Jackson County Trustee Deed Form

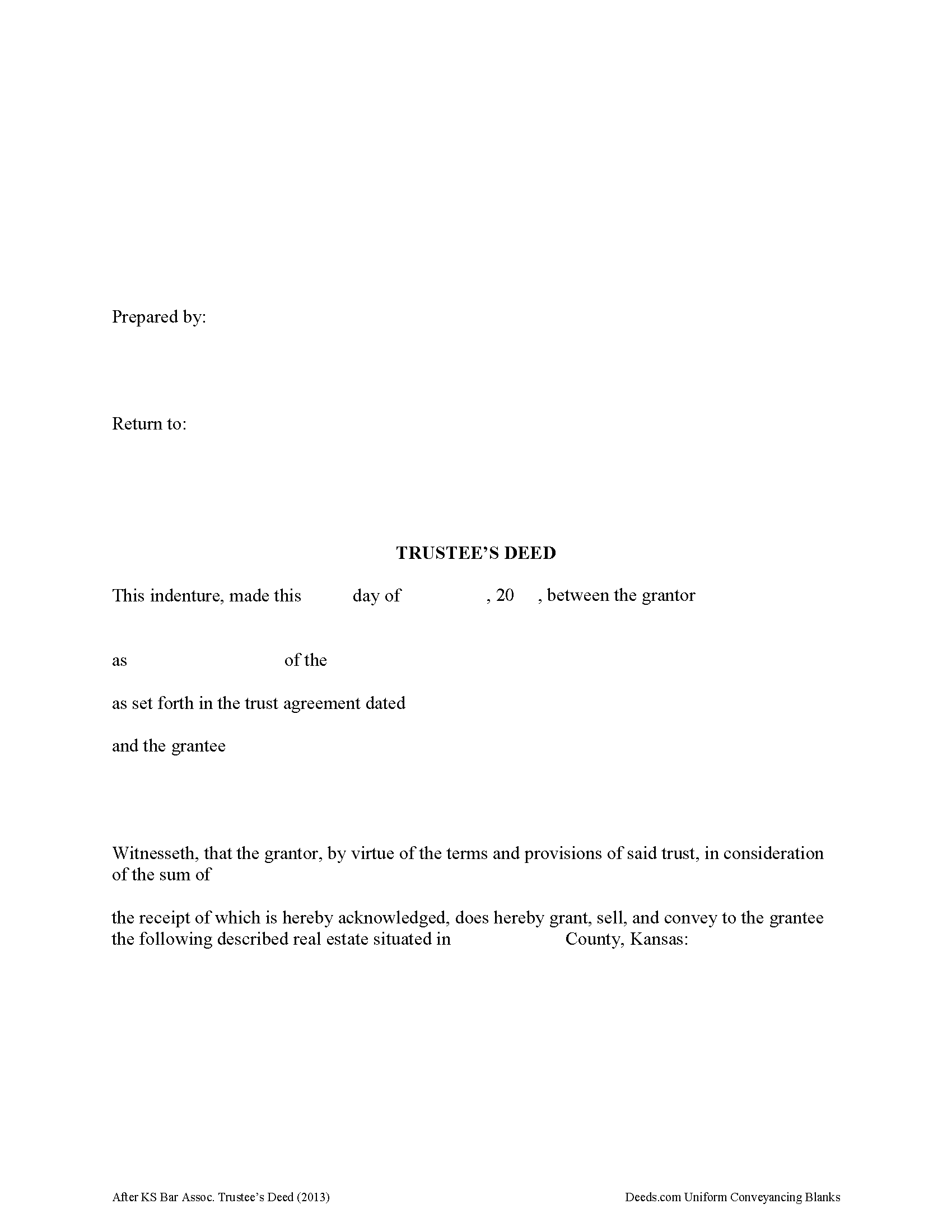

Jackson County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Jackson County Trustee Deed Guide

Line by line guide explaining every blank on the form.

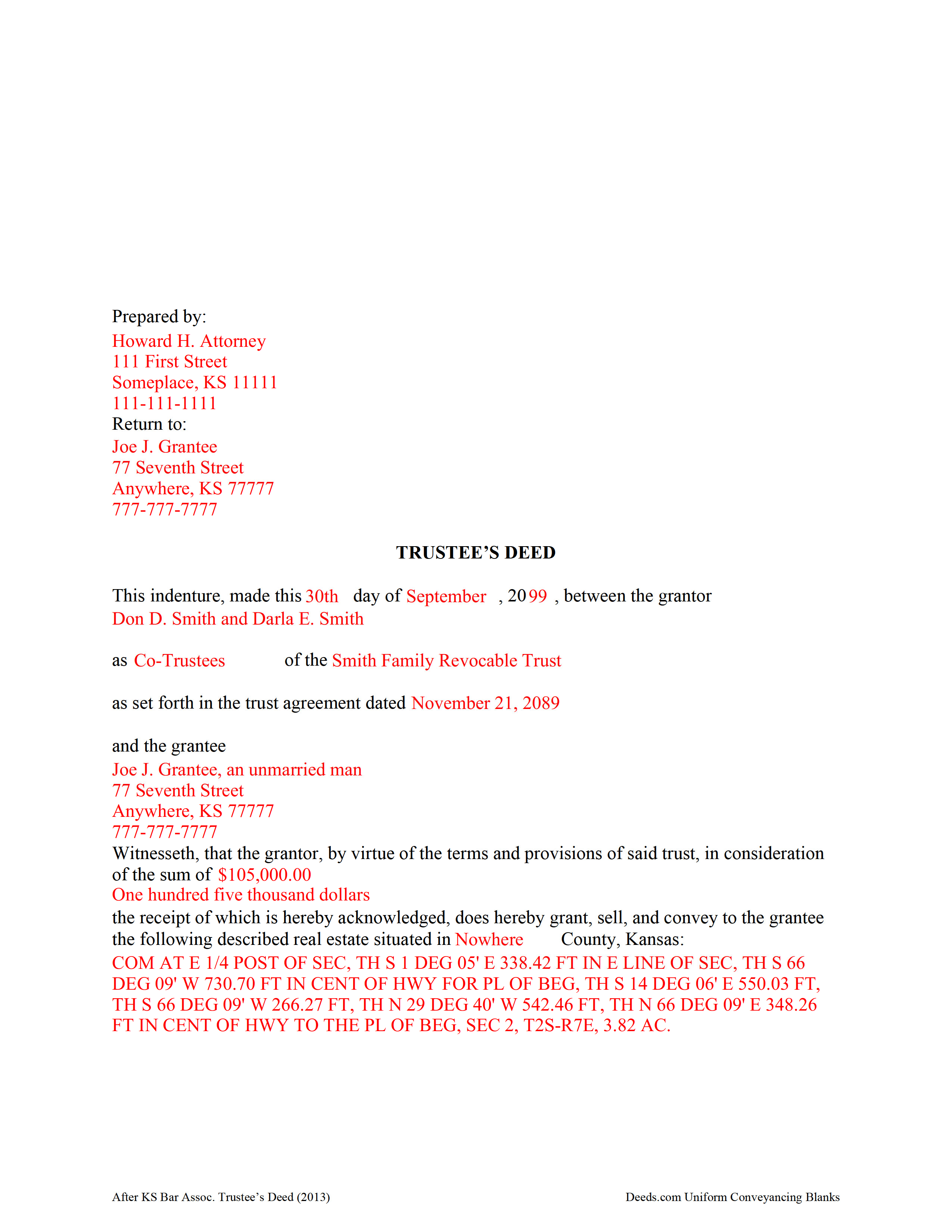

Jackson County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Register of Deeds

Holton, Kansas 66436

Hours: 8:00 to 4:30 M-F / E-recording until 3:00

Phone: (785) 364-3591

Recording Tips for Jackson County:

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Circleville

- Delia

- Denison

- Holton

- Hoyt

- Mayetta

- Netawaka

- Soldier

- Whiting

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (785) 364-3591 for current fees.

Questions answered? Let's get started!

A trustee's deed is used in trust administration to convey real property from a trust. Unlike other real estate deeds, which are named for the type of warranties of title they contain, the trustee's deed is named for the person executing the document.

The trustee is the fiduciary appointed in the trust instrument to represent a trust. Since the trust as an entity cannot hold title to real property, property is transferred to the trust in the name of the trustee-as-representative. The settlor is the person executing the trust instrument and funding the trust with assets.

In a trustee's deed, then, the trustee is the grantor conveying title to the grantee. In Kansas, the trustee's deed is a special warranty deed containing covenants that the grantor defends the title against claims by, through, or under the grantor and grantor's heirs. Further, the deed warrants that the grantor is lawfully seized of the property, has the right to convey the property, and that the property is free from encumbrances, other than those which may be listed in the form. The warranty is limited in that the grantor does not warrant title against those claiming a right, interest, or title that arose prior to, or separate from, the grantor's interest in the property.

Apart from the information above, the trustee's deed's granting clause references the name and date of the trust under which the trustee is acting, as well as the role of the trustee (co-trustee, successor trustee, etc.). The deed requires all the necessary information for documents affecting real property in the state of Kansas, including a recitation of the legal description of the real estate.

The Kansas trustee's deed form also carries a certification that the grantor is the duly appointed, qualified, and acting trustee of the trust, with a reference to the article or section from the trust instrument where the trustee is granted the authority to convey trust property. Further, the deed certifies that the trust is in full force and effect and has not been amended or revoked. These statements are also found in a certification of trust, a document that a trustee may need to furnish, depending on the transaction taking place.

All acting trustees need to sign the deed in the presence of a notary public before submitting the deed for recording in the county in which the real property is located.

(Kansas Trustee Deed Package includes form, guidelines, and completed example)

As each situation is unique, contact a lawyer for guidance.

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Suhila C.

August 23rd, 2020

This site is awesome. It has everything I need to purchase and sell (transfer deed ownership) land and property. I cannot wait to get our new land and building for business. Thanks, Suhila

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eva S.

February 6th, 2024

I was able to download the forms and I needed and fill out quickly. There were examples to review if I needed any assistance. I would recommend this site to anyone.

We are delighted to have been of service. Thank you for the positive review!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

Bobby V.

October 30th, 2019

Great

Thank you!

william h.

September 26th, 2022

got what I needed.

Thank you!

Charles S.

July 7th, 2021

Quick and easy. Highly recommend. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia (Cindy) R.

August 24th, 2020

This has been the most seamless process I have ever experienced. Thank you for addressing my needs so quickly and professionally.

Thank you!

Michael S.

September 28th, 2019

So far so good! Easy site to navigate for old farts like me

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joel M.

November 8th, 2024

Very easy and efficient. The team was quick to respond when I had questions and made it very simple.

We are delighted to have been of service. Thank you for the positive review!

Bernadette G.

February 4th, 2019

I LOVE that very concise directions and a sample completed deed were included. They were incredibly helpful. I did like the quick response to questions and the refund of my purchase when they were unable to find a deed I needed. I wasn't sure if I could trust this site, but my deed transfer went through without a hitch with the paperwork that was provided/purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tamara H.

May 11th, 2023

Absolutely awesome! Quick, easy and efficient. I will definitely be using again!

Thank you Tamara. We really appreciate you taking the time to leave your comments. Have an amazing day!

Chuck M.

May 30th, 2019

Easy to use service. However, the product that I purchased did not meet my needs. No fault of the company.

Thank you for your feedback Chuck. We certainly don't want you to purchase something you can not use. We have canceled your order and payment. Have a wonderful day.

Lori G.

June 17th, 2019

I needed to add my husband to my deed. an attorney would charge me $275.00. I decided to file myself. This makes it easy. Not done w/the process yet. But so far so good! :)

Thank you for your feedback. We really appreciate it. Have a great day!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stan B.

March 19th, 2022

Very satisfied with the PDF documents that I purchased. Will be able to transfer property without hiring an attorney. Well worth the price I paid. Stan

Thank you for your feedback. We really appreciate it. Have a great day!