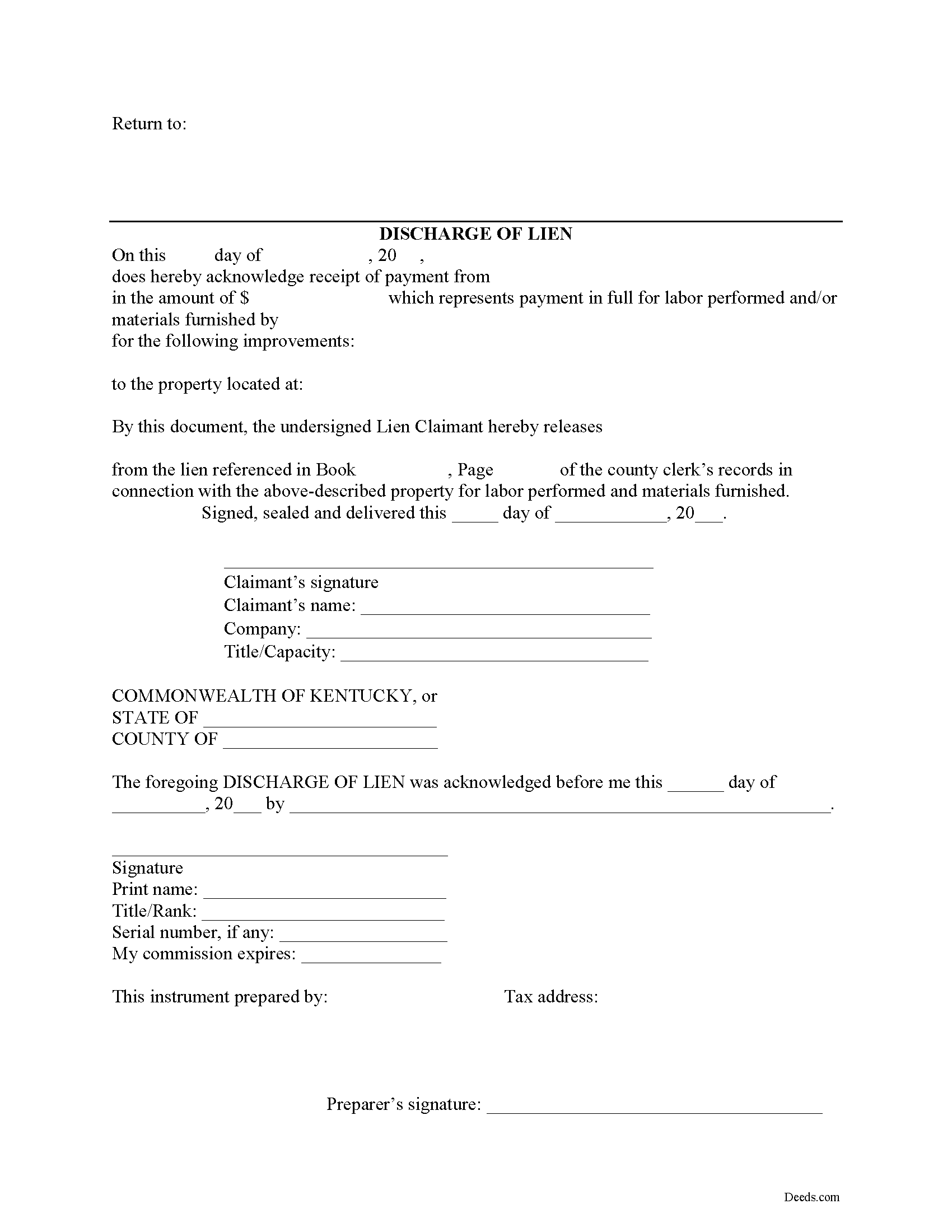

Knox County Discharge of Lien Form

Knox County Discharge of Lien Form

Fill in the blank Discharge of Lien form formatted to comply with all Kentucky recording and content requirements.

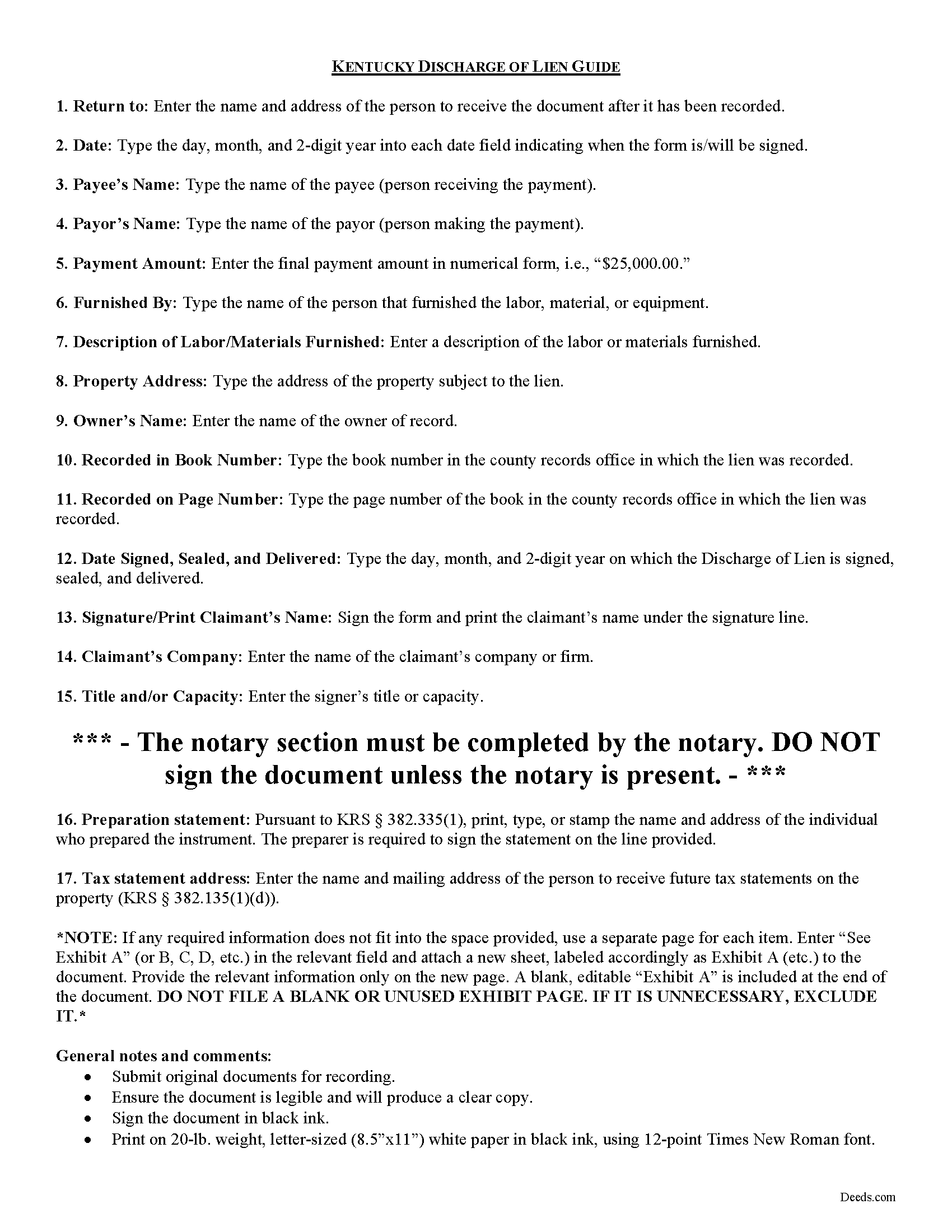

Knox County Discharge of Lien Guide

Line by line guide explaining every blank on the form.

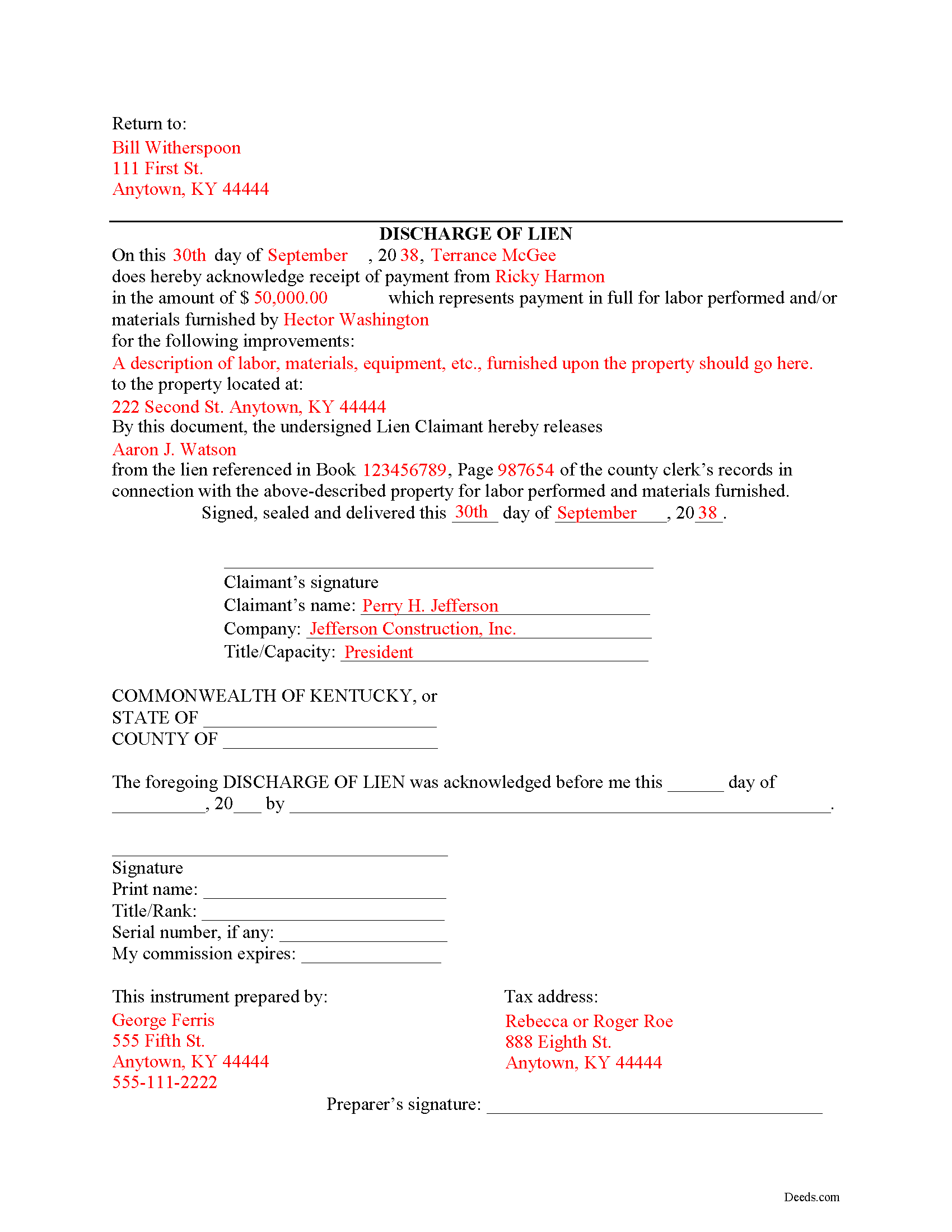

Knox County Completed Example of the Discharge of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Knox County documents included at no extra charge:

Where to Record Your Documents

Knox County Clerk

Barbourville, Kentucky 40906-1463

Hours: 8:00 to 4:00 Monday - Friday; 8:00 to 12:00 Saturday

Phone: (606) 546-3568

Recording Tips for Knox County:

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Knox County

Properties in any of these areas use Knox County forms:

- Artemus

- Barbourville

- Bimble

- Bryants Store

- Cannon

- Dewitt

- Flat Lick

- Girdler

- Gray

- Green Road

- Heidrick

- Hinkle

- Scalf

- Trosper

- Walker

- Woodbine

Hours, fees, requirements, and more for Knox County

How do I get my forms?

Forms are available for immediate download after payment. The Knox County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Knox County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Knox County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Knox County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Knox County?

Recording fees in Knox County vary. Contact the recorder's office at (606) 546-3568 for current fees.

Questions answered? Let's get started!

Discharging a Lien in Kentucky

When a lien has been paid off in full or is no longer necessary for any other reason, best practices direct the claimant to file a document discharging the lien. Kentucky does not provide for a specific mechanism of discharging a lien, as a lien already expires twelve months after its filing without any enforcement action. This document, however, reduces the amount of time a lien is in effect.

File the Discharge of Lien document in the county where the property is located (this should be the same location where the statement of lien was originally filed). The Discharge of Lien contains then following information: 1) name of the payor and payee; 2) payment amount; 3) name of person who originally furnished labor or materials; 4) description of items furnished; 5) address of the property; 5) the owner's name, and 6) the book and page number where the lien was recorded. Once the Discharge of Lien is filed and recorded, the lien will be struck from the record.

This article is provided for information purposes only and should not be relied on as a substitute for the advice from a legal professional. If you have questions about discharging a lien, or any other issues related to liens in Kentucky, please speak with a licensed attorney.

Important: Your property must be located in Knox County to use these forms. Documents should be recorded at the office below.

This Discharge of Lien meets all recording requirements specific to Knox County.

Our Promise

The documents you receive here will meet, or exceed, the Knox County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Knox County Discharge of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

OLGA B.

March 17th, 2021

I just purchased the documents. I appreciate that they are accurate to the county and state I live in and all the forms to make it complete. Thank you so much for your assistance in a very chaotic situation.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George S.

June 24th, 2020

Very good, very expensive. I hope that this is what my lawyer needed for us to finish our wills. George

Thank you!

David J.

March 27th, 2020

Very easy to use and saved a lot of time

Thank you!

Sol B.

February 13th, 2020

Got me all the info I was looking for Thanks you deeds.com

Thank you!

LuAnn F.

September 8th, 2022

Simple and quick access to the form I needed

Thank you!

Pamela C.

October 5th, 2022

It was easy to download. And your guide was informative as was the completed form for an example. But I wish that I had been able to edit the forms online and then print. My handwritten info is just not as crisp.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeremiah W.

August 2nd, 2020

Very helpful information and great forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Darren D.

December 29th, 2019

Easy-peasy to find, download and use the forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna J.

May 22nd, 2019

what do you do with it once filled out. doesn't tell you

Generally, once the documents are completed and executed they are recorded with the recorder where the property is located.

Eric S.

August 11th, 2020

Very easy and efficient to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

John L.

February 26th, 2023

excellent...exactly what i need....

Thank you!

Charles C.

October 1st, 2020

Easy to use, fast!

Thank you!

Molly S.

November 13th, 2020

I used deeds.com to record a deed because the recording office closed due to Covid 19. It was easy to sign up and upload the documents I needed recorded and within 24 hours possibly even less, the deeds were recorded. I am very happy with the service and the $15 fee was affordable and worth every penny to get it done so quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David C.

February 7th, 2021

I found it pretty easy to navigate, all worked well. Need a better example of excise tax. Lastly, your link in the email to get to this page doesn't work :)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!