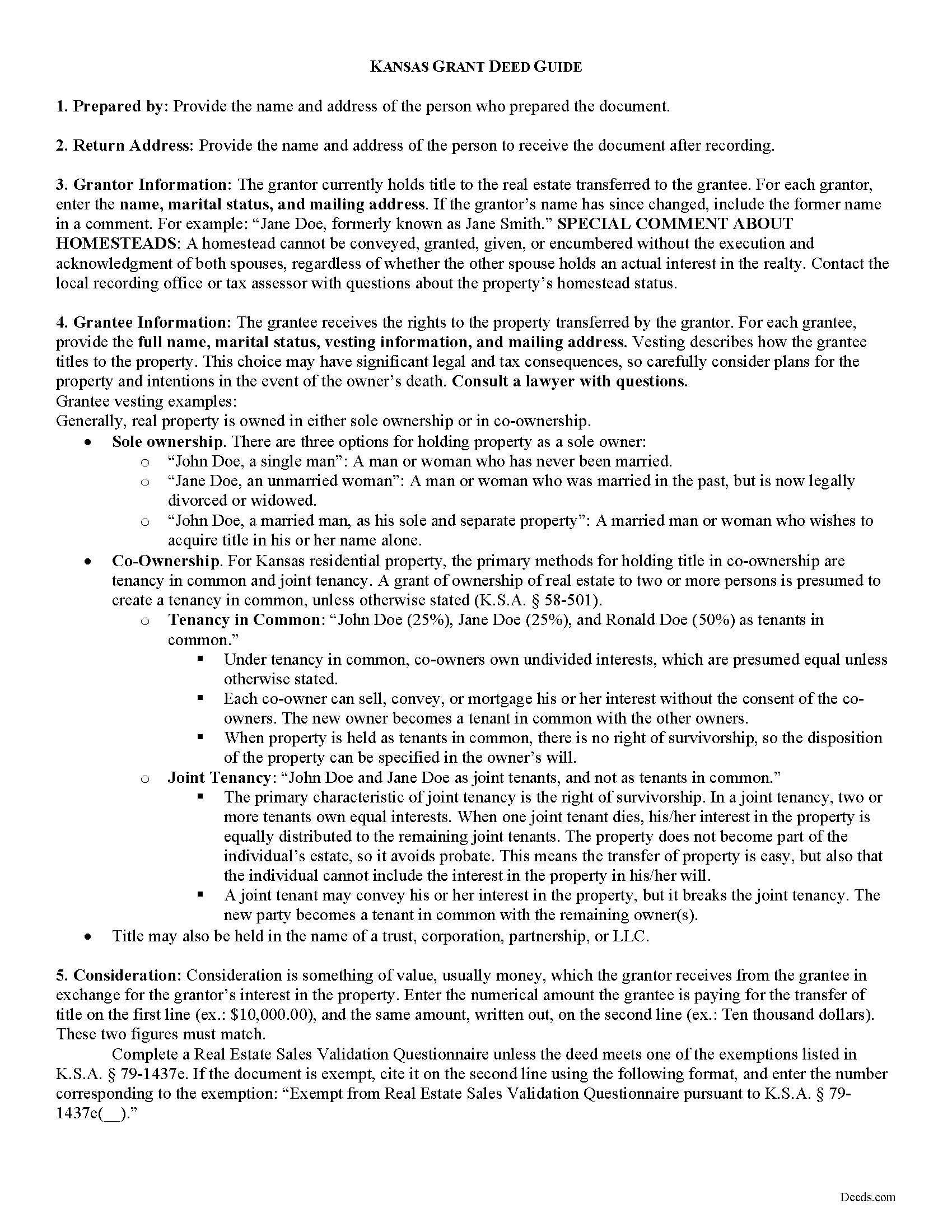

Greenwood County Grant Deed Guide

Line by line guide explaining every blank on the form.

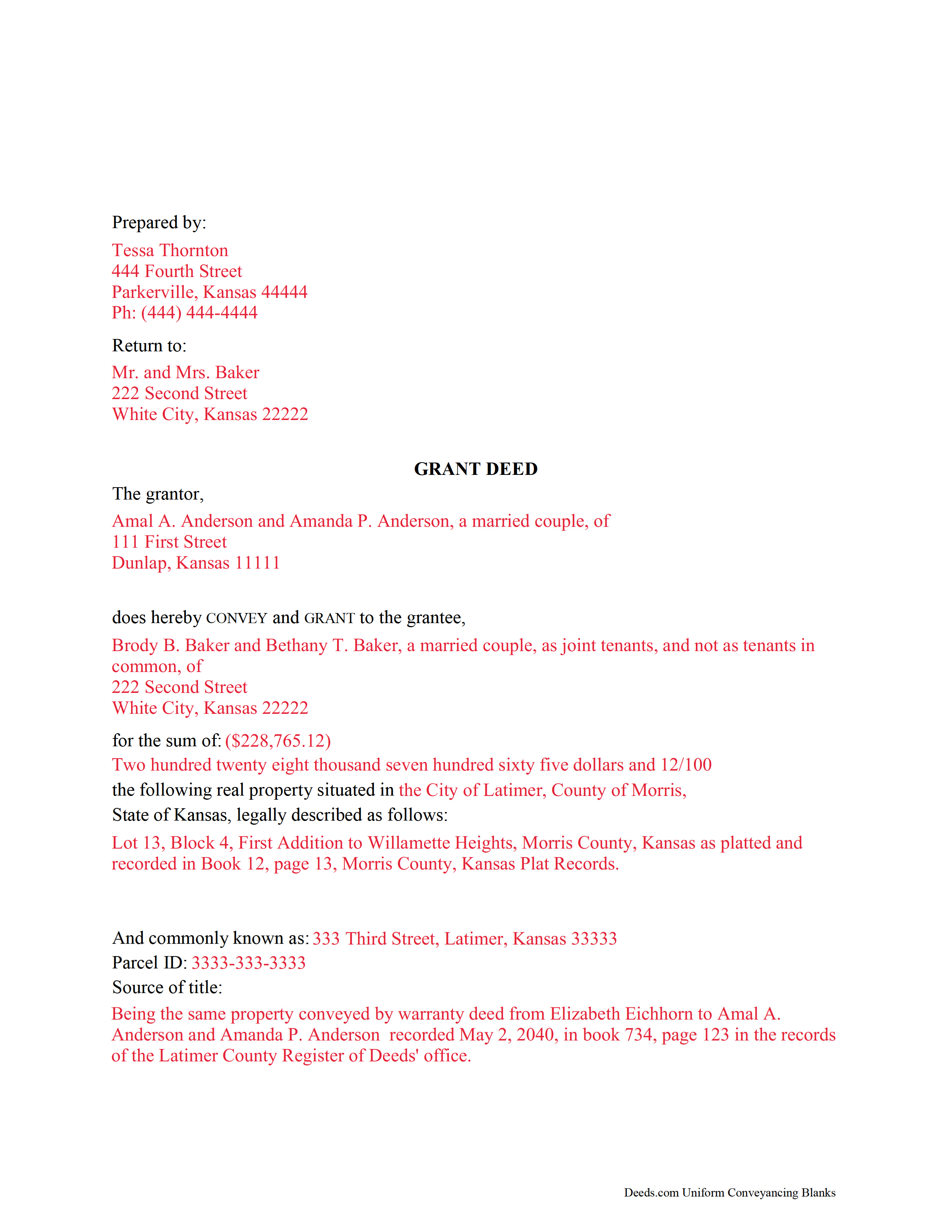

Greenwood County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Greenwood County documents included at no extra charge:

Where to Record Your Documents

Greenwood County Register of Deeds

Eureka, Kansas 67045

Hours: 8:00am-5:00pm M-F

Phone: (620) 583-8162

Recording Tips for Greenwood County:

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Greenwood County

Properties in any of these areas use Greenwood County forms:

- Eureka

- Fall River

- Hamilton

- Lamont

- Madison

- Neal

- Piedmont

- Severy

- Virgil

Hours, fees, requirements, and more for Greenwood County

How do I get my forms?

Forms are available for immediate download after payment. The Greenwood County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Greenwood County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Greenwood County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Greenwood County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Greenwood County?

Recording fees in Greenwood County vary. Contact the recorder's office at (620) 583-8162 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Kansas are governed by Chapter 58, Section 22 of the Kansas Statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). A recorded grant deed imparts notice of this transfer to all persons, including subsequent purchasers or mortgagees (K.S.A. 58-2222).

Within the deed are covenants, or guarantees, that the grantor has not previously sold the real property interest now being conveyed to the grantee, and that the property is being conveyed to the grantee without any liens or encumbrances, except for those specifically disclosed in the deed. Grant deeds do not generally require the grantor to defend title claims.

A lawful grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

Include the complete legal description for the subject property, as well as its physical (street) address or common name and the derivation of title. Additionally, the form must meet state and local standards for recorded documents.

All deeds must be signed by the grantor, or by the party's lawful agent or attorney, and may be acknowledged or proved and certified in the manner prescribed by the Uniform Law on Notarial Acts (K.S.A. 58-2209).

The State Property Valuation Department requires a Real Estate Sales Validation Questionnaire with each deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Include the amount of consideration exchanged on the form (K.S.A. 79-1437g).

Submit the deed and any required supplemental documents for recording in the county where the property is located. In most cases, the deed will be returned to the grantee after recording. The register of deeds will forward the information to the county clerk, who will update records for mailing tax statements (K.S.A. 58-2221). Record the deed in the appropriate county to provide notice to third parties (K.S.A. 58-2223).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Greenwood County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Greenwood County.

Our Promise

The documents you receive here will meet, or exceed, the Greenwood County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Greenwood County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

John W.

June 3rd, 2021

The Staff are very helpful if needed and the process is amazingly simple and efficient!

Thank you!

DAVID K.

April 6th, 2019

Already gave a review Great site and help

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

Catherine B.

October 26th, 2021

Was looking for information and forms relating to a trust my parents created, but what I purchased seems geared toward trusts containing real estate only, which is not what I needed. Clearly I missed something prior to purchasing something I can not use. Perhaps additional clarification for us without any experience is this area would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert J D.

December 19th, 2018

No feedback

Thank you for your feedback. We really appreciate it. Have a great day!

Robert C.

March 31st, 2019

I hope I have the right form. My deed should be for a mfg home.

Thank you for your feedback. We really appreciate it. Have a great day!

Giovanni S.

February 23rd, 2023

Simple and easy going process

Thank you!

Taylor M.

July 18th, 2020

Service is good. The website isn't very user friendly and could use some updating. Overall I'm happy with the service.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia W.

September 12th, 2020

Had to have help because unable to put phone number in your format. Daughter figured a way around the problem. I am 80 years old but capable of filling out simple forms but not when the format creates problems.

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

December 14th, 2018

I needed to file an affidavit of succession. I downloaded the forms and filled in the blanks. The instructions and example sheet were very helpful. I got the paper recorded with the county today and all went smoothly. Good product.

Thank you for your feedback. We really appreciate it. Have a great day!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly D.

June 4th, 2022

Deeds.com was a great experience in helping me get some important documents recorded.I would recommend them to anyone wanting documents recorded in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Troy B.

July 8th, 2020

Very pleased with website very simple to navigate through

Thank you for your feedback. We really appreciate it. Have a great day!

Denise P.

April 19th, 2021

Seamless transaction. Was pleased with the additional information that was provided. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell D.

June 6th, 2023

Thx. Easy to research and download. Now proof is in the pudding. :-)

Thank you for your feedback. We really appreciate it. Have a great day!