Russell County Transfer on Death Deed Form

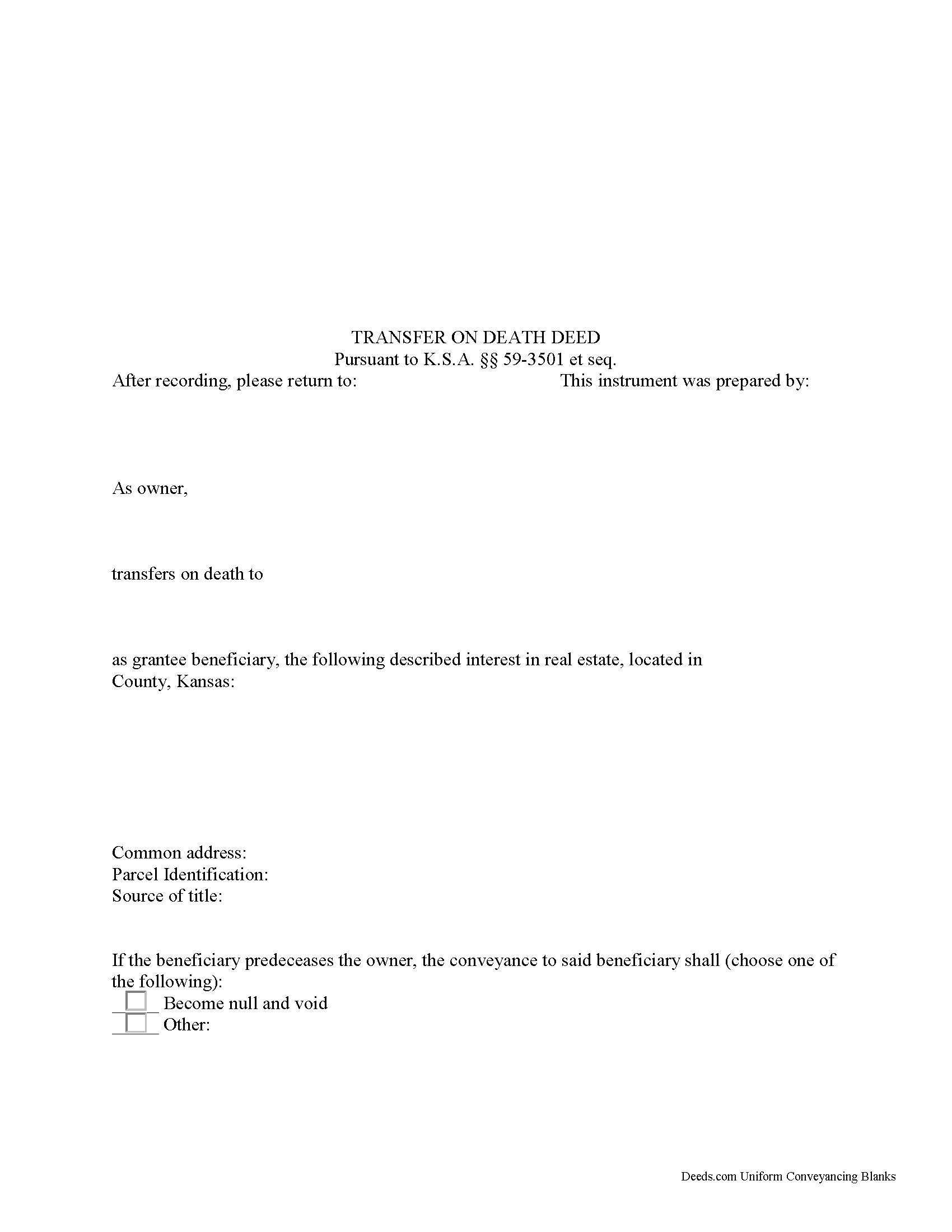

Russell County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

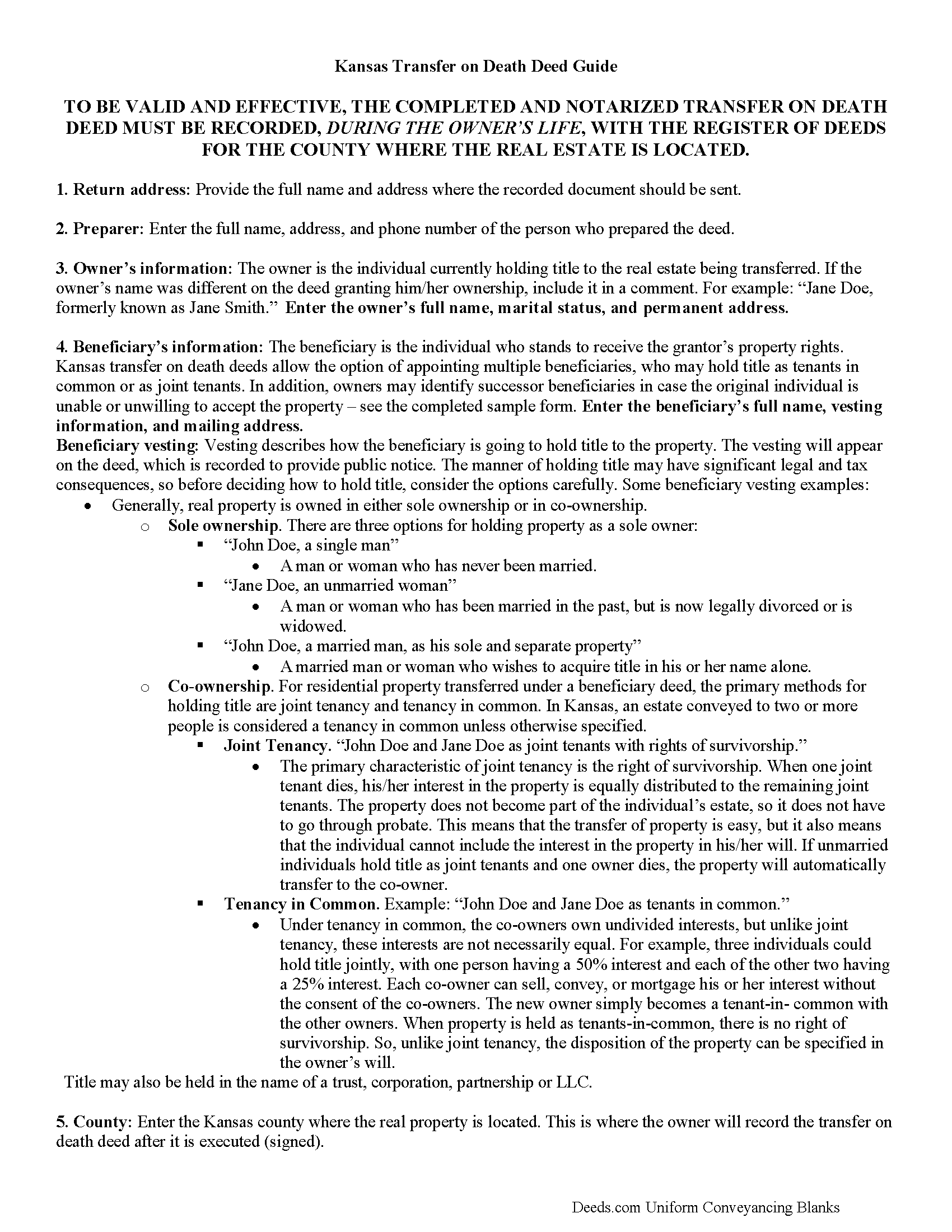

Russell County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

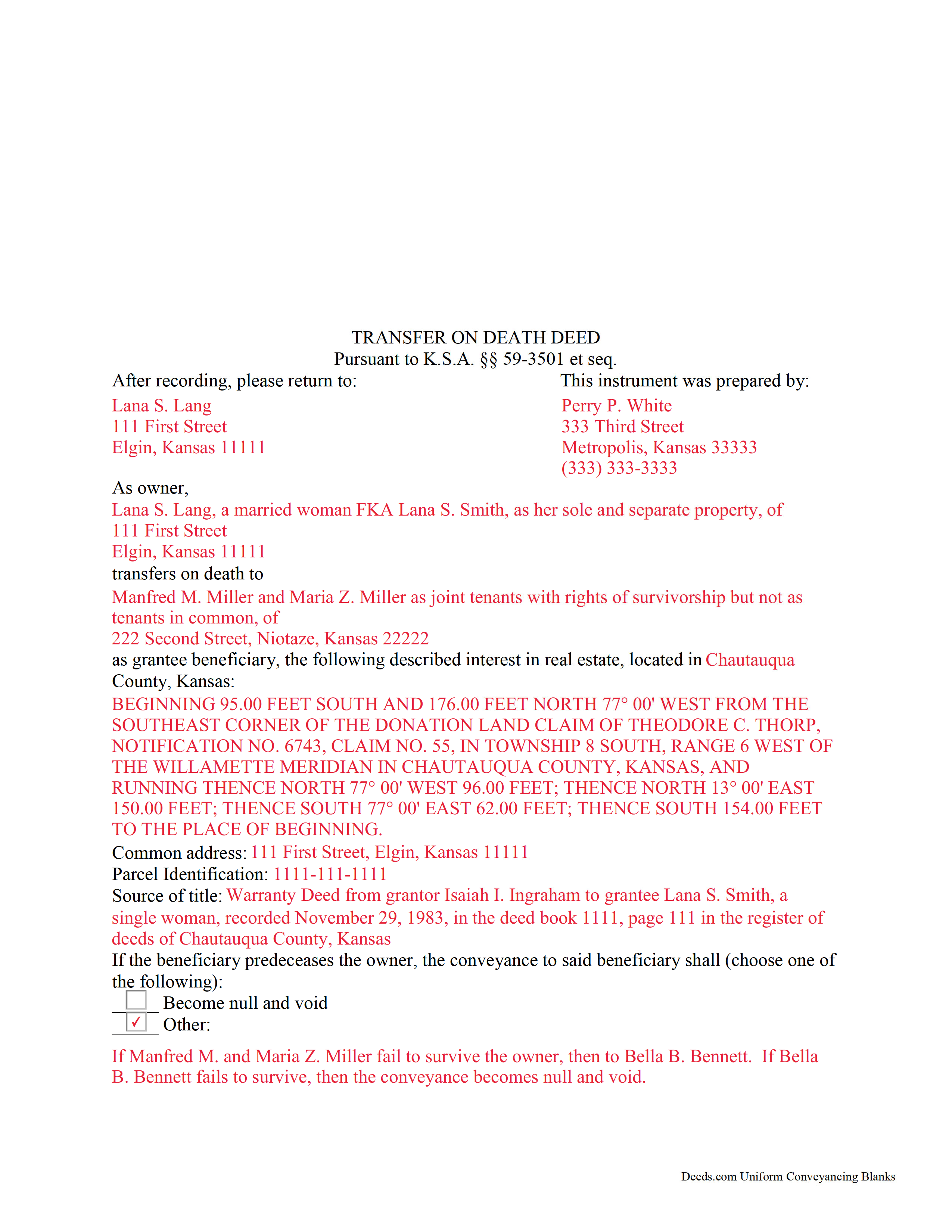

Russell County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Russell County documents included at no extra charge:

Where to Record Your Documents

Russell County Register of Deeds

Russell, Kansas 67665

Hours: 8:00am-5:00pm M-F

Phone: (785) 483-4612

Recording Tips for Russell County:

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Russell County

Properties in any of these areas use Russell County forms:

- Bunker Hill

- Dorrance

- Gorham

- Lucas

- Luray

- Paradise

- Russell

- Waldo

Hours, fees, requirements, and more for Russell County

How do I get my forms?

Forms are available for immediate download after payment. The Russell County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Russell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Russell County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Russell County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Russell County?

Recording fees in Russell County vary. Contact the recorder's office at (785) 483-4612 for current fees.

Questions answered? Let's get started!

Kansas enacted its statutory transfer on death deeds in 1997. These nontestamentary, nonprobate conveyances are governed by K.S.A. 59-3501 (2012) et seq. Nontestamentary means that the transfer is not included in or affected by the owner's last will and testament. Nonprobate means that the property's change in title occurs outside the probate process.

Transfer on death deeds, when lawfully executed and RECORDED DURING THE OWNER'S LIFE, convey a land owner's interest in a specific piece of real property to a designated beneficiary after the owner dies. Until death, the owner retains absolute rights to and control over the property, including entering into agreements to rent, mortgage, or sell the property outright.

The deeds do not require any consideration from the beneficiary, nor do they demand that the beneficiary receive notice about his/her/their potential future interest in real estate. The owner may also change, revoke, or otherwise modify the terms of the transfer. In addition, the statute explains that a "subsequent transfer-on-death beneficiary designation revokes all prior designations of grantee beneficiary or beneficiaries by such record owner for such interest in real estate" (K.S.A. 59-3503(b)).

As with a transfer on death deed, all revocations or other changes to a recorded transfer on death deed may be made "at any time prior to the death of the record owner, by executing, acknowledging and recording in the office of the register of deeds in the county where the real estate is located an instrument describing the interest revoking the designation. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries is not required" (K.S.A. 59-3503(a)).

Beneficiaries should be aware, however, that they take "the record owner's interest in the real estate at death subject to all conveyances, assignments, contracts, mortgages, liens and security pledges made by the record owner or to which the record owner was subject during the record owner's lifetime, including . . . claims of the state of Kansas for medical assistance, as defined in K.S.A. 39-702" (K.S.A. 59-3504(b)).

Overall, transfer on death deeds offer a flexible and useful tool to owners of Kansas real estate. Even so, there are benefits and drawbacks to this method of estate planning. Because each situation is unique, contact an attorney with specific questions or for complex situations.

(Kansas Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Russell County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Russell County.

Our Promise

The documents you receive here will meet, or exceed, the Russell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Russell County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Ronald P.

August 18th, 2020

Very easy to use... awaiting info

Thank you for your feedback. We really appreciate it. Have a great day!

Ann B.

December 27th, 2019

Works perfect. Saved money hiring someone to do this work.

Thank you!

DAVID K.

April 6th, 2019

Already gave a review Great site and help

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

albert C.

May 21st, 2021

thumbs up

Thank you!

susanne y.

July 13th, 2020

wonderful service, docs recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Jackie C.

April 10th, 2022

It was easy to access the documents for a minimal fee.

Thank you for your feedback. We really appreciate it. Have a great day!

Nanette G.

March 4th, 2020

The Website was easy to use. I live in Houston Texas and mother recently passed away in California and I need affidavit of joint tenant forms. I was provided all the forms necessary to complete the documents. I had been a legal secretary in California about 20 years ago and just need the current forms and received them all very quickly.

Thank you!

Deborah P.

September 13th, 2022

Very helpful! Easy and clear guidance. Good examples on sample forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda D.

May 12th, 2021

This is a very nice service. Easy to use and reasonable. I especially appreciated the helpful explanations of each of the fields on the form. I will positively use this service again.

Thank you for your feedback. We really appreciate it. Have a great day!

Trace A.

June 3rd, 2023

Deeds.com had much better and fuller information than any other help i found (90% complete vs 60 % complete); they tout how up-to-date they are on all the counties in the country and the idiosyncrasies of each county's forms and procedures; but some minor points of the info i needed were missing or confusing. Including that they sold me on e-Recording my deed through them, only to find out after i had done all the prep for that, that they had failed to tell me upfront (or i missed it somehow) that the county i was dealing with did not yet accept online recording. So, they were by far the best i found, but not 100%.

Thank you for your honest and thorough feedback Trace. We will review your concerns carefully in an effort to improve our services. Hope you have an amazing day.

janelle s.

September 15th, 2020

Uncertain about use as I am new to online forms. Through use I am sure it will feel more comfortable. I like the storage of filled in info forms because I might be using I will be using them or the info in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon B.

February 19th, 2021

Awesome and so easy Thanks

Thank you!

Anthony N.

January 31st, 2021

The site was not easy to navigate. Maybe putting the different things offered at the heading instead of searching for it.

Thank you for your feedback. We really appreciate it. Have a great day!

James C.

December 28th, 2021

Worked well.

Thank you!

Thomas W.

January 16th, 2019

easy to use, no problems except in beneficiary box. Need to make the box bigger because I have 4 beneficiaries to list. how do I enlarge the box.

Thanks for reaching out. All available space on the document is being used. As is noted in the guide, if you have information that does not fit in the available space the included exhibit page should be used.